How Do You Choose High Probability Zones?

Fresh Level Zones, Original Level, What Is a Fresh Level, Overlapping Zones, Supply or demand zone

Course: [ Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy ]

Trading with supply and demand can be extremely rewarding if you follow the strategy and enter the market at the right time.

How Do You Choose High Probability Zones?

Trading

with supply and demand can be extremely rewarding if you follow the strategy

and enter the market at the right time.

Most

traders fail to make money, because they trade what they believe instead of

what they see. No matter what strategy you are using, if you have no patience

and no discipline, you will always lose in this business.

Now that

you know how to find and trade supply and demand zones, let’s see how you can

filter these levels and choose only those with high probability of success.

I am

going to share with you a few tips to increase your odds of success and be able

to make money in Forex market.

Fresh Level vs Original Level

1.

What Is a Fresh Level?

A fresh

level simply means that the price has not returned to test the supply or demand

zone. Once the price retests the zone, the level is no longer considered fresh

and it is called non-fresh level. If the price keeps returning to the same

level, we say that the level is used up, in other words, if we enter a trade at

that level our chances of winning are down to zero.

We need

to choose fresh supply and demand levels to increase our chances of making

money. By eliminating those non-fresh and used up levels, we have increased the

odds of winning the trade.

Supply

and demand levels can be either:

·

Fresh Levels,

·

Non-Fresh Levels, or

·

Used up levels,

2.

How to tell if your level is

fresh, non-fresh, or used up?

All we

need to do is:

1.

Find our supply or demand zone,

2.

Look right to see if the price

has or has not touched the zone,

3.

If the price has not touched it

then the level is fresh, if it did touch it once then the level is non-fresh

and if it touched it more than once then the level is called used up.

So as a

rule of thumb, if you have a supply or a demand zone and you find out that it

is not fresh, you need to forget that zone and look for another opportunity.

You could trade a non-fresh level, but again our goal is to look for the high

probability setups and non-fresh levels might not work for you all the time.

Let’s see couple of examples:

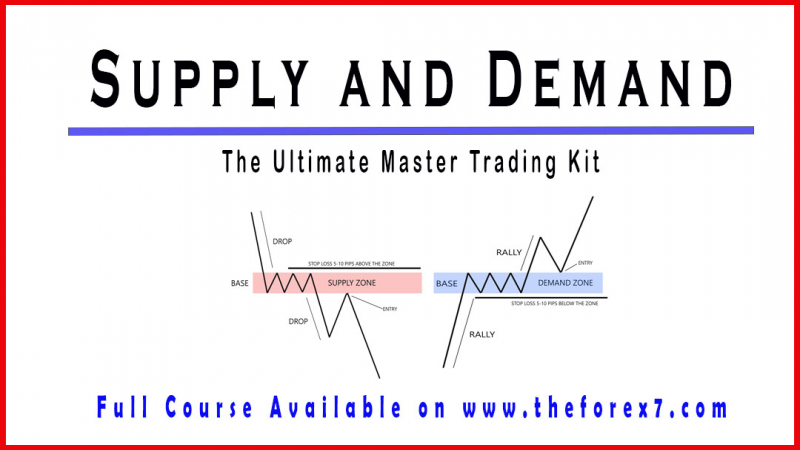

The next

chart shows a fresh supply level (figure 48). By looking to the right of the

supply zone we identified, we notice that the price has not pulled back yet to

test the zone, and therefore, the supply zone is considered fresh.

Same

thing for a demand zone, we look to the right and see if the price has pulled

back to test the demand zone. In the next chart (figure 49), we can see that

the price in an uptrend and as it goes up, the price is creating new fresh

demand zones. If the price pulled back to these zones (figure 50), they will be

considered non-fresh or used up (if the price tests the zone more than once).

Now let’s

see examples of non-fresh and used up levels:

3.

What Is an Original Level?

An

original level is a level of supply or demand that are created from nowhere, in

other words, it is a level that is not caused by any previous level (figure

51).

4.

How to tell if your level is

original or not?

We look

to the left side of the chart and we draw a horizontal line from our zone and

we scroll to the left until we touch a candle. If the candle is a part of a

previous supply or demand zone, then our zone is not considered original.

Overlapping Zones

The most

significant areas of the chart are “overlapping zones”. The multiple time frame

analysis gives us the possibility to spot high probability supply and demand

zones. If the zone on a smaller time frame chart coincides with a level on a

larger time frame chart, then the probability of that zone working out is very

high (figure 52). The higher the number of overlapping zones, the better the

probability of success at that level.

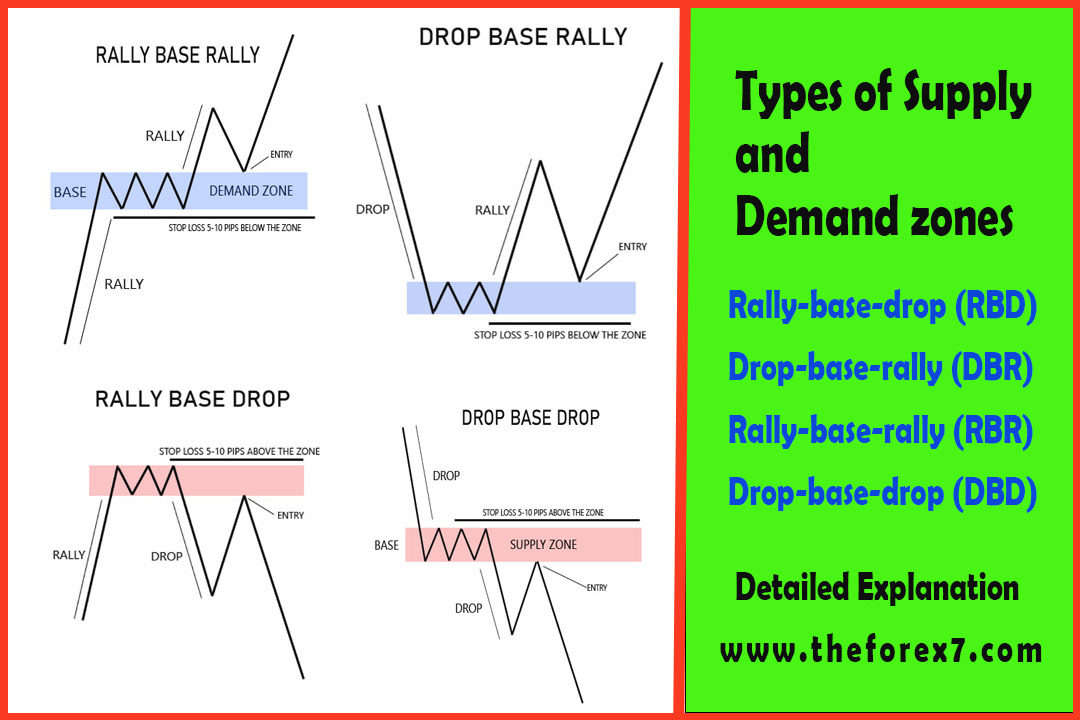

Sometimes

we can have overlapping zones in the same time frame, which is also a strong

confirmation signal to trade that level (figure 53). We have two supply zones

one below the other, both drop-base-drop type of structure, we notice that the

two zones are overlapping and when the price pulled back, it retested both the

zones. This created a very profitable setup to short the market. Look how the

price dropped from the supply zones.

In figure

54, the price pulled back to test the previous demand zone created a new demand

zone that overlaps with the previous one creating a good opportunity to go long

in this pair.

Reward-to-Risk Ratio

Not all

supply and demand zones work out a 100% of the time, that why we need to filter

them to increase our profitability on the market.

The

reward-to-risk ratio gives an idea of how the trade could work out. Once we

locate a supply or demand zone, we need to calculate our reward-to-risk ratio

before opening the trade.

A ratio

of 3:1 reward-to-risk ratio is a perfect ratio, because we are risking 1 to

gain 3. For example, if my trade has 10 pips stop loss, then my target should

be at least 30 pips away from my entry point. If the market doesn’t give us a

3:1 ratio, we stay away from the trade and we look for another one offering 3:1

reward-to-risk ratio.

A 2:1

ratio is also a good ratio, and trades could work out just fine, but again we

are choosing high probability setups and leaving those with low rate of

success.

Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy : Tag: Supply and Demand Trading, Forex : Fresh Level Zones, Original Level, What Is a Fresh Level, Overlapping Zones, Supply or demand zone - How Do You Choose High Probability Zones?