Identify Supply and Demand Zones

supply and demand curve, how to identify trading opportunities, Supply Zone, Demand Zone, Order flow

Course: [ Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy ]

In order to move price on a chart, there must be willing sellers and willing buyers. When you sell a currency pair, let’s say EURUSD you are selling Euro to a buyer or buyers willing to buy Euro from you, and buying U.S. dollar from a seller or sellers willing to sell it to you.

Identify Supply and Demand Zones

In order

to move price on a chart, there must be willing sellers and willing buyers.

When you sell a currency pair, let’s say EURUSD you are selling Euro to a buyer

or buyers willing to buy Euro from you, and buying U.S. dollar from a seller or

sellers willing to sell it to you. If there are no sellers and no buyers in the

market, the price won’t move and no transaction will take place.

There are

many players placing trades in the market, which make up the “order flow”. These include retail traders,

such us yourself, independent and private traders, institutions and

professional traders.

The

institutions and Hedge Fund Managers are very important because they have big

money. Professional traders understand how the Financial Markets work. They

trade in the opposite way to the way in which retail traders do things. That

explains why only 5% of retail traders make money in the Forex market. Because

only 5% know how to trade like professional traders.

The 90%

of the retail traders do not know how the Financial Markets work. And most

importantly, they trade using indicators and robots and they end up operating

in the opposite way in which professionals trade.

By

learning how to trade the market using supply and demand, you will be able to

enter the market at the same time as professionals and institutions do. We

cannot know with certainty where they are placing their orders, but we can use

supply and demand to locate high probability areas where big chunk of order

flows are still unfilled.

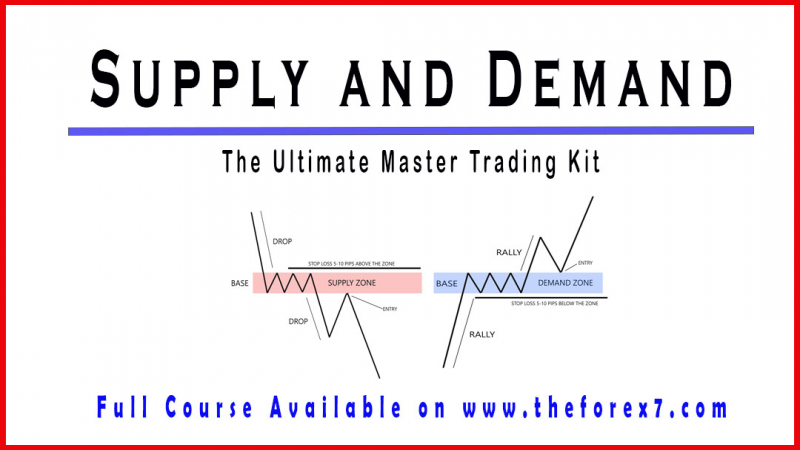

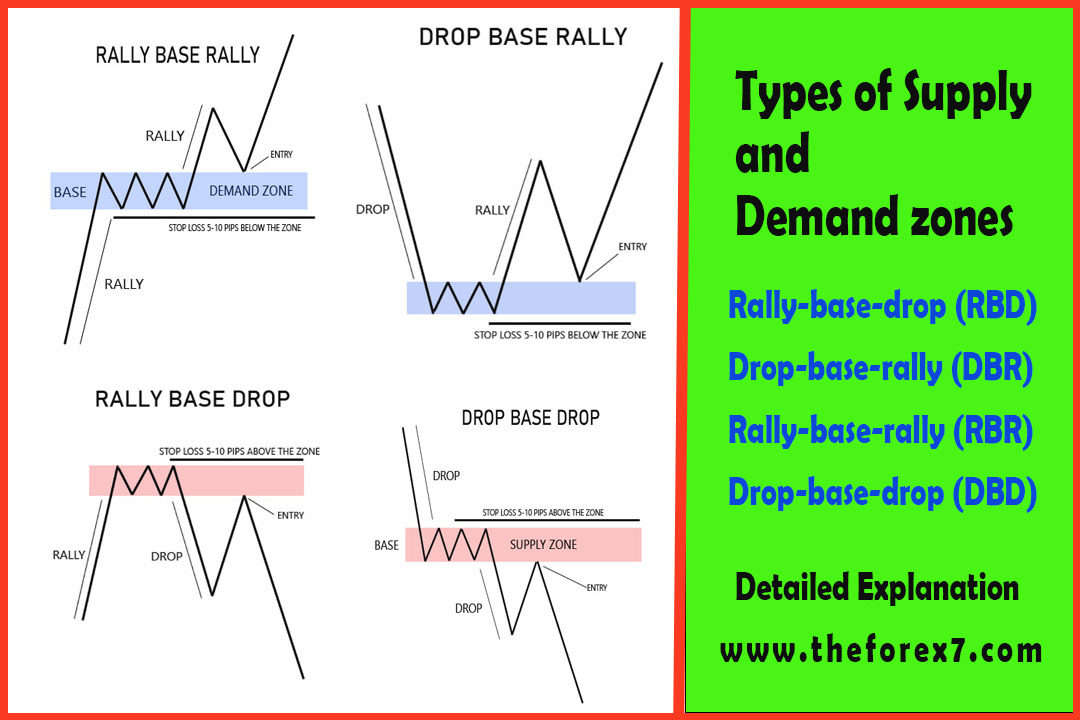

Supply Zone:

In the

chart below, the price dropped rapidly after making a small pause

around

1.13237 and 1.13874 (figure 21). The red rectangle on the chart represents the

area where institutions and professionals are placing their orders and that is

what caused the big drop in price.

Notice at

the far left of the trend, the market was in an uptrend and then started going

down. Retail traders will think this might be a pullback so they enter long

position at that area.

The

question that we need to ask ourselves is from whom retail traders are buying

EURUSD? They are buying it from Institutions and Professional Traders that are

selling it to them in order to short the market and therefore, go against the

retail traders.

No one

would think that we need to go short at that particular price level, because

conventional technical analysis states that we need to trade with the trend and

not the way around.

Fig.21.

Supply Zone.

The red

rectangle represents a pile of sell orders, which is where we are looking for

trading opportunities. The imbalance is created by the increasing number of

sellers over buyers, and therefore, the sellers are taking control of the

market and buying at this price level will be a bad idea.

Let’s

place a sell order at this supply zone around 1.3237, and wait for the price to

return and test the level.

On the

next chart, we can see that the price did actually return to the zone and

triggered our order (figure 22). The trade worked out perfectly and the price

dropped to approximately 1.08100. That is a very profitable trade with low risk

and high profitability of success.

Fig.22.

Price returned to the supply zone and hit the limit order.

Demand Zone:

In figure

23, the price created a demand level between 118.772 and 120.230. This is where

we need to look for opportunities to go long.

The small

green rectangle on the left represents the area where institutions and

professionals are placing their orders and that is what caused the big rally in

price.

In late

February, the market created a nice big bearish candle. Retail traders would

consider this a confirmation to go short, but things went a little different

and the market went up. The imbalance is created by the increasing number of

buyers over sellers, and therefore, the buyers are taking control of the market

and selling at this price level will be risky. Again, who’s going to sell here,

of course the retail traders, and the buyers are institutions and professional

traders.

Let’s

place a buy order at this demand zone at 120.230, and wait for the price to

return and test this level. The price returned to the zone and triggered our

buy order. The trade worked out perfectly and the price rallied to almost reach

131.000. That is again a very profitable trade with low risk and high

profitability of success.

Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy : Tag: Supply and Demand Trading, Forex : supply and demand curve, how to identify trading opportunities, Supply Zone, Demand Zone, Order flow - Identify Supply and Demand Zones