Fibonacci External Retracements

Internal Retracements, External retracements, Fibo Expansions, Fibonacci Retracements

Course: [ Advanced Fibonacci Trading Concept : Basic Concept of Fibonacci ]

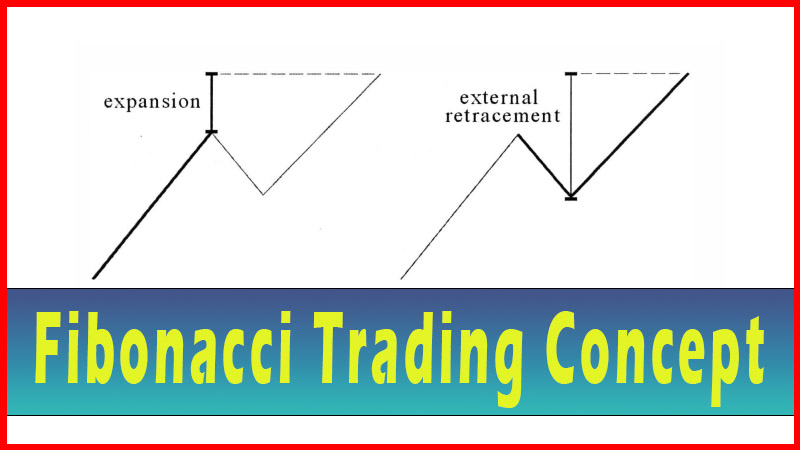

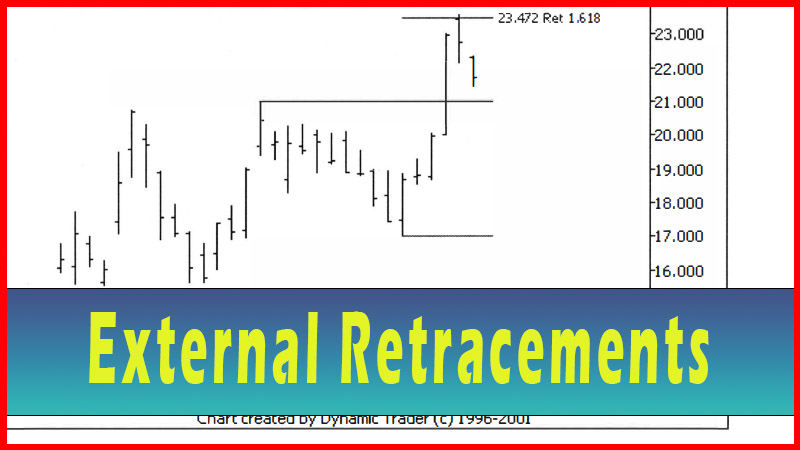

A retracement can also continue beyond the original starting point of the trend we are looking at. This is sometimes referred to as an ‘external retracement’.

Fibonacci

External Retracements

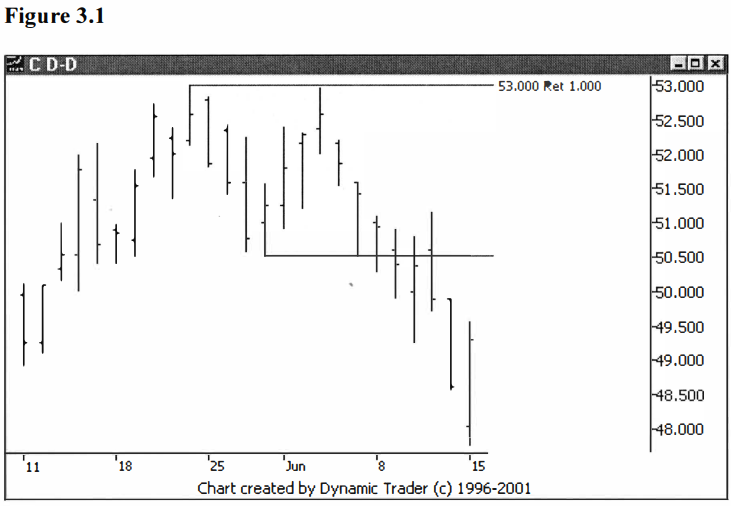

Sometimes a

retracement will continue back to the point where the trend started. If the

issue stopped there and then continued back in the direction of the trend, it

is what you would call a ‘double bottom’ or a ‘double top’. It could also be

called a 1.000 retracement (since 100% of the move has been retracted, or

expressed without the percent sign, 1.000). See figure 3.1.

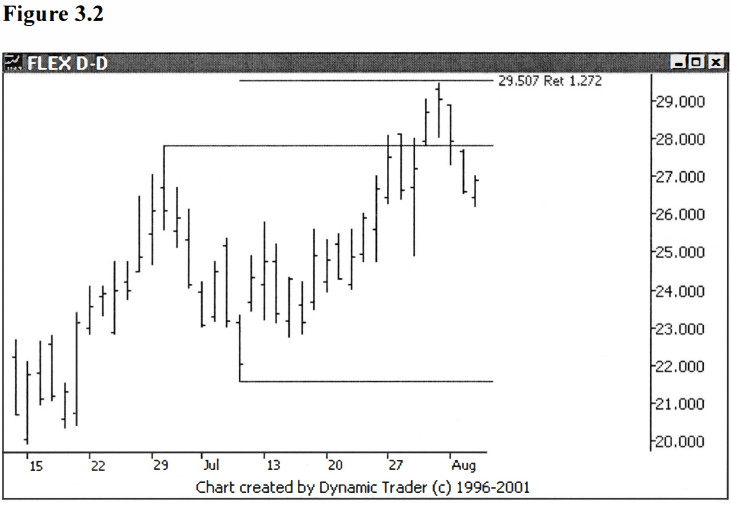

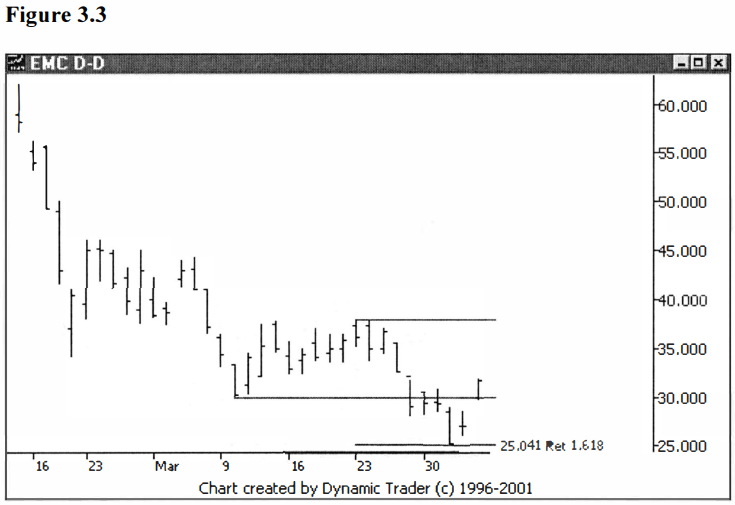

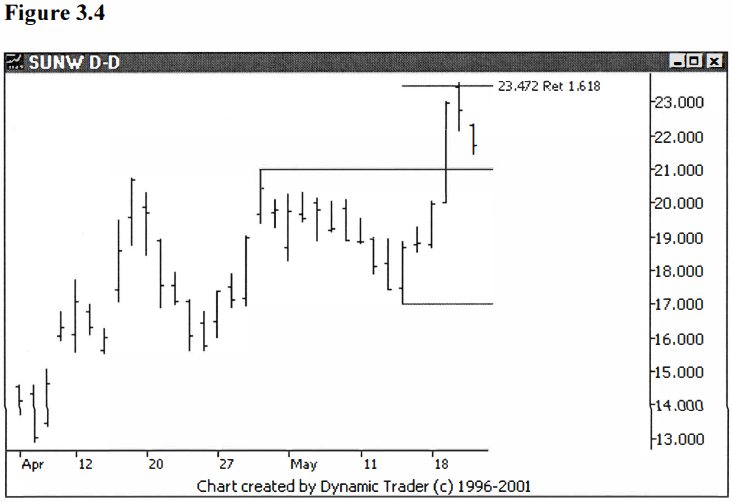

A retracement can

also continue beyond the original starting point of the trend we are looking

at. This is sometimes referred to as an ‘external retracement’. I like to call

these extensions, because they extend beyond what I would normally think of as

a retracement, but I’ve frequently seen that term used elsewhere with several

different meanings ascribed to it. For that reason, I’ll stick to external

retracement. See figures 3.2-3.4.

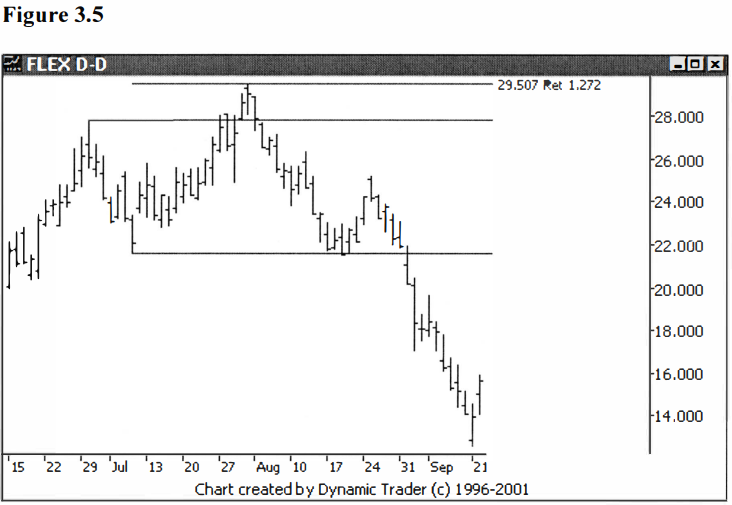

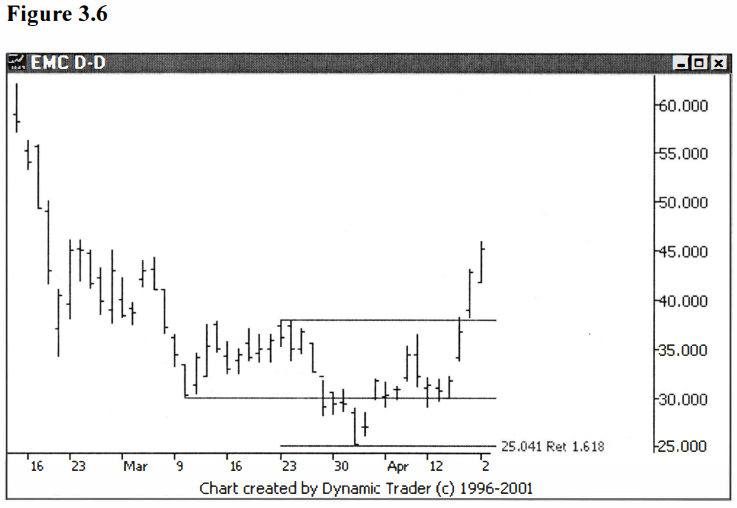

Although I’m

going to leave the trading concepts until later chapters, notice in the

following examples how these external retracements point to the end of the immediate

move in the trend. I’ll show the same three charts we’ve just looked at in

figures 3.2-3.4, extended further ahead in time, to show what actually happened

at these Fibonacci points. See figures 3.5-3.7.

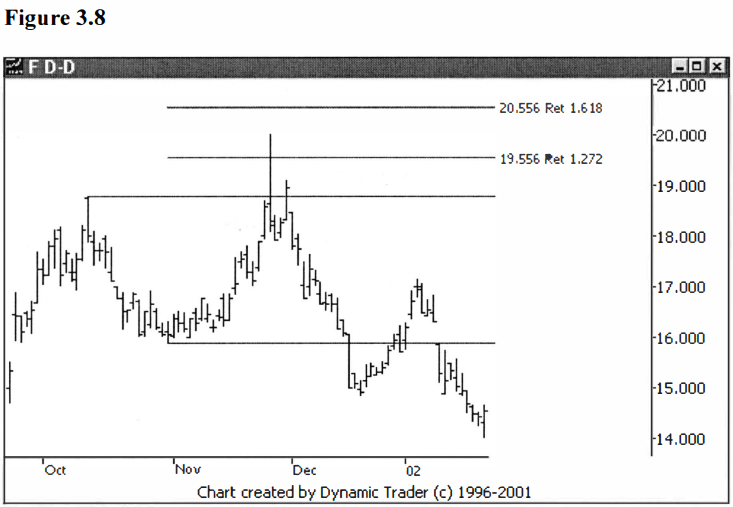

Many times,

you’ll see the countertrend moves start right in the area of a Fibonacci

external retracement. You’ll also see that since this has become pretty common

knowledge, overshoots seem to be more common than they used to be. You’ll also

see ‘jumping the gun’ moves, where the issue almost gets to the external

retracement and then everyone ‘dogpiles’ on it, trying to get in early and off

it goes. This leads some to say that the numbers aren’t valid because so many

times they don’t work. I’ll conclude this chapter with a ‘jumping the gun’

example. See figure 3.8

Did the issue

overshoot the 1.27? Or did it jump on early before the 1.618? There’s no way to

know exactly why an issue turns when it does.

The Fibonaccis

give your ideas where things might happen. And as we’ll see later, what if we

have more than one Fibonacci in a given area? Then we have a zone. If we have a

lot of Fibonacci in one area, we have a grouping. We have a possibly

significant zone for a trade.

Advanced Fibonacci Trading Concept : Basic Concept of Fibonacci : Tag: Fibonacci Trading, Forex : Internal Retracements, External retracements, Fibo Expansions, Fibonacci Retracements - Fibonacci External Retracements