How to Trade Morning Star Candlestick Pattern

Star morning chart, evening star candlestick, Morning star is the name given to, Morning doji star, Morning doji star candlestick pattern, Three inside up candlestick pattern, Is a Morningstar candle

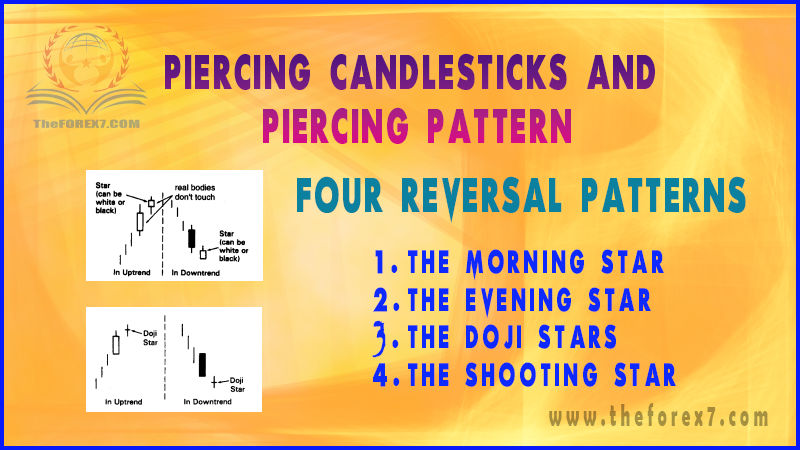

Course: [ JAPANESE CANDLESTICK CHART AND TECHNIQUES : Chapter 3: Candlestick Reversal Patterns ]

The morning star is a bottom reversal pattern. Its name is derived because, like the morning star (the nickname for the planet Mercury) that foretells the sunrise, it presages higher prices.

THE MORNING STAR

The

morning star (Exhibit 3.3) is a bottom reversal pattern. Its name is derived

because, like the morning star (the nickname for the planet Mercury) that

foretells the sunrise, it presages higher prices.

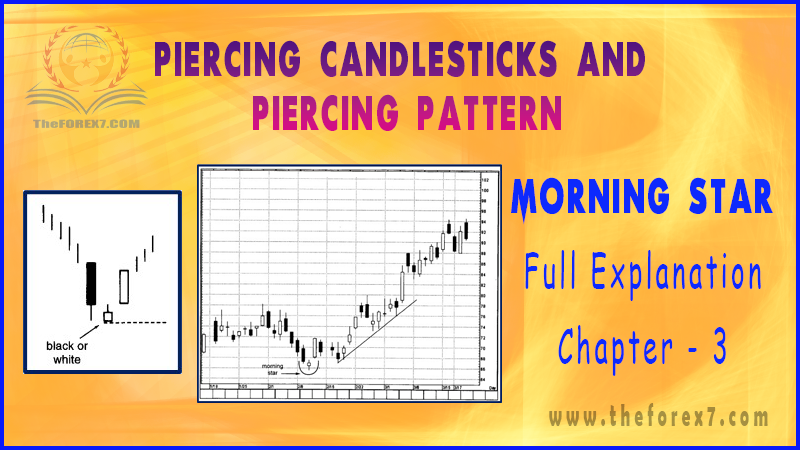

Exhibit 3.3. Morning Star

Three Candle Lines comprising this Pattern

·

Candle 1. An extended black real body.

This pictorially proves that the bears are in command.

·

Candle 2. A small real body that doesn't

touch the prior real body (these two lines comprise a basic star pattern). The

small real body means sellers are losing the capacity to drive the market lower.

·

Candle 3. The concluding candle of the

morning star is a white real body that intrudes deeply into the first session's

black candle. This is the indication that the bulls have seized control.

The

lowest low of the three lines that form this pattern should be support as shown

by the dashed line in Exhibit 3.3.

An

ideal morning star would have a gap between the second and third real bodies.

From my experience, a lack of a gap does not seem to weaken the power of this

formation. The decisive factor is that the second candle should be a spinning

top and the third candle pushes well into the black candle.

Exhibit

3.4 is an example of this. In late July/early August we see three candle lines

that make up the requisite criteria of a morning star: a long black candle, a

small real body, and then a tall white candle. Of course, this pattern has to

follow a decline. An aspect that kept this from an ideal morning star pattern

was that the third real body wrapped around the second candle. However, from my

experience, even if the second and third candles overlap, it doesn't mitigate

the effectiveness of this pattern. In fact, the second and third lines of this

morning star pattern created a bullish engulfing pattern.

Exhibit 3.4 Wheat-Weekly Continuation (Morning Star)

This

chart is also a good example of how candle charts will frequently give turning

signals before the more traditional signals derived from a bar chart. A bear

channel that began in February remained in force until the third quarter that

year. The close over the top of the bear channel was the traditional Western

signal that the downtrend had been broken. By using the light of the candles

(via the morning star), we had obtained an early warning beacon of a turn many

sessions prior to the break over the bear channel.

A

limitation with the morning star is that since this is a three-candle pattern,

one has to wait until the close of the third session to complete the pattern.

As is usually the case, if this third candle is a tall white one, we would get

the signal well after the market already had a sharp bounce. In other words,

the completion of the morning star may not present an attractive risk/reward

trading opportunity. An option is waiting for a correction to the morning

star's support area to start nibbling from the long side. As shown in Exhibit 3.5,

there was a morning star in early February. If one bought on the completion of

this pattern near $74, by the next day he or she would have had a loss. By

waiting for a correction to anywhere near the low of the morning star (toward

$65.50) before buying, a trader would decrease his or her risk since the stop

would be under the low of the morning star. As this stock ascended, it did so

along a rising support line.

While

the ideal morning and evening stars should have none of their three real bodies

touching, there is even more flexibility to the definition of the morning star

(and also the evening star) in markets where the open and close are either the

same or close to one another. This would include:

1. Foreign exchange

markets where there is no official open and close.

2. Many indexes such as

the Semi-Conductor or Drug Indexes.

3. Intraday charts. For

instance, on a 15-minute chart the open of a 15-minute session is usually not

much different from the close of the prior 15-minute session.

Exhibit 3.5. Merrill Lynch-Daily (Morning Star)

Let's

use the intraday chart in Exhibit 3.6 to see an instance of the value of being

flexible in interpreting the candle patterns. Mid-day on December 27 the index

made a new low for the move and in doing so broke under the support from early

that day of 3535/3530. The bears thus took control. But at 13:00 a small real

body and the next session's long white candle made a morning star. Notice how

all three bodies touched one another (the open of the second candle was the

same as the close of the first candle and the open of the third candle was the

same as the close of the second session). Because this was an intraday chart

where the open/close difference is usually minor, I still viewed this as a

viable morning star. This pattern took on more credibility since the third

candle, which finalized this pattern, also pushed the index back above the

previously broken support area near 3530. When a market makes a new low and the

bears can't maintain these new lows, it is frequently a hint of a reversal.

Exhibit 3.6. NASDAQ Composite Index

JAPANESE CANDLESTICK CHART AND TECHNIQUES : Chapter 3: Candlestick Reversal Patterns : Tag: Candlestick Pattern Trading, Forex : Star morning chart, evening star candlestick, Morning star is the name given to, Morning doji star, Morning doji star candlestick pattern, Three inside up candlestick pattern, Is a Morningstar candle - How to Trade Morning Star Candlestick Pattern