How to Use Evening Candlestick Pattern for Trading with Example

evening star candlestick, evening star candle, evening star candlestick pattern, evening doji star, morning star and evening star pattern

Course: [ JAPANESE CANDLESTICK CHART AND TECHNIQUES : Chapter 3: Star Candlestick Pattern ]

The evening star is the bearish counterpart of the morning star pattern. It is aptly named because the evening star (the nickname for the planet Venus) appears just before darkness sets in.

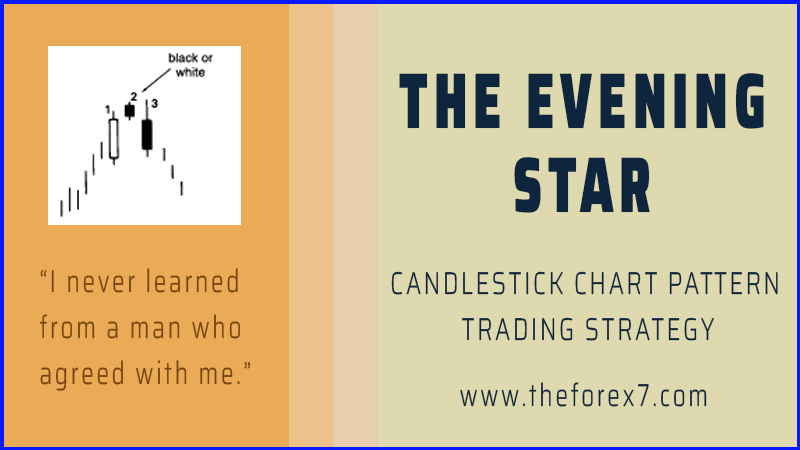

THE EVENING STAR

The evening

star is the bearish counterpart of the morning star pattern. It is aptly

named because the evening star (the nickname for the planet Venus) appears just

before darkness sets in. Since the evening star is a top reversal, it should be

acted upon if it arises after an uptrend. Three lines compose the evening star (see Exhibit 3.7). The

first is a long white real body, the next is a star. The star is the first hint

of a top. The third line corroborates a top and completes the three-line

pattern of the evening star. The third line is a black real body that closes

sharply into the first period's white real body. I like to compare the evening

star pattern to a traffic light. The traffic light goes from green (the bullish

white real body) to yellow (the star's warning signal) to red (the black real

body confirming the prior trend has stopped).

Exhibit

3.7 Evening Star

In principle, an

evening star should have a gap between the first and second real bodies and

then another gap between the second and third real bodies. But, as detailed

earlier in the section on the morning star, this second gap is rarely seen and

is not necessary for the success of this pattern. The main concern should be

the extent of the intrusion of the third day's black real body into the first

day's white real body.

Exhibit 3.8 Western Island Top

At first glance

Exhibit 3.7 is like an island top reversal as used by Western technicians.

Analyzing the evening star more closely shows it furnishes a reversal signal

not available with an island top (see Exhibit 3.8). For an island top, the low of session 2 has

to be above the highs of sessions 1 and 3. However, the ideal evening star only

requires real body 2 to be above the high of real bodies 1 and 3 to be a

reversal signal.

Some factors increasing

the likelihood that an evening or morning star could be a reversal would

include:

1. If there is no overlap among the

first, second, and third real bodies.

2. If the third candle closes deeply

into the first candle's real body.

3. If there is light volume on the

first candle session and heavy volume on the third candle session. This would

show a reduction of the force for the prior trend and an increase in the

direction force of the new trend.

The highs of the

evening star become resistance as displayed by the dashed line shown in Exhibit

3.7.

Let's look at

Exhibit 3.9. A classic evening star was completed in early January. This

evening star had the ideal prerequisite of the three real bodies not

intersecting. Intersecting the star portion (that is, the second candle line of

the evening star pattern) was a hanging man line whose bearish confirmation

came the next day. The descent from the evening star culminated a week later

near 1210 at area A. The rally from A hesitated a week later via a doji near the

resistance area created by the evening star. This doji hinted the rally was

exhausting itself. (Dojis are discussed in Chapter 8.)

The next time

the market rallied to this resistance in the first week of February, it formed

a bearish engulfing pattern at B. I mention this bearish engulfing pattern to

bring out the importance of trend in helping to define a candle pattern. I have

discussed how a bearish engulfing pattern is when a black real body engulfs a

white real body. There was a black real body at A that

|

Historical

Note The

full name of the evening and morning star patterns are the three- river

evening star and the three-river morning star. I originally thought they were

termed "three-river" evening and

morning stars because each of these patterns had three candle lines, hence

three rivers. I

discovered that the origin is much more fascinating. Nobunaga Oda, a major

military figure of the late sixteenth century, was one of the three military

leaders who unified feudal Japan (see Chapter 2). He fought a seminal battle that occurred in

a very fertile rice-growing province. Since rice was a gauge of wealth,

Nobunaga was as determined to wrest this area as fervently as the owners were

to defend it. This fertile rice area had three rivers. The heavily defended

area made it difficult for Nobunaga to cross these three rivers. Victory was

his when his forces finally forded these three rivers. Hence the names "three-river" morning and evening

stars reflect a time when, if these patterns are formed, it will be difficult

get through these three rivers once they are formed. That

is, the bullish three-river morning star should be important support and the

bearish three-river evening star should be pivotal resistance. Yet, victory

for the attacking army is assured when the hurdle of the "three

rivers" is crossed. As such, a close over the evening star's resistance

(under the morning star's support) proves that the army of demand 1 (supply)

has taken control of the battlefield. |

wrapped around a

prior white candle. Was this a bearish engulfing pattern? No, because it came

after a price decline; whereas a bearish engulfing, as a top reversal, needs a

rally to reverse. This is why I define B as a bearish engulfing pattern, but

not A.

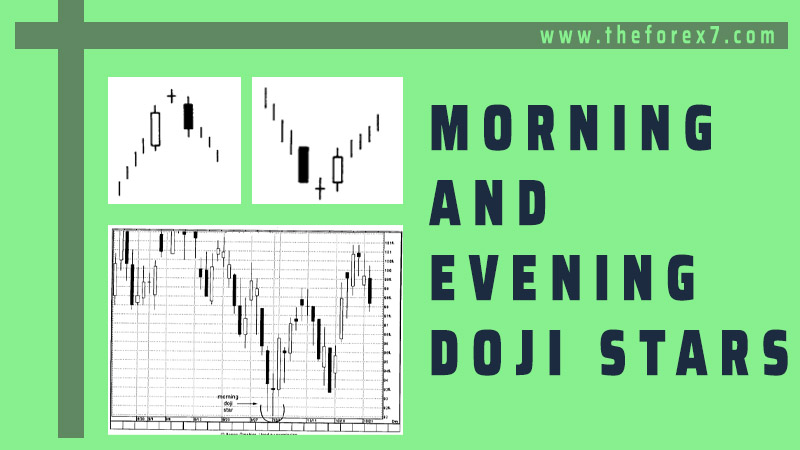

Another doji in

late February echoed continued supply near the evening star's resistance level.

The long black candle after this doji formed another evening star pattern. This

evening star had a doji as a second candle line instead of a spinning top. This

is a special type of evening star called an evening doji star, which is

discussed later in this section. The second evening star is an example where

the second and third candles overlapped. From my experience this works as well

as the more classic pattern in which none of the real bodies touch.

A challenge with

some of the candle patterns is that by the time the pattern is completed, the

market may be well off its highs or lows. The evening star, because of the need

to wait for its completion with a long black real body, may give a reversal

signal well after the market has already turned. We look at this aspect in

Exhibit 3.10.

As shown in this

chart, the high of the move was near $34, with the evening star's completion on

the close of the third session at $31. As such, if one sold based on the

evening star at $31, the risk would be to the high of evening star toward $34.

There is no problem with a $3 risk if the target is many times that risk. Only

then would it be an attractive risk/reward trade.

If this $3 risk

is too large, one can improve the risk/reward aspect of this trade by waiting

for a bounce to near the resistance area at the top of the evening star (of

course, there is no guarantee of a bounce). In this example, two sessions after

the evening star we got a $2 rebound which took the stock very close to its

pivotal resistance at $34. After this stock resumed its decline, it moved into

the April-May period. The shrinking real bodies presaged those chances for a

turnaround had increased.

Exhibit

3.9. S&P Index-Daily (Evening Star)

Exhibit 3.10. Roger Communications-Weekly (Evening Star)

JAPANESE CANDLESTICK CHART AND TECHNIQUES : Chapter 3: Star Candlestick Pattern : Tag: Candlestick Pattern Trading, Forex : evening star candlestick, evening star candle, evening star candlestick pattern, evening doji star, morning star and evening star pattern - How to Use Evening Candlestick Pattern for Trading with Example