Gaps Down at the Top Candlestick

candlestick chart gap top pattern, Gap-up, Gap-down, High Profit pattern

Course: [ How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps ]

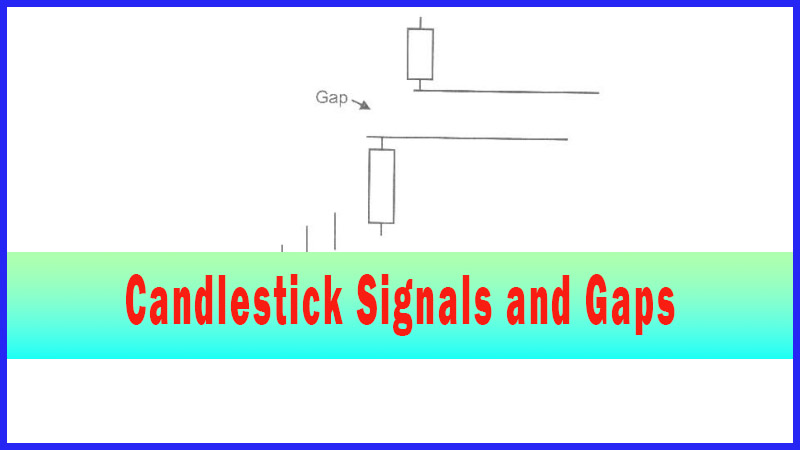

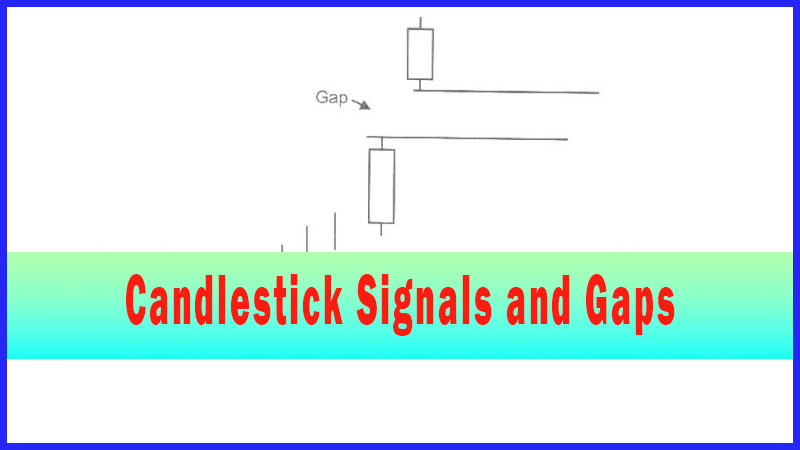

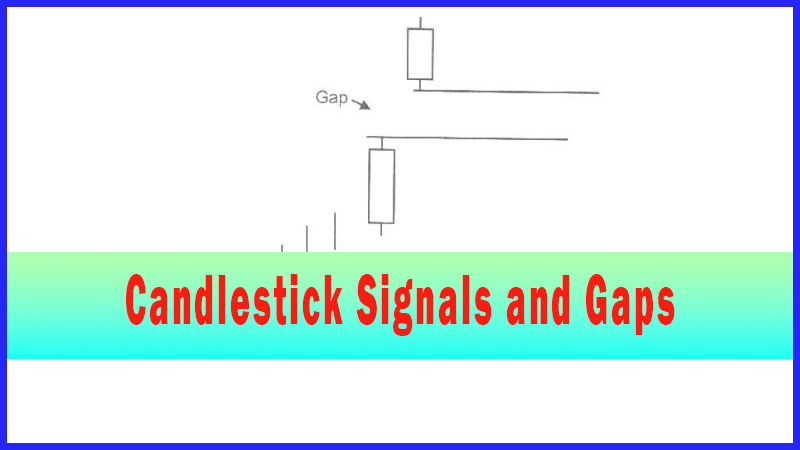

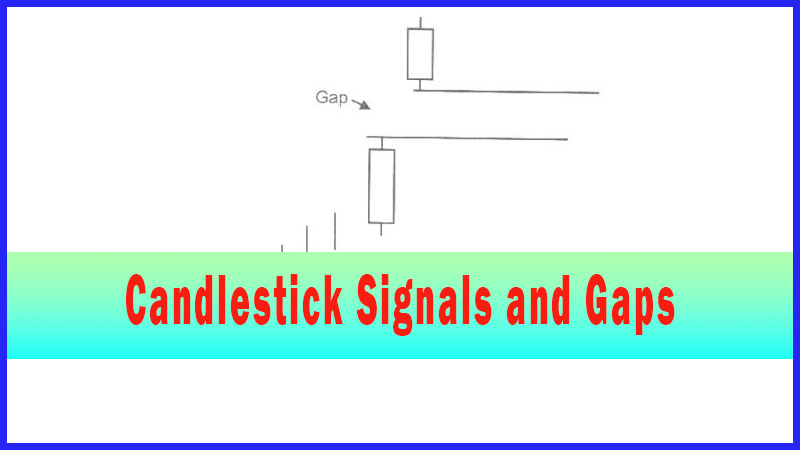

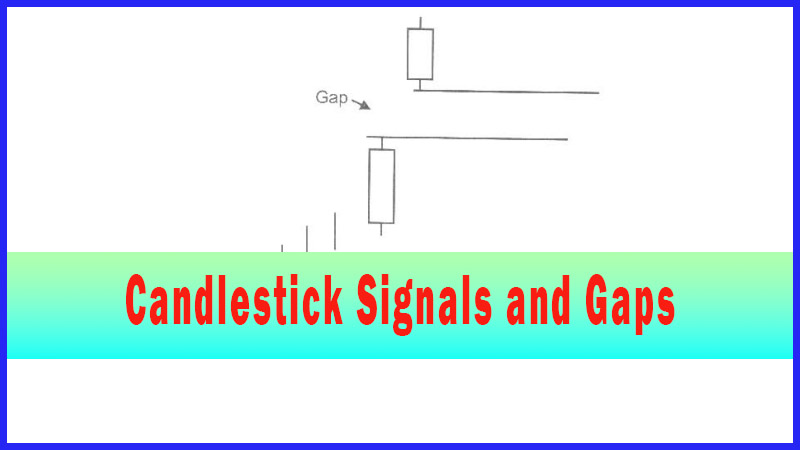

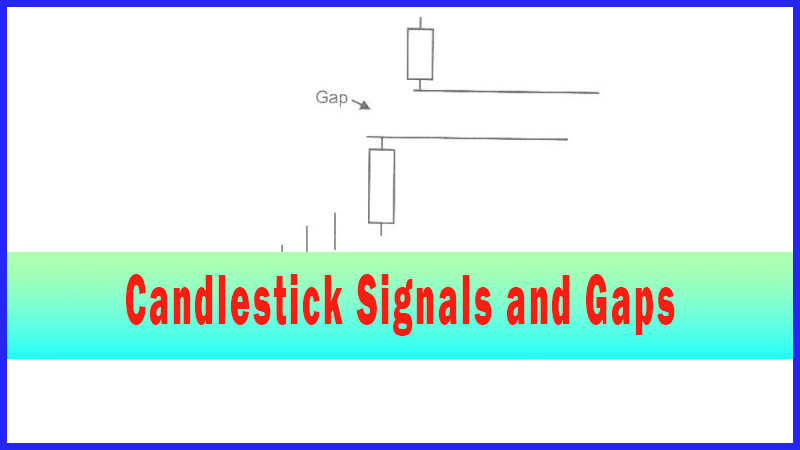

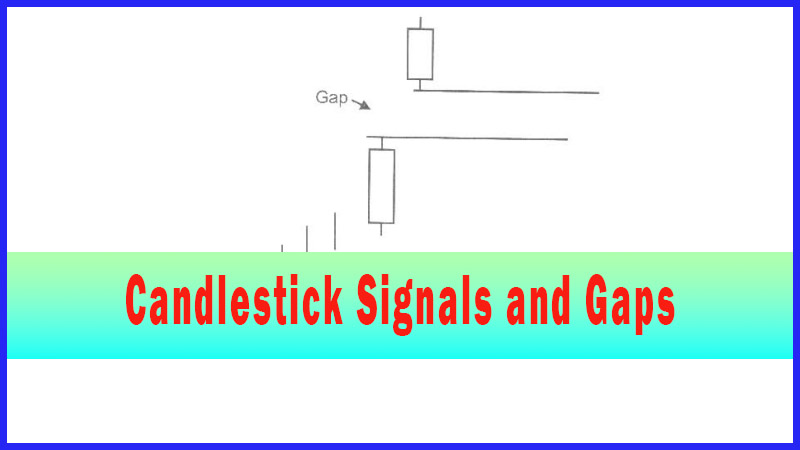

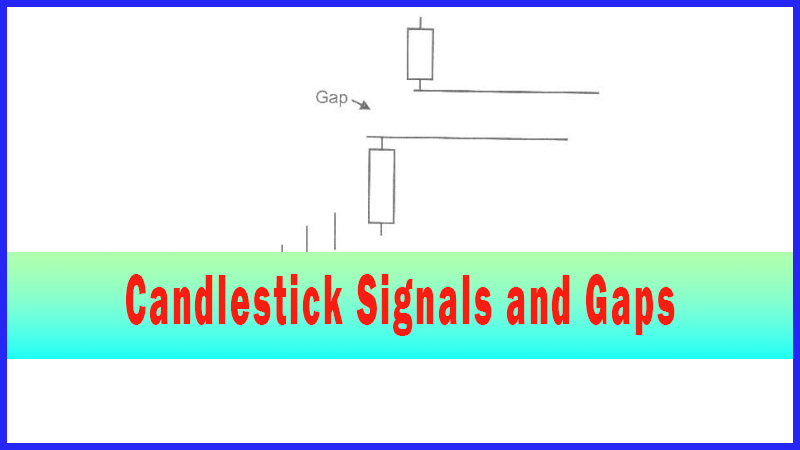

The same zeal illustrated when prices gap at the bottom is just as relevant at the top. A candlestick “sell” signal, when stochastics are in the overbought condition, followed by a gap down, clearly illustrates the sellers wanting to get out of that position aggressively.

Gaps Down at the Top

“If you want to know what’s happening in the market, ask the

market.”

The

same zeal illustrated when prices gap at the bottom is just as relevant at the

top. A candlestick “sell” signal, when stochastics are in the overbought

condition, followed by a gap down, clearly illustrates the sellers wanting to

get out of that position aggressively. For those investors that want to find

strong short positions, a gap down at the top provides strong shorting

opportunities. The same confirmation that is applied to a bullish signal can be

applied to a bearish signal. Prices, gapping away to the downside after a

candlestick sell signal, provide the additional confirmation that the downtrend

will move with good force.

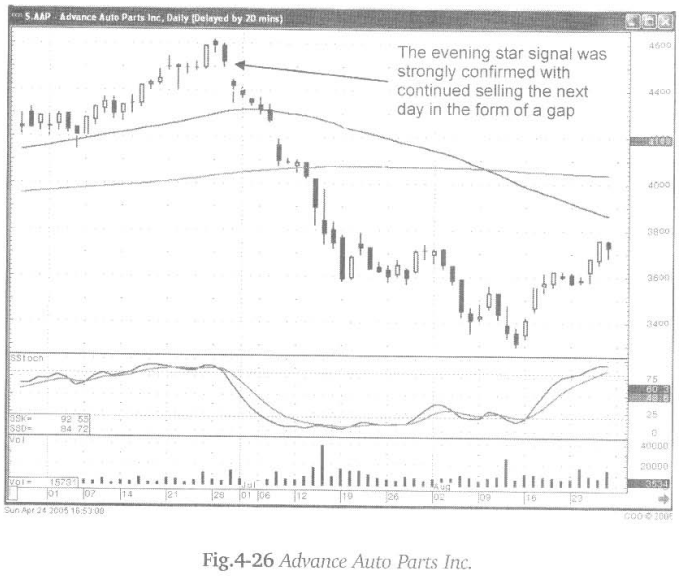

Fig.

4-26 (following page), The Advanced Auto Parts Inc. chart demonstrates that

investors are very anxious to get out of the stock. The appearance of the

Evening Star signal produces the first indication that the sellers were

stepping

in. The gap down makes it visually obvious that investors wanted out of this

position in a hurry. If you are planning to short positions, you want to find

those positions that are demonstrating strong downside potential. A second gap

down moves prices significantly below the 50-day moving average, clearly

illustrated the downside selling force is reasonably strong.

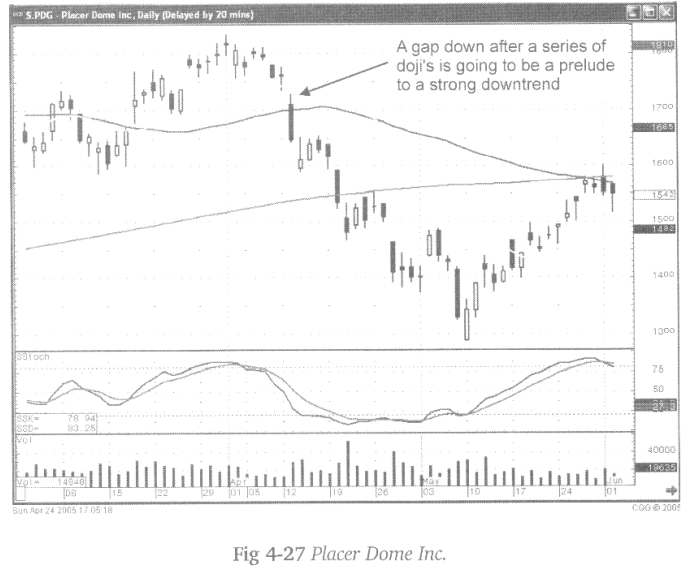

Doji

at the bottom are powerful indicators when followed by a gap up. The same is

true when witnessing Doji at the top. Fig. 4-27 (following page), The Placer

Dome Inc. chart clearly demonstrates a period of indecision with a series of

Doji in the overbought condition. Notice how the gap up created the series of

Doji, a flat trading range of indecisive signals. The new trend started to the

downside with a gap down bearish candle that immediately breached the 50- day

moving average.

This

chart pattern reveals an immense amount of information. The gap down bearish

candle provides information needed to make an important short decision. The

sellers want out of this position with great vigor. The 50-day moving average

appears not to be a support level. The two weeks of Doji type trading started

after a gap up. The gap down created an island reversal which is a very strong

reversal signal. Numerous indecisive trading days foretell a strong downtrend.

The bigger the number of indecisive signals, prior to a gap down in a trend,

the stronger the new trend will be.

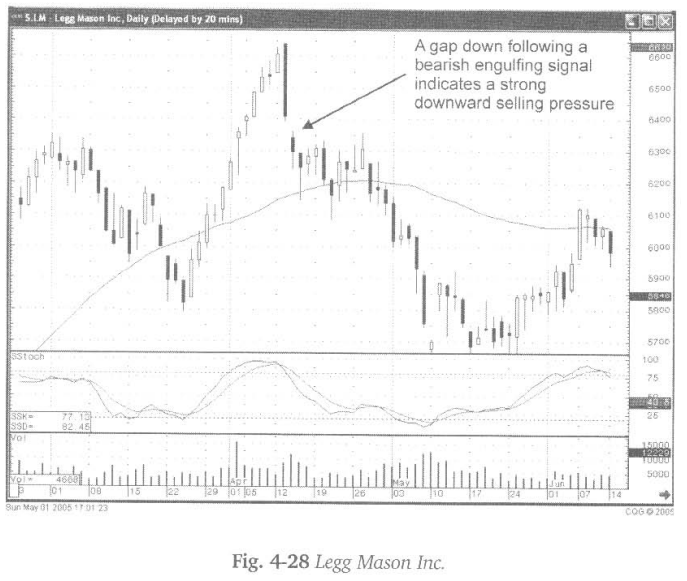

Fig.4-28,

the Legg Mason Inc. chart has the downtrend confirmed, after the Bearish

Engulfing signal at the top, with the appearance of a gap down. Although the

downtrend had temporary support at the 50-day moving average, there was a gap

down after the candlestick reversal signal. This should have indicated the

potential of additional selling. Until the stochastics had gotten into the

oversold condition, an extremely strong candlestick ‘buy’ signal would have

been required to negate the implications of the gap down.

A

gap down informs the investor that there is a selling force that is usually

stronger than just a downward trend force. That information becomes built into

the analysis. What will a trend do if it hits a support level soon after the

gap down? As seen in the Legg Mason Inc. chart, what could be some consolidation,

at what would be considered a support level, does not have any strength in the

follow-through buying. A gap down indicates that the selling pressure should be

substantial.

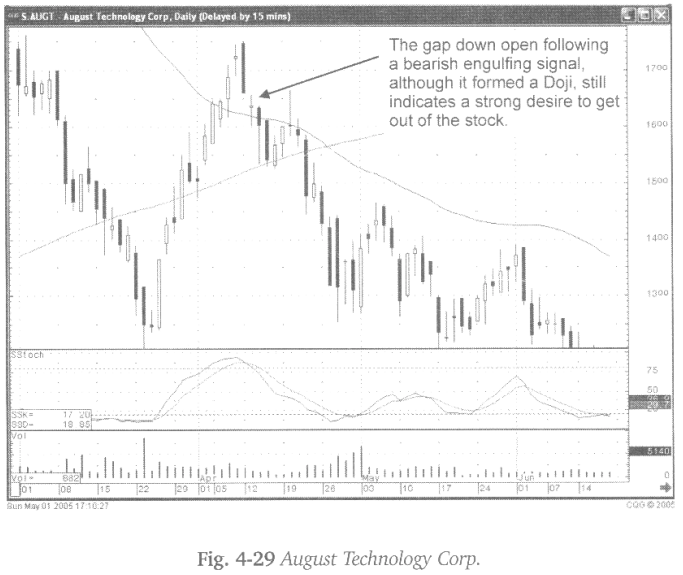

Fig.

4-29, The August Technology Corp. chart reveals the same type of pattern, a

Bearish Engulfing signal followed by a gap down the next day. As illustrated in

the previous chart describing a Doji, it is not unusual to see a Doji day after

a reversal signal. This is the Bears conflicting with the last of the Bull

buying after the signal. The fact that the open gaps down from the close of the

Bearish Engulfing signal should immediately reveal that the sellers are anxious

to get out of the stock.

Being

able to identify a candlestick reversal signal produces the visual advantage

that the non-candlestick analyst does not have. Witnessing a gap down from a major

signal formation provides much more confirmation.

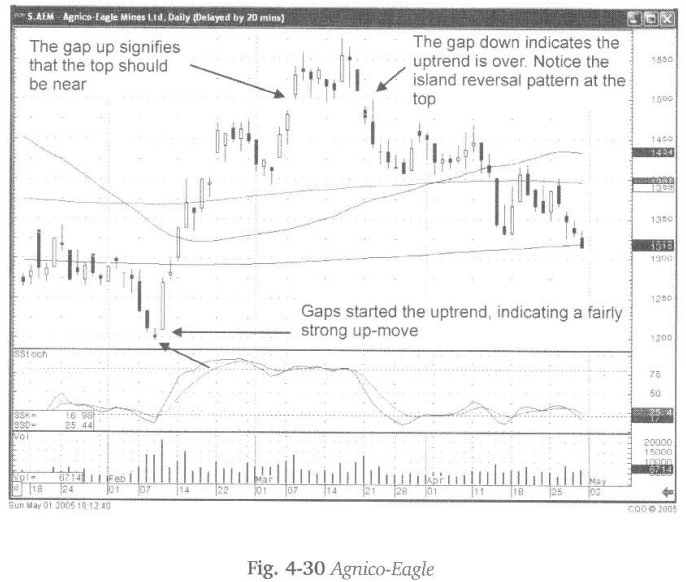

Fig. 4-30, The

Agnico-Eagle Mines Ltd. chart reveals the strength in which the sellers want to

get out of the stock. The large Doji signal, followed by a gap down in price the

next day, was a signal that the uptrend was over.

Use

a gap down at the top as a profitable indicator. A gap down indicates that the

sellers are moving the downtrend with force. Especially when seen in overbought

conditions, a gap down produces an extremely high probability that the existing

uptrend has now been reversed. The downtrend is going to move with significant

strength.

How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps : Tag: Candlestick Pattern Trading, Forex : candlestick chart gap top pattern, Gap-up, Gap-down, High Profit pattern - Gaps Down at the Top Candlestick