Track and Chart your Trades

Money management, Risk management, Risk Reward Ratio, Track Trade Results

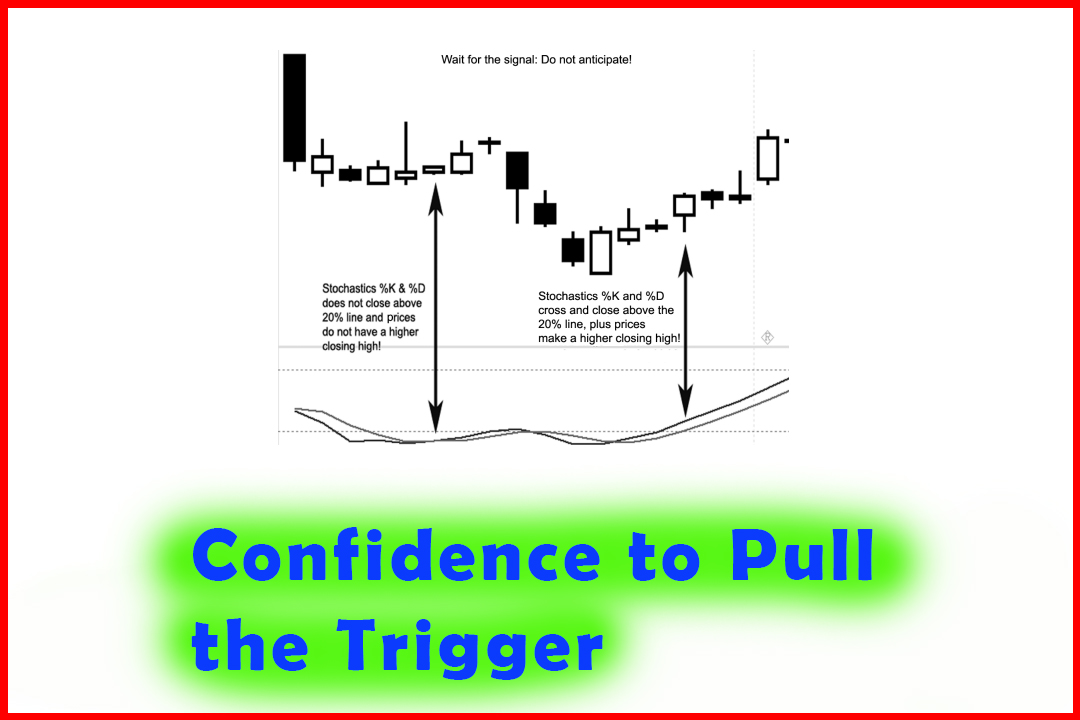

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 12. Confidence to Pull the Trigger Comes from Within ]

A trading diary is a great way to check and confirm your trading execution entries and exits. In fact, most charting software has the capability to go back to see when you executed a trade.

TRACK AND CHART YOUR TRADES

A trading

diary is a great way to check and confirm your trading execution entries and

exits. In fact, most charting software has the capability to go back to see

when you executed a trade. Think what this can do for a trader. If it is

followed properly, it can and most likely will help you to improve to a new

level of self-discipline and ultimately lead to increasing your self-confidence.

How? If you execute when the signals call for action, you can validate whether

you responded when called to do so. You can check your work. You will find out

if you hesitated when your methods called for you to exit and if you timed it

per the system or not. One lesson we teach our students at Trading Triggers

University is to save a chart and print it out with the entry scale-out and

exit. Printing the chart out helps you to see clearly how you respond or react

to the trade signals. It will reinforce the validity of your system or any

system, including my Defcon program with Genesis Software. By printing out and

cataloging your trades by a chart, you will gain more experience in identifying

the patterns that drive your trading signals. It also keeps track of or “inventories” what went right or what went wrong with a trading

plan. It will allow you to study and examine the results in black and white. On

successful trading days, it will be good to capitalize on your successes so

that they can be repeated. Of course, on bad days, it can allow you to focus on

what went wrong so that you can understand and improve on it so that you stop

repeating the same mistakes over and over again.

TWO CASES IN POINT

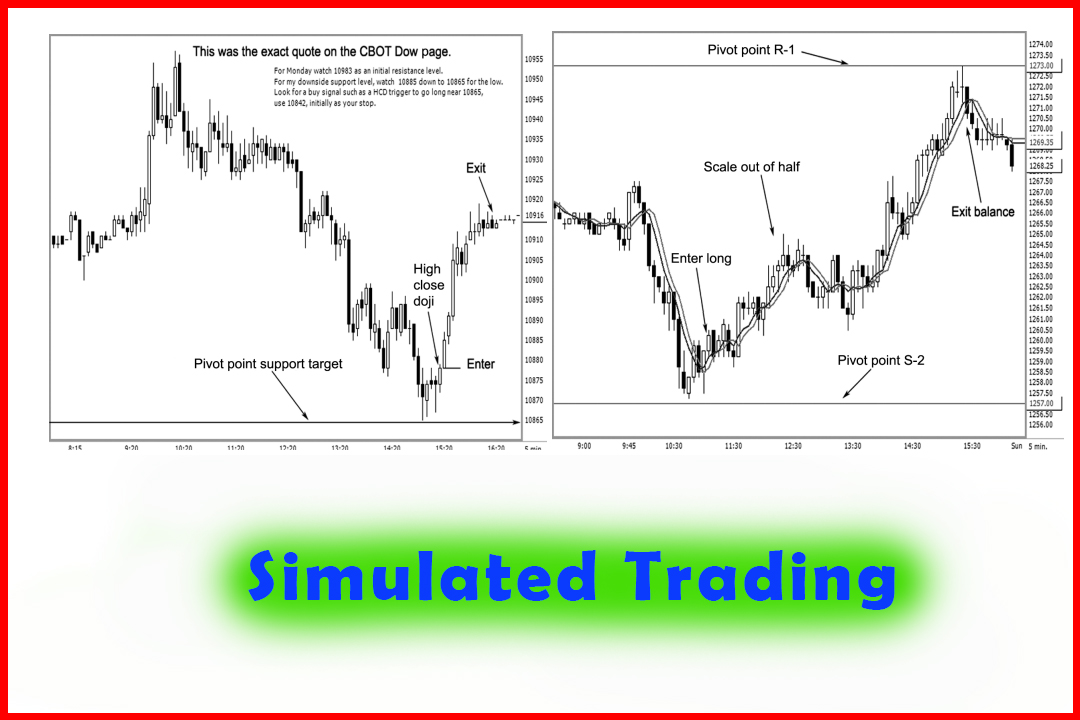

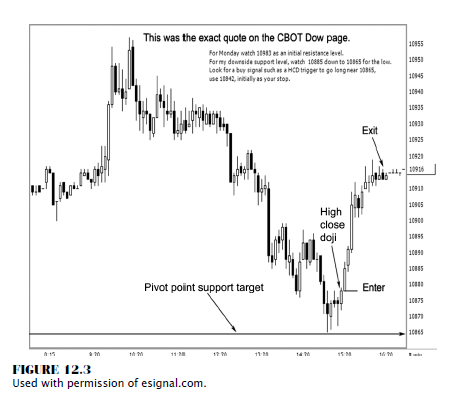

If you

map out a game plan, trade off the “numbers,” or

have a trading system, when you print out your chart and examine your trades,

you are grading your own homework. I have posted on my web site a daily Dow

Report to which the Chicago Board of Trade links. Every day after the market

closes, I post two numbers based on my teachings and on what we went over in

this book.

Those

numbers are what I believe the high and/or low of the session will be; and

then, based on the market direction number, I will post a trade recommendation.

Figure 12.3 shows a direct quote that was for Monday, February 13, 2006. The

initial resistance level was 10983, and my target support was 10865. The exact

low was 10865, and a high close doji pattern formed.

This is

not rocket science. Why would I state the day before what type of pattern to

look for and at what price? We know the reasons why I select a high close doji

trigger based on the statistical findings in Chapter 7. When I introduce two

other dimensional market analysis approaches, such as a moving average and

pivot point analysis, all you need is the patience to wait for the signal to

materialize. It is a high-probability setup; and in this case, the trade

resulted in a 38-point gain, or $190 per contract, in less than an hour. The

only drawback on this trade was that you had to wait until the end of the day

for it to materialize. No pressure, no worries, just profits. A nice trade. And

if you print out a chart and plot your entries and exits, you will begin to see

more clearly how a trade develops; and you will reinforce your subconscious

mind on what to look for in the next trade and improve your confidence from

within to win.

There are

many who visit my site just to see my numbers selection for the market. I also

include what the projections are for the week. For day traders and swing

traders, it helps them also identify a potential confluence support level based

on pivot point analysis. Feel free to visit and check the numbers yourself at

www.nationalfutures.com; just click on the link that says Daily Dow Report.

Even better: You now have your own Pivot Point Calculator, provided on the

accompanying CD to this book.

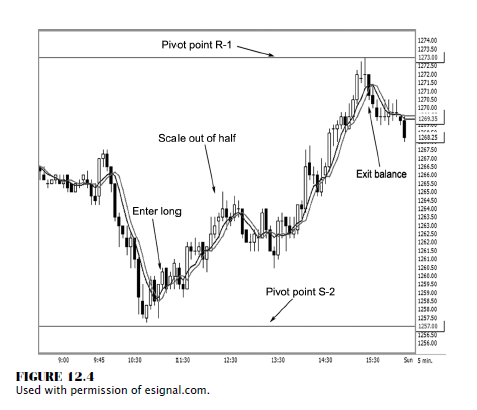

Another

case in point as to why it is helpful to print out and catalogue charts that

track your trades is that it will help you to visually back-test the methods.

The more you see the patterns recur, the more assurance you will have in the

methodology.

The topic

I covered in Chapter 5, demonstrating how to filter the pivot point price

projections, based on the moving average approach, gives me an edge by reducing

the noise or eliminating excess information. It helps me to narrow the field to

what the potential range might be of a given market for a specific time frame.

If I have a predetermined point of view that

the market might see a low of 1257 and a high of 1273, once I identify a

pat-tern and conditional change in the price action, I can enter a position. In

Figure 12.4, I have a trade example in the e-mini-S&P (Standard &

Poor’s) that demonstrates how the market was contained within the bearish target

selected pivot point numbers based on the system. Remember, if bearish, then

the target low will be near S-2 and the high will be near the first resistance

level (R-1). If you stick to the rules and look for buy signals near support

and sell signals near resistance, follow the game plan, add the other two

dimensional factors such as a high close doji or hammer pattern, with the

moving average indicating a conditional change, then you enter a position. As

the market starts to show momentum loss as indicated by shadows, scale out of

half of your positions, place a hard stop at breakeven, and then wait to see

the flow of the market. If you print out your chart and plot your entry price,

your scale-out price, and then the price where you exited on the balance of

your positions, you will not only grade the trading system but also your

performance and how you react to market conditions.

The Candlestick and Pivot Point Trading Triggers : Chapter 12. Confidence to Pull the Trigger Comes from Within : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Money management, Risk management, Risk Reward Ratio, Track Trade Results - Track and Chart your Trades