Trading Signals

Best Trading signals, Best trading Strategy, Pivot Point Trading Triggers

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 12. Confidence to Pull the Trigger Comes from Within ]

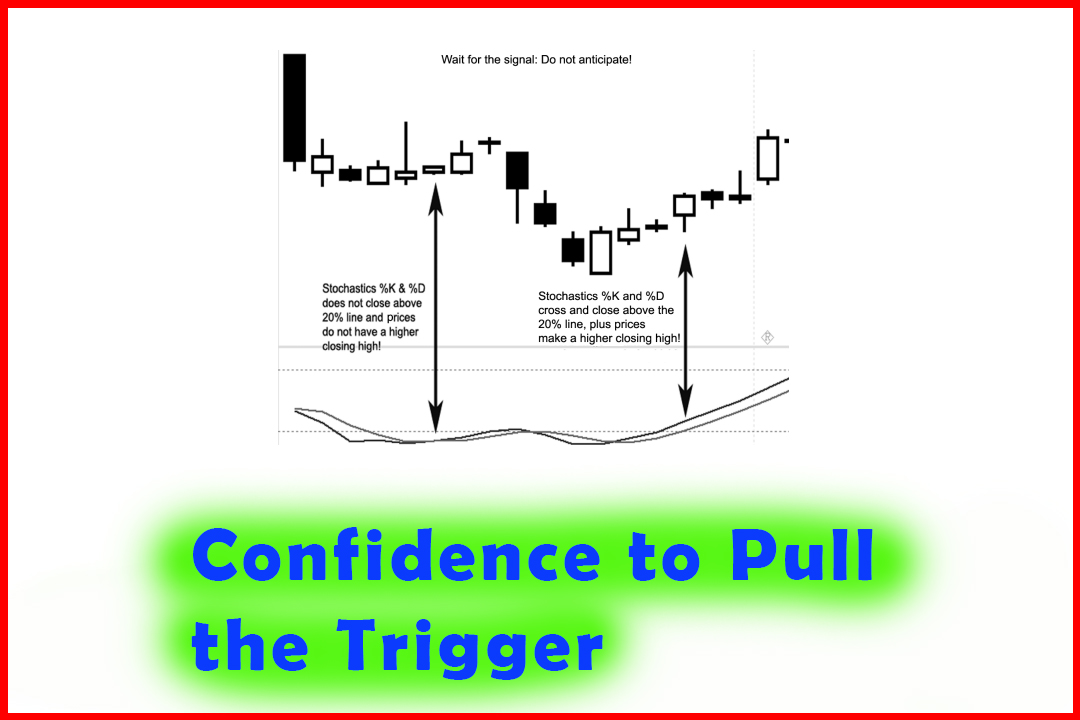

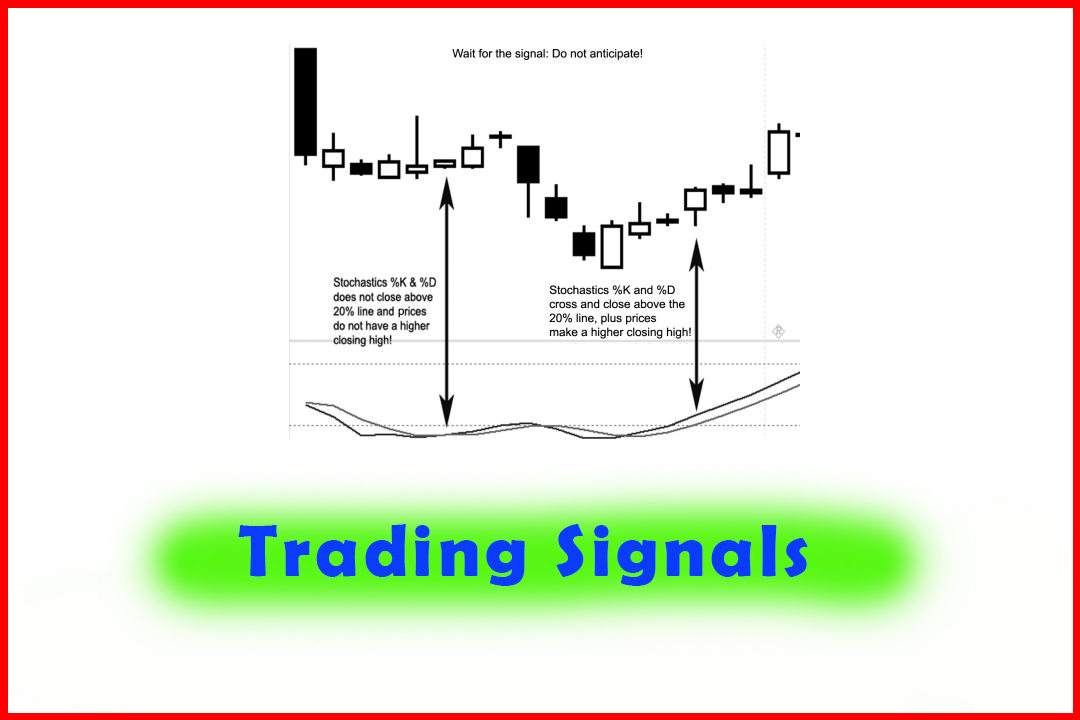

short-term, or swing trading, you need to wait for signals and trade by those signals. That seems easier said than done. But it is a common mistake that I have helped traders with, especially when they have jumped the gun, anticipating a buy signal from an indicator such as stochastics.

WAIT FOR THE TRADE SIGNALS

For day,

short-term, or swing trading, you need to wait for signals and trade by those

signals. That seems easier said than done. But it is a common mistake that I

have helped traders with, especially when they have jumped the gun,

anticipating a buy signal from an indicator such as stochastics. We went over

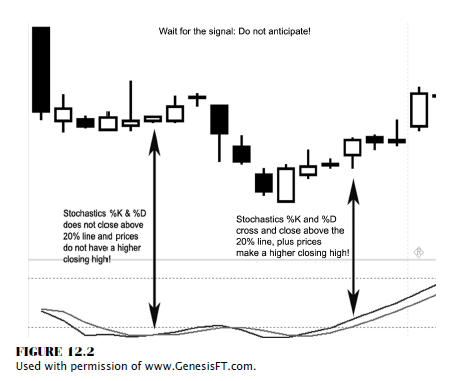

the stochastics %K and %D 20-level line-cross signal. Figure 12.2 shows a

detailed description of how to apply the 20 percent line closing signal

properly, using the market’s price action while waiting for the close of a time

period to keep you from anticipating a trade. It also demonstrates when it is

more appropriate to enter a long. If you learn what a true signal is, based on

the close of a time period, and if you repeat that successful action, then you

will develop the skills needed to have the confidence to consistently apply

this method. Ultimately, your performance and trading results will improve.

We

discussed in Chapter 3 how to use the stochastics oscillator properly. It is so

important. Let’s review: If you anticipated a buy signal based on the

stochastics %K and %D hook crossover the first time, you should notice how

either of the two closed above the 20 percent line in Figure 12.2. In addition,

you did not see a higher closing high collaborate a buy signal. Anticipating

without confirming factors or misreading a signal can and usually does result

in losses. Notice that the second signal where both %K and %D cross and close

above the 20 percent level is confirmed with a higher closing high. This is a

confirming signal and will put you in a better mindset and more often than not

on the profitable side of the ledger. Remember, your mind can and does play

tricks on you when you are trading. That little subconscious voice will tell

you to just hang in there, to just keep holding on to the loser, because the

market will bounce back. Odds are that fear takes over and you sell out of a

long, right on the low of the move. You cannot act on emotional impulse. If you

act on impulse and you are wrong, you need to get out immediately once and if

the market breaks further against you, because the emotional state of greed got

you into the trade and the emotional state of fear will get you out. Usually it

is on the low. If you wait for a true buy signal based on the closing price

action, you are trading with the current flow of the market. This method of

trading, once you see consistent results, will increase your confidence; and

that will give you what it takes to become a successful trader consistently

over time.

THE RIGHT FRAME OF MIND

Many

times traders subconsciously sabotage themselves inadvertently. Avoid putting

yourself in a situation that will cause you to be skeptical or afraid before

you trade. A better way to state it is, do not trade while undergoing a major

personal setback. This would include stressful events like buying or selling a

house, moving, sickness, a change in careers or a loss of a job, a death in the

family, or loss of a friend. A breakup in a relationship or a divorce can also

cause undue stress. Try to make educated decisions, and make sure you have the

time to invest in your work before putting on any trades. Remember that it is alright

to be wrong; just don’t be wrong all the time, making the same mistakes over

and over again. If you follow a proven strategy, you are already aware that

there will be losses. We discussed this in Chapter 11. If you are trading on

the edge, not in the right frame of mind, angry, or upset, then you have lost

the emotional edge that is needed to stay focused and disciplined.

If you

are not trading with an indicator, a plan, or a software program, then write

your rules down on your computer screen. This is one method that can help keep

you on track when you start trading out of impulse or from an emotional state

of mind.

The Candlestick and Pivot Point Trading Triggers : Chapter 12. Confidence to Pull the Trigger Comes from Within : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Best Trading signals, Best trading Strategy, Pivot Point Trading Triggers - Trading Signals