Confidence to Pull the Trigger Comes from Within

Trading opportunity, Buying opportunity, Pull the trade, How to Place pending Order

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 12. Confidence to Pull the Trigger Comes from Within ]

Successful trading is all about diligence and hard work and having a winning attitude! Great traders take the trades that were developed with thought and with keen observations that were based on predefined trading signals.

Confidence to Pull the Trigger

Successful

trading is all about diligence and hard work and having a winning attitude!

Great traders take the trades that were developed with thought and with keen

observations that were based on predefined trading signals. This mentality

will help you develop the confidence to execute when a trading opportunity

presents itself. Lack of confidence and fear are your enemies. Trading on a

rule-based system will help you overcome most emotional issues as long as you

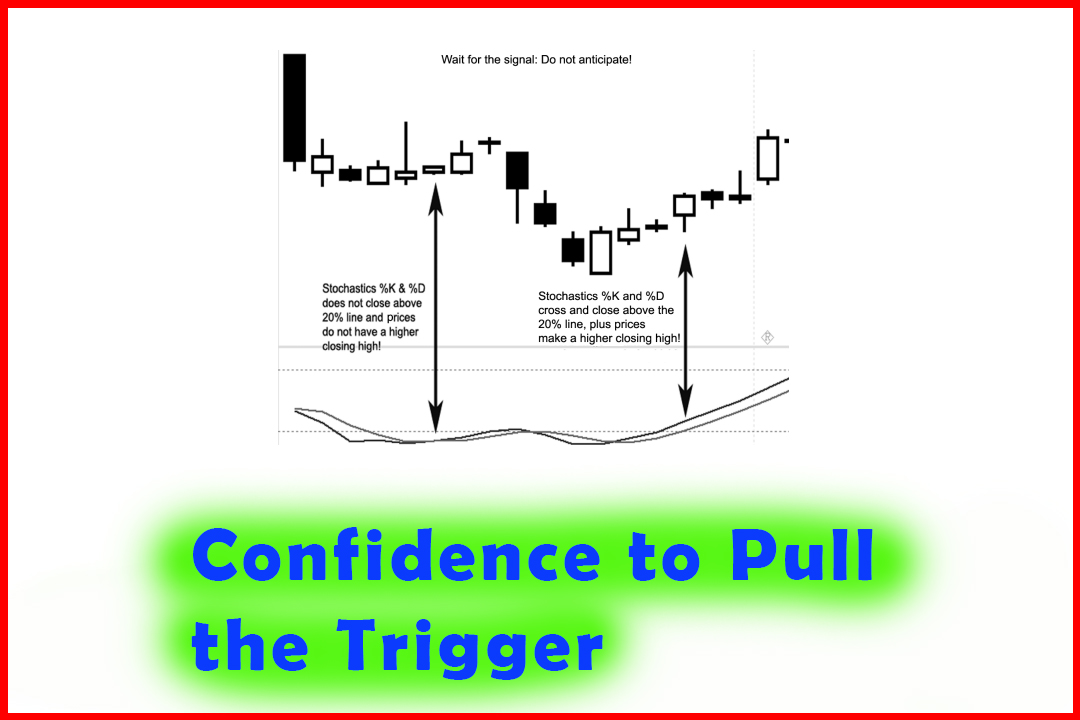

are trading based on a signal or trigger. Never take action on anticipating the

signal. If the rule states to buy when X crosses over Y, you have to wait for

the cross rather than anticipating that the cross is about to occur. That is

what trigger means: It is a call to action based on a conditional change.

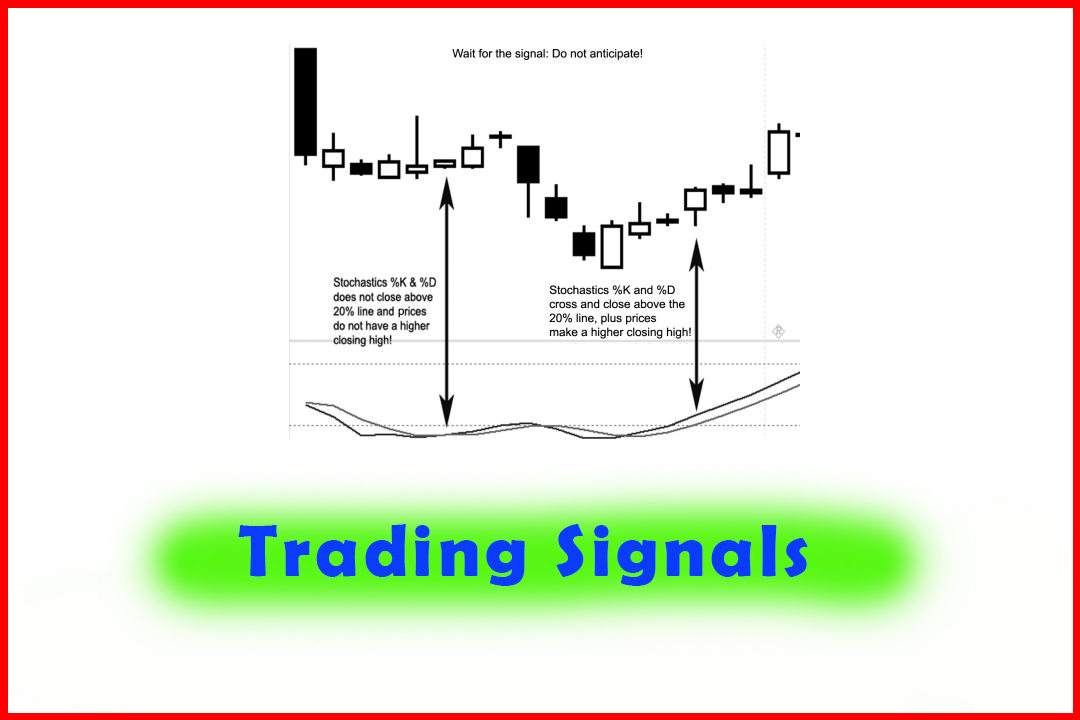

Many experienced

losing traders who have come to me for help have a common problem—they try to

jump the gun and try to outguess the market. They have this feeling that they

will miss the opportunity if they don’t act. By now, you know what a candle

chart is; and you have read many times that it is imperative that you wait for

the close of the time period for which you are trading to close before acting

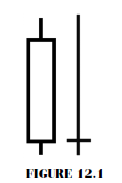

on a buy or a sell signal. Look at Figure 12.1—the candle on the left may have

given an impression that a bullish breakout would materialize. However, keep in

mind that unless you waited for the close, it really formed a doji. Imagine

getting all wrapped up emotionally, thinking you were missing a great buying

opportunity only to experience buying the high of the time period because you

failed to be patient and disciplined in waiting for the time period to

conclude, assuring you of the buy signal, or of the higher close.

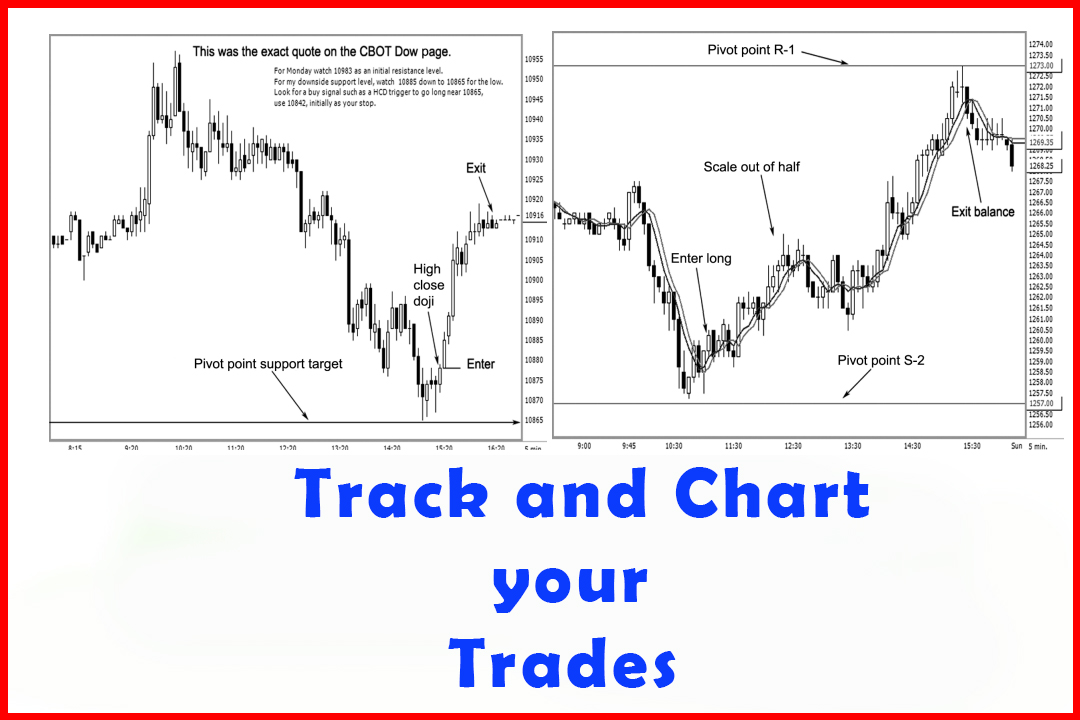

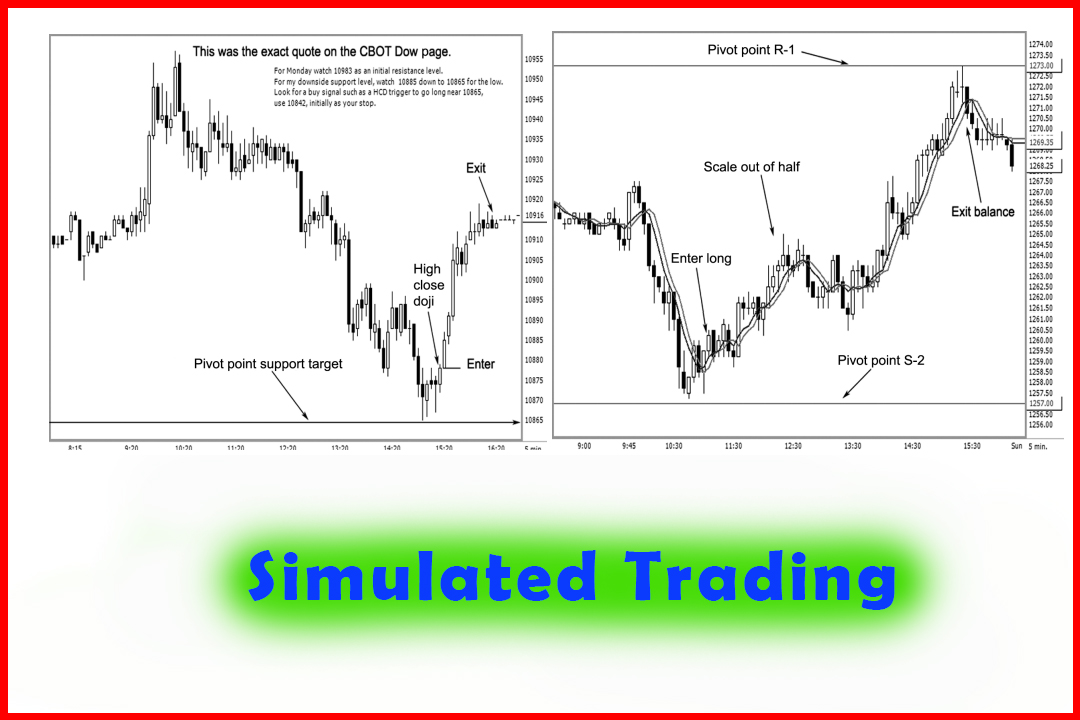

If you

anticipate a signal, you might be right; and there are times when you can

anticipate taking a trade based on a formulated, educated guess. One such

scenario would be to make a buying decision based on what I call a “gap band”

play. That is when the market departs too far from the pivot point moving

average, which for a buying opportunity would be defined as a potentially

overstretched price extreme or oversold market condition. Armed with the

longer-term numbers, such as a monthly second support (S- 2) target, I would

look to go long but with partial positions; or I would simply scale into a

position with from one-quarter up to one-third of my normal lot size or

positions.

Here is

where it might seem like I would be playing the “catch the falling knife” game,

which I am. But when the market has the capacity to make a major price reversal,

especially when several indicators line up, such as stochastics warning of

bullish convergence, the Commodity Futures Trading Commission (CFTC) Commitment

of Traders (COT) report shows a major imbalance, as discussed. Then if the

market has been in a long-term downtrend and shows that prices have departed

too far from the mean, that is what spotting a buying opportunity is about.

That is also when, under these certain conditions, it is appropriate to

anticipate a trade. You should cut back on your initial position size and set a

risk factor such as a conditional setup if the market, for instance, makes a

lower closing low. You can also add a time element, such as “If the market does

not reverse in X amount of periods, then get out.” In a situation like this,

you could implement a longer-term option strategy, such as buying call options.

(I did not go into options in this book because that subject matter was covered

in my first book on page 217.) Options are a great investment vehicle that

offers traders peace of mind and confidence to pull the trigger in highly

volatile and precarious situations, such as picking longer-term tops and

bottoms, especially in the bullish scenario just described. Remember, I have

stated many times that as traders, we “look for opportunity and then apply a

strategy.” That is how we capture potential profits on big reversals.

Anticipating

trades is a dangerous game, so you need to take that into consideration. If you

ask yourself the right questions, then you can develop a solid trading plan.

One such question is, “Is the risk worth the reward?” If it is, take the

opportunity.

The Candlestick and Pivot Point Trading Triggers : Chapter 12. Confidence to Pull the Trigger Comes from Within : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Trading opportunity, Buying opportunity, Pull the trade, How to Place pending Order - Confidence to Pull the Trigger Comes from Within