Candlestick Entry and Exit Strategies

Candlestick signals, Candlestick analysis, Candlestick best entry setup, Candlestick best exit setup, Candlestick Trading Setup

Course: [ How To make High Profit In Candlestick Patterns : Chapter 8. Candlestick Entry and Exit Strategies ]

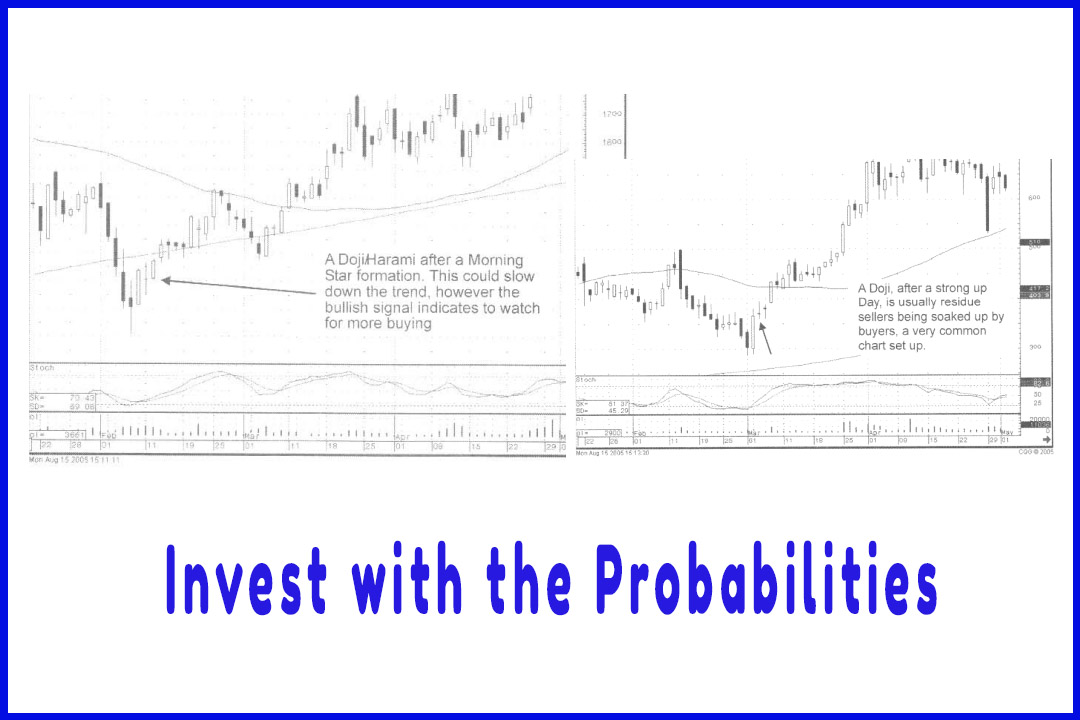

Candlestick signals tire in existence today because of their statistical probabilities. As can be imagined, the signals would not be in existence today if they did not produce noticeable profits throughout history.

Profitable Candlestick Entry and Exit Strategies

“It is a great folly to struggle against such things as thou

const not overcome.”

Candlestick

signals tire in existence today because of their statistical probabilities. As

can be imagined, the signals would not be in existence today if they did not

produce noticeable profits throughout history. Profits showing significantly

more than random luck or normal market returns. The purpose for utilizing the

Candlestick signals is to put as many probabilities in your favor as possible.

The fact that a signal is still around is due to its observed results over

centuries. Assuming that the probabilities of making a profit from that signal

is above 50%, maybe 60%, 70% or even 80%, and those percentages can be enhanced

by an additional factor. The signals indicate when to get out of failed trades immediately,

thus cutting losses. (To date, statistical performance has been difficult

to obtain. The combination of severe misunderstandings of when a signal is

truly a signal by most investors has been a deterrent. That lack of knowledge

and the multitude of parameters required to do a statistical analysis makes

programming for statistical results an overwhelming task. What can be visually

accessed in the matter of milliseconds involves a multitude of numeric

calculations and parameters. The Candlestick Forum is currently directing

projects to accumulate these statistics and will make them available to

Candlestick Forum members as results are obtained. Because of the magnitude of

this project, information will most likely be released in bits and pieces as

completed.) How a position is performing, once the signal has appeared, is

an immediate filtering element. We are all eternal optimists and want every

position to go up as soon as we buy it. However, keep in mind, even with the

possible phenomenal results of 80% positive trades, that still leaves 20% that

will not work. The more steps taken to reduce bad trades, the better your

results will be in your investment funds.

The

information revealed in this book and on the Candlestick Porum website is not

the revealing of ancient “secrets” or the development of sophisticated computer-generated

formulas. It is the assembling of commonsense observations from centuries of

actual profitable experience.

Candlestick

information has been around in the U.S. investment arena for several decades.

Everybody knows about them. They use the candlestick graphics for better

viewing of charts. However, most investors do not know how to apply the signals

for effective results. You, taking the time and effort to research the

Candlestick method, are still in an extremely small minority of the investment

community. The Japanese rice traders made huge profits from the Candlestick

method. They used rice paper to draw charts and backlit the charts in candle

boxes. The concepts applied to Candlestick analysis eventually became the

backdrop of the Japanese investment culture.

Common Sense

As you

learn about the Candlestick method, keep in mind that the commonsense approach

is what distinguishes this investment technique from most investors trading

practices. The information you are receiving is knowledge that is available to

everyone. However, you have the benefit of learning the correct interpretation,

which means you get the desired results. Take advantage of this knowledge. It

will create a confidence in investing that most people never experience.

Just as

the signals produce valuable information as to when to buy a position, they

are just as valuable for demonstrating when to sell. This, sometimes, is much

sooner than expected. Simple logic tells us that if a Candlestick “buy” signal

appears in the right place with the right confirming indicators, the trade

should have a high probability of being a profitable trade. Unfortunately, reality

may show a different outcome. How a price ‘opens’ the next day is a very important

indicator as to how aggressive the buyers are. (The same parameters apply to

sell transactions, but for illustration, the buy side will represent all

trades.) Utilizing that information can be instrumental in weeding out less

favorable trades.

The logic

behind the results of an opening price the next day after a signal is simple.

Is there evidence that the buyers are still around? That information is readily

available through inexpensive live-feed services. Being able to view how a

stock is going to open, before the market opens, improves an investor

positioning dramatically. Returns expand dramatically by eliminating bad

trades.

The

shorter the trading period, the more critical the ‘open’ pricing. Options are

trading vehicles that require as exact timing as possible. Longer-term

investors have more leeway when putting on a position. A six-month trade or a

one-year trade is usually being bought when the monthly, weekly and daily

candlestick charts all coordinate, each chart shows that it is time to buy.

(The monthly and daily charts are the pivotal charts for long-term investors.

The weekly chart is sometimes out-of-sync. It is better to do your own testing

with a four-day, six-day, seven-day, or eight-day chart. They may have more relevance

than the one-week chart.)

“Buy stocks that are going up; if they don’t go up, don’t buy

them.”

Each

formation is not a signal. A Candlestick “buy”

signal in the overbought area does not mean the same as a Candlestick “buy”

signal in the oversold area. Conversely, a Candlestick “Sell”

signal does not mean the same in the oversold area as it does in the overbought

area. Many investors confuse the formations as signals. They do not take into

consideration where the overbought or oversold indicators (Stochastics,

settings of 12,3,3) might be.

When do

most investors want to buy into a stock? They usually want to buy after the

price has gone consistently up for days or weeks! Finally, they become

convinced that the stock is going to go up forever. That is tire reason an

inordinate amount of volume appears at the tops. Finally, everybody has gained

enough confidence and wants in. After a sustained uptrend, the broadcasts begin

on the financial news stations. The “experts” discuss how great the company or

the industry is doing. The average investor perceives they will be left behind

if they do not get into the stock. Of course, that is usually the first sign

that the top is near. Prices start to pull back because of profit taking. The

new investors hang on anticipating the uptrend will continue after some profit

taking. However, the pullback lasts a few weeks longer than everybody expects.

Then it moves slowly up to the area that diose investors bought, bumps into

resistance, then pulls back again. Soon they are sitting in a stock they have

owned for three months where the price still is not back where it was bought.

This is not a good return on the invested dollars.

Alternatively,

the inexperienced investors are going to try another approach. They are going

to buy a stock that they have followed because it has pulled back a hefty

percentage. This is at least more logical than buying a stock because it has

gone up a great deal. However, this also has its flaws, if done without using

any buying parameters or signals. Enron Corporation is a prime example of not

buying a stock just because it has backed off a good percentage from its high.

The person, buying a stock without any buying signals because it has gone down,

is just grabbing for the fallen knife. One of three things can happen from that

point and two of them do not make you money. The price could easily continue

its downward trek. Buying because you think that the sellers have sold enough

may not be a viable approach. The stock price could level out and trade flat

for the next six months, not a profitable endeavor. Finally, because you have a

wonderful sixth sense, you happened to buy the stock at the bottom and it

turned up reasonably quick. If that is the case, you do not want to read this

book or any book that would screw up that talent.

The best

investment strategy is to buy a stock that has bottomed and the buying is

becoming more prevalent. Tall order? Not really, when you can visually see the

buy signs. The probabilities are much greater to find the stocks that are just

starting to make an ‘up’ move. It is better to buy a stock where fresh buying

is recently coming into the stock and getting in on strength. Participating

with other buyers at least indicates that there are other buyers, logical! As

in the famous investment strategy of Will Rogers, “Buy stocks that are going up, if they don’t go up, don’t buy

them”. As backward as that philosophy appears in the

real world, the Candlestick signals get investors close to that concept.

How To make High Profit In Candlestick Patterns : Chapter 8. Candlestick Entry and Exit Strategies : Tag: Candlestick Pattern Trading, Option Trading : Candlestick signals, Candlestick analysis, Candlestick best entry setup, Candlestick best exit setup, Candlestick Trading Setup - Candlestick Entry and Exit Strategies