Invest with the Probabilities

when invest with the probabilities, how do invest with the probabilities, top 10 invest with the probabilities, why do invest with the probabilities

Course: [ How To make High Profit In Candlestick Patterns : Chapter 8. Candlestick Entry and Exit Strategies ]

Not every trade is going to shoot straight up after the buy signal appears. There will be many entry points that fit the perfect buying conditions, yet fade just after you fill your position. Mistake? Depends on how the rest of the day finishes.

Invest with the Probabilities

Not every

trade is going to shoot straight up after the buy signal appears. There will be

many entry points that fit the perfect buying conditions, yet fade just after

you fill your position. Mistake? Depends on how the rest of the day finishes.

Will every trade work the way the signals indicate? Definitely not! Nevertheless,

back to the basics. You are looking for the best possible place for your money

to make the best returns while minimizing risk. Hopefully, the signal itself is

representing well above a 50/50 probability of making money This ratio maybe

60%, 68%, or 74%. Fine-tuning the entry process may increase the probabilities by another 3%, 4%, or 5%. A good evaluation of the entry also has the element of

limiting the losses. If a trade is placed, and the basis for entering the trade

disappears immediately, and the buyers have disappeared, then liquidate the

trade immediately. The loss may only be 1%, 3%, or maybe as much as 5% if it is

liquidated that day or on the open the next day. The gains get an opportunity

to run when the buy signal is not negated. The losses are trimmed immediately

if the signal fizzles. All from a simple premise! Are the buyers still in

control?

There is

a good rule of thumb for protecting a newly established position. If after a buy

signal, a position is established, and the prices back off by the end of the

day, closing more than halfway down the bullish candle that identified the buy

signal, close out tire position. Statistically, this represents that the sellers

still have the upper hand. However, keep in mind that a buy signal did form at

the bottom of the trend. Despite having to exit the trade at a small loss, be

prepared to see new buying evidence soon. If so, re-establish the position. The

initial buy signal occurred for some reason.

The most

important decision-making area is at the reversal points. Is it a reversal or

is it a pullback in the trend? That is where the analysis and monitoring is

most important. A buy signal requires follow-through. The weight of a sustained

downtrend needs a strong change of sentiment to reverse its course. If the

reversal has only two or three days of an up move, do not be hesitant to take

quick profits once a weak signal appears. There may be a more opportune time to

get into a position if a pullback occurs. Will the current low hold, act as

a support level? You should be watching for a new buy signal. This is your

opportunity to get into the position again.

If the

previous low does not hold and prices go lower, watch for the next buy signal to

occur at lower levels. This is true whether a short-term trader or a

long-term holder.

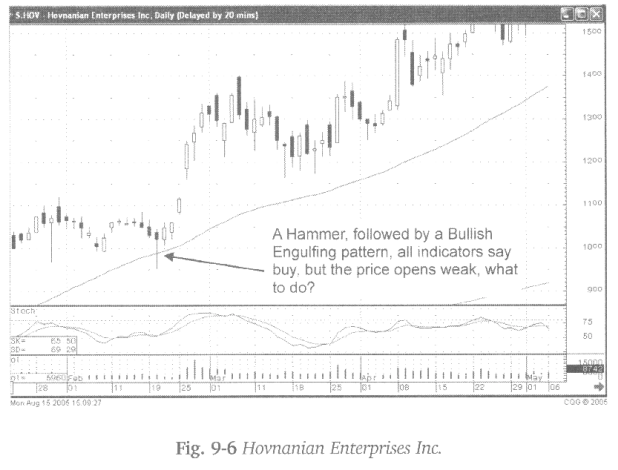

Fig. 9-6,

Hovnanian Enterprises Inc. illustrates the Candlestick investors’ minor

dilemma. All the parameters say to buy this stock. A Hammer is followed by a

Bullish Engulfing pattern. The stochastics have turned up, volume is picking

up. But the next day the price opens much lower than what would indicate that

buyers were still active. What is the best way to enter this position? Are the

sellers taking back control for some reason? Maybe the indexes opened much

lower. In keeping with the practice of buying a stock that is going up, the

best entry strategy would be to put a buy stop at the close of the previous

day. If the buyers are still participating, it will be evident when the price

moves from the lower ‘open’, and then back up through the close of the previous

day. Buying the stock at a slightly higher price is a small premium to pay for

knowing that you are getting in a position when the buyers are around.

If the

buy stop never gets executed, the lower open and a close below the previous

day's close would form a Harami. This formation would indicate that the buying

had stopped. You are not in a position where the sellers may be taking control

again. If the buy stop is executed, a buy signal is confirmed.

As

described in “Profitable Candlestick Trading” a Hammer signal can show the

investor great amounts of information. In the example of Hovnanian Enterprises

Inc, the buyers did come into the stock, executed the stop, and continued to

show strength. This made for a good trade.

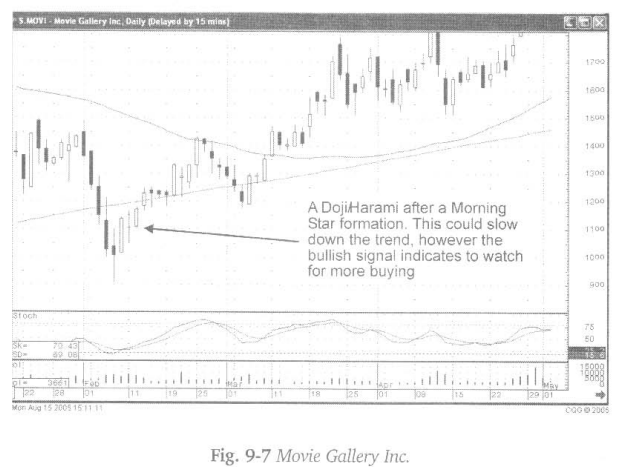

If market

conditions were weaker or profit taking comes into a stock, it can create a

different evaluation after the close. Fig. 9-7, Movie Gallery Inc., for

example, creates an evening of less positive possibilities for the next day. In

this case, the price opened lower, came up during the day, and executed the buy

stop. Now the position closed lower than where it was bought, forming a Doji/

Harami. That could lead to a few days of consolidation. However, it is still

early in the up-trend. Stochastics are heading up. Fortunately, the buying

continues the next day and moves prices positive. Again, the overriding factor

boils down to the appearance of a Morning Star “buy” formation. As seen in the

chart, the Morning star formation was the bottom reversal point for a strong

uptrend.

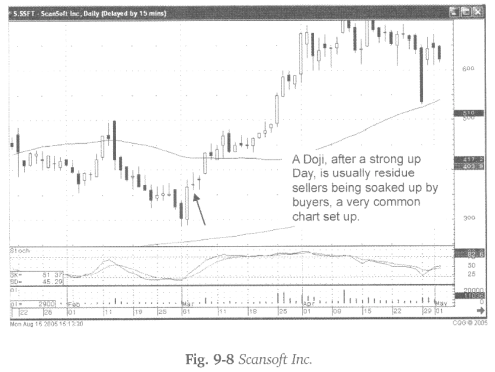

One of

the most common chart patterns is the Doji after a big up day. Consider the

dynamics that are occurring in the investors’ minds. In an example such as Fig,

9-8 (following page), Scansoft Inc., there has been a recent distinct

downtrend. All of a sudden, a Bullish Engulfing pattern emerges. The buyers are

stepping in. They have overwhelmed the sellers to the point of reversing the

trend. The following day after the big up surge, there will still be sellers

that will take advantage of being able to get out at a higher price than just a

couple of days prior. This continued selling is met with buyers coming into the

position. It is not unusual to see a Doji day after a big up day. However, when

the sellers see that the buying is now soaking up all the selling, they get concerned

and step out of the way. The following day should see higher prices.

Don’t let

the Doji Day concern you. It is the transfer of stock from selling hands into

buying hands. If the price opens higher the next day, you can be assured that

the buyers have now gained control. The rally should continue.

Entering

a trade involves a combination of evaluations. Just as you would make a

decision about what you are going to wear today involves a number of observations.

You may have heard the weather report saying that it is going to be cold and

rainy today. You peer out the window to see what the conditions are. You look at

the thermometer to see what the temperature is doing. You may open a door to

see if it is windy or calm. You do the same process when getting ready to enter

a trade.

You

investigate. You have already done your research and decided on what position

you want to buy in the morning if the conditions are right. You check the

futures in the morning to see what the general market sentiment appears to be.

You can check to see if the bid and ask have moved one way or the other during

the non-market hours. You can check on other stocks in the industry to see how

they will open. You may look for any news reports since the close yesterday

that would influence the stock price.

If

nothing seems out of kilter, based upon what the “buy” signal was indicating

to make your “buy” decision, then the final input will be how prices are

actually opening. If nothing appears to be out of line, purchase the position.

That is what the Candlestick signal had indicated should be done. Fine-tuning

the entry process will minimize getting into a bad trade. For each bad trade

that can be avoided, more opportunities are available to put investment funds

into a good trade. Eliminating a very small percentage of losing trades will

increase your returns in geometrical proportions. Avoiding a loss negates

having to make back those losses with a positive trade while using up that

next trade and time to get back to even.

“If skills could be acquired just by watching, every dog would

be a butcher.”

How To make High Profit In Candlestick Patterns : Chapter 8. Candlestick Entry and Exit Strategies : Tag: Candlestick Pattern Trading, Option Trading : when invest with the probabilities, how do invest with the probabilities, top 10 invest with the probabilities, why do invest with the probabilities - Invest with the Probabilities