Prices ‘Open’ Reveals Valuable Information

Candlestick trader, Continuation patterns, psychology in downward trend, Candlestick signal, candlestick reversal signal

Course: [ How To make High Profit In Candlestick Patterns : Chapter 8. Candlestick Entry and Exit Strategies ]

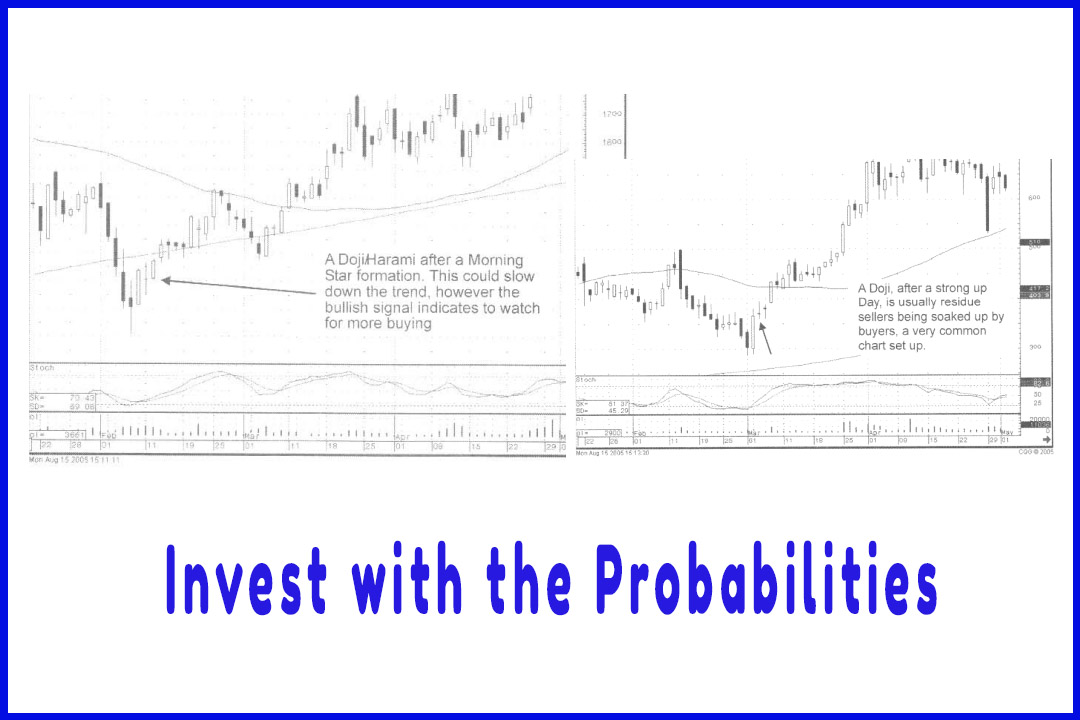

Simply stated, the signal is showing the evidence of buyers coming into a stock, reversing the previous downtrend. The Candlestick trader can identify those signals, 12 major signals and approximately 50 secondary signals and continuation patterns.

How Prices ‘Open’ Reveals Valuable Information

After the

above wordy dissertation, the meat of this subject is being aware of how to get

into trades properly. What is the message of a “buy” signal? As expressed in

the Profitable Candlestick Trading book, a signal is the cumulative

knowledge of all investors participating in that stock that day. If this is

the only statement that you remember about Candlestick analysis, you will

easily comprehend the ramifications behind the signals. A “buy” signal forms

by the reversal of investor psychology in downward trend. That formation

becomes visually evident to the Candlestick investor.

Simply

stated, the signal is showing the evidence of buyers coming into a stock,

reversing the previous downtrend. The Candlestick trader can identify those

signals, 12 major signals and approximately 50 secondary signals and continuation

patterns. As discussed earlier, the signals each provide a positive percentage

of profitable trades. Upon recognizing a candlestick reversal signal, the best

test to determine when to establish your position is based upon one simple

question. “On the open of the next day, are the buyers still showing their

presence?” This may appear to be elementary, but that is the basis for getting

into the position in the first place. The Candlestick signal represents a change

of direction. The magnitude of buyers present is an important factor on how

strong the reversal will perform.

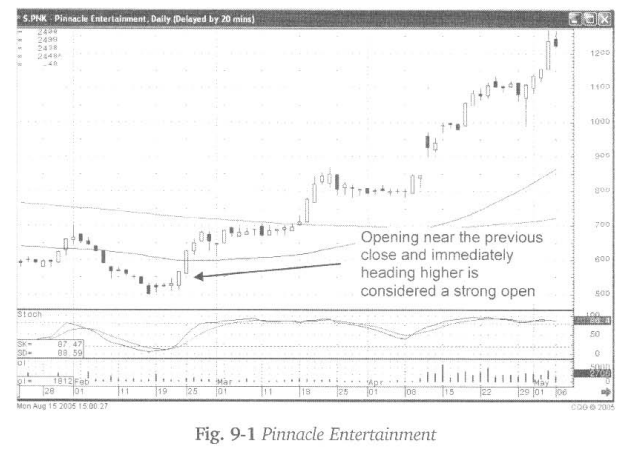

Fig. 9-1,

the Pinnacle Entertainment chart opens near the previous close. This clearly

indicates that the buyers have not backed away. Witnessing the price advance at

the ‘open’ reveals that buyers are stepping in without hesitation. Buy immediately.

You have all the parameters evaluated. The probabilities are in your favor.

There should be no reason not to get into the position.

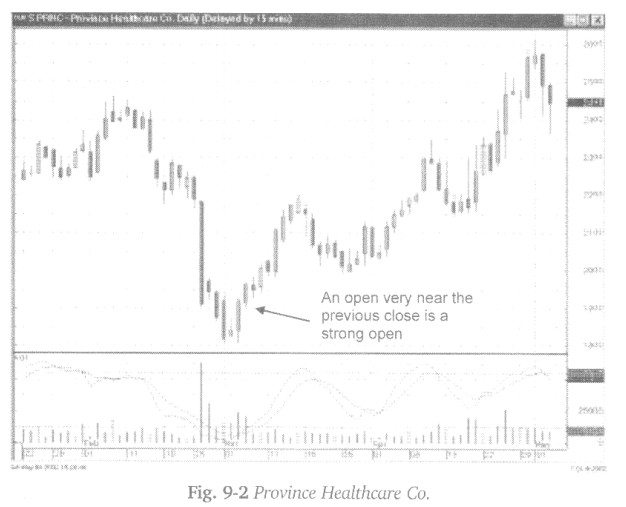

Note in

Fig. 9-2 Province Healthcare Co. that the buyers were still present. The open,

by remaining in the area of where the buyers closed the price the night before,

indicates that there was not a change of heart during the evening. “In the

area” can mean a slightly lower opening price. Consider the action of the

price the previous day. It had a big up day. As the end of the trading day is

getting near, the shorts may have realized that buying was the overriding influence.

The shorts may have covered, pushing the price up further on the close. Profit

taking or sellers still wanting to get out of the stock could lower the price

on the open. The next morning, prices opening slightly lower and immediately

moving higher indicate that the buyers have not disappeared. As soon as the

first few minutes of trading transpire after the open, an investor should be

able to ascertain how the stock and markets arc performing.

If the

market in general is not falling out of bed and the stock price does not appear

to want to move lower, it is time to start establishing the position. A prudent

method would be to buy half the position at the slightly lower level and put a

buy stop at the previous days close for the other half. The rationale being

that if the price conies up through yesterday’s price, the buyers are still

present.

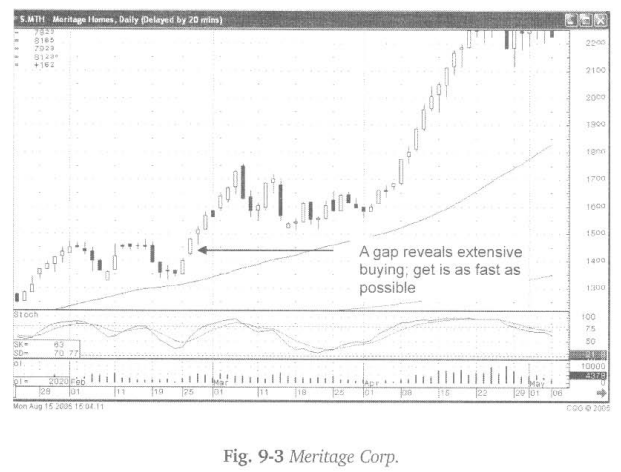

The most

promising form of evidence, indicating the price is getting strong buyers’

attention, is the gap up. Note in Figure 9-3, Meritagc Corp,, a gap up formed.

As defined by the gap, the strength of the buyers is very strong. A gap- up, at

the bottom of a downtrend, and after a candlestick reversal signal, is one of

the best signs of buying strength. One should be committing funds immediately.

The gap

up at a beginning of a trend bodes very well for an extended rally. Whether the

indexes are opening up weak or strong, a gap up in a stock deserves immediate

attention. The buying coming into this stock is not concerned about the status

of the markets. Try to get into tire stock as fast as possible. The advantage

of being able to view the bid and ask prior to the open is that it prepares an

investor for an entry strategy. Seeing a stock price biding up before the open

and knowing what a gap up indicates after a Candlestick signal allows for

placing a market order on the open.

Use that

buying force to your advantage. Get in early as possible. Again, the

probabilities are in your favor and this time the gap is adding to the force of

the move.

Sometimes

you are going to see a gap up; you get in and then watch the price head back

the other way. Don’t worry. The buy signal was the reason to buy. The buyers

were still around if prices gap up. If profit taking occurs after that, no big

deal, the buyers are still around. Wait for a day or two and the signal should

confirm itself.

A

substantial gap up may require watching to see if there is any immediate profit

taking. This might be better accumulated by buying one-half the position on the

open, the second half after observing the price move. In some substantial gaps

up, the opening price might be the high for that day, creating a black candle.

The fact that it had many buyers on the open, followed by some immediate profit

taking, still reveals that there was a strong change in sentiment.

“I hear and I forget. I see and I remember. I do and I

understand.”

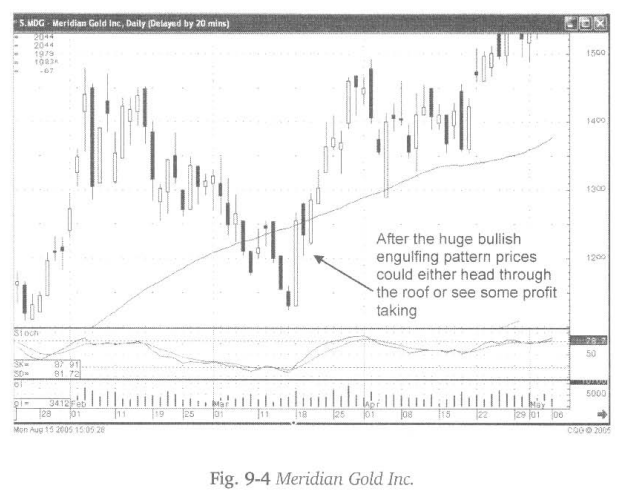

Note in

Fig. 9-4, the Meridian Gold Inc. chart, how the large bullish engulfing pattern

clearly illustrated that the bulls had stepped in. This shows a great buying

influence. The next day gaps up. This could be the beginning of a very strong

rally. This has all the makings of a strong run up. There would be no reason

not to get into the position. However, once the position is filled, the profit

taking sets in. Is this time to worry? Remember what the bullish engulfing

pattern told you. The buyers were coming into this stock with great force for

some reason. It would seem very unusual that the next day they would all of a

sudden disappear.

It is not

unusual to see some profit taking after a 10% to 15% run up in two days. The

underlying factor remains that the buyers have come into this position with

vigor. Sit comfortably for a day or two to see what happens after the profit

taking disappears. In this case, the strong ‘buy5 signal was the prelude to

more buying.

The

appearance of a gap tip is a clear indication that the “buy” signal is having

the follow through that is required to sustain a strong rally.

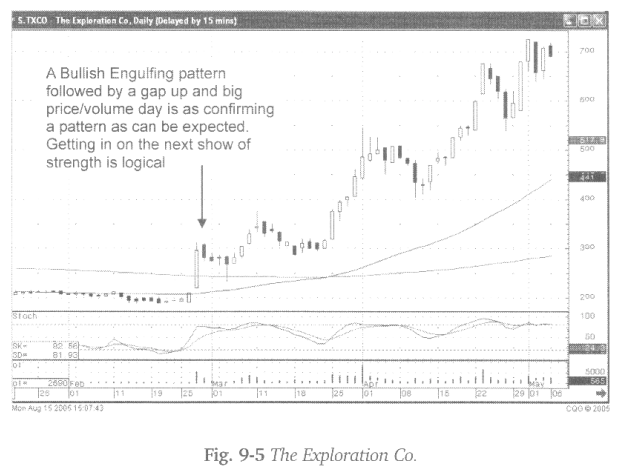

Fig. 9-5,

The Exploration Co. has every sign of strong buying. A Bullish Engulfing

pattern is the first signal. The gap up and the strong buying afterwards is

more evidence. There would be no reason for not getting into the position on

the next show of strength.

Once you

have gotten into the position, the price rolls back. Profit taking, or the market

in general starts getting weak. Your peace of mind is still in the strong buy

signals. As in this illustration, it took a few days for the trend to start

back up. During those few days, note that the sellers could not knock the

prices down.

It may

have tested some nerves, but after 3 or 4 days, the bulls starting gaining

confidence that the sellers did not have enough strength to push the price back

down. This leads to the continuation of the upward trend. It took a few extra

days but that is reality. Some positions look great when you get in but will be

a laggard for a few days. Nevertheless, if the message of the signals is

correct, the trend will be continuing. Sometimes that will take patience but

the probabilities will be in your favor.

How To make High Profit In Candlestick Patterns : Chapter 8. Candlestick Entry and Exit Strategies : Tag: Candlestick Pattern Trading, Option Trading : Candlestick trader, Continuation patterns, psychology in downward trend, Candlestick signal, candlestick reversal signal - Prices ‘Open’ Reveals Valuable Information