Moving Average Convergence/Divergence (Macd)

macd on chart indicator, macd signal, macd full form, macd indicator how to use, macd settings

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 3. Using Read Oscillators to Spot Overbought ]

In simplest terms, moving average convergence/divergence is an indicator that shows when a short-term moving average crosses over a longer-term moving average.

MACD

In simplest

terms, moving average convergence/divergence is an indicator that shows when a

short-term moving average crosses over a longer-term moving average. Gerald

Appel developed this indicator as we know it today, and he developed it for the

purpose of stock trading. It is now widely used for short-term trading signals

in stocks, futures, and forex markets, as well as for swing and position

traders. It is composed of using three exponential moving averages. The initial

inputs for the calculations were a 9-period, a 12-period, and a 26-period. The

concept behind this indicator is to calculate a value, which is the difference

between the two exponential moving averages, which then compares that to the

9-period exponential moving average. What we get is a moving average crossover

feature and a zero-line oscillator, and that helps us to identify overbought

and oversold market conditions.

I might

add that because traders are now more computer savvy than ever before and

because many charting software packages such as RealTick allow traders to

change or optimize the settings or parameters, it is easy to change, or

“tweak,” the variables in Appel’s original calculations. Traders can increase

the time periods in the moving average calculations to generate fewer trade

signals and can shorten the time periods to generate more trade signals. Just

as is the case for most indicators, the higher the time periods used, the less

sensitive the indicator will be to changes in price movements. MACD signals

react quickly to changes in the market that is why a lot of analysts, including

myself, use it. It helps clear the picture when moving average crossovers

occur. It measures the relative strength between where current prices are as

compared to past time frames from a short-term perspective to a longer-term

perspective.

The MACD

indicator is constructed with two lines: One is the 9-period exponential

average (slow line), and the other is the difference between the 12- and

26-period exponential moving averages (fast line). In general, when the fast

line crosses above the slow line, a buy signal is generated; the opposite is

true for sell signals.

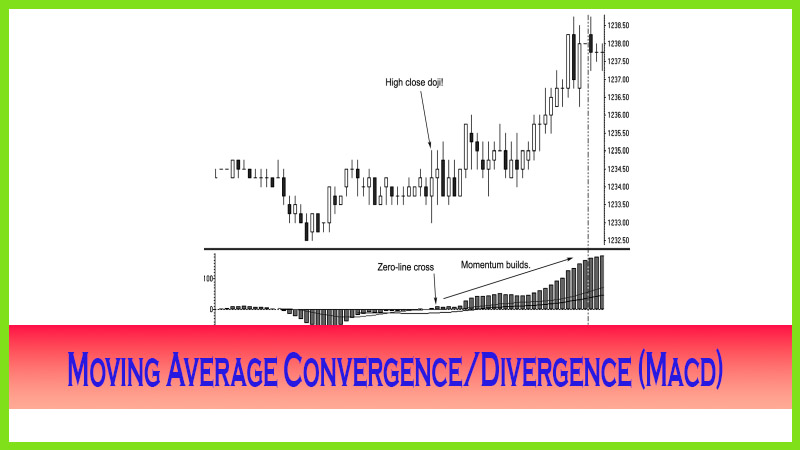

The MACD

also has a zero baseline component, called the histogram, that is created by

subtracting the slower signal line from the MACD line. If the MACD line is

above the zero line, prices are usually trending higher. The opposite is true

if the MACD is declining below the zero line. The MACD is a lagging indicator;

that is, it is based off moving averages. We want to look for the zero-line

crossovers to identify market changes and to help confirm trade entries or

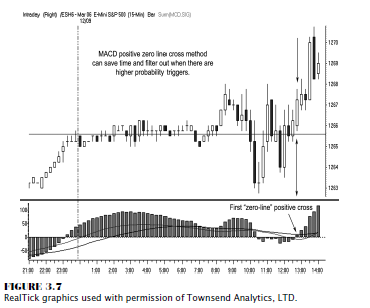

trigger action to exit a position. As you can see in the e- mini-Standard &

Poor’s (S&P) chart in Figure 3.7, the MACD readings cross back above the

zero line, indicating a confirmed shift in momentum. That zero-line cross

helped filter out the bottoming process. A long position would have been initiated

at the close of the candle or at the next time period’s open at 1267.25, which

resulted in an immediate price gain, carrying prices up over 1270.

Clues

that identify shifts in momentum as the market moves from one extreme to

another or from overbought to oversold to trigger a trading opportunity can be

identified with the aid of MACD readings in both the moving average and the

histogram component. While profits are higher when buying the absolute bottom,

that is a haphazard guessing game to play.

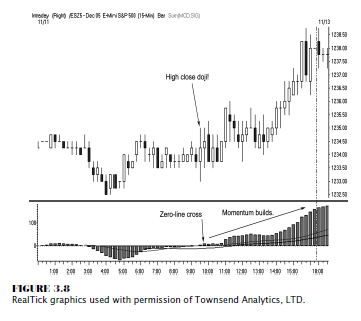

Trading

based on a set of rules and using a confirming indicator to identify a change

in price direction and then following that price movement are the keys to

making money in the markets. Figure 3.8 shows an e-mini-S&P example; the

intraday trend is established to be higher by 10 a.m., as the symmetry of

higher highs and higher lows exists. The MACD confirms an HCD trigger as the

histogram bar crosses above the zero line, initiating a long at 1234.75. Notice

that the histogram bars continue to expand higher, confirming that the bullish

momentum is accelerating. Identifying a zero-line cross is a powerful tool in

confirming entries, and watching the progression of the histogram bars may help

you maintain a winning position.

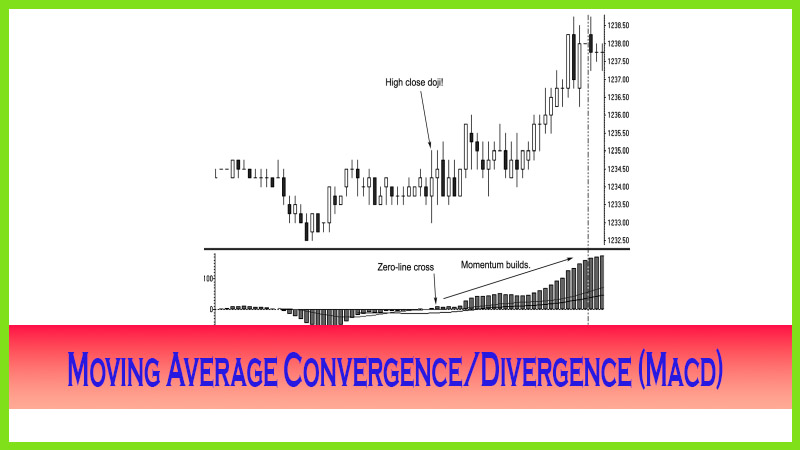

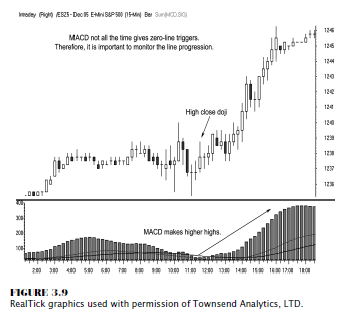

It is not

in every single instance that we see the MACD signals work exactly the same as

Figure 3.9 demonstrates. The histogram was not under the zero line; therefore,

a zero-line cross did not trigger. However, observing that the histogram bars

move higher as prices start to advance would certainly help confirm the

strength of the uptrend.

The Candlestick and Pivot Point Trading Triggers : Chapter 3. Using Read Oscillators to Spot Overbought : Tag: Candlestick Pattern Trading, Forex, Pivot Point : macd on chart indicator, macd signal, macd full form, macd indicator how to use, macd settings - Moving Average Convergence/Divergence (Macd)