Stochastics Patterns

stochastic rsi patterns, what does stochastic rsi indicate, how to set stochastic

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 3. Using Read Oscillators to Spot Overbought ]

One other method in which to use the stochastics indicator is trading off a pattern called bullish convergence. It is used in identifying market bottoms—where the market price itself makes a lower low from a previous low, but the underlying stochastics pattern makes a higher low.

Stochastics Patterns

One other

method in which to use the stochastics indicator is trading off a pattern

called bullish convergence. It is used in identifying market bottoms where the

market price itself makes a lower low from a previous low, but the underlying

stochastics pattern makes a higher low. This indicates that the low is a “false

bottom” and can resort to a turnaround for a price reversal. Figure 3.4 shows

how prices make a secondary low significantly lower from a primary low, which

is posted by a low in the stochastics indicator.

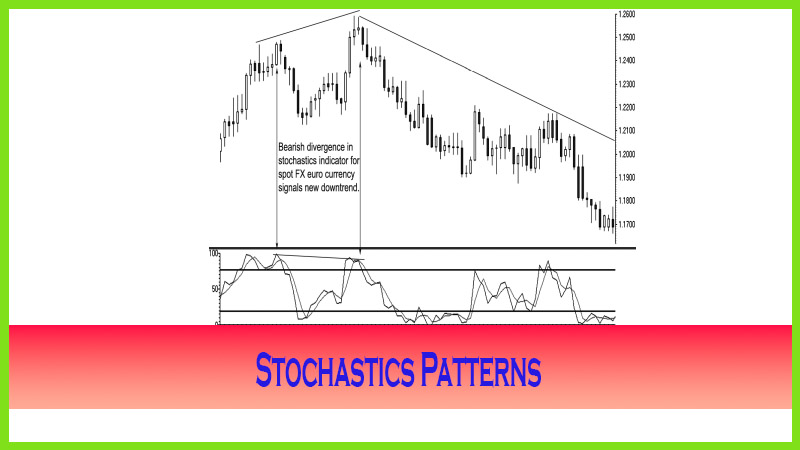

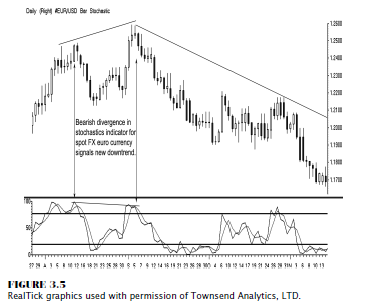

The

reverse of this signal is a trading pattern called bearish divergence. It is

used in identifying market tops—where the market price itself makes a higher

high from a previous high, but the underlying stochastic pattern makes a lower

high. This indicates that the second high is a “weak” high and can resort to a turnaround

for a lower price reversal. Figure 3.5 shows how the market makes a secondary

high, but the corresponding high in the stochastics is at a lower level than

the price charts’ primary high point.

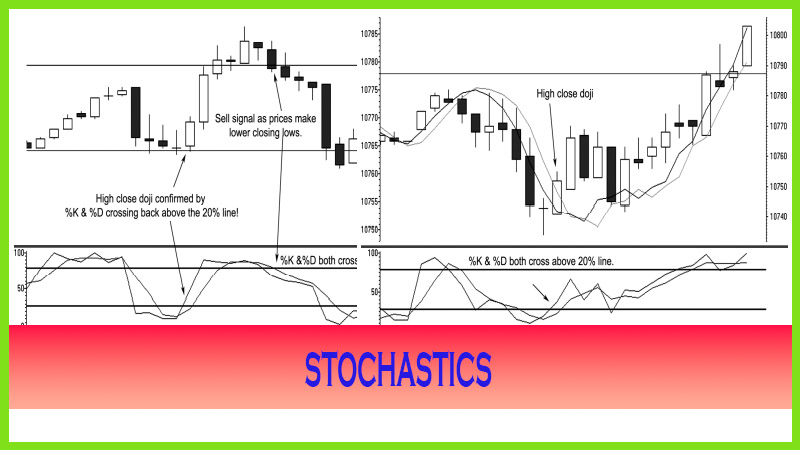

This

stochastic pattern can alert you to a false breakout. Notice the low close doji

(LCD) off the secondary peak; and then as %K and %D both cross over and close

back beneath the 80 percent line, a sell trigger is generated. That signal

warns of an impending, prolonged downtrend of substantial proportion.

Therefore, it is important to monitor for divergence patterns.

Rules to Trade By

The bearish divergence pattern signals that there is an impending price reversal ready to occur in a market. As I mentioned previously, you can anticipate and get ready to place an order to act on the signal; but you should not act until the confirmation of a lower closing low triggers the entry, which would be to act on the close or the next open. Here are four rules to guide you to trading a stochastics divergence pattern:

- The first peak in prices should correspond with a peak in the %K and %D reading above the 80 percent level.

- The second peak must correspond to a significant higher secondary price high point.

- If the secondary stochastics peak is less than or under the 80 percent level, this signals a stronger sell signal.

- Prices should make a lower closing lower to confirm a trigger to enter a short position. Enter on the close of the first lower closing low or the next open. The protective stop should initially be placed above the high of the secondary high.

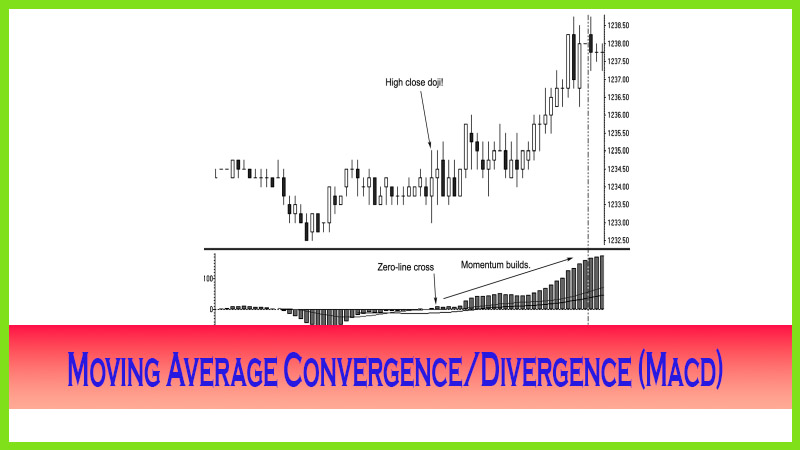

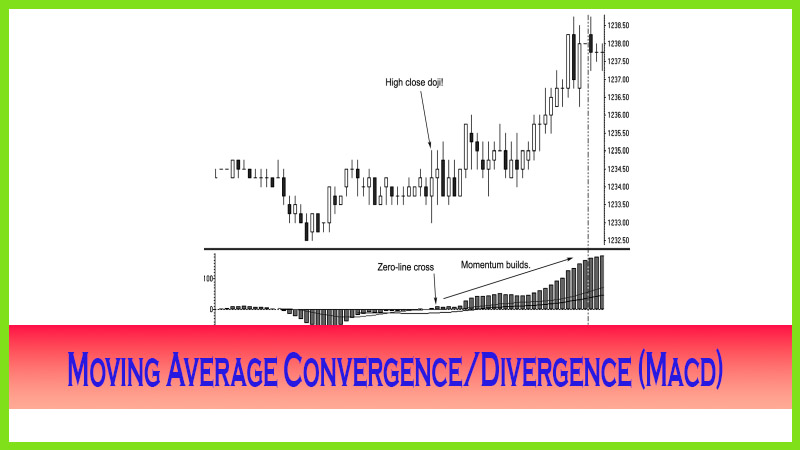

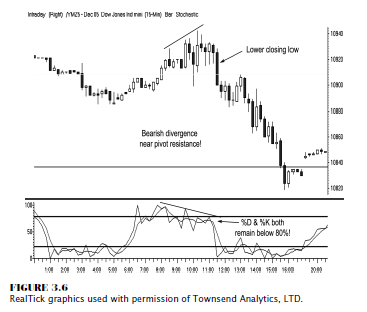

Figure

3.6 demonstrates a bearish divergence setup with the rules described. This is a

15-minute candle chart on the CBOT mini-Dow. The secondary high is established

at 10940. Both %K and %D make a primary high above the 80 percent line, and the

secondary high in price corresponds with %K and %D below the 80 percent level.

Once the long dark candle closes below the prior low (in fact, it closes below

five prior candles lows), a sell signal is triggered. The initial entry is made

on that time period close or on the next open, which in this case is 10897.

The stop

is placed at 10945, above the high of the secondary peak high. As you can see,

the market continues to decline into the close down to 10836, for a 61-point

gain had you exited on the close. That equates to a gain of $305 on a day trade

margin of $500 per contract. Notice that as the market declines, the

stochastics indicator remains below the 20 percent line as the %K and %D cross

multiple times but never back above the 20 percent level to trigger a buy

signal until after the electronic day session close, which is 4 P.M. (CT).

The Candlestick and Pivot Point Trading Triggers : Chapter 3. Using Read Oscillators to Spot Overbought : Tag: Candlestick Pattern Trading, Forex, Pivot Point : stochastic rsi patterns, what does stochastic rsi indicate, how to set stochastic - Stochastics Patterns