Scale and Trail

currency chart, swing trading opportunity, trending market condition

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 10. Projecting Entry and Exit Points ]

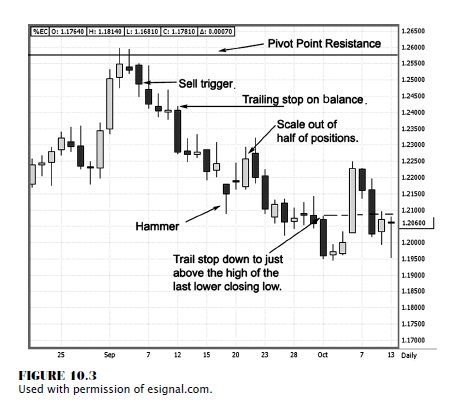

The euro currency chart in Figure 10.3 demonstrates a nice swing trading opportunity and how scaling out of half of your positions is a great mechanism to capture profits while staying with a potentially longer-term trend.

SCALE AND TRAIL

The

euro currency chart in Figure 10.3 demonstrates a nice swing trading opportunity

and how scaling out of half of your positions is a great mechanism to capture

profits while staying with a potentially longer-term trend. As you can see, the

sell signal triggers at 124.80. Immediately we see the sequence of events

develop: lower closes than opens, lower highs, lower lows, and lower closing

lows. This is what we want to see each time we place a short position in the

market. As the price declines, a hammer forms; and as you know, that generally

gives a clue that a market reversal is developing. The market does make a

higher closing high, which would give you reason to scale out of half of your

positions at 122.65. Not a bad trade, which took place over 11 trading

sessions.

The

market has not given any confirmation of a trend change; therefore, you would

want to move a stop down on the balance of the positions to just above the high

of the candle that made the last major conditional change of a lower closing

low. Trading with scaling out of the balance of half of your positions combined

with the trailing stop method we went over in Chapter 9 will help you capture

profits while participating in the majority of a trending market condition.

The Candlestick and Pivot Point Trading Triggers : Chapter 10. Projecting Entry and Exit Points : Tag: Candlestick Pattern Trading, Forex, Pivot Point : currency chart, swing trading opportunity, trending market condition - Scale and Trail