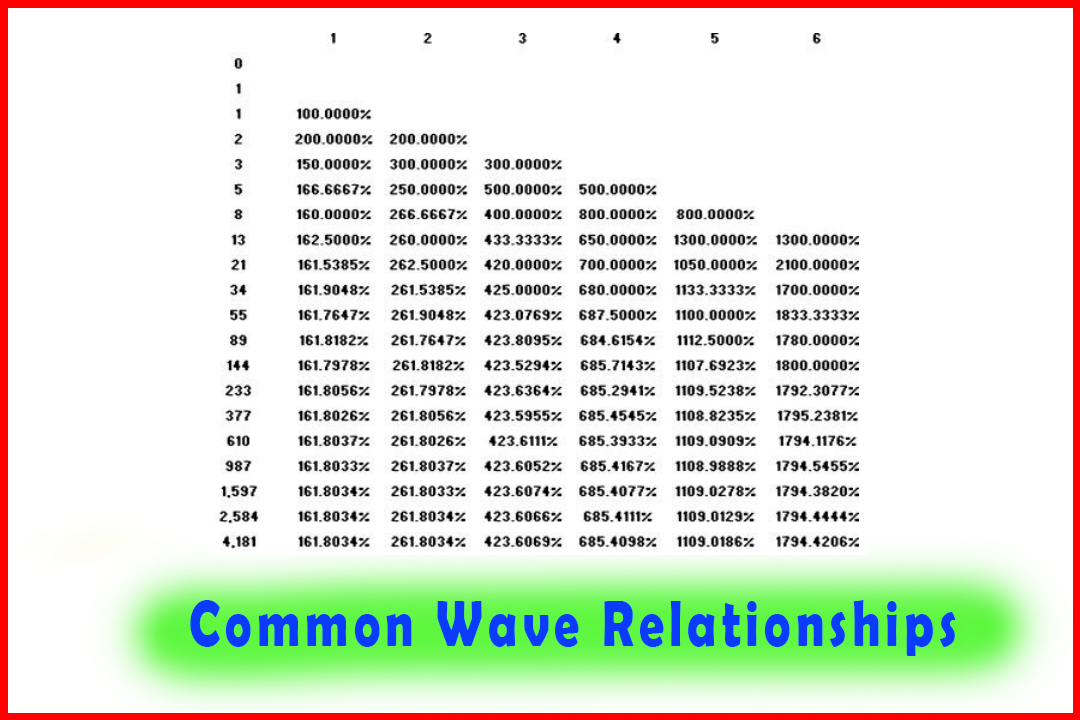

Common Wave Relationships

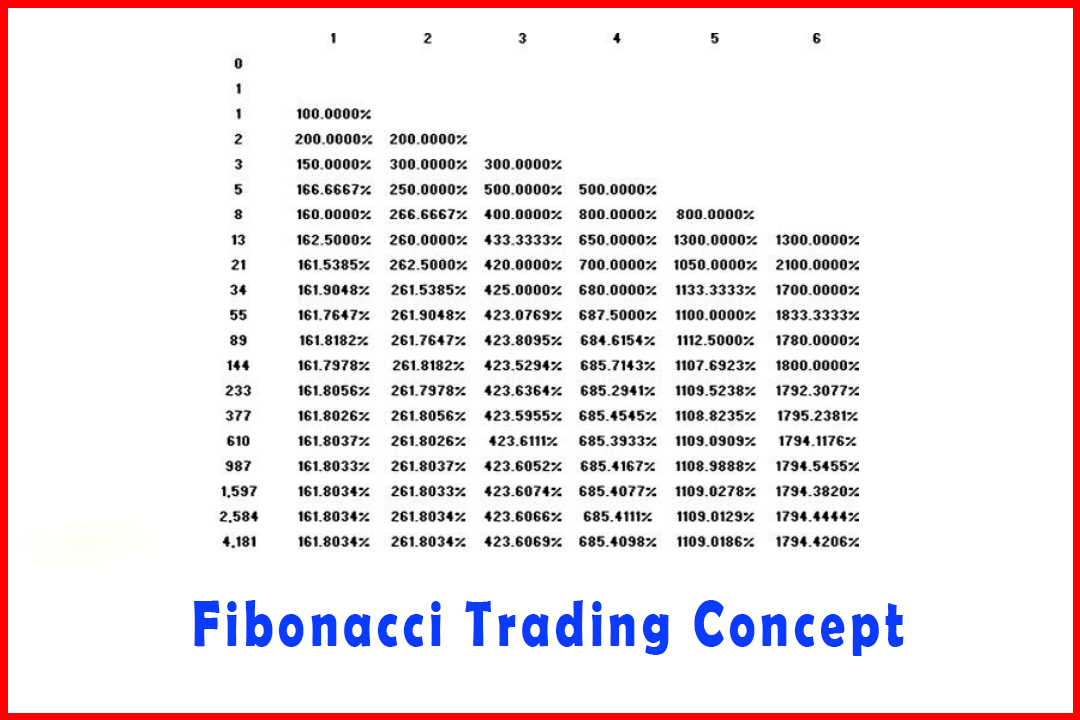

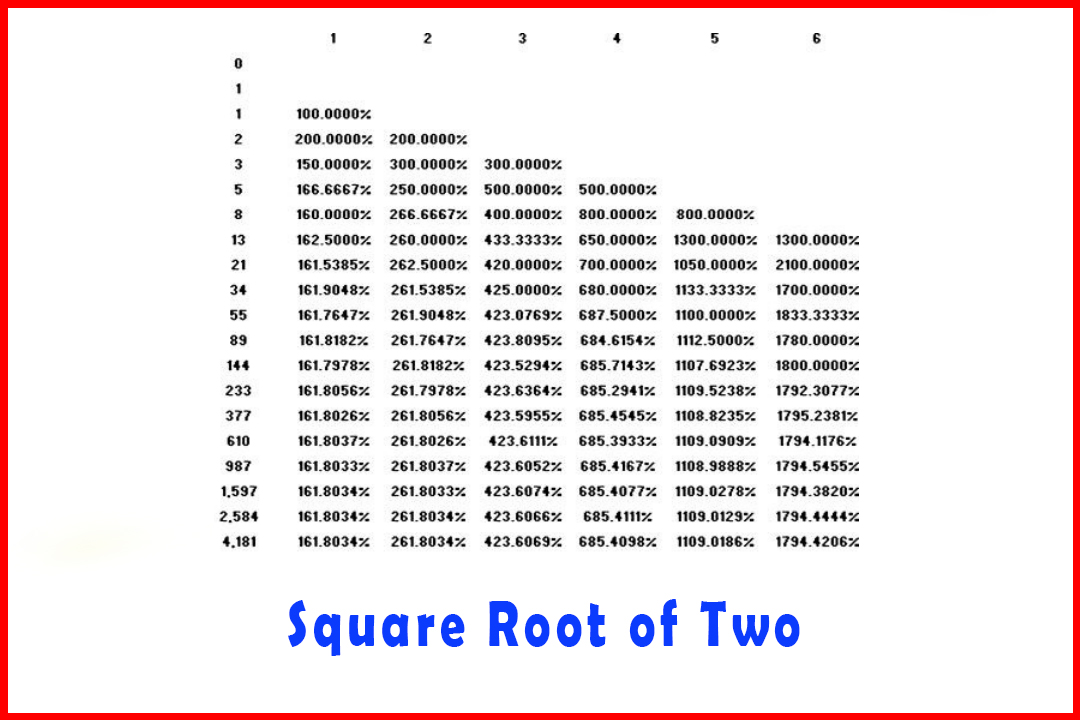

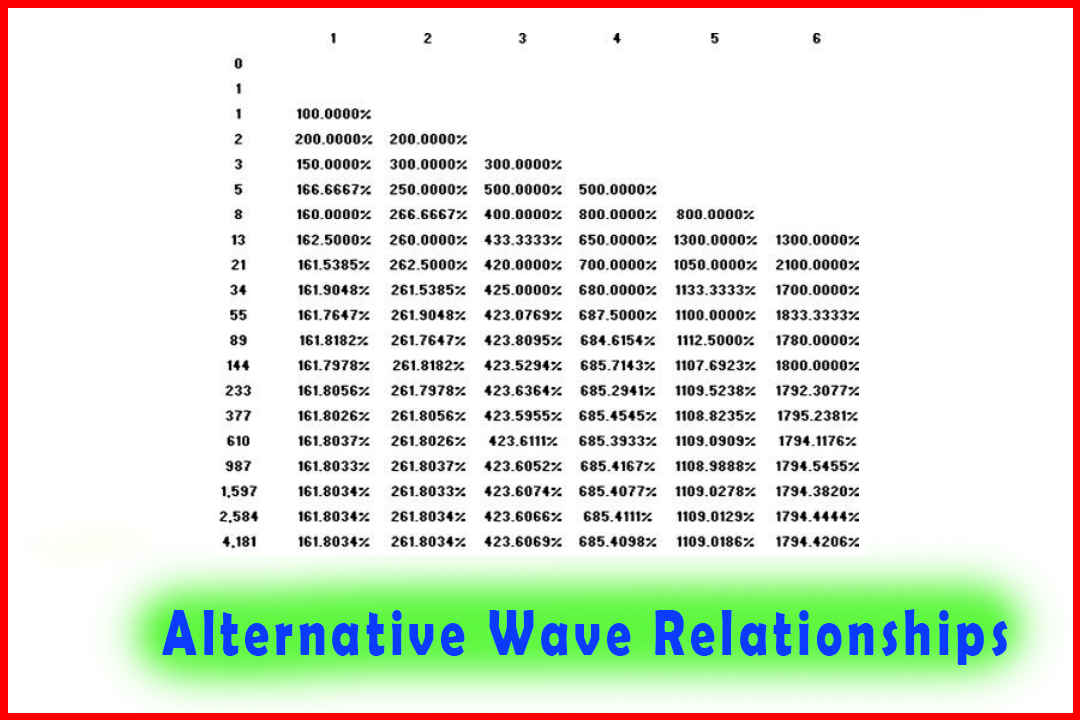

Fibo Retracement, What is Fibonacci, Fibonacci Trading Concept, Fibo basics, Types of waves

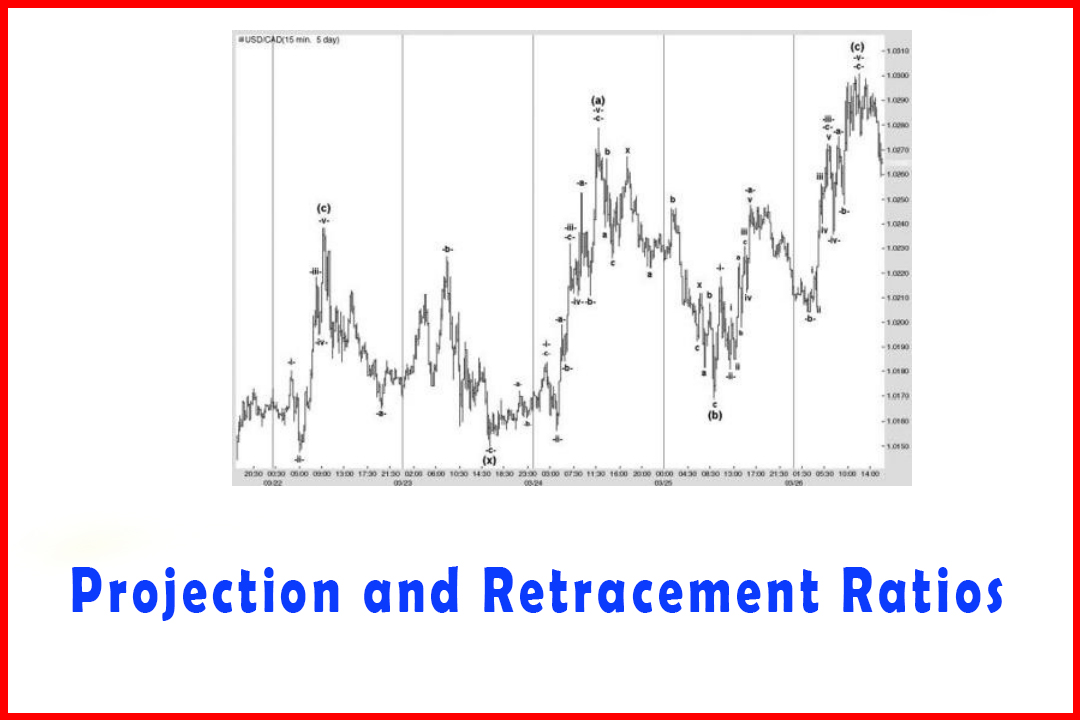

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

Here I shall provide the wave relationships most often noted in each wave position.

Common Wave Relationships

Here

I shall provide the wave relationships most often noted in each wave position.

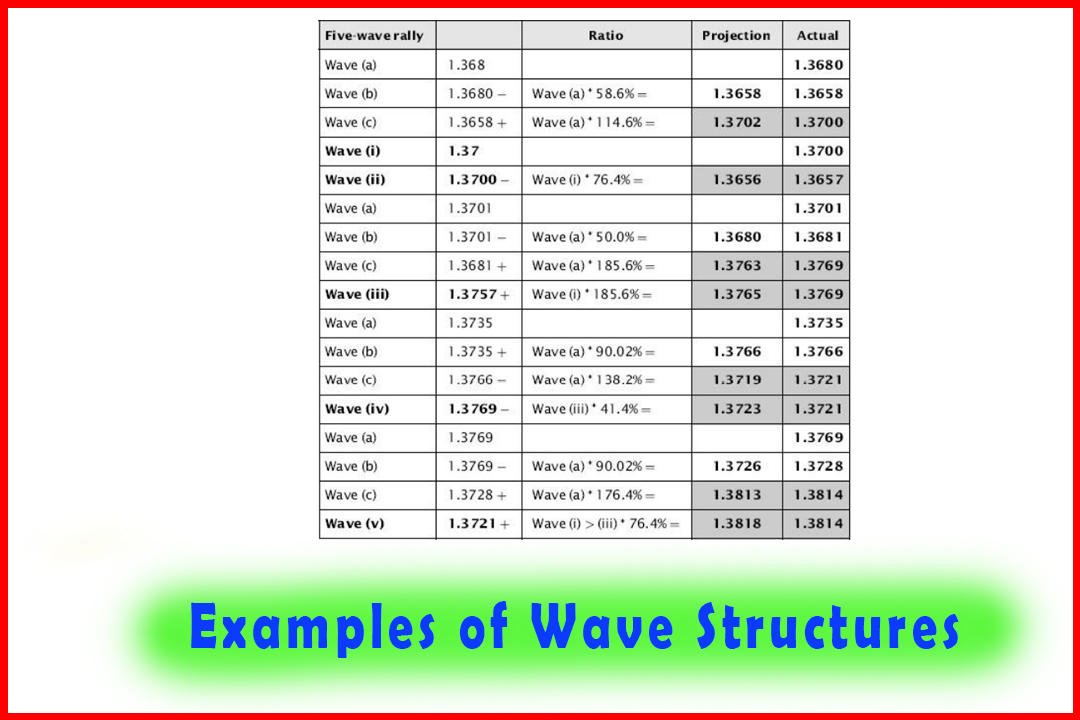

Wave (i)

There

is no relationship to any prior wave given that it is the start of a five-wave

sequence. If we are to consider any stalling point then it may be the span of

the prior Wave (b) of Wave (v) or possibly close to the most recent swing high

or low.

Where

we can begin to identify where Wave (i) will complete is by observing the most

frequent projections in Wave -c-of the anticipated Wave (i).

Wave (ii)

Wave

(ii) is a retracement of Wave (i).

This

is probably the most difficult to assess before it starts. If looking at a

straight retracement ratio then I have seen these to be as shallow as 14.6% and

as much as 100%. We can also consider the span of the Wave -b-of Wave (i).

When

observing a Wave (ii) in a five-minute chart, for example, it is often

difficult to really observe the individual waves that construct the correction,

whether this be a simple abc move, a Triple Three, or an even more complex

correction. However, in a daily chart we can see the development of Wave (ii)

within the shorter time-frame charts and observe the sequence of individual abc

moves.

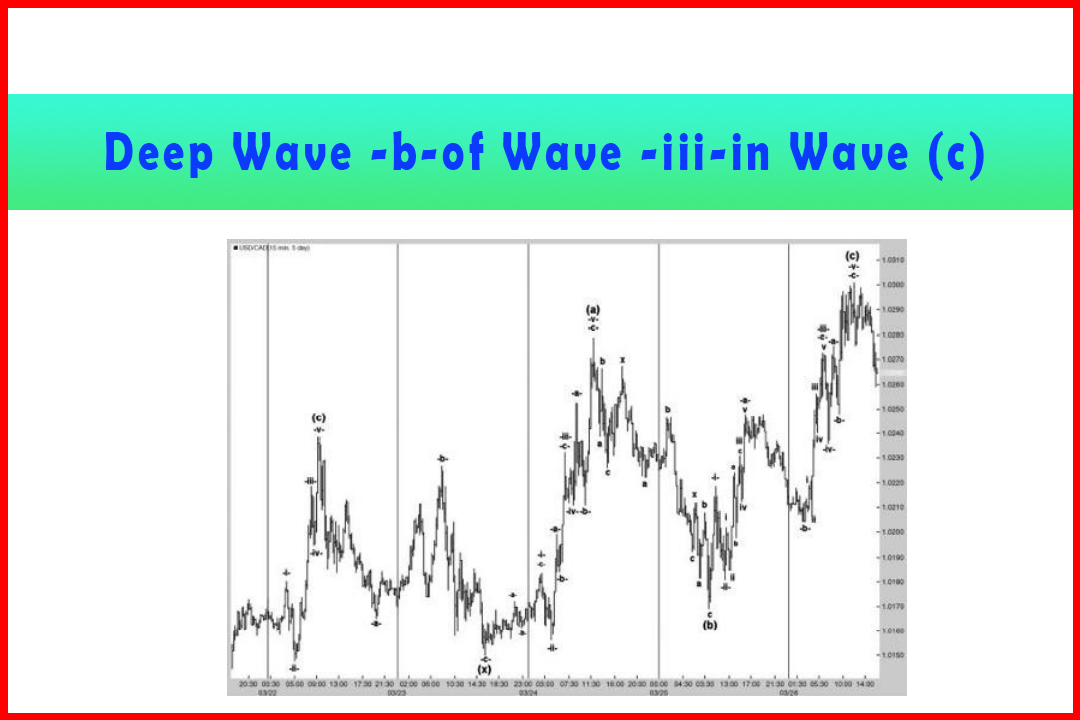

Wave (iii)

Wave

(iii) is an extension of Wave (i) and projected from the end of Wave (ii). It

is in Wave (iii) that we can begin to consider more reliable and consistent

projection ratios.

The

most common ratios are: 176.4%, 185.4%,

190.02%, 223.6%, 276.4%, and 285.4%.

Less

frequent ratios are: 138.2%, 166.7%%,

and 261.8%.

Occasional

ratios are: 123.6%, 238.2%, 361.8%,

423.6%, and 476.4%.

Needless

to say, when reviewing a chart all potential ratios should be kept in mind as

long as they are both accurate and the projections in Wave (c) also match that

target.

Wave (iv)

Wave

(iv) is a retracement of Wave (iii).

Wave

(iv) is one of my favorite corrections since, as long as the Wave (ii) and Wave

(iii) of the sequence have been identified accurately and we have noted the

implications of alternation with Wave (ii) or Wave (b), we have a much stronger

basis to identify the completion of this pullback.

For

shallow retracements: 14.6%, 23.6%,

33.3%, and 38.2%.

For

fuller retracements: 41.4% and 50%.

For

deep retracements: 58.6% and

infrequently 61.8% or 66.7%.

It

is also important to understand the underlying characteristics of the

particular market that is being analyzed. For example, I find that Dollar-Swiss

Franc and British Pound-Dollar have a greater tendency to stall at 41.4% and

58.6%.

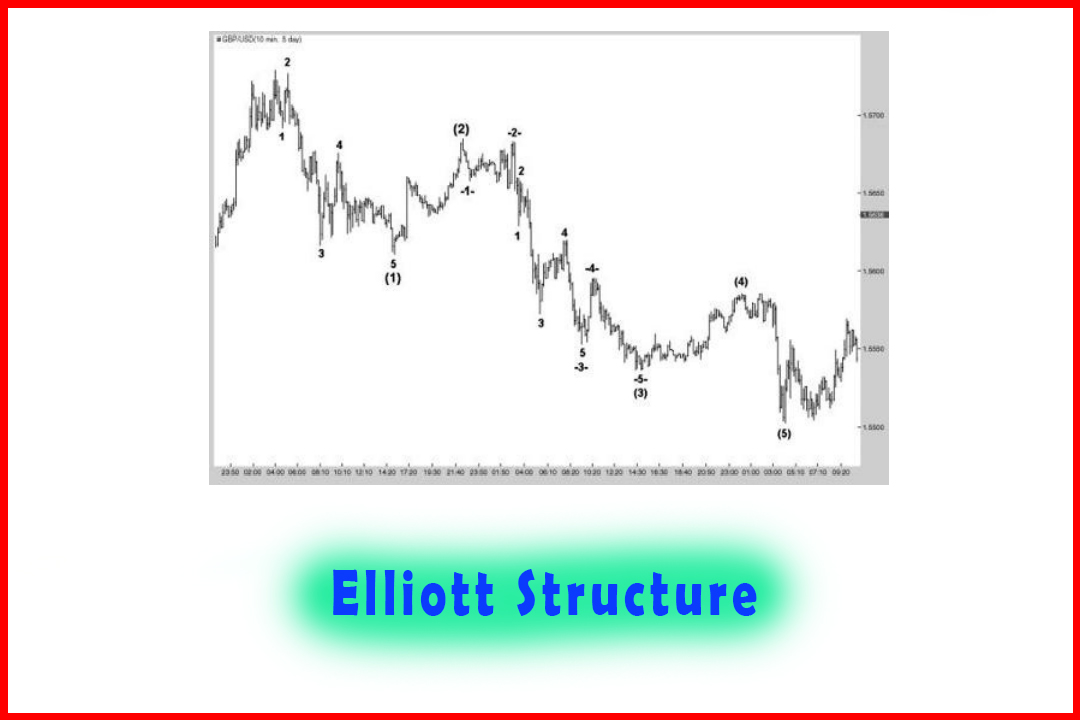

Wave (v)

Wave

(v) is an extension of the entire move from the start of Wave (i) to the end of

Wave (iii) and projected from Wave (iv).

Again,

having identified Wave (iv) it is much easier to develop projections for Wave

(v). In particular the projections in Wave (v), given they will be coming at

the end of a Wave (C) of one higher degree, should also match the target of

this higher degree.

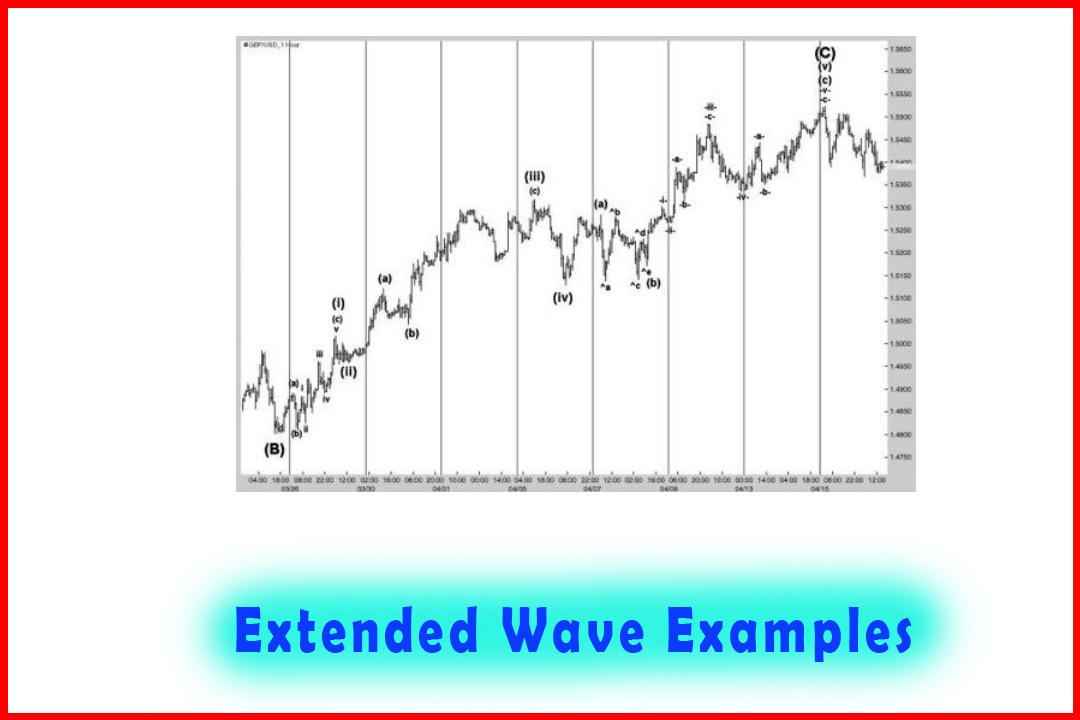

The

majority of projection ratios are: 61.8%,

66.7%, or 76.4%.

In

a truncated Wave (v), common ratios are: 58.6%

and less frequently 50%.

In

an extended Wave (v), common ratios are: 85.6%,

100%, 114.4%, and occasionally 123.6% and 138.2%.

Wave (A)

As

with Wave (i), there is no uniform way of identifying where this will stall as

it is not related to any prior wave. It is possible to consider the prior Wave

b of

Wave

(v) and occasionally the prior Wave (iv), especially when this is a key swing

high or swing low in a trend. Markets tend to shun testing a swing low/high on

the first test. Other areas to consider are pivot levels, which I find of

particular benefit.

If

this is a Wave (A) in a daily chart then again we should be watching the

development of the five waves that construct Wave (A) and matching the

projections in the internal Wave v with any of the prior Wave b of Wave (v),

the prior Wave (iv), or pivot level.

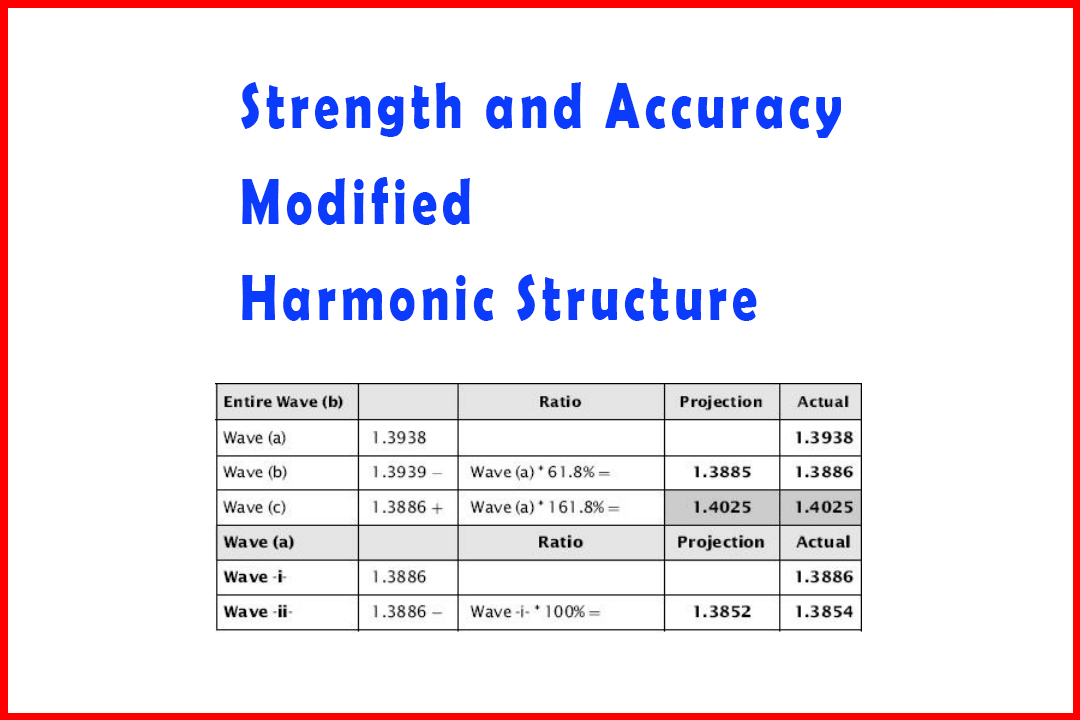

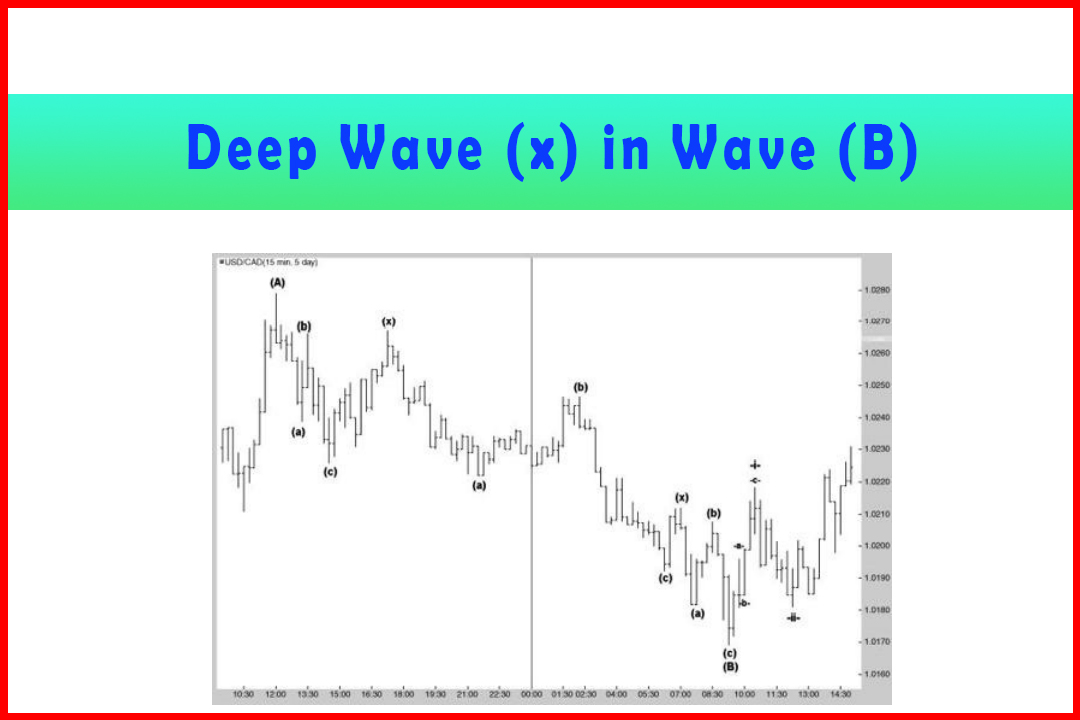

Wave (B)

Wave

(B) is a retracement of Wave (A)

Being

the correction within a correction, Wave (B) can prove to be the most

complicated and erratic of all waves. It is probably one where the most errors

can be made. We could be talking about a simple Wave (B) within a Zigzag or a

complex correction such as a Flat, Expanded Flat, or Triangle correction.

Depending on which area of the entire wave sequence in which the Wave (B) is

developing, we may also have to consider the impact of alternation.

If

looking at a straight retracement ratio then I have seen these to be as shallow

as 14.6% and as much as 100%. We can also consider pivot levels and key swing

highs or swing lows.

When

observing a Wave (B) in a five-minute chart, for example, it is often difficult

to really observe the individual waves that construct the correction, whether

this be a simple abc move, a Triple Three, or an even more complex correction.

However, in a daily chart we can see the development of Wave (B) within the

shorter time-frame charts and observe the sequence of individual five- wave

moves.

Wave

(B) of Wave (III) tends to be 50% on average, but unlike any other Wave (B)

position it is subject to the guideline of alternation and may be very brief if

Wave (II) has been exceptionally deep, or alternatively very deep—as much as

66.7%—if Wave (II) has been exceptionally shallow.

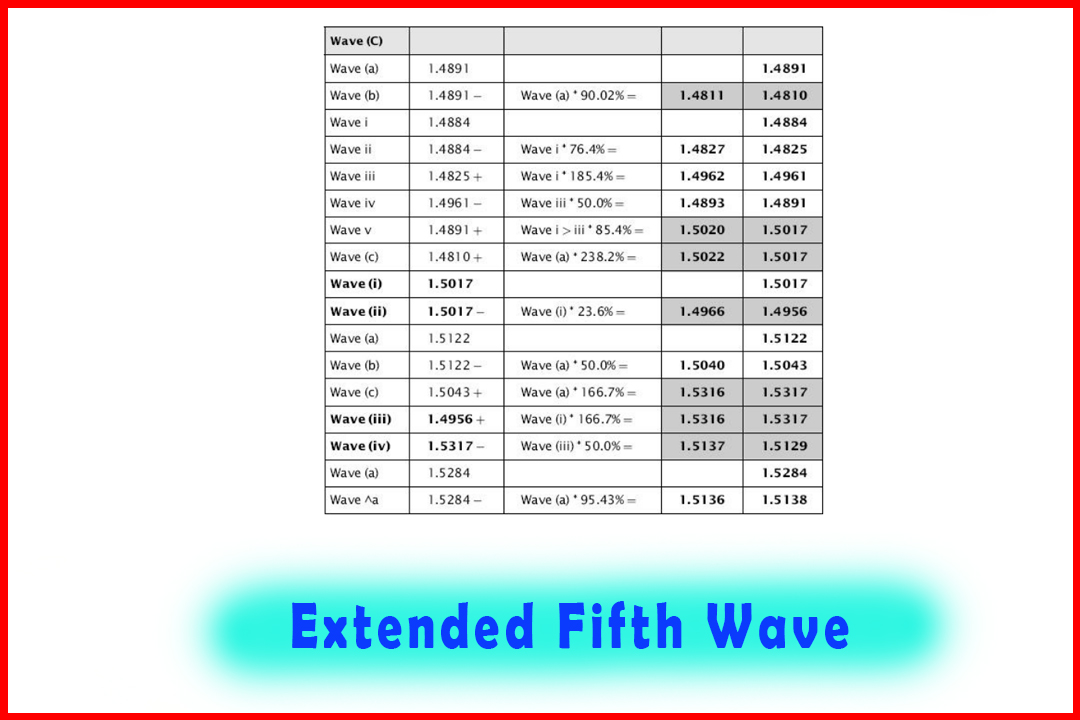

Wave (C)

Wave

(C) is an extension of Wave (A) projected from the end of Wave (B).

The

most common ratios are: 100%, 105.6%,

109.2%, 114.4%, 138.2%, and 161.8%.

Less

frequent ratios are: 76.4%, 85.6%,

123.6%, and 176.4%.

Occasional

ratios are: 123.6%, 223.6%, and 261.8%

or as short as 61.8%.

Needless

to say, when reviewing the targets for Wave (C) it is important to relate this

to the targets in both the next higher degree and also lower degree. Therefore,

take note that the internal Wave v of the Wave (C) should match the extension

of Wave (A) and also, if this is part of a Wave (iii) or Wave (v), the

potential projection targets for this higher degree.

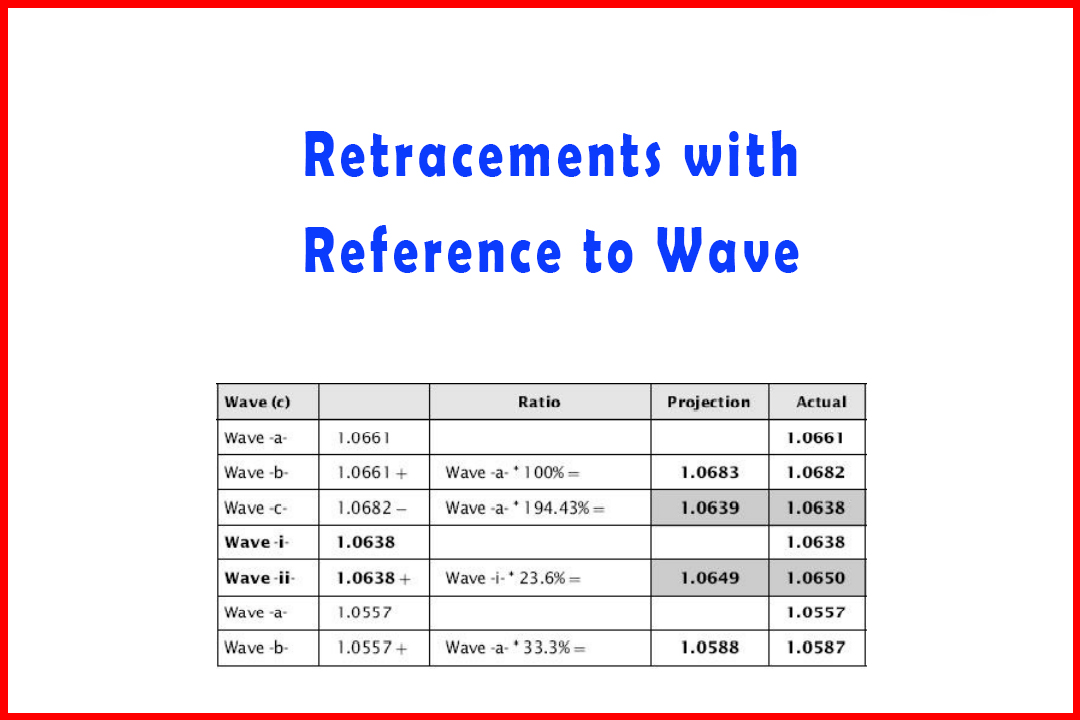

Wave (x)

Generally

this intermediate corrective wave between Zigzag patterns tends to retrace in

the same way as a Wave (b). However, one common guideline is that if the

previous Wave (b) was very deep, perhaps as much as 76.4%, then Wave (x) will

likewise have a greater tendency to be also deep.

Triangles

Wave

∧a will normally retrace quite

deeply. In a Wave (iv) position this will often be quite sharp and to at least

50% of Wave (iii), and possibly more as long as this does not imply a move too

close to the prior Wave (b) of Wave (iii).

Wave

∧b: Will commonly be a 76.4% retracement of Wave ∧a, or occasionally 85.6%.

Wave

∧c: 66.7%, 76.4% of Wave Aa projected from the end of Wave ∧b.

Wave

∧d: 66.7% to 76.4% of Wave Ab from the end of Wave ∧c.

Wave

∧e: In my experience I have found this to normally be a simple Zigzag, but

it rarely moves beyond 61.8% to 66.7% and may, on occasion, be less than 61.8%.

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Fibo Retracement, What is Fibonacci, Fibonacci Trading Concept, Fibo basics, Types of waves - Common Wave Relationships

Elliott Wave | Forex | Fibonacci |