Examples of the Strength and Accuracy of the Modified Harmonic Structure

Strength Harmonic Structure, Accuracy Harmonic Structure, Five wave pattern

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

The modified structure is highlighted in the construction of Wave (a) and Wave (c), each comprising five waves but all of them in three-wave structures. In Wave-iii-of Wave

Other Examples of the Strength and Accuracy of the Modified Harmonic Structure

Next

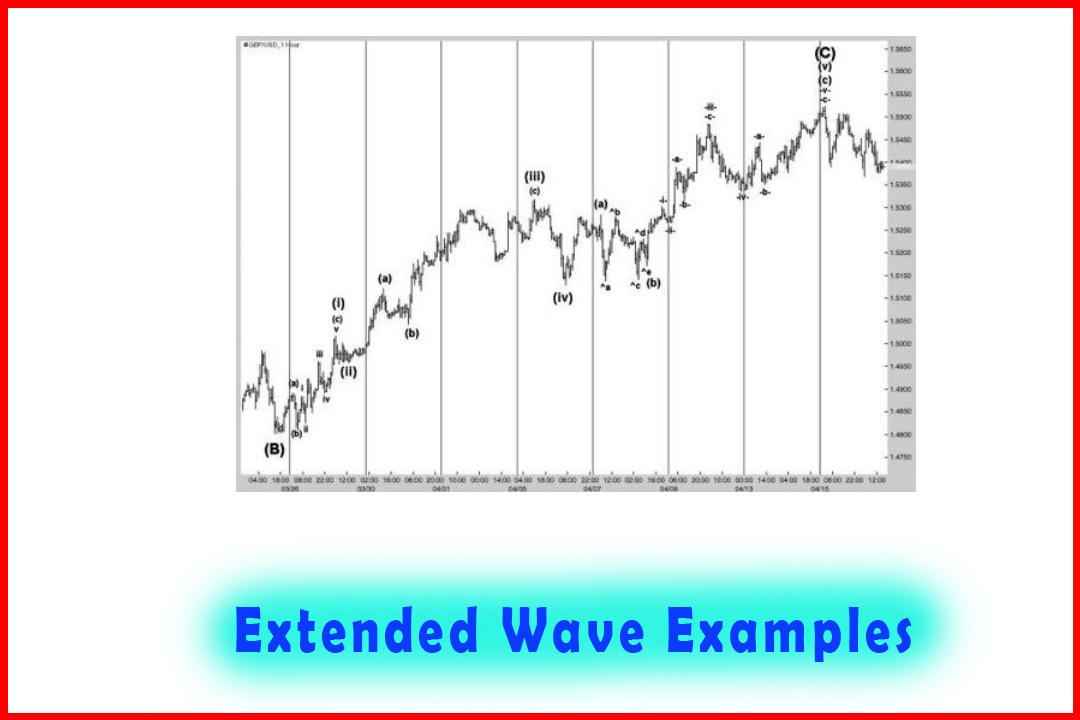

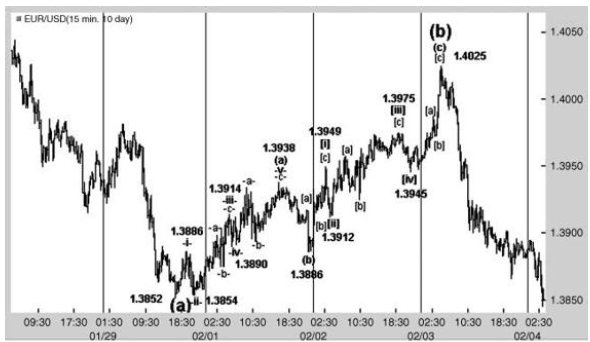

in Chapter 3, I provided the example of Figure 3.17 which displayed a Zigzag

higher in 30-minute EURUSD with an overlap in Wave [i] and Wave [iv]. I have

reproduced the image with the key price levels listed (Figure 4.14).

Figure 4.14 Zigzag

Higher in 30-Minute EURUSD with Overlap in Wave [i] and Wave [iv]

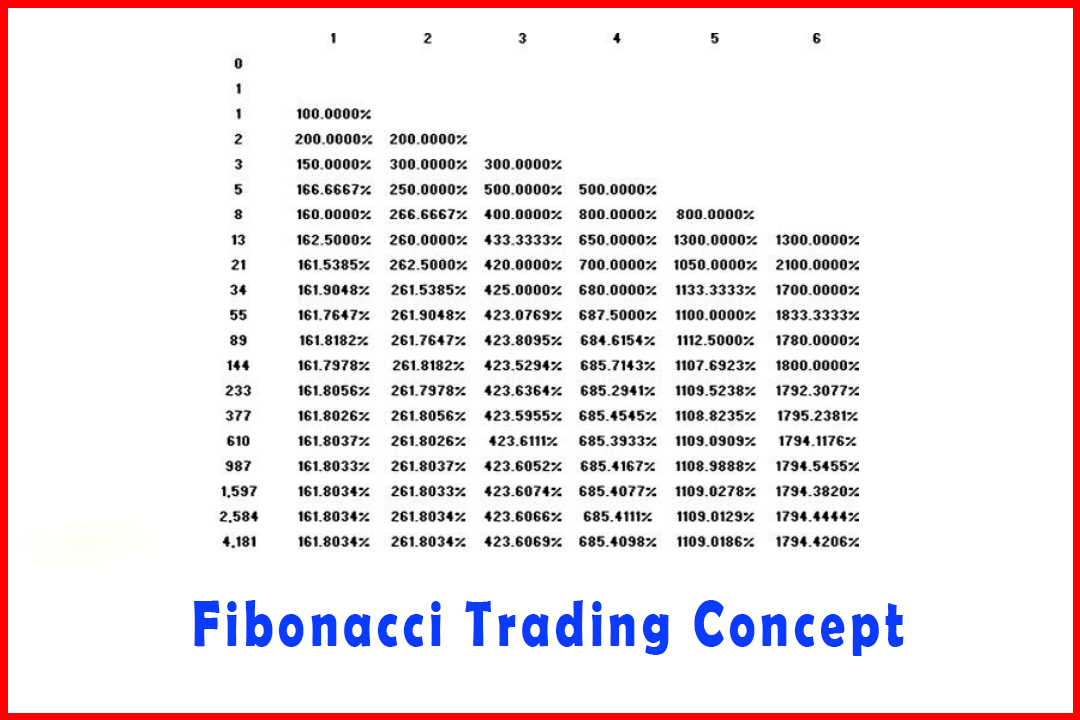

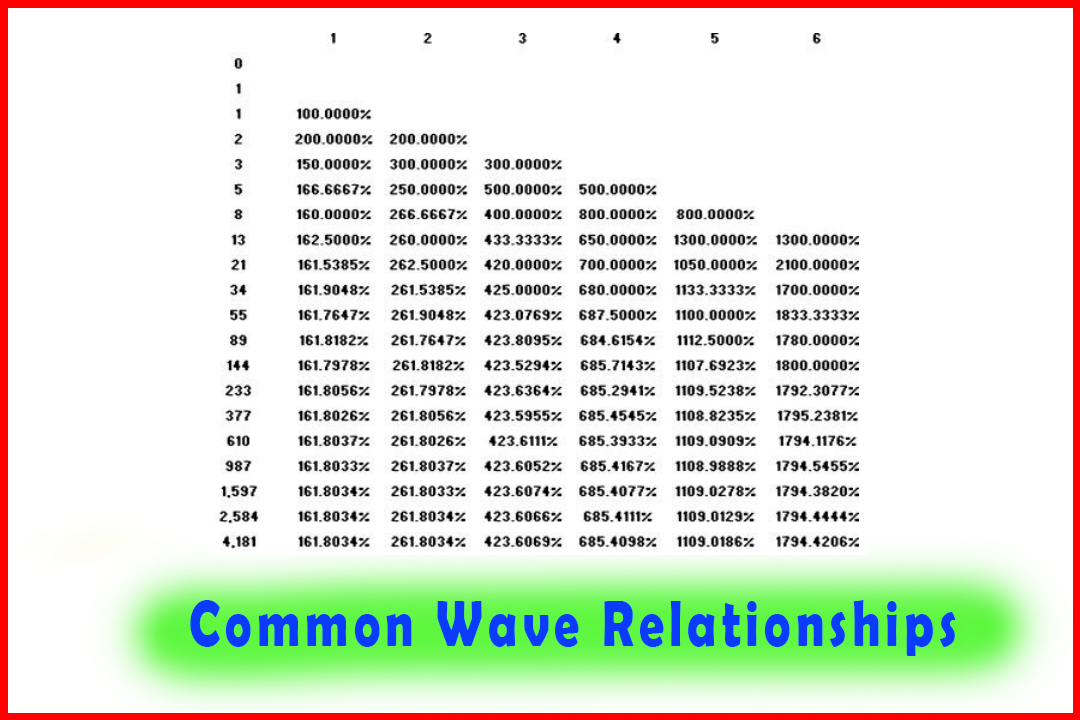

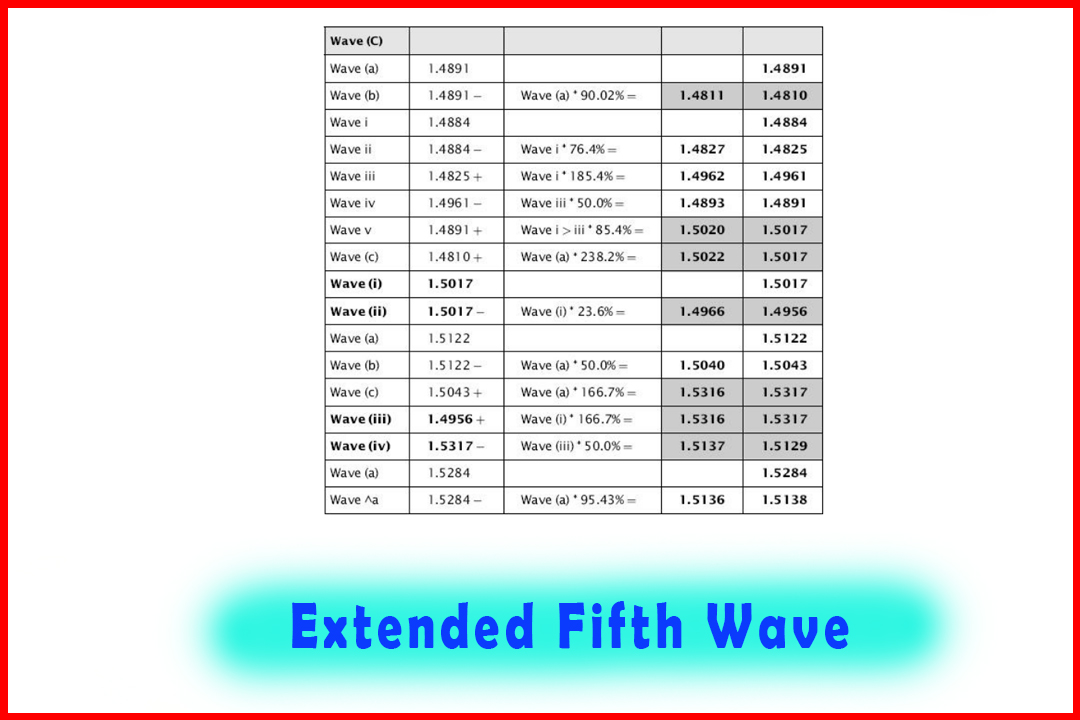

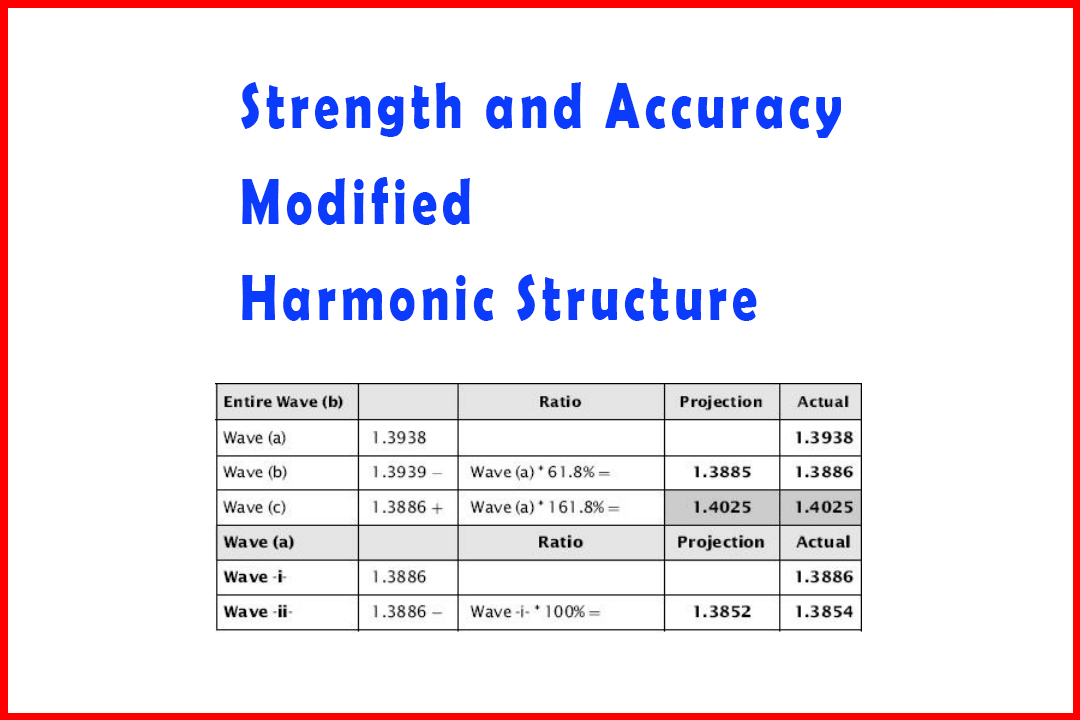

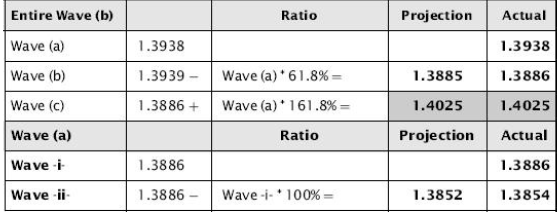

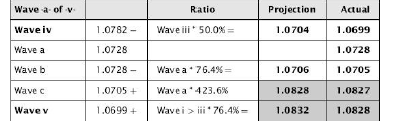

Table

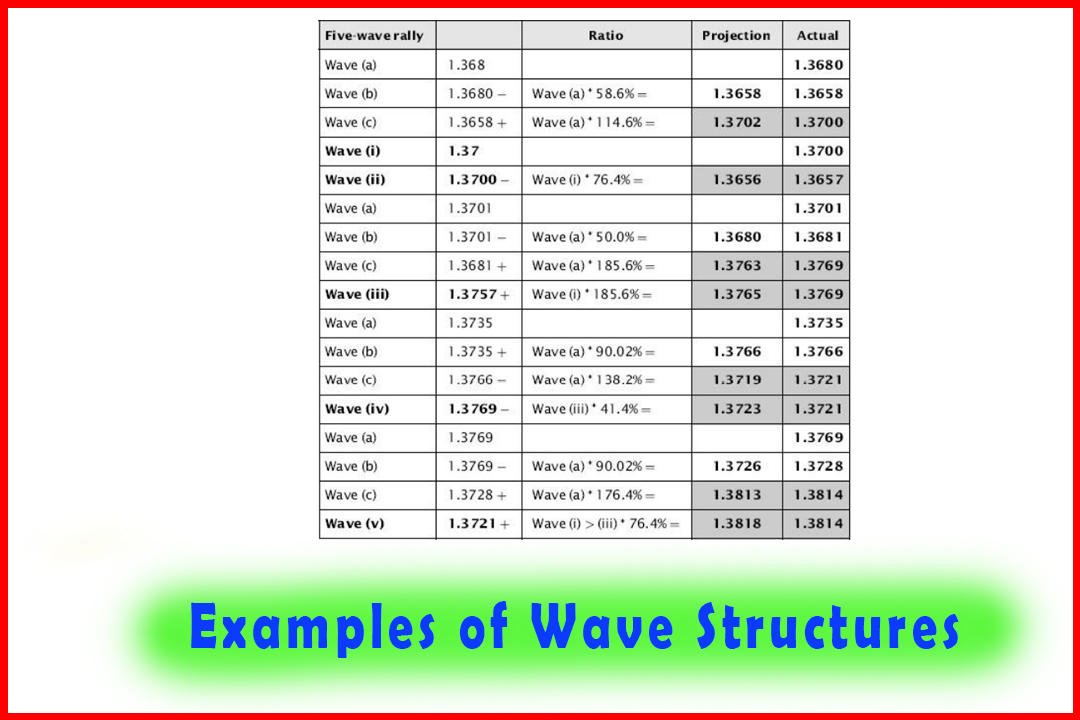

4.8 displays the wave relationships for each section of the corrective rally.

Table 4.8 Wave

Relationships for the Zigzag higher in Figure 4.14

I

have separated each specific wave and listed the results. The first section is

nothing new as it merely relates to the Zigzag development in the overall Wave

(b), developing in an (a)(b)(c) move. Wave (b) was a 61.8% retracement of Wave

(a) and Wave (c) a 161.8% projection of Wave (a).

The

modified structure is highlighted in the construction of Wave (a) and Wave (c),

each comprising five waves but all of them in three-wave structures.

In

Wave -iii-of Wave (a), note that Wave-c-had a projection at 1.3914 while the

extension in Wave -iii-was the common 176.4% projection of Wave -i-. Given Wave

-ii-was just about a 100% retracement of Wave-i-we can see that Wave-iv-was a

shallow 38.2%. This gave rise to a 76.4% projection in Wave -v- to the same

target as a wave equality projection of Wave -a-in Wave-c-.

In

Wave (c) it can be seen that a similar process provided remarkably accurate

targets in Wave [c] of Wave [iii] and the extension of Wave [i], which turned

out to be a wave equality target with Wave [i]. Similarly the targets for Wave

[c] of Wave [v] and Wave [v] itself were within six points.

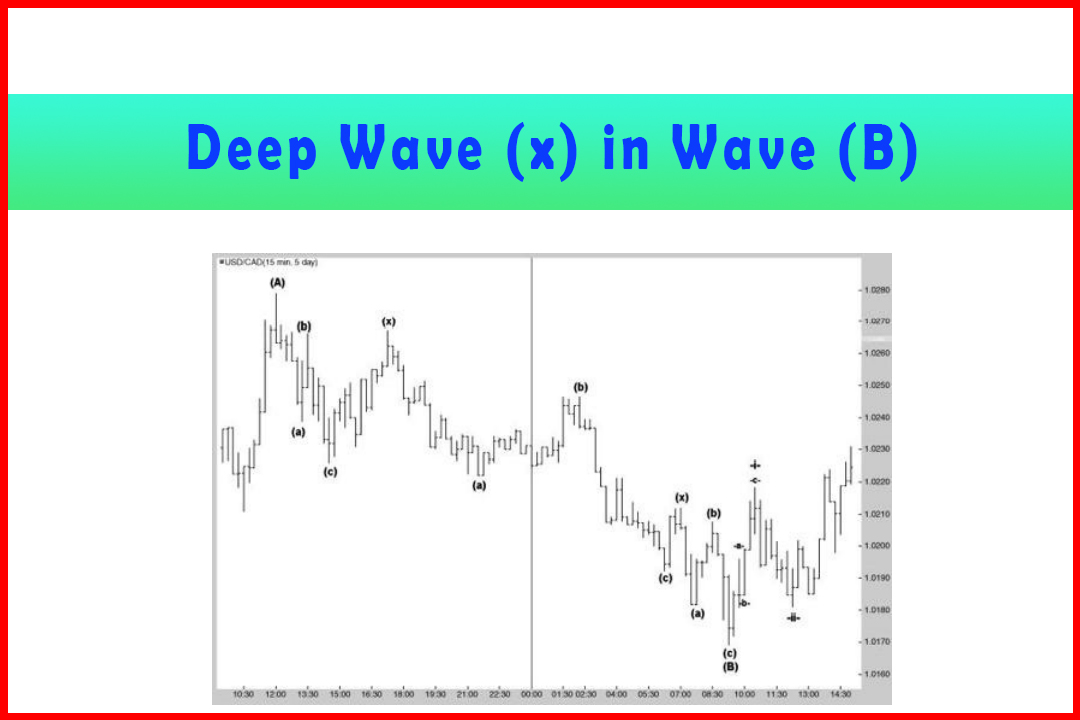

This

larger Wave (b) was actually a deep Wave (b) of a declining Wave (iii) which

retraced an exact 66.7% of Wave (a).

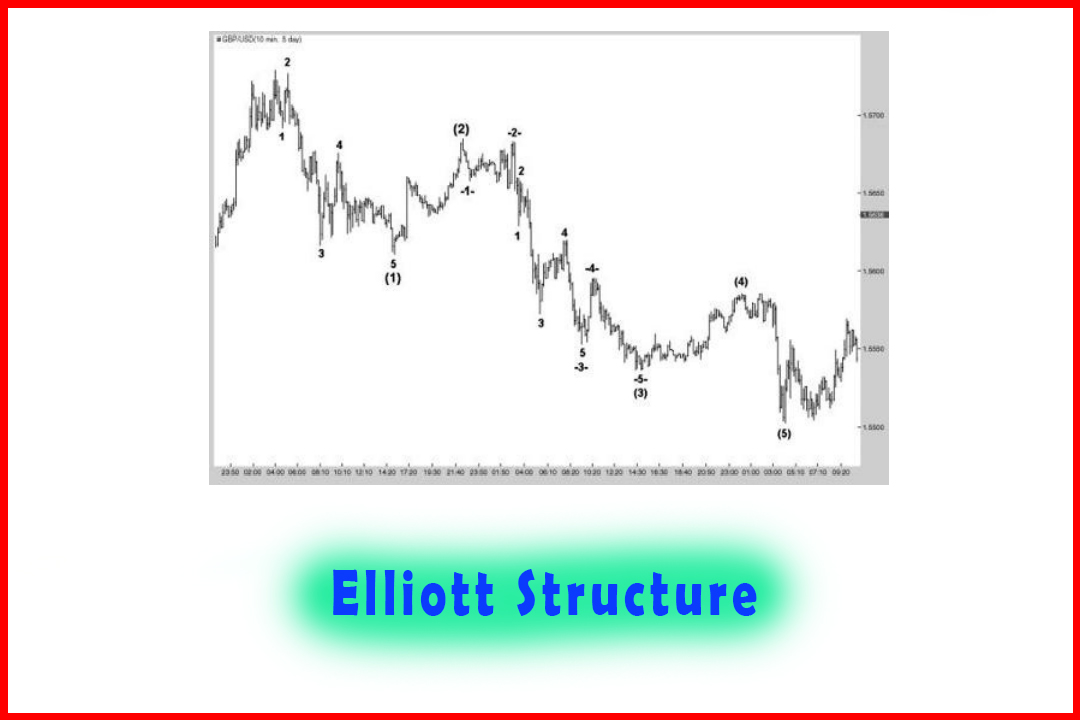

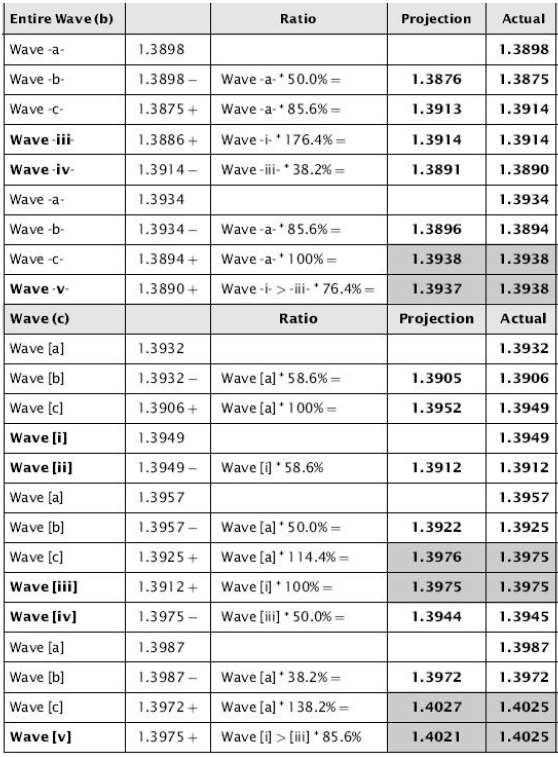

In

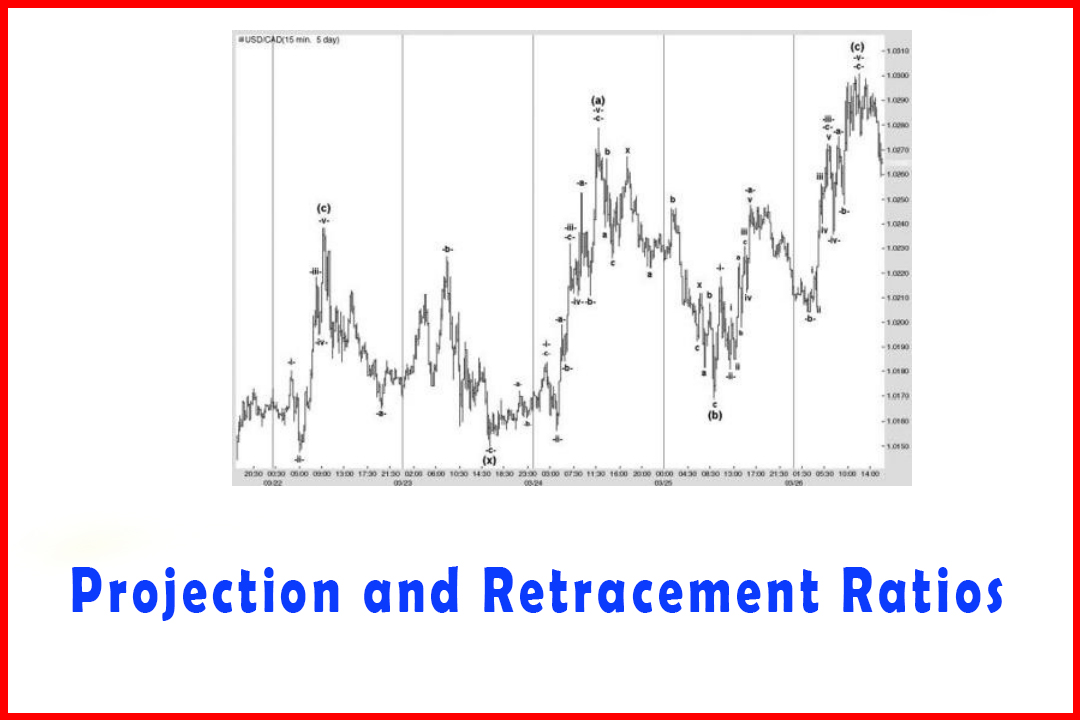

another example in Chapter 3 I offered the five-wave decline in Wave efc in

USDCAD (as shown in Figure 4.15).

Figure 4.15 A

Decline in Wave efc in 10-minute USDCAD to Complete what was a Wave (iv)

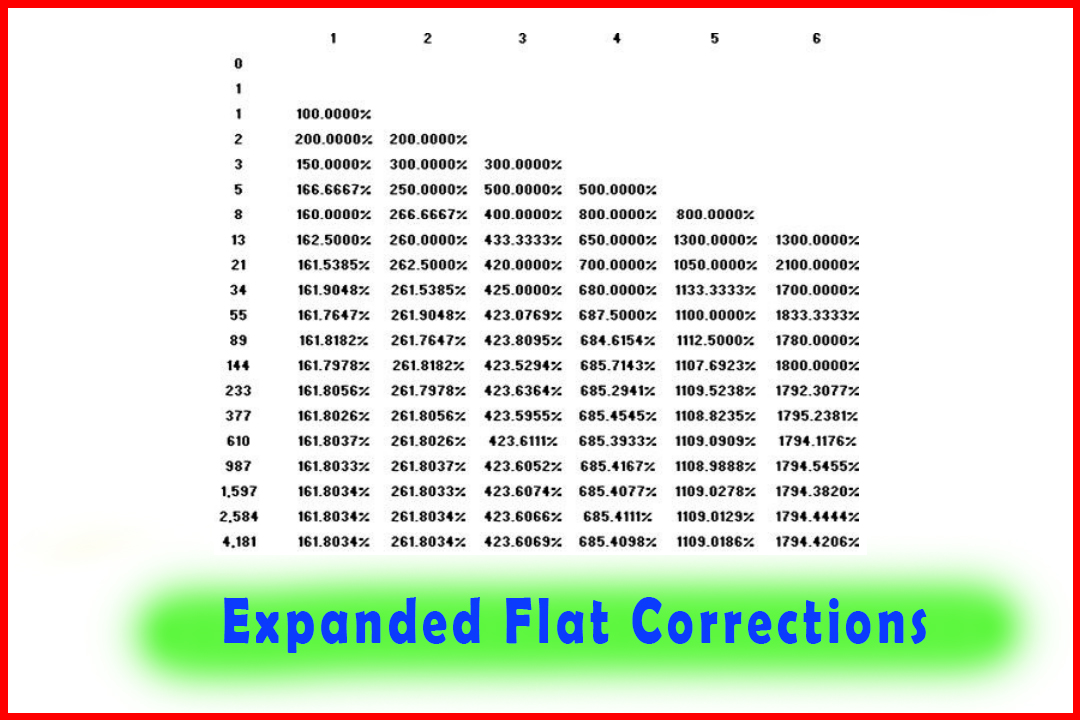

Table 4.9 shows the table of the individual waves that constructed the decline

Here

I have separated each of the impulsive waves and also the breakdown of Wave

-a-and Wave -c-of Wave -v-.

The

modified structure in this example is remarkably accurate, with the majority of

individual wave targets matching the internal abc waves to within one point.

Only in the final Wave -c-of Wave -v-was there a difference of six points, but

then the Wave v of Wave -c-did have a 66.7% projection that matched the 66.7%

Wave -v-projection at 1.0545. All waves adhered to the normal ratios seen in

the modified wave structure.

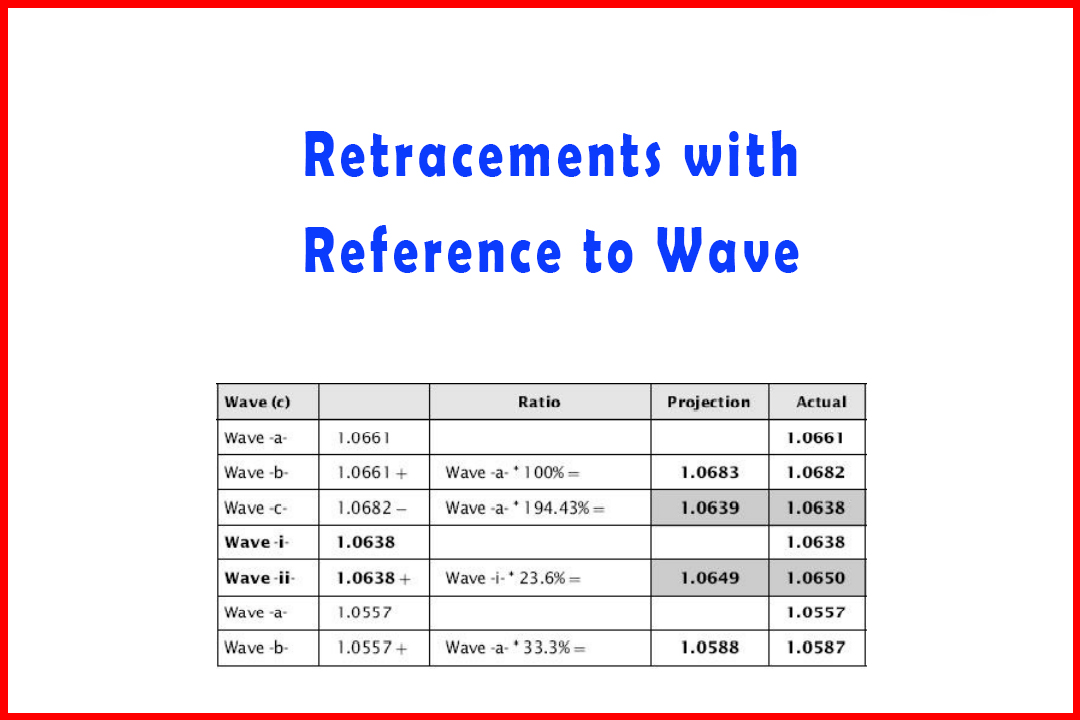

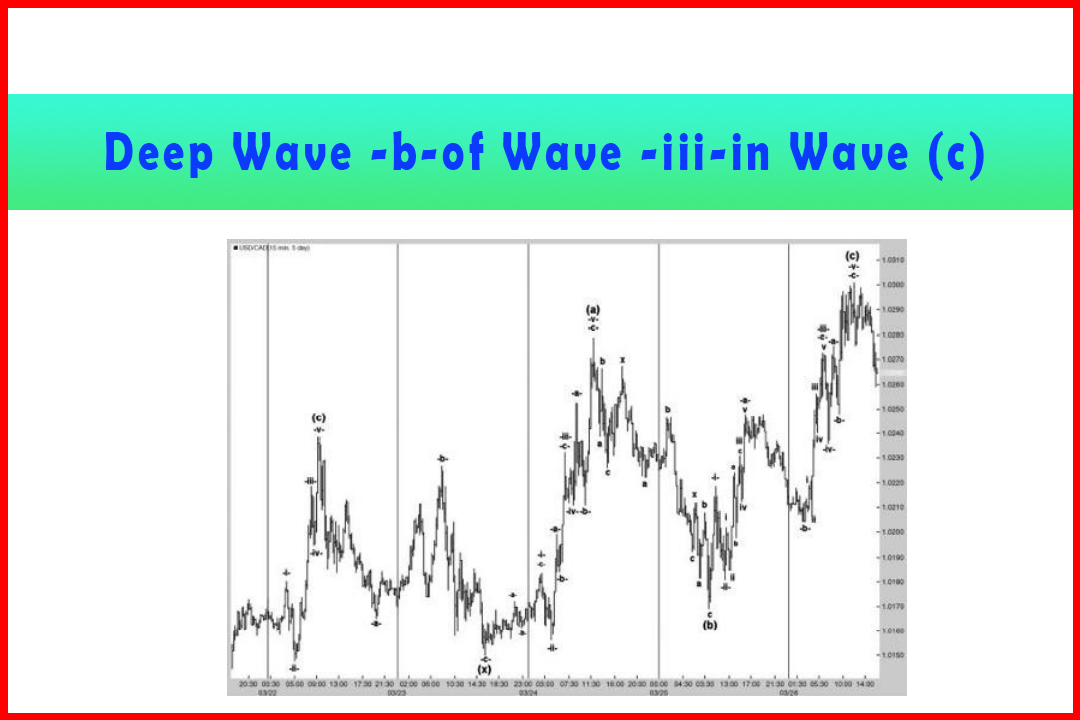

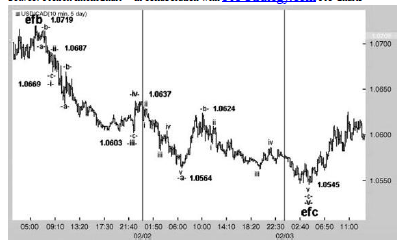

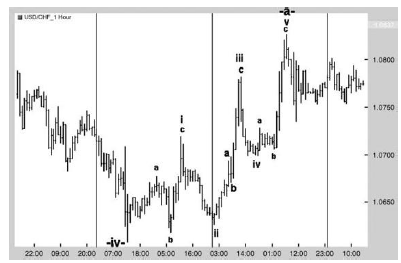

As

a third example, in Figure 4.16. I have taken the deep Wave -b-of Wave - iii-that

was shown in Figure 3.21 in the hourly USDCHF market.

Figure 4.16 An

(A)(B)(C) with a Deep Wave-b-in Wave -iii-in Hourly USDCHF

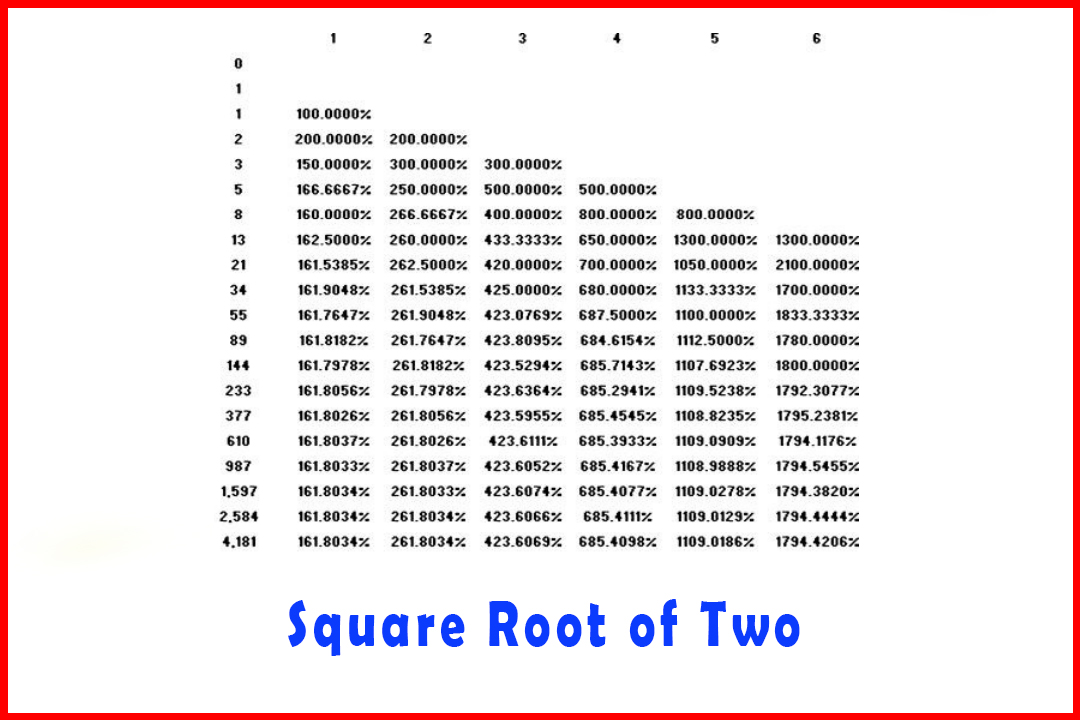

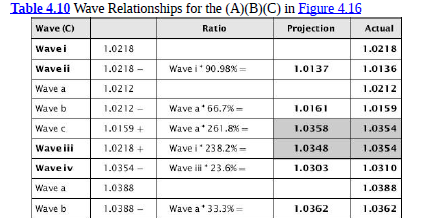

Table

4.10 shows the individual waves that constructed the rally.

In

Wave (A) we had a standard five-wave move in which Wave (v) ended midway

between the 76.4% and 85.4% projections. The retracement in Wave (B) was just

over 33.3%.

After

seeing the pullback in Wave (B), we would be looking for a rally in Wave (C)

and thus we should be concentrating on normal projections generated from Wave

(A). These produced potential targets at:

100.0%

= 1.0732

114.6%

= 1.0785

138.2%

= 1.0872

161.8%

= 1.0958

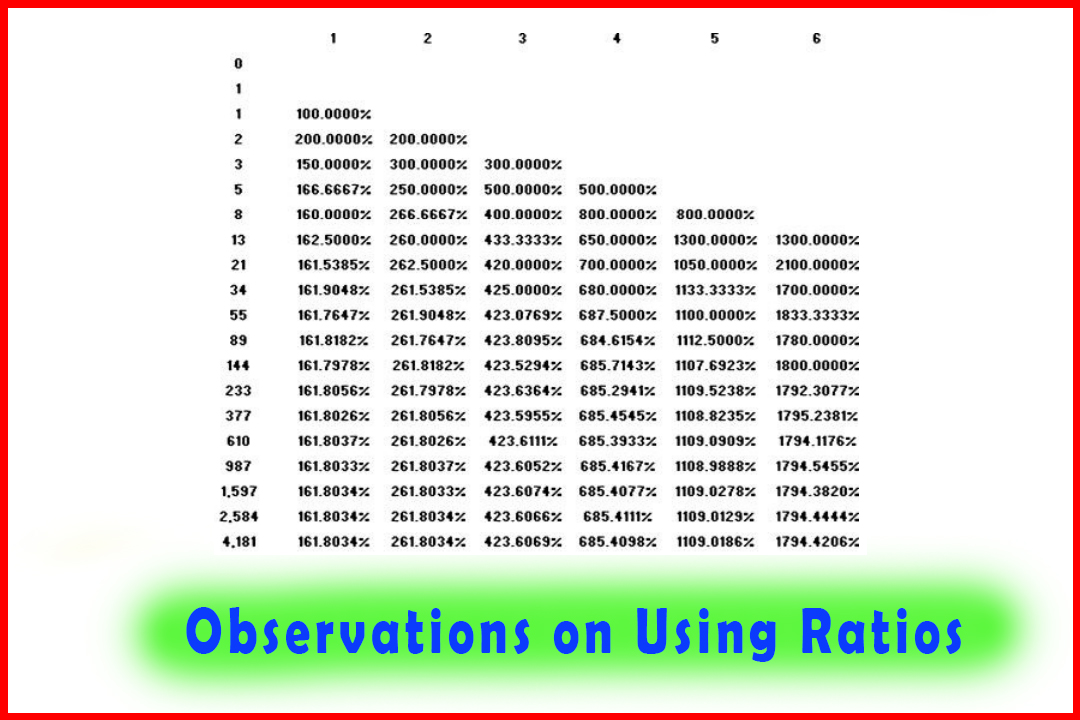

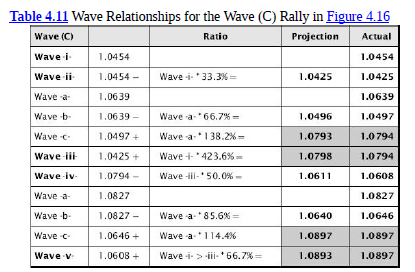

Table

4.11 displays the relationship in Wave (C).

Table 4.11 Wave Relationships for the Wave (C) Rally in Figure 4.16

Here

I am concentrating on the rally from the 1.0366 Wave (B) low until the

completion of Wave (C) at 1.0897. In terms of projections of Wave (A), the final

1.0897 high was not particularly accurate, which disappoints. However, the Wave

-v-projection of 66.7% came within three points and the 114.6% projection in

Wave -c-of Wave-v- was actually perfect.

Once

again, the rally in Wave (C) was fueled by common wave ratios. Note the

relatively shallow 33.3% retracement in Wave -ii-that spurred a deeper Wave

-b-of Wave -iii-that was the very common 66.7% retracement. In addition the

138.2% projection in Wave -and the 423.6% projection of Wave -i-, both

arrived at the same area with only four points of variance.

In

this case, the Wave -iv-was probably deeper than would normally be expected at

50% and this would have had to have been managed by observing the nature and

structure of the decline in the five-minute chart.

The

66.7% projection in Wave -v-and the 114.4% projection in Wave -c-also matched

with a variance of four points.

I

should add at this point that the 85.6% and 114.4% projections in Wave–c-are

surprisingly common. I can only imagine that there is a common observation that

wave equality relationships occur quite frequently and the slightly shorter and

slightly longer are reflections of early profit taking and stop losses being

triggered from reversal positions at the wave equality target respectively.

However, from the analyst's perspective, what we are looking for are

matching targets drawn from both the larger projection of Wave -a-and the

internal Wave v of Wave -c-.

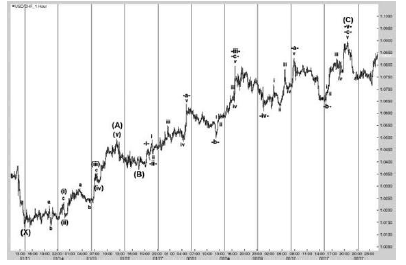

In

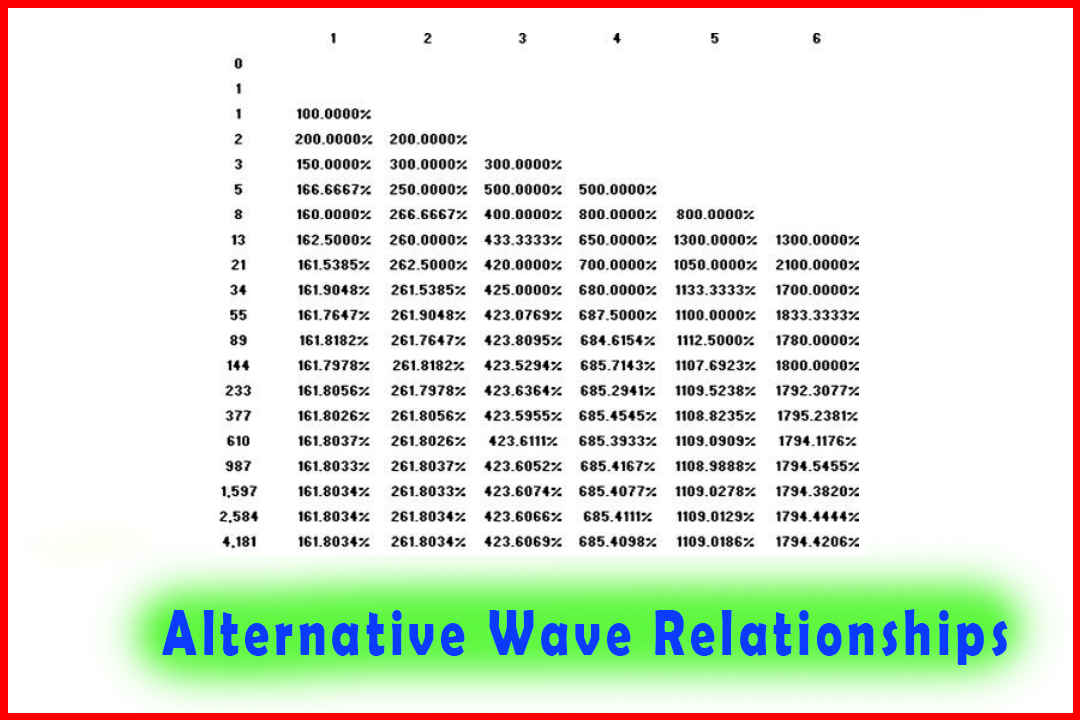

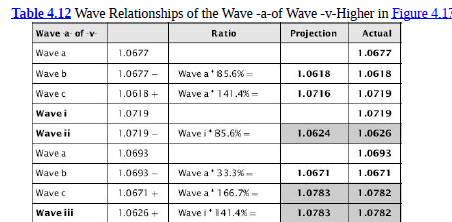

Figure 3.22, I also covered the rather unusual structure in Wave -a-of Wave

-v-. Therefore, we should also take a closer look at the internal structure and

wave relationships (as shown in Figure 4.17).

Figure 4.17

Internal Structure of Wave -a-of Wave -v-Higher in USDCHF

The related table of wave relationships is shown in Table 4.12.

This

type of price development is not the easiest to forecast due to the number of

less common wave relationships. An 85.6% retracement in Wave b (of Wave i) must

always be one of the areas to watch out for, but it can begin to cause some

doubts when approached. The 141.4% projection in Wave c is not one I'd

usually look for, but since this is an hourly chart the wave development in the

five-minute chart should have provided some indication. The 85.6% retracement

in Wave ii would have again raised some doubts but the key was the fact the

Wave b low was not breached.

Given

that both Wave b and Wave ii were exceptionally deep, the guideline of

alternation would warn that Wave b may well be short and shallow. Indeed it

was, and then Wave c of Wave iii extended by 166.7% which again is less

frequently seen. To have it match again with a 141.4% extension of Wave i is

not high on the list of common projections.

Even

after a 50% retracement in Wave iv the 76.4% projection in Wave v is very

common, but the 423.6% projection in Wave c is not.

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Strength Harmonic Structure, Accuracy Harmonic Structure, Five wave pattern - Examples of the Strength and Accuracy of the Modified Harmonic Structure

Elliott Wave | Forex | Fibonacci |