Extended Fifth Wave

Fifth wave, elliott fifth wave, Best trading strategy

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

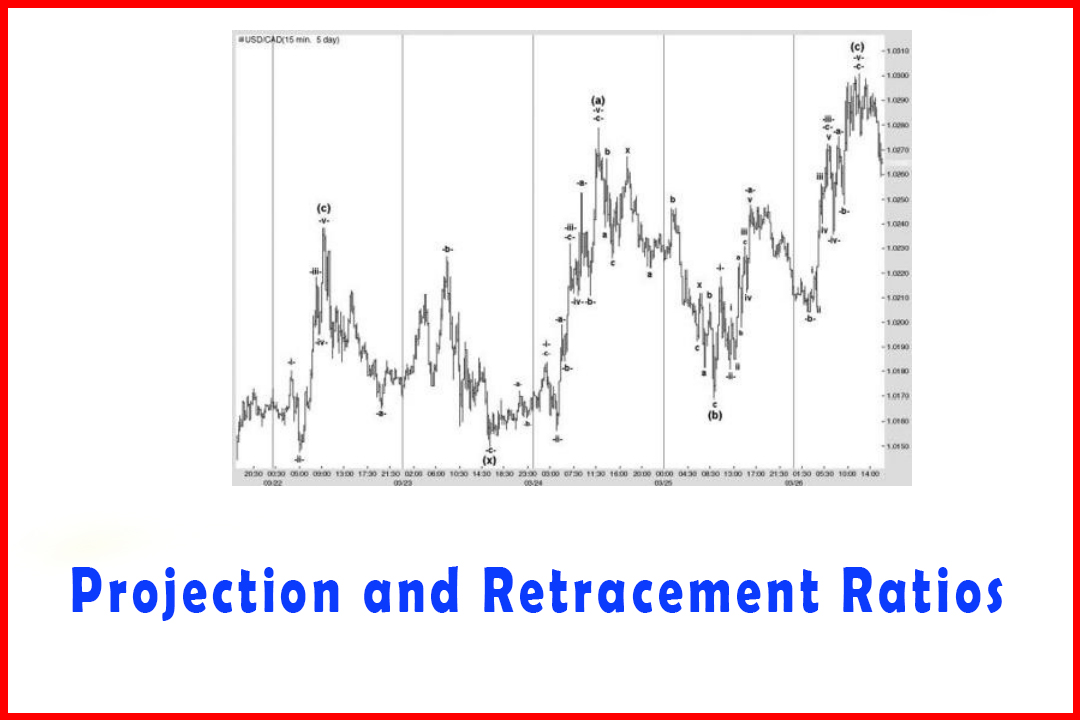

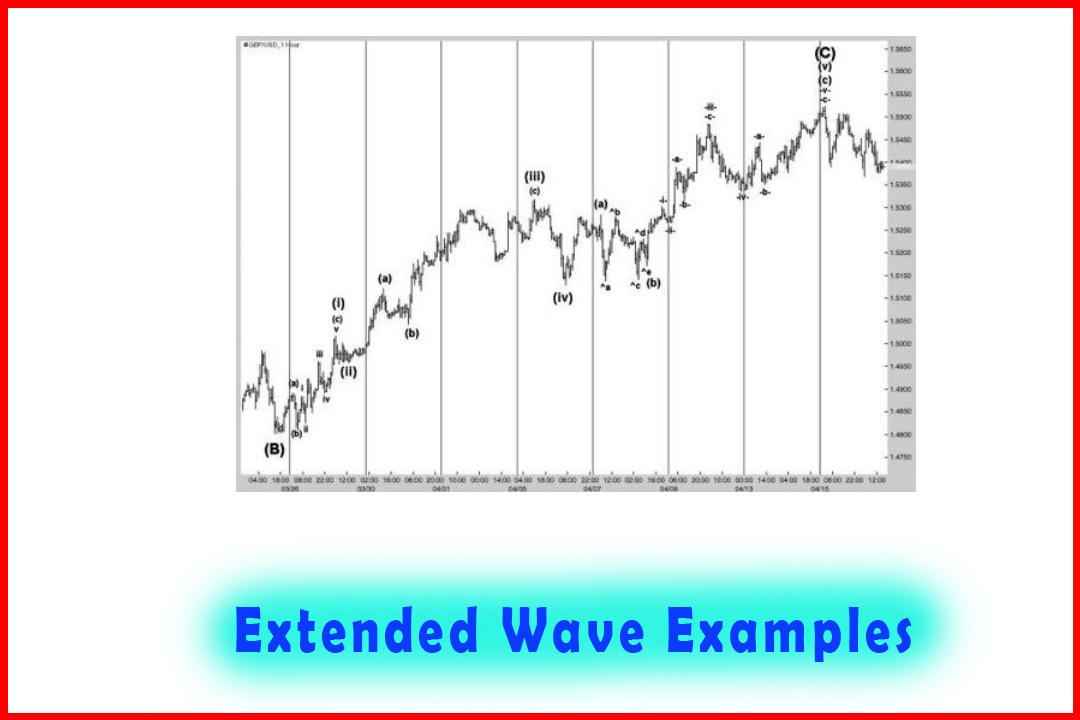

These are always very tough but there are normally some pointers to guide or suggest that an extension may occur. The following example was provided in Chapter 3 and was of an extended Wave -v-of Wave (c) of Wave (v).

Extended Fifth Wave

These

are always very tough but there are normally some pointers to guide or suggest

that an extension may occur. The following example was provided in Chapter 3

and was of an extended Wave -v-of Wave (c) of Wave (v).

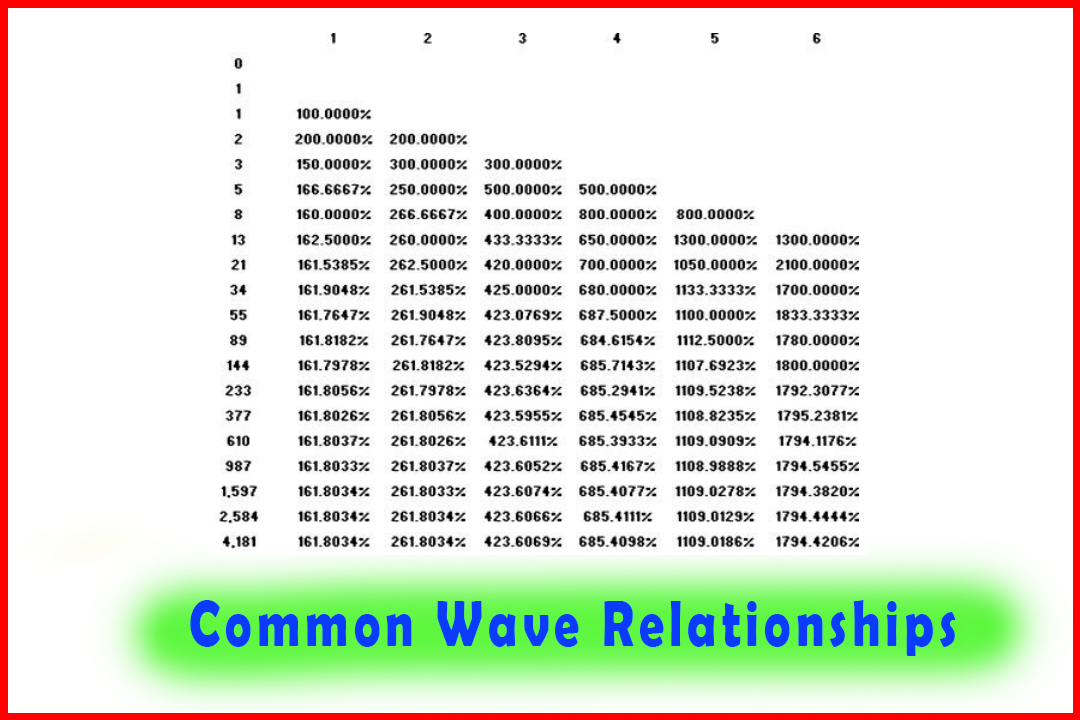

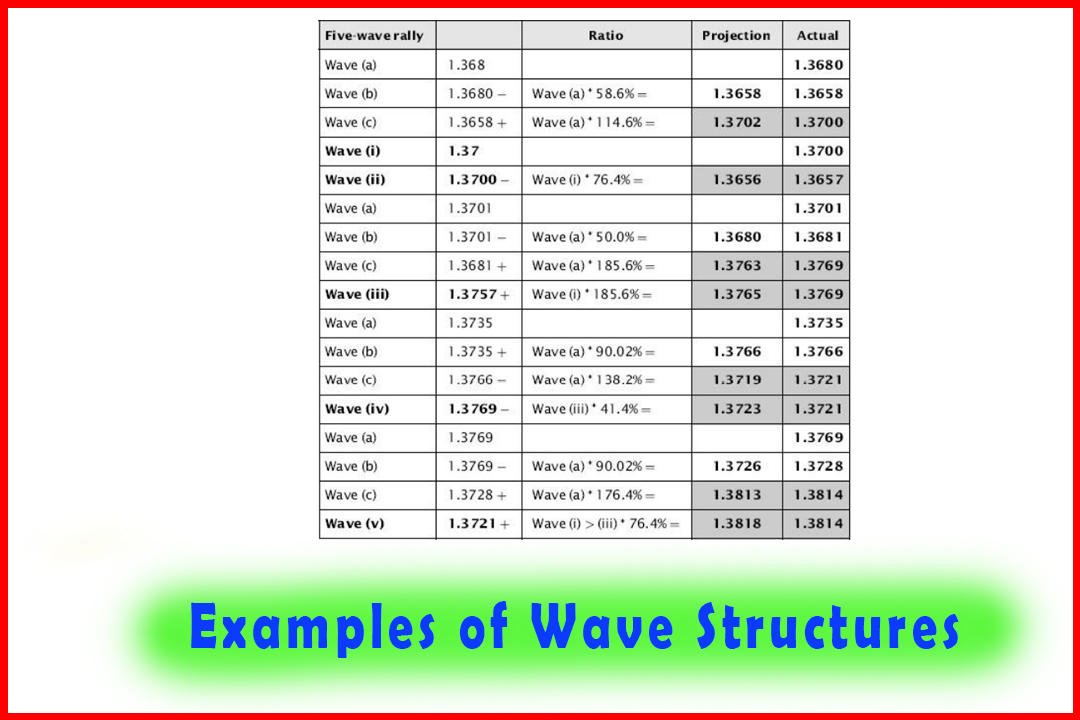

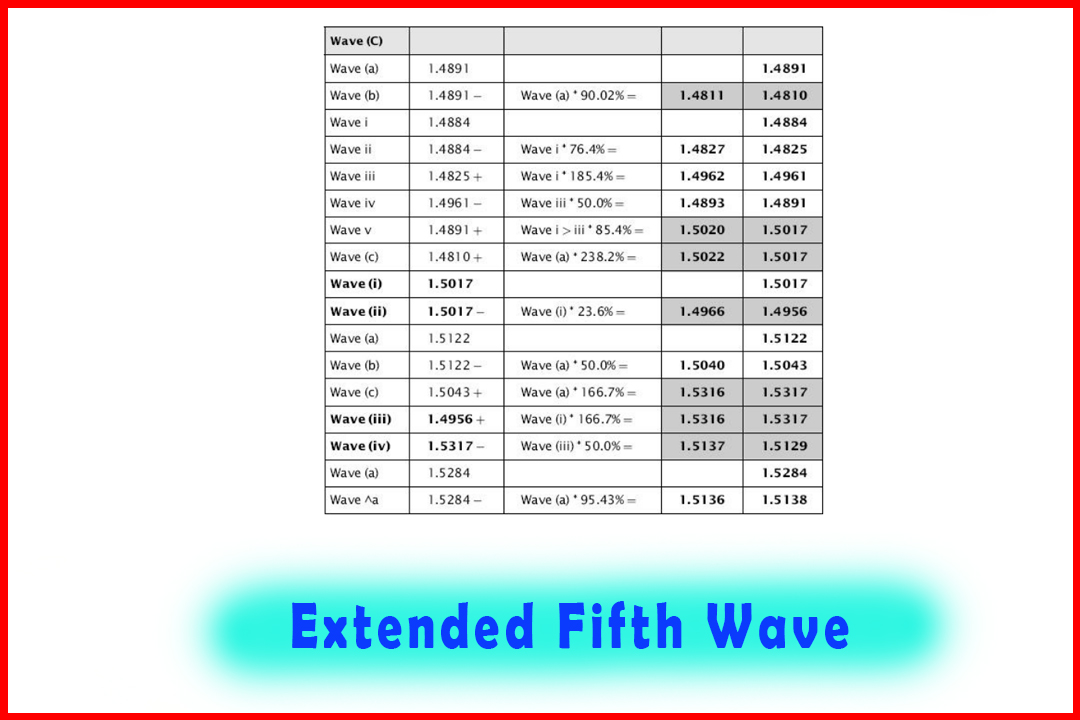

In

Chapter 3 I provided Figure 3.13 as an example of an extended fifth wave (shown

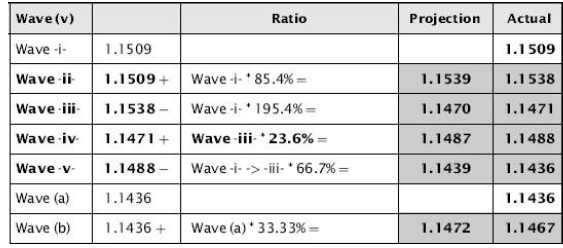

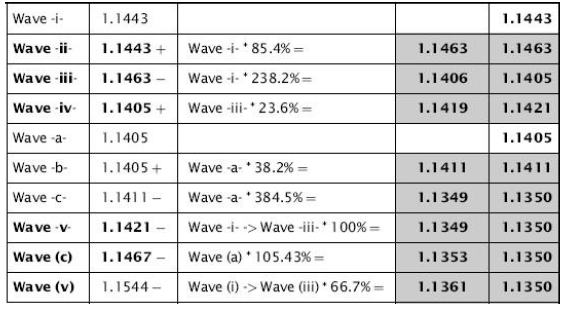

in Figure 4.10). The wave relationships are shown in Table 4.5. Note that the

common Wave (c) projection at 105.43% offered a potential target at 1.1353,

while the wave equality target in a Wave -v-extension was implied at 1.1349.

Overall, the 66.7% target in Wave (v) was at 1.1361. Therefore, the general

1.1350-60 area was implied by several different measurements. Even the 385.4% projection

in Wave -c-of Wave -v-pointed to 1.1349 also but would be observed as being

able to fit that target. Attempting to predict such excessive moves is always

accompanied by some uncertainties.

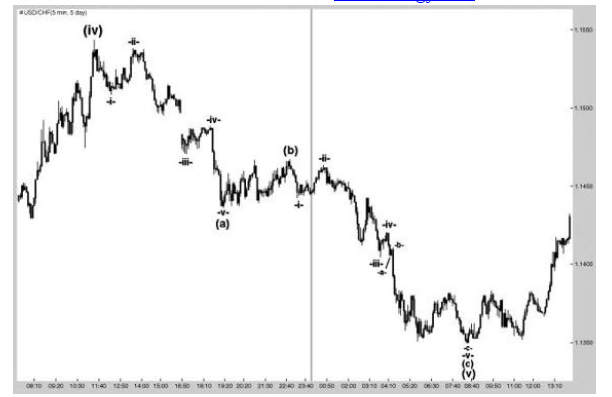

Figure

4.10 A Three-Wave Decline in Five-Minute USDCHF with an Extended Wave

-v-of Wave (c)

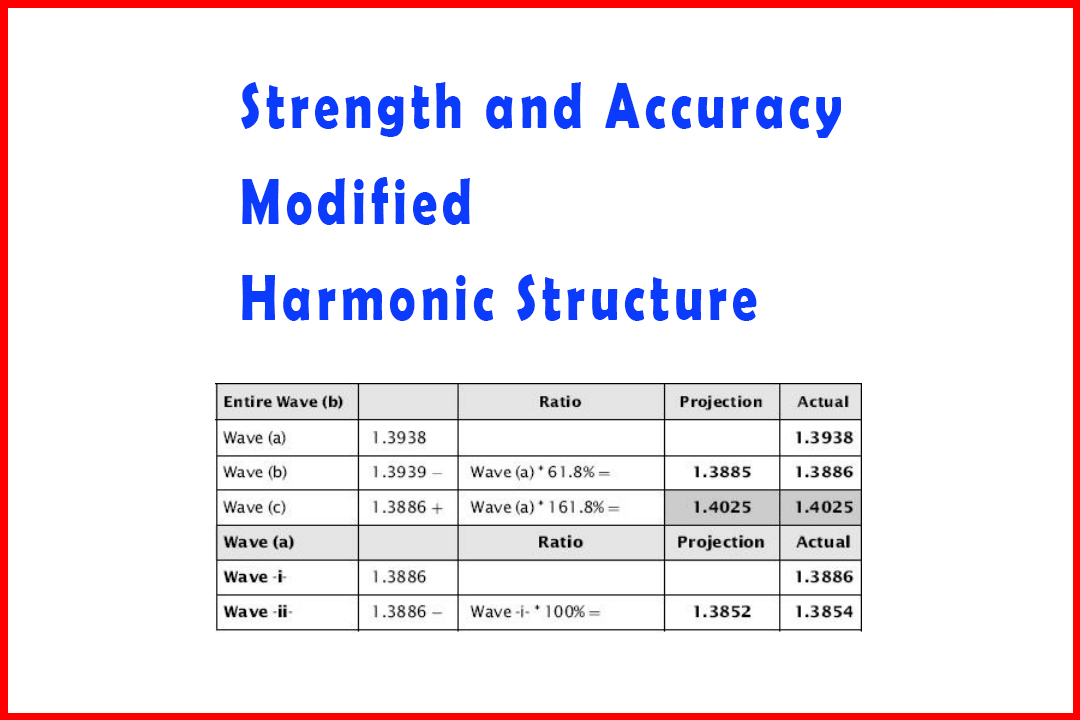

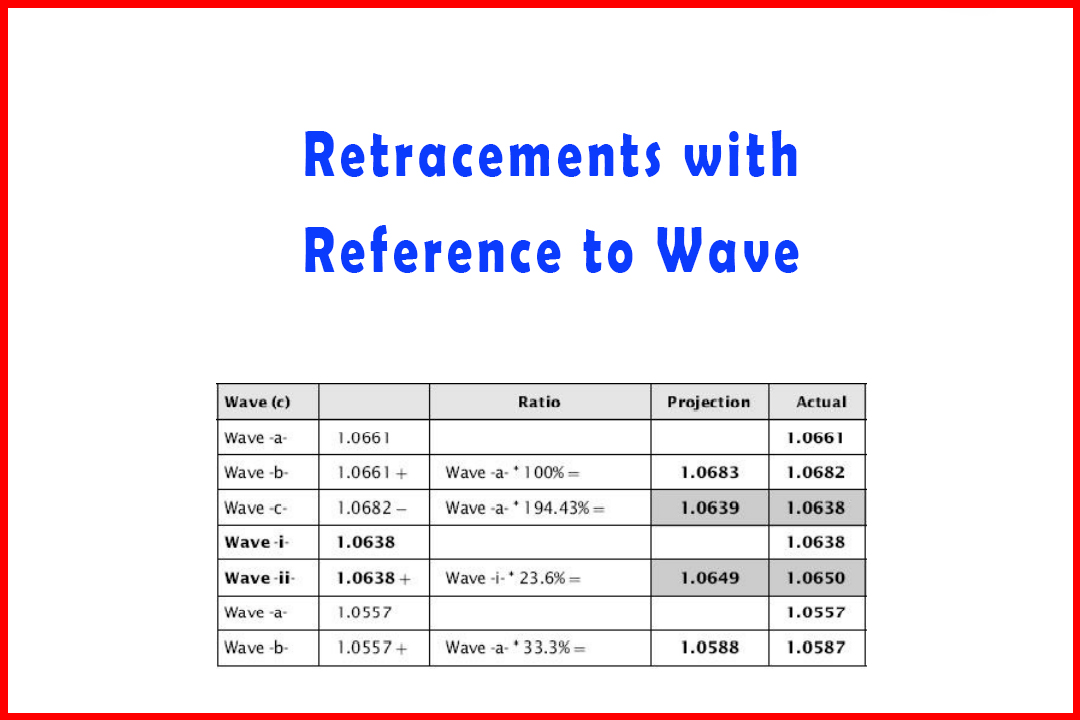

Table 4.5 Wave Relationships for the Three-Wave Decline in Figure 4.10

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Fifth wave, elliott fifth wave, Best trading strategy - Extended Fifth Wave

Elliott Wave | Forex | Fibonacci |