Extended Wave Examples

Extended Wave Trading Strategy, Harmonic wave, Fibonacci ratios, harmonic structure

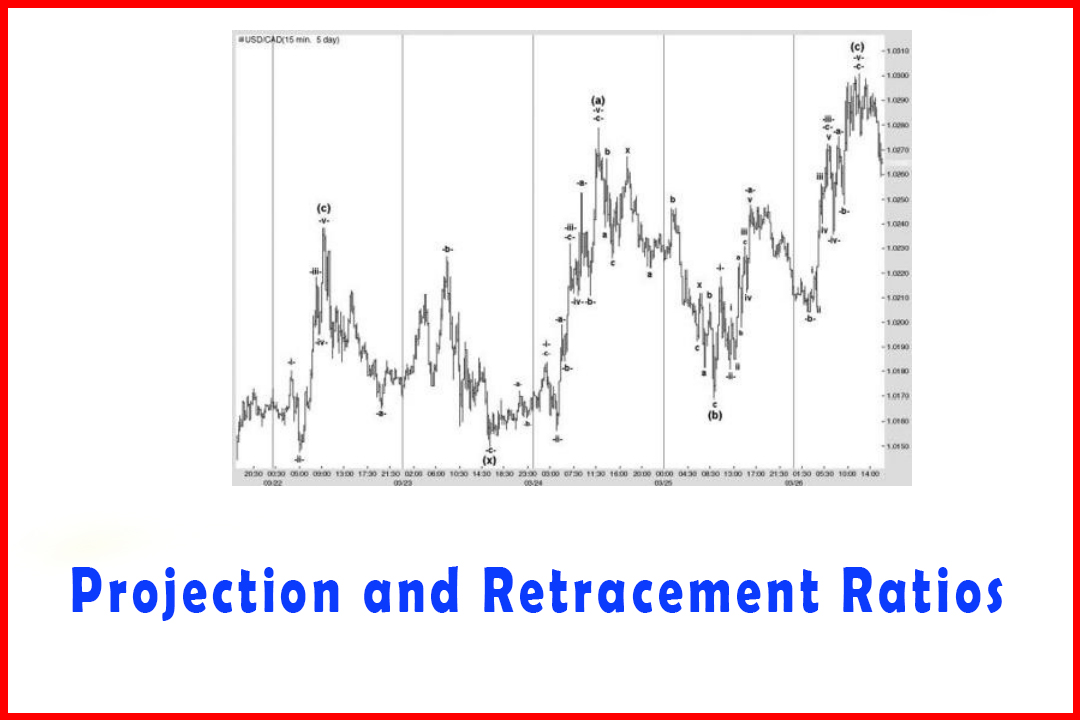

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

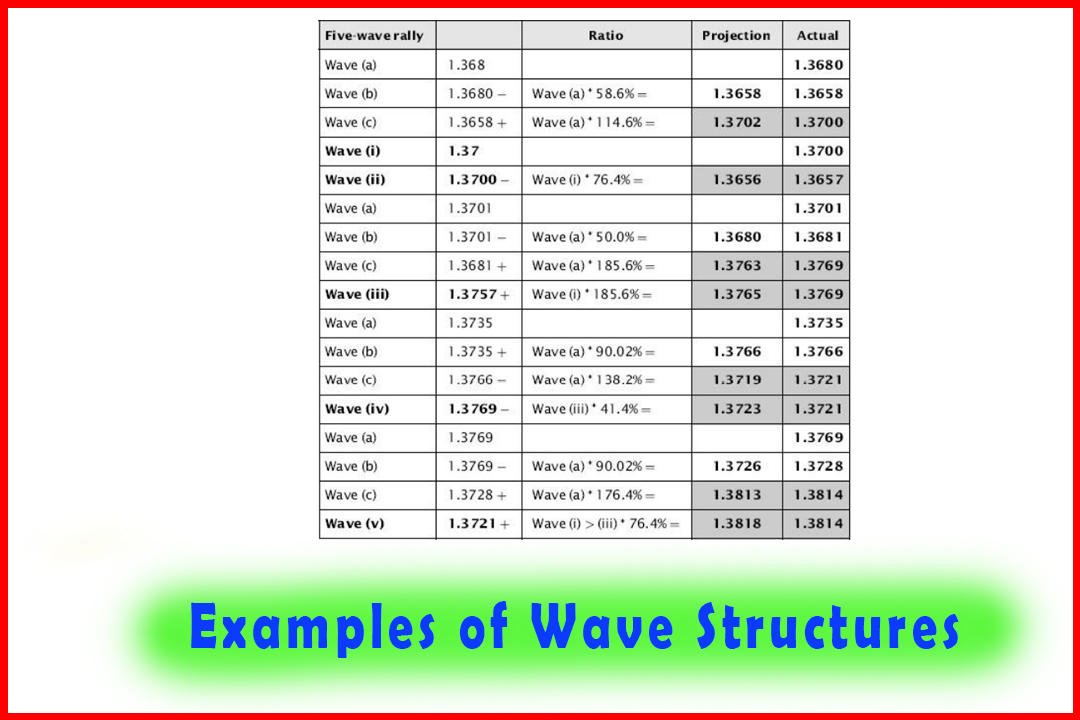

The extremely close correlations of the key waves are highlighted, with all projections and retracements being linked to Fibonacci ratios.

Extended Wave

Examples

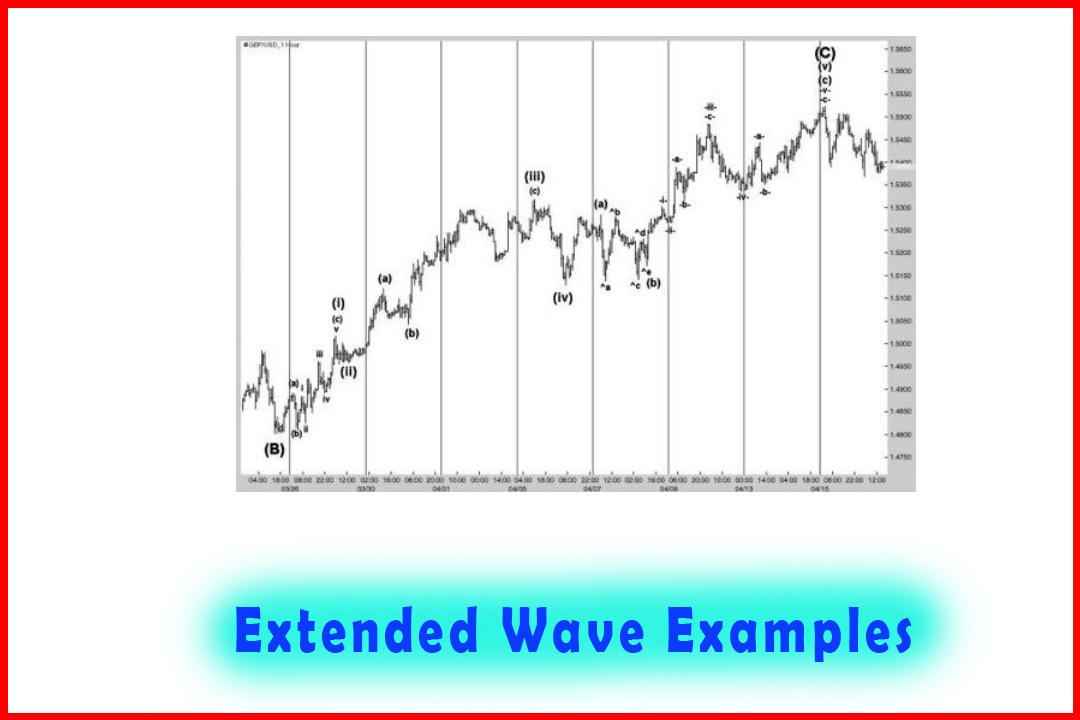

In

Chapter 3, I covered examples of how Elliott's extended wave appears

to be a misjudgment of the real underlying harmonic structure. In Figure 3.8 I

provided the example of a rally in GBPUSD and provided the harmonic wave count

(shown in Figure 4.7).

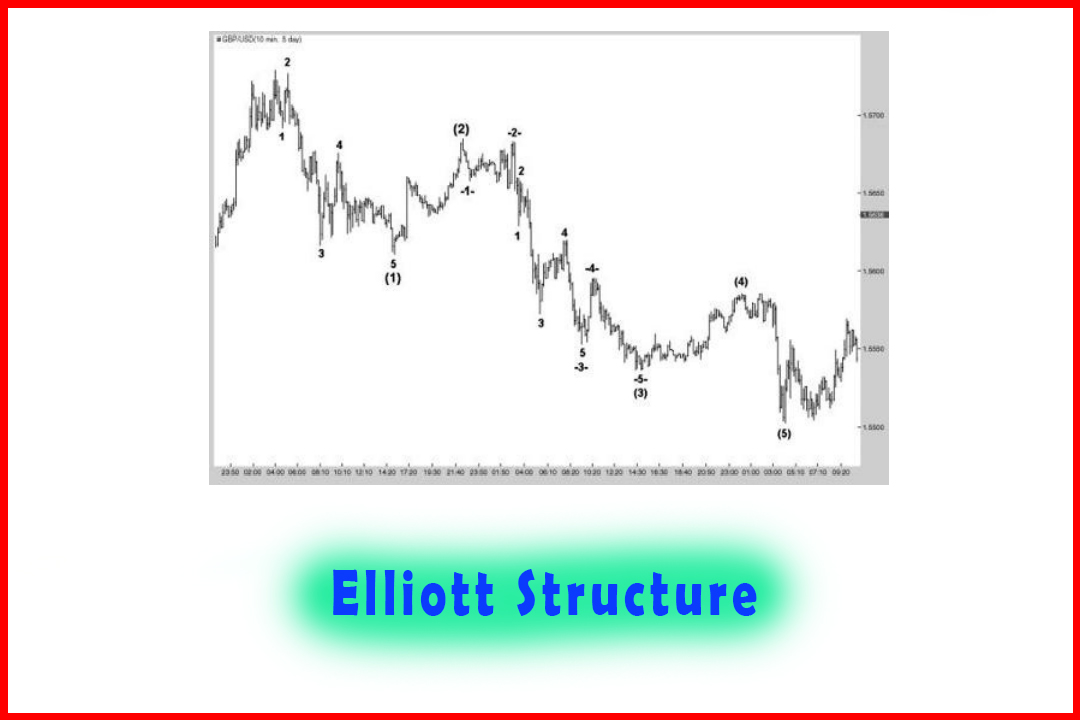

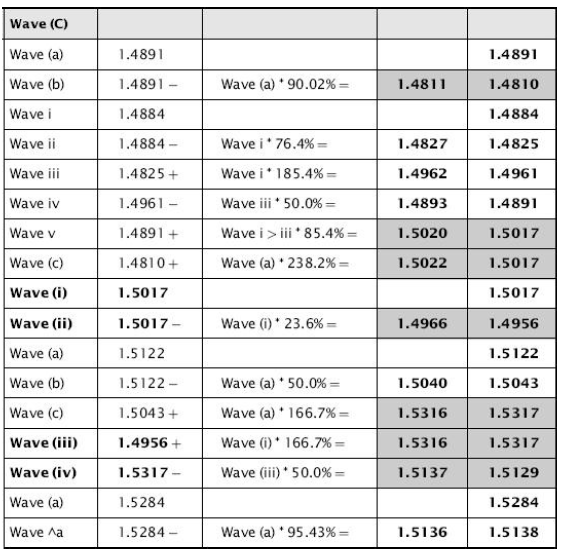

Figure 4.7 A

Five-Wave Rally in the Hourly GBPUSD Market

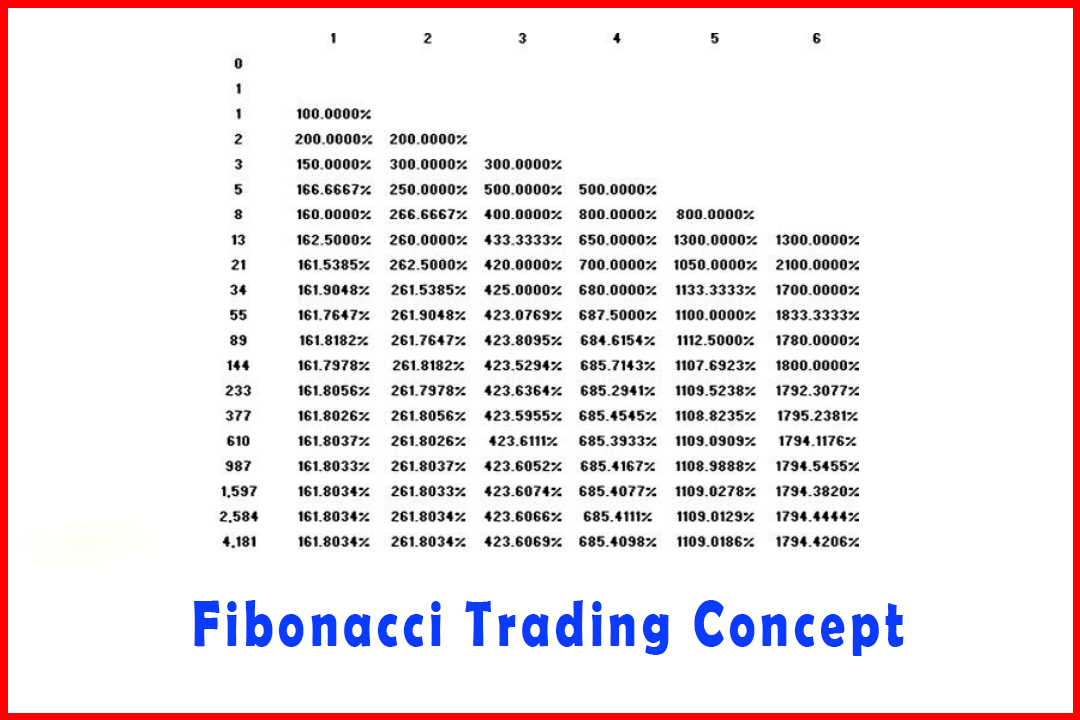

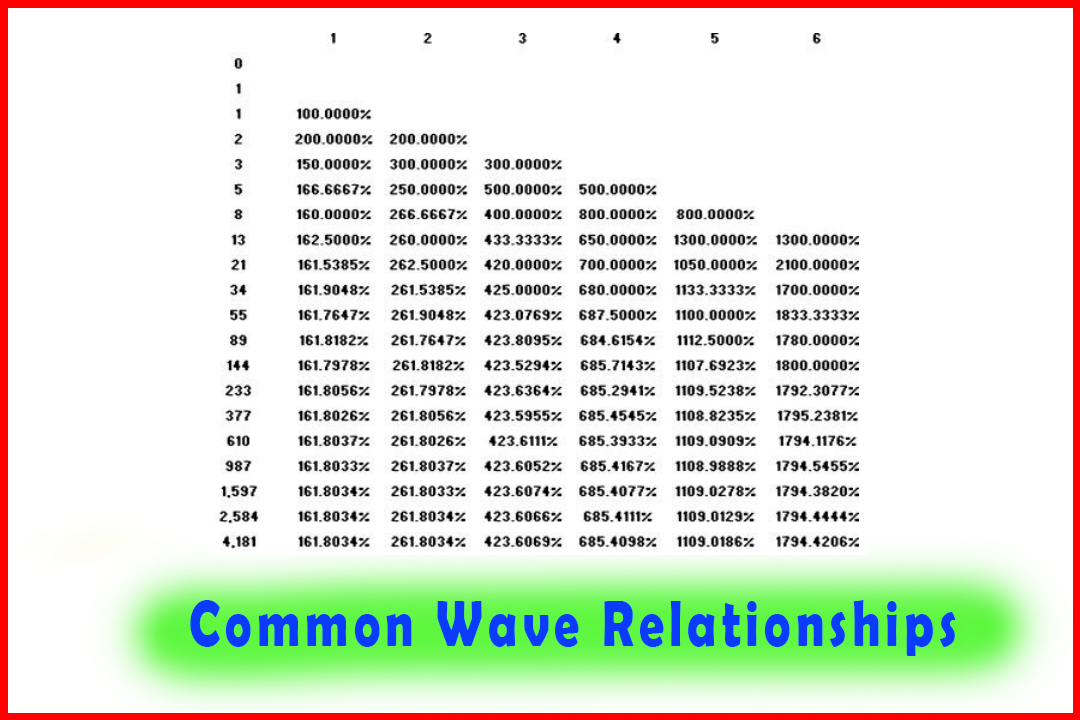

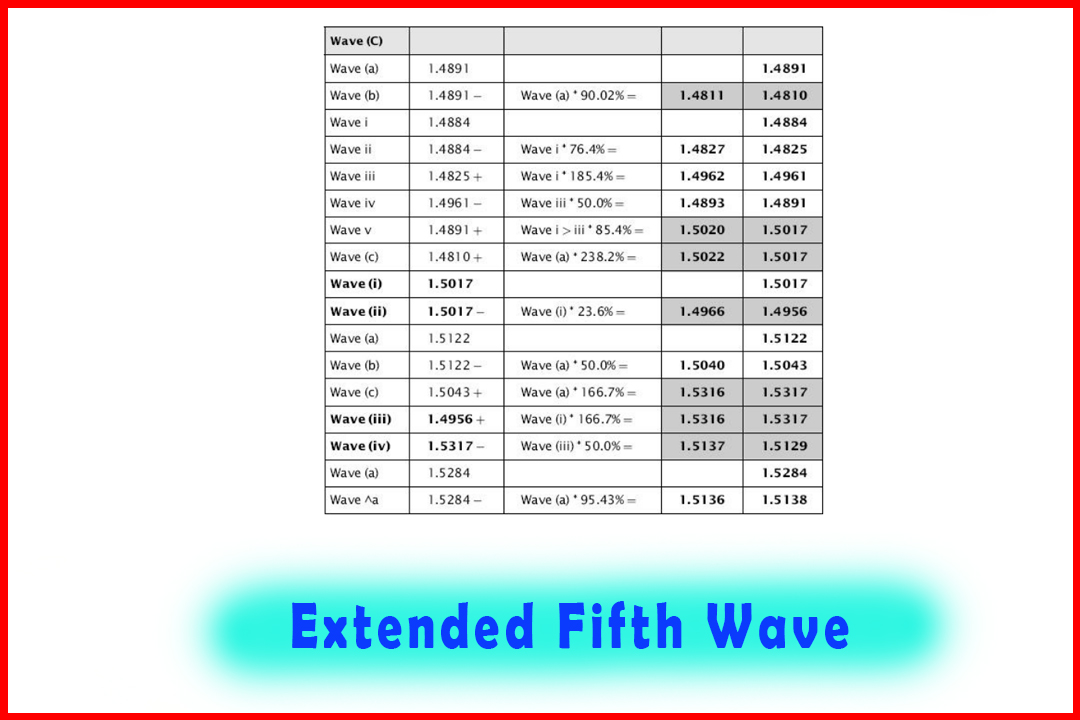

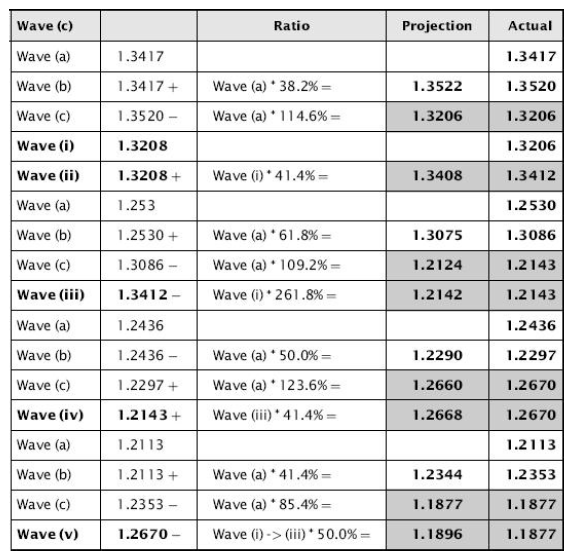

Table 4.2

provides the ratios in all waves.

The

extremely close correlations of the key waves are highlighted, with all

projections and retracements being linked to Fibonacci ratios. Such ratios can

provide extremely precise targets, or if the structure has been complex then

identification of exactly what has occurred once that part of the structure has

been completed. Above all, it generates more confidence in understanding each

section of the structure and leaves fewer instances where subjective judgment

needs to be applied.

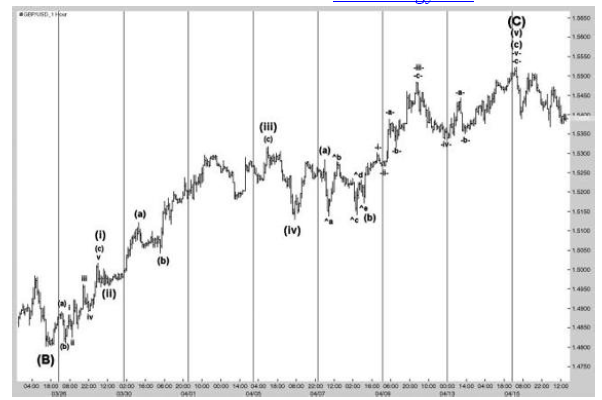

Also

in Chapter 3 I provided an example of a harmonic version of a stronger extended

wave (shown in Figure 4.8).

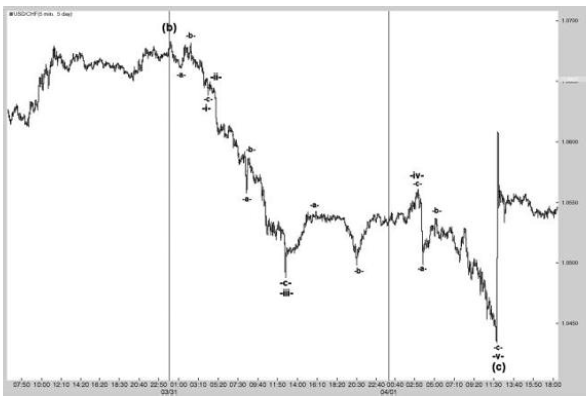

Figure 4.8 A

Five-Wave Decline with a Strong Extended Wave -iii-in Five- Minute USDCHF

Market

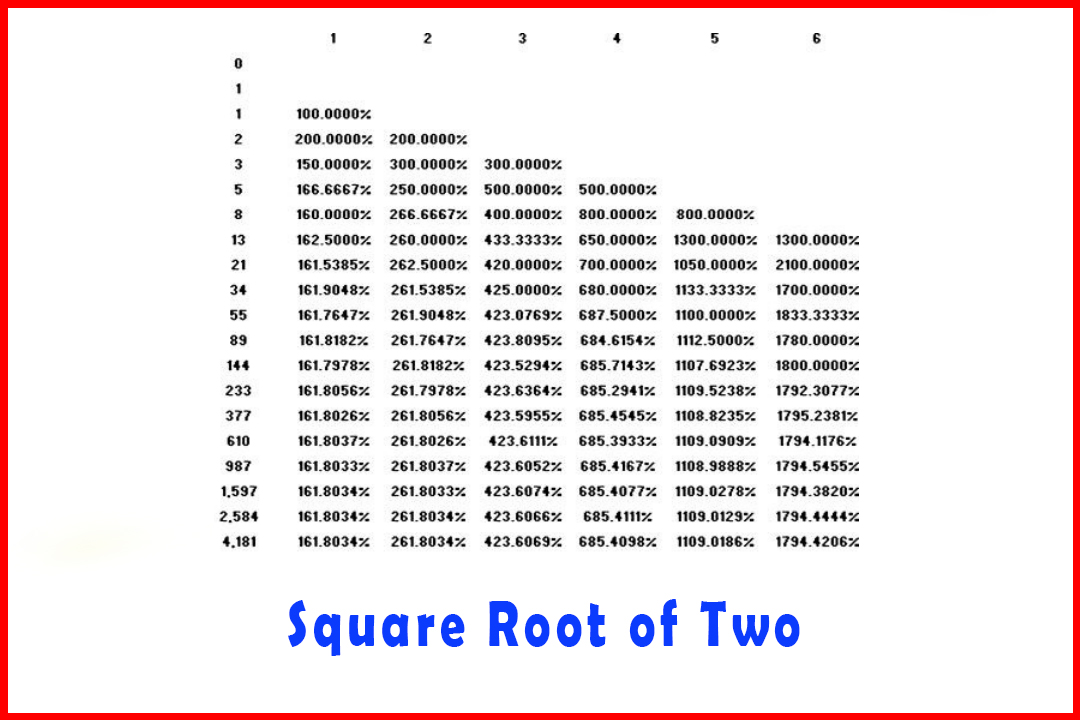

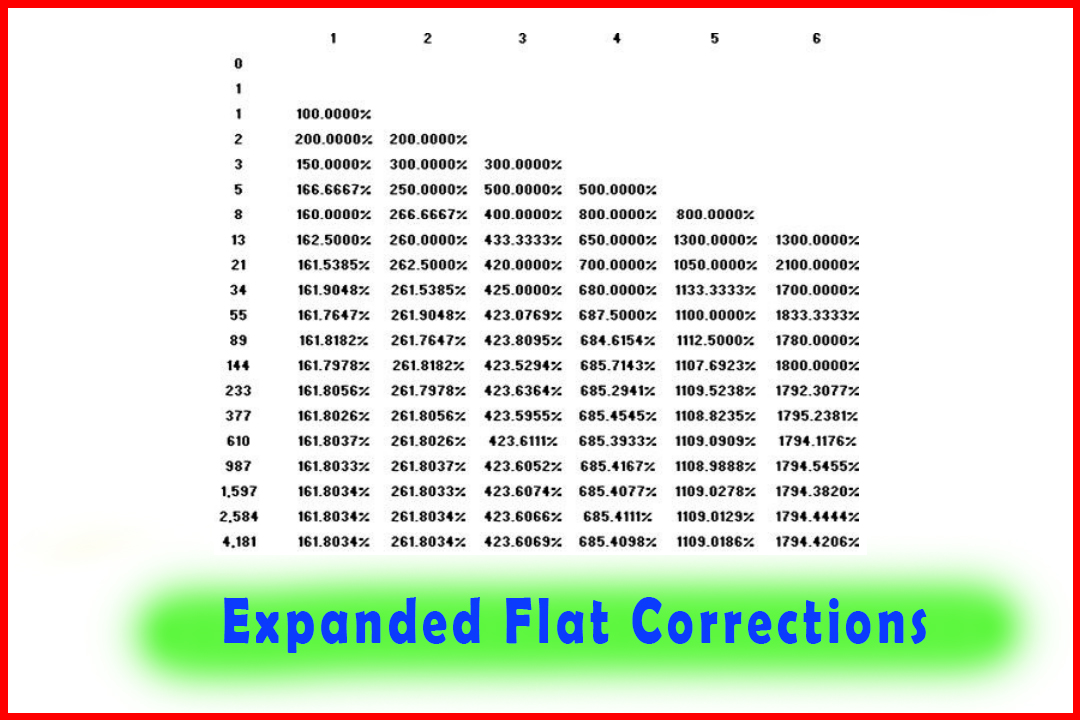

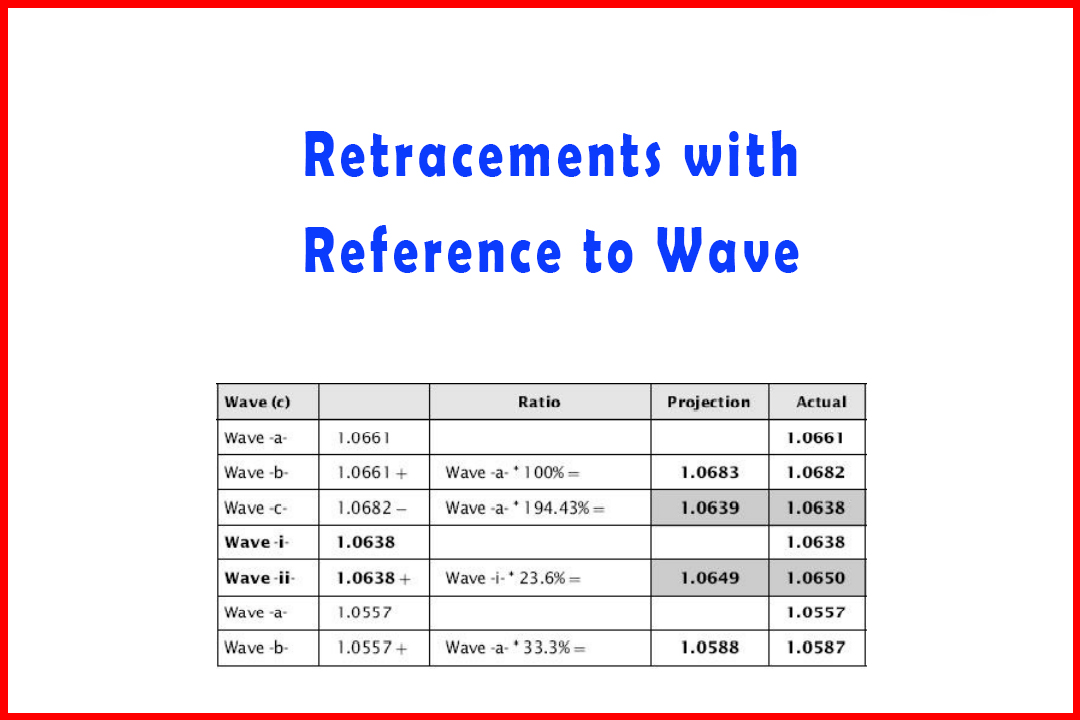

In

this example the wave relationships are exceptionally accurate (as shown in

TableAB). It is very important to note how the internal ABC relationships

confirm the projections of Waves -i-through Wave -v-. In addition, while not

shown, the end of Wave (c) at 1.0434 should also be a close relationship with

that of Wave (a).

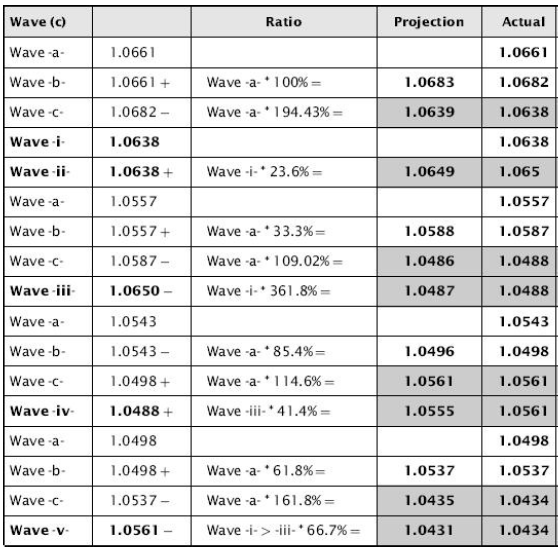

Table 4.3 Wave

Relationships for the Five-Wave in Figure 4.8

These

fractal relationships across the entire wave structure of all degrees is very

noticeable and, in my mind, is conclusive proof that R. N. Elliott (probably

quite understandably) made an error of judgment when defining the five-wave

impulsive structure.

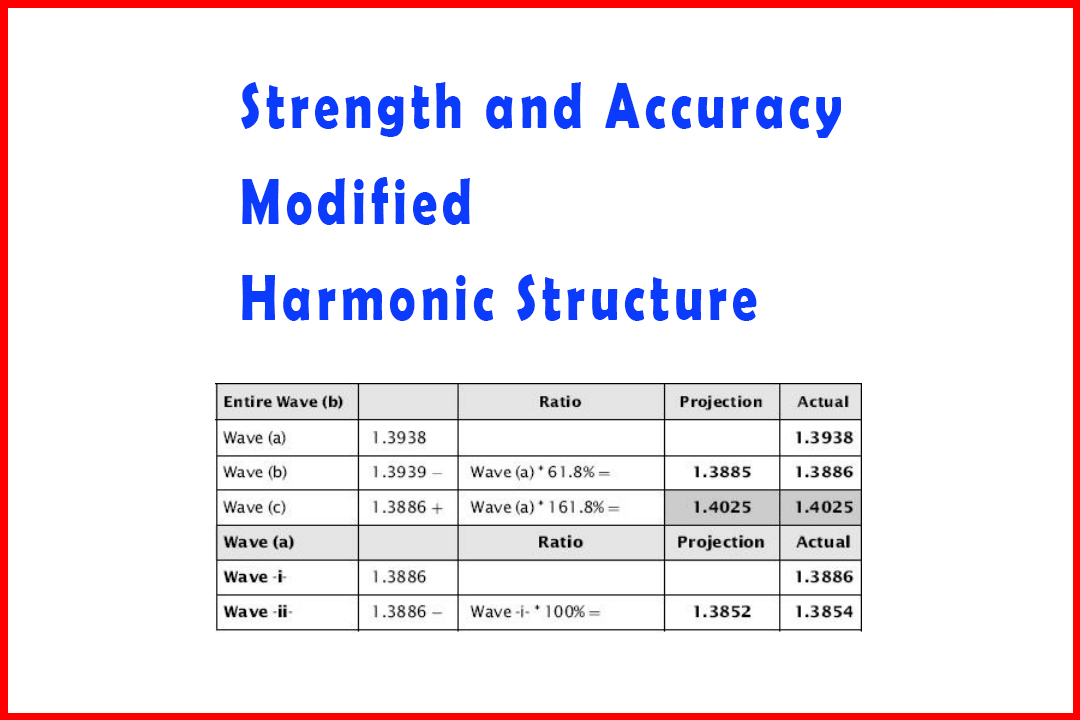

As

a second example of a clearly extending Wave (iii), in Chapter 3, I offered the

hourly chart of a decline in Wave (c) in what I considered then to be Wave

(iii).

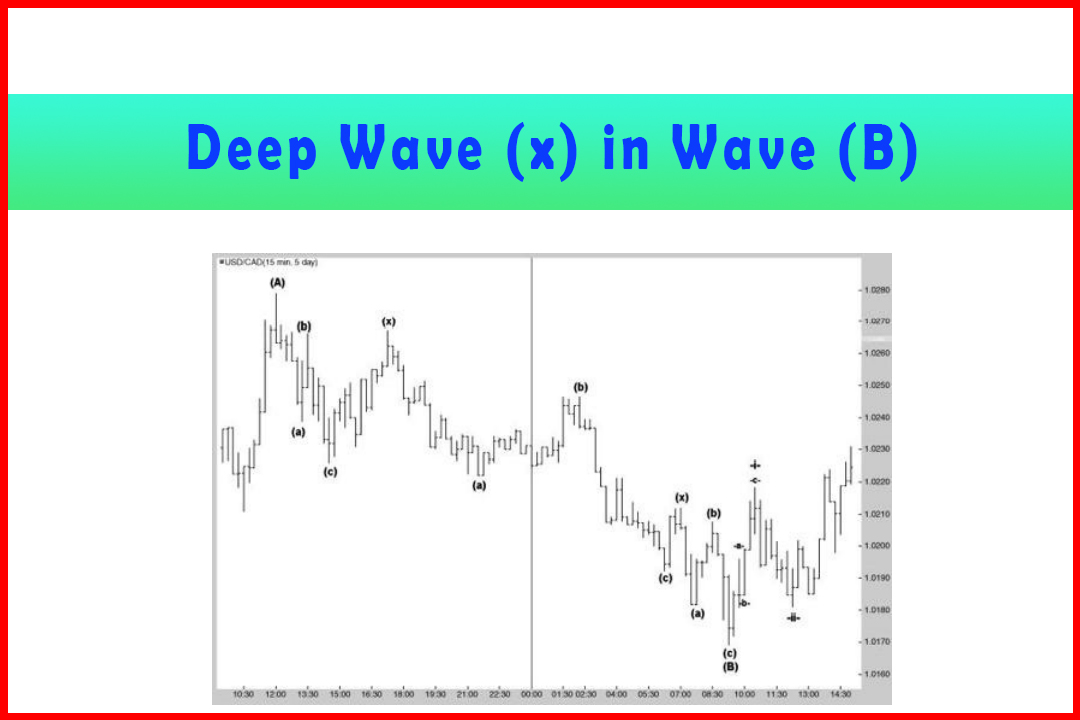

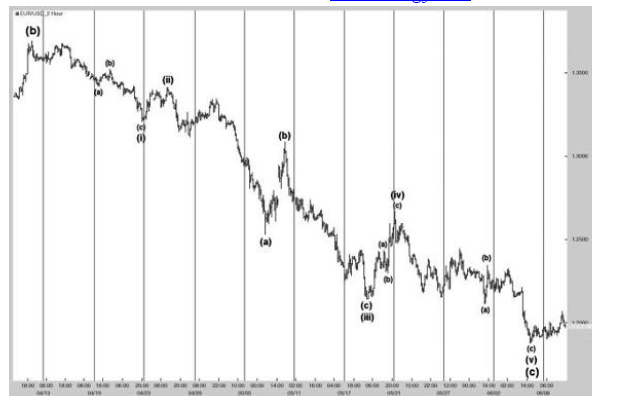

Figure

4.9 displays the same chart as provided in Chapter 3 as an example of an

extended wave and also one with a deep Wave (b). The key to identifying the

harmonic structure is in synthesizing the different fractal elements of the

entire wave. Each impulsive wave must have a projection in Wave (c) that is a

normal ratio of Wave (a). Waves (iii) and (v) must in addition have targets

from extensions of Wave (i) and Wave (i) to (iii) respectively.

Figure 4.9 A Five-Wave Decline in Hourly EURUSD with an Effective Extended Wave (iii)

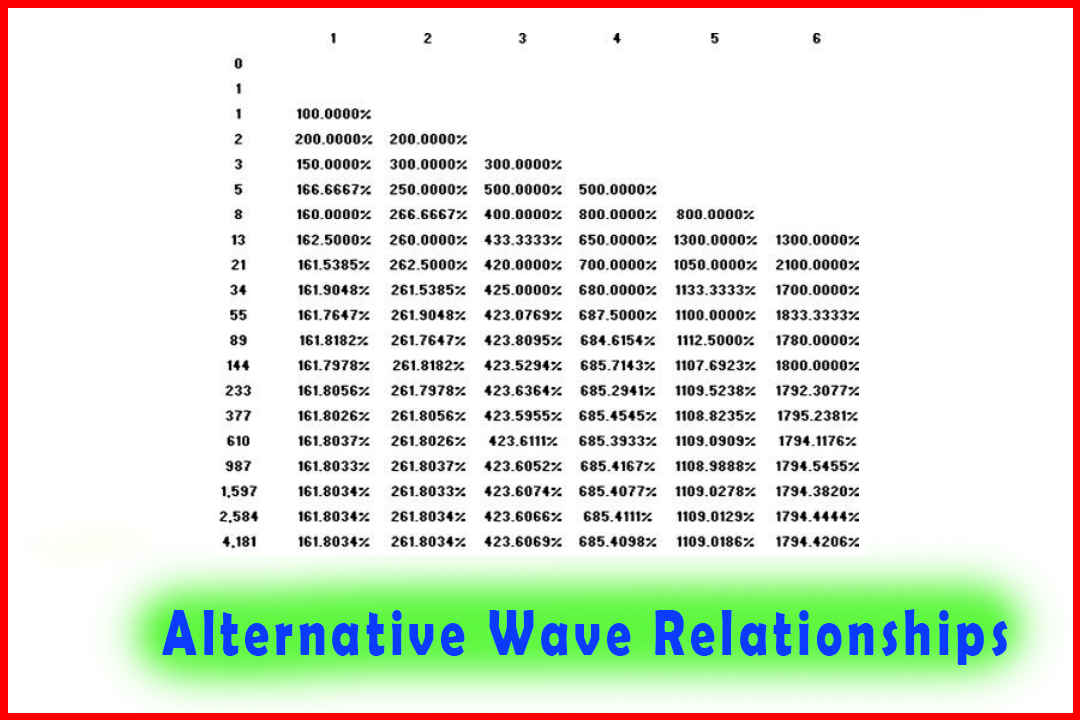

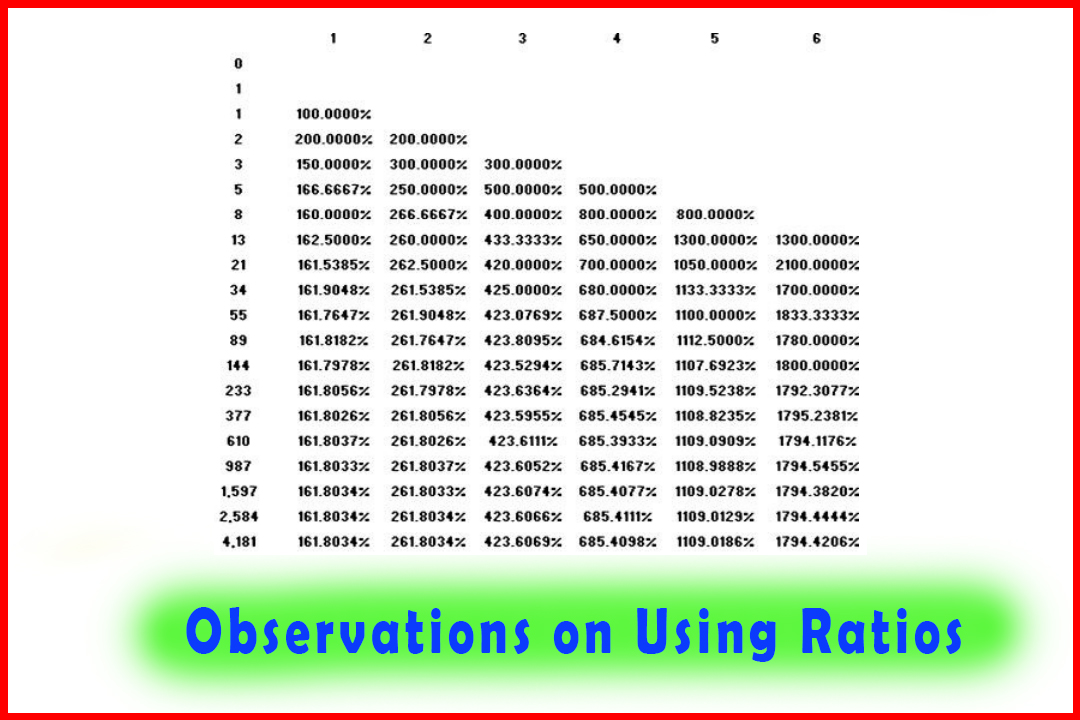

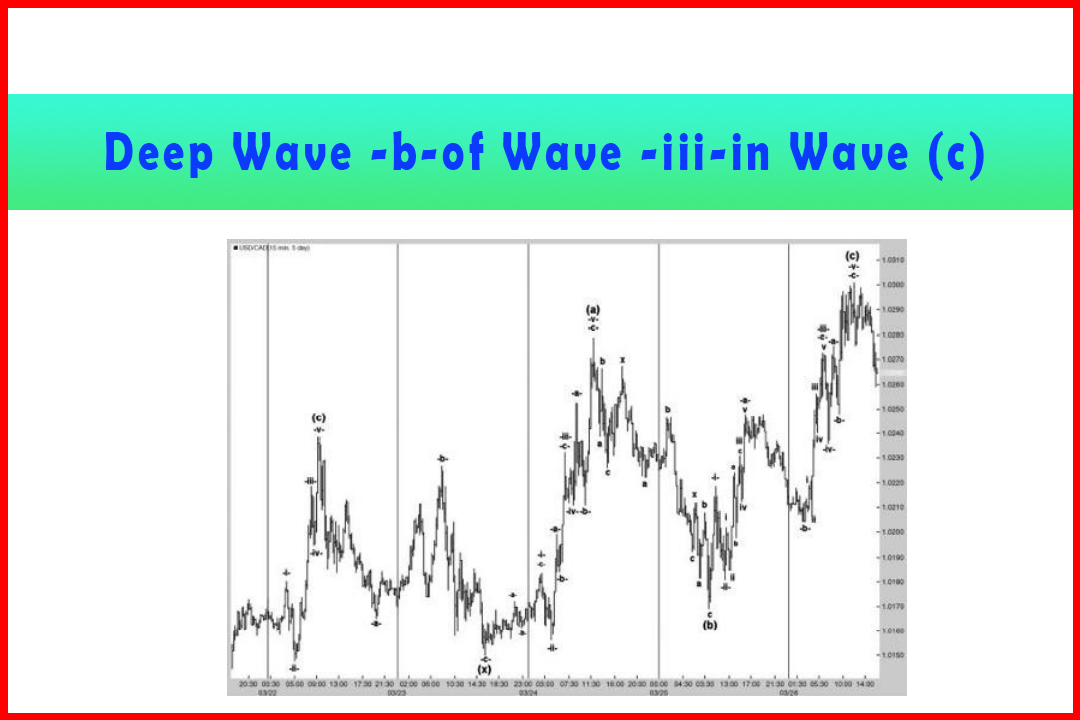

Table

4.4 shows the harmonic fractal nature of the modified structure and in general

holds quite accurate targets throughout. Note the deep Wave (b) of 61.8% but

which slots in nicely with the projection in Wave (iii). Both Wave (ii) and

Wave (iv) were modestly shallow at 41.4%. While the final 50% projection in

Wave (v) is not uncommon, it is not one that I usually look for but should be

considered if there is a discrepancy with the targets of one higher degree. In

this case the larger Wave (c) lower displayed was a normal extension ratio of

Wave (a) and also of Wave (i).

Table 4.4 Wave

Relationships for the Five-Wave Decline in Figure 4.9

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Extended Wave Trading Strategy, Harmonic wave, Fibonacci ratios, harmonic structure - Extended Wave Examples

Elliott Wave | Forex | Fibonacci |