Elliott Structure versus the Modified Harmonic Relationships

Elliott wave structure, Harmonic Pattern, Five wave pattern, harmonic wave structure

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

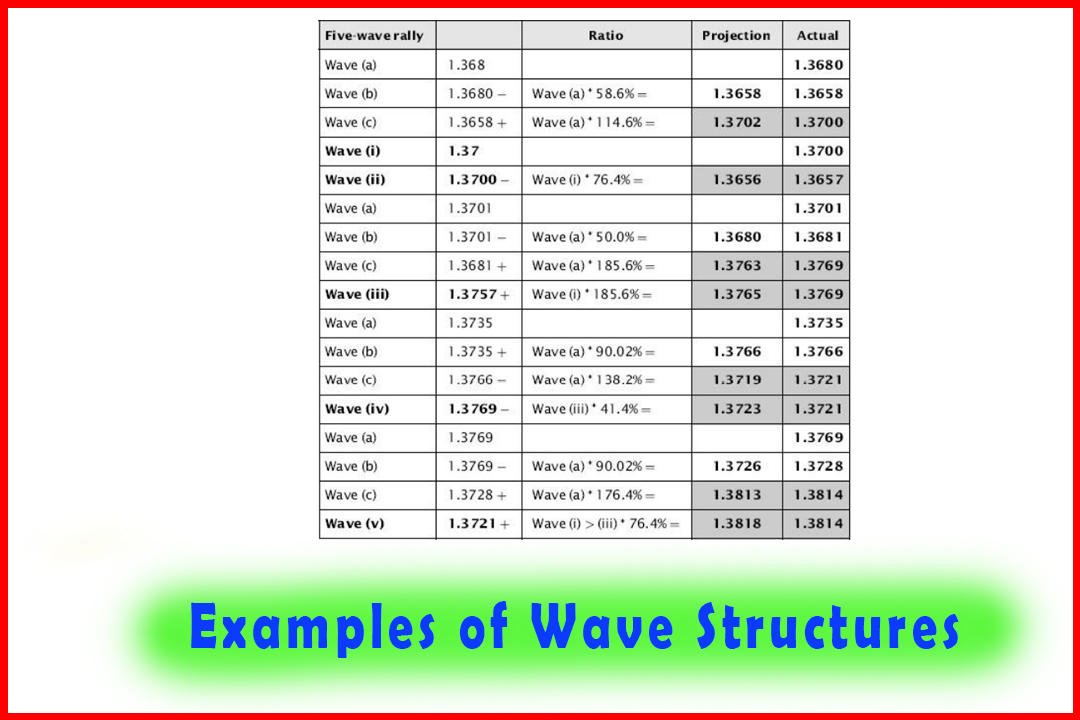

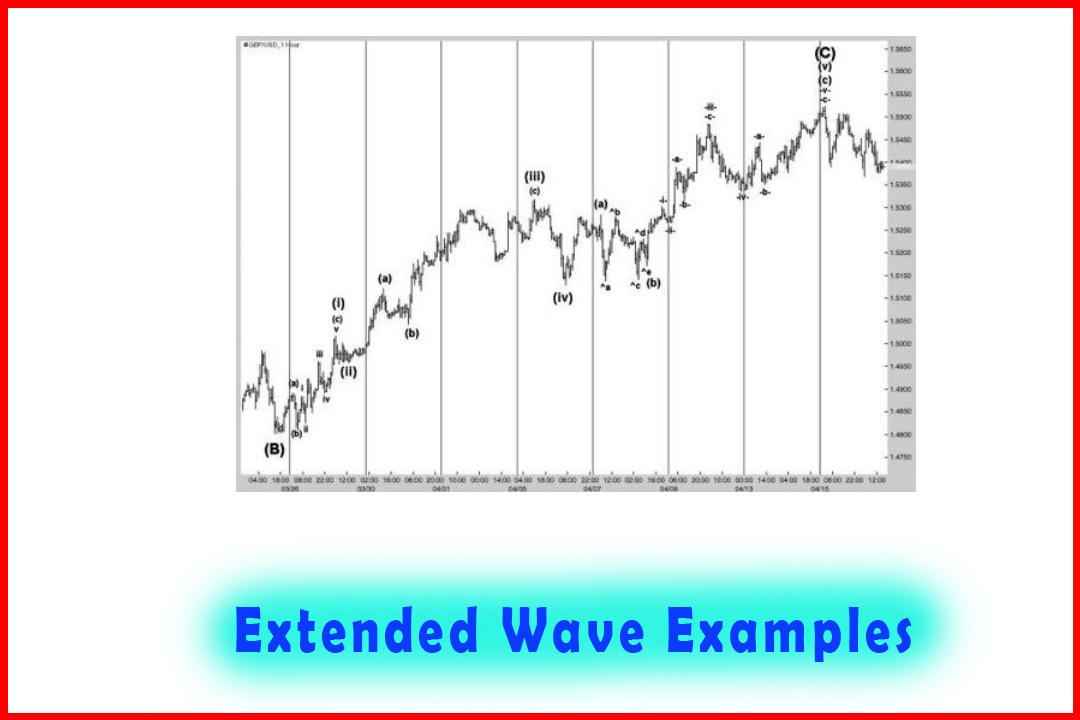

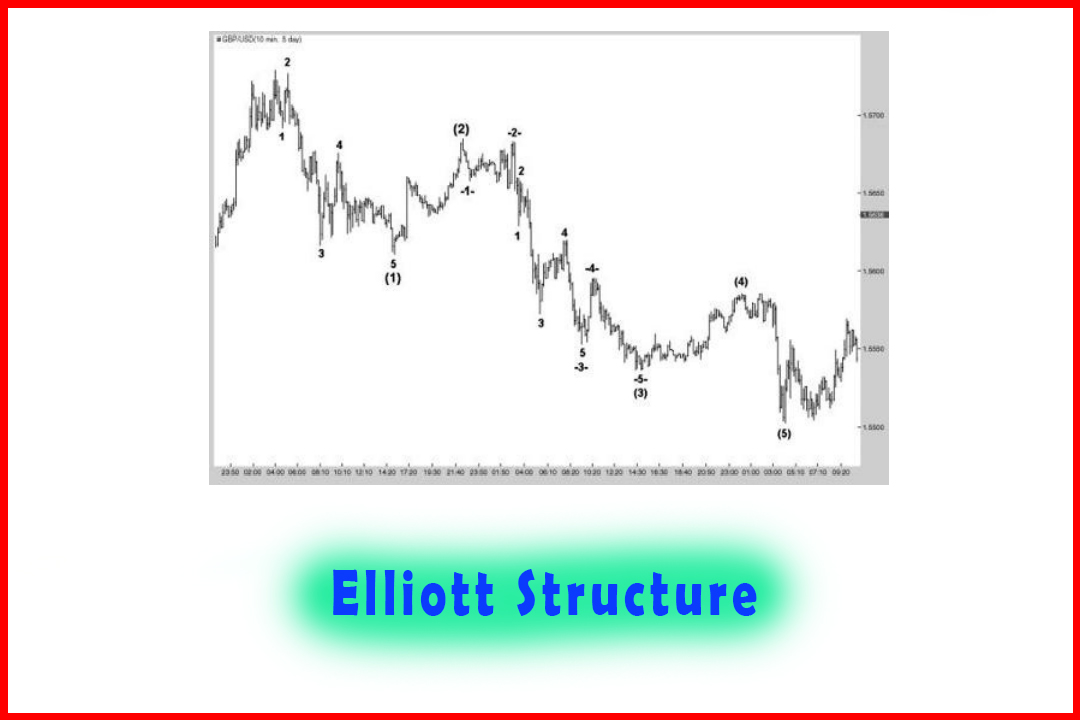

As another example of how the extended waves in Elliott's original structure fail to stand up to rigorous wave relationships, I will provide an example of an apparent impulsive decline in hourly GBPUSD and compare wave relationships between Elliott's structure and the harmonic structure.

Elliott Structure Relationships versus the Modified Harmonic Relationships

As

another example of how the extended waves in Elliott's original

structure fail to stand up to rigorous wave relationships, I will provide an

example of an apparent impulsive decline in hourly GBPUSD and compare wave

relationships between Elliott's structure and the harmonic structure.

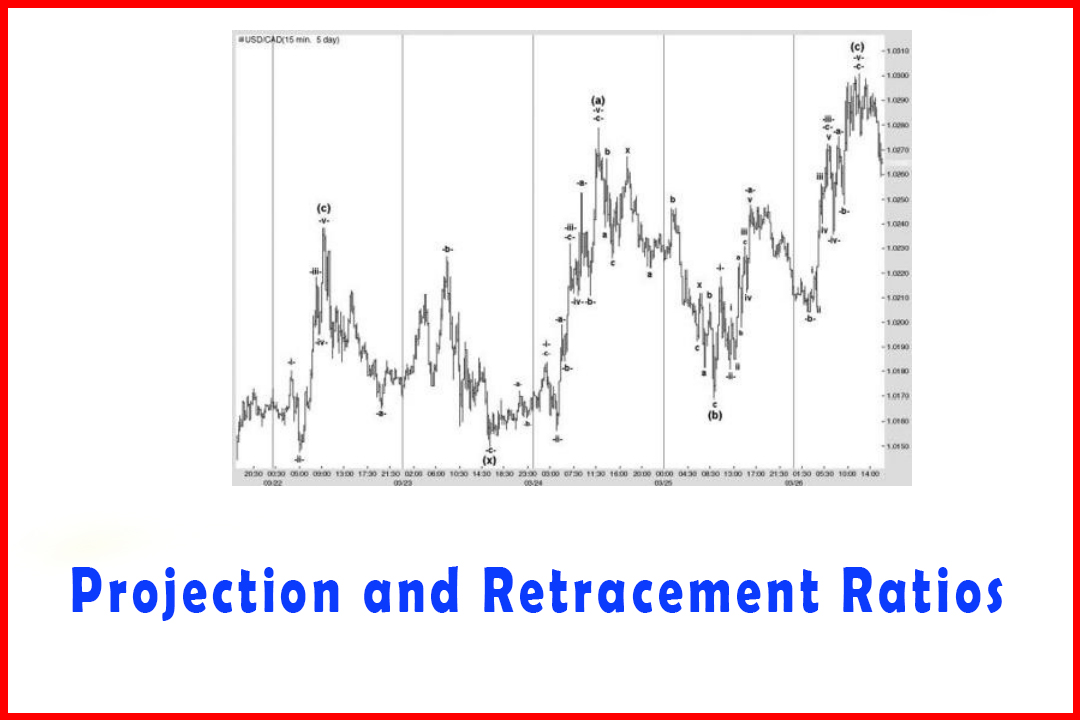

Figure

4.11 displays the decline in the hourly GBPUSD market. This appears to decline

in a complex five-wave move in which Wave (3) has a double extension. Apart

from the correction in Wave (2), all the swing highs and swing lows are

declining, confirming a bearish move. This decline followed a previous move

lower and therefore the implication is for another five-wave decline.

Figure 4.11 A

Complex Five-Wave Decline in GBPUSD

The

decline in Wave (1) does follow Elliott's structure of five waves with

Wave 3 being the longest and providing the main thrust of the decline. The

correction in Wave (2) appears normal, and this is followed by a Wave (3) which

has extended twice. Wave -2-is an Expanded Flat with the rest of the decline

developing normally.

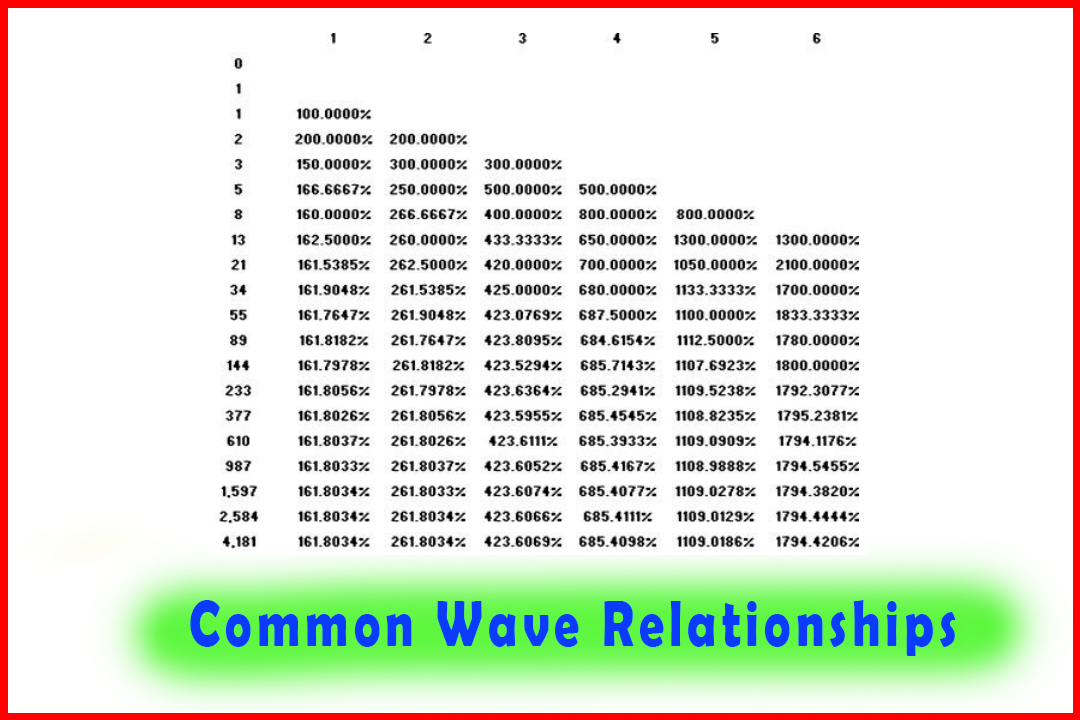

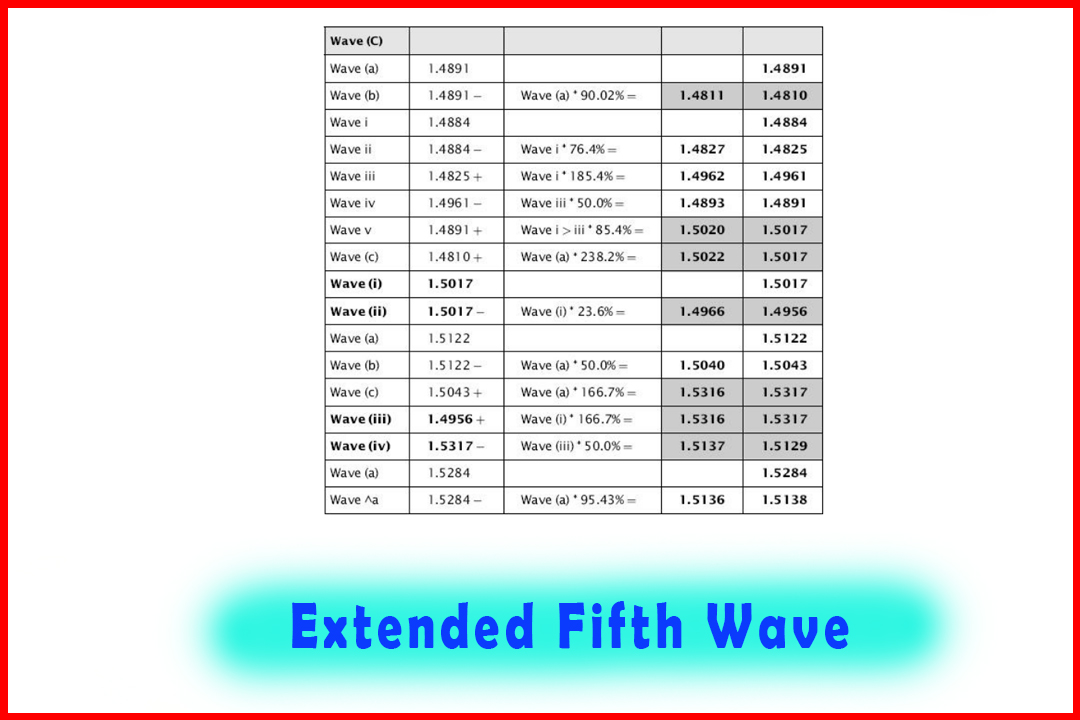

The

problems I habitually encountered with Elliott's structural

development were twofold. Firstly, these extended waves frequently lacked any

consistent wave relationships, and this generated the second problem of being

able to forecast where price should stall. To demonstrate the frustration I

commonly encountered, the wave relationships are displayed in Table 4.6.

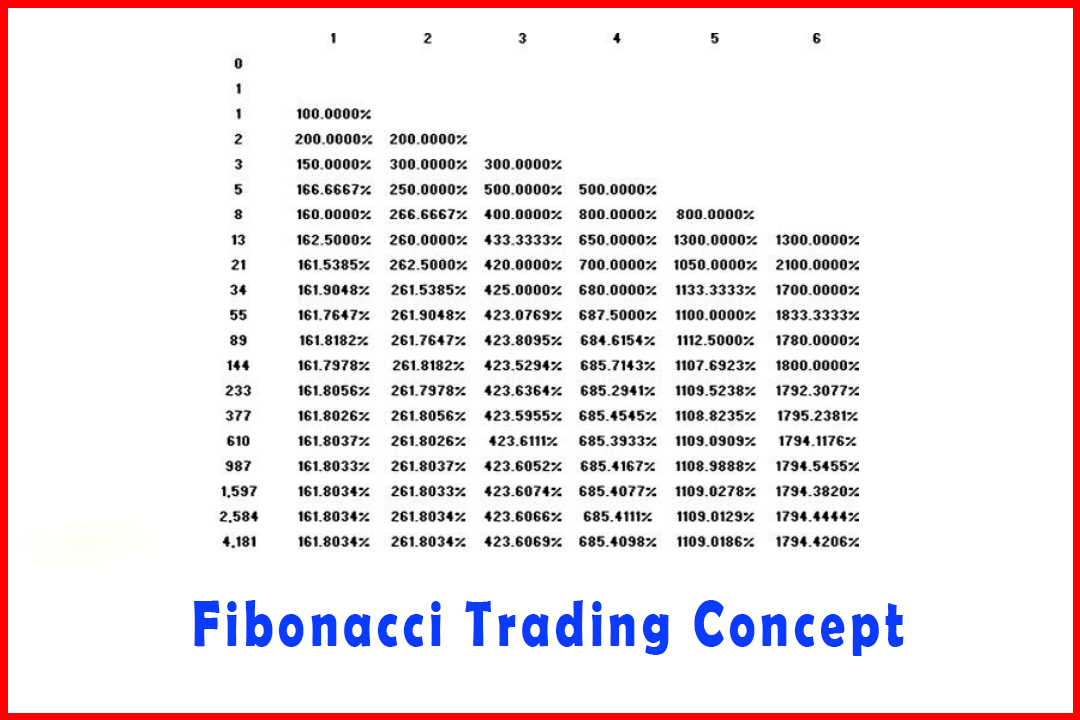

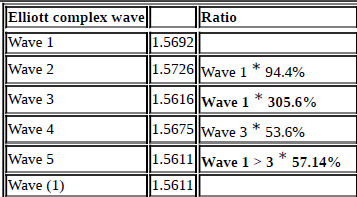

Table

4.6 Wave

Relationships

As

can be seen, there is a mixture of wave relationships. While there are some that

have the normal wave relationships I look for, within a reasonable deviation, I

have highlighted those which really would have posed serious issues in

forecasting.

It

was this type of imprecision that I found difficult to accept. On many

occasions the failure to be able to identify turns within a reasonable margin

saw reversals much earlier and left me in no man's land wondering

whether a correction was being seen and not a reversal. Anticipating extended

waves and where each Wave 1 would stall was a hit-or-miss affair, and then

everything became much more problematic.

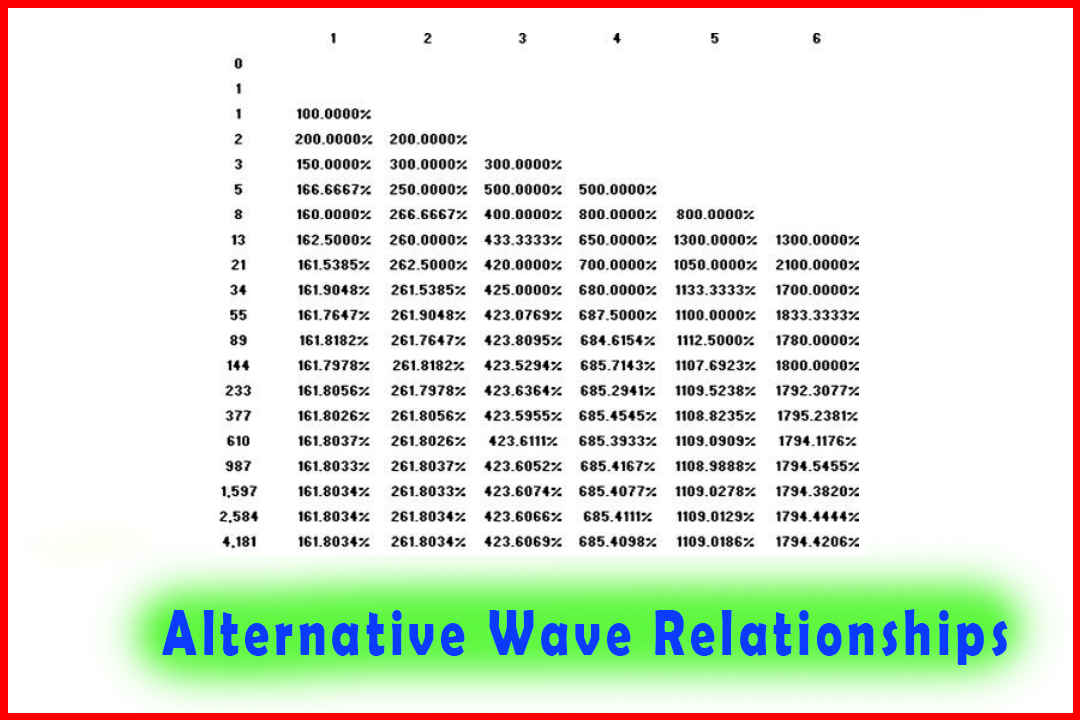

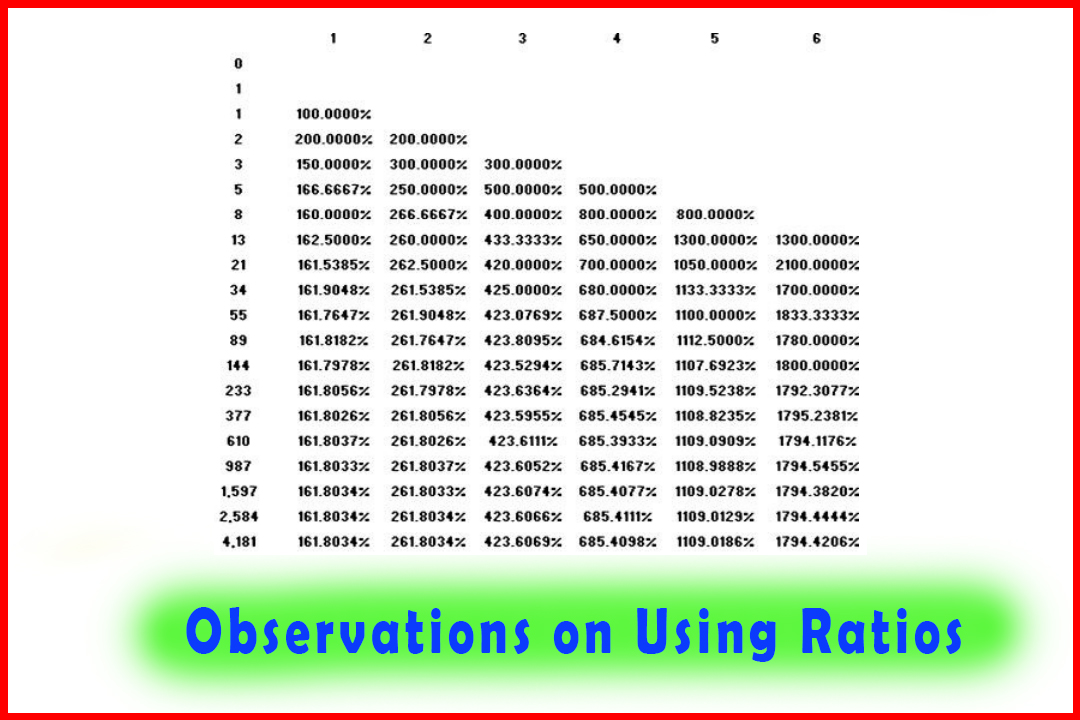

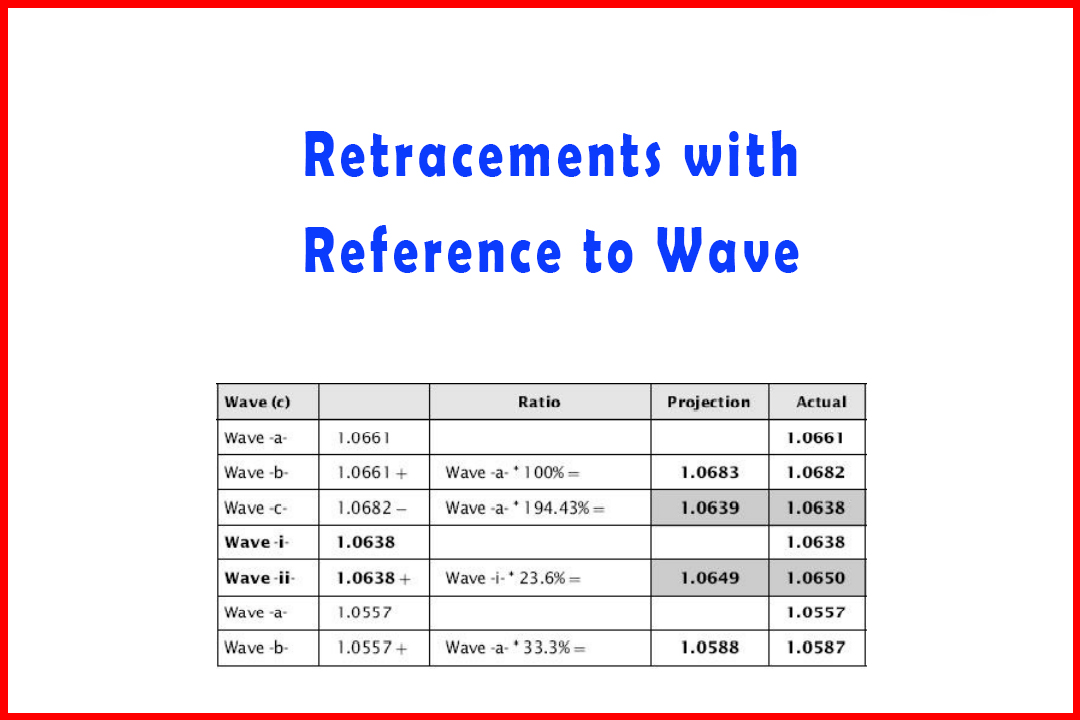

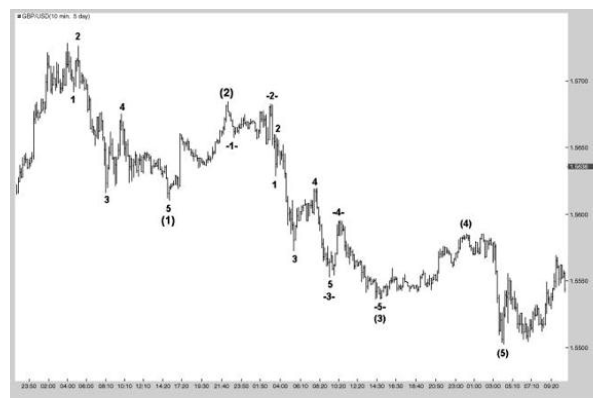

Now

let's look at the same decline employing the harmonic wave structure.

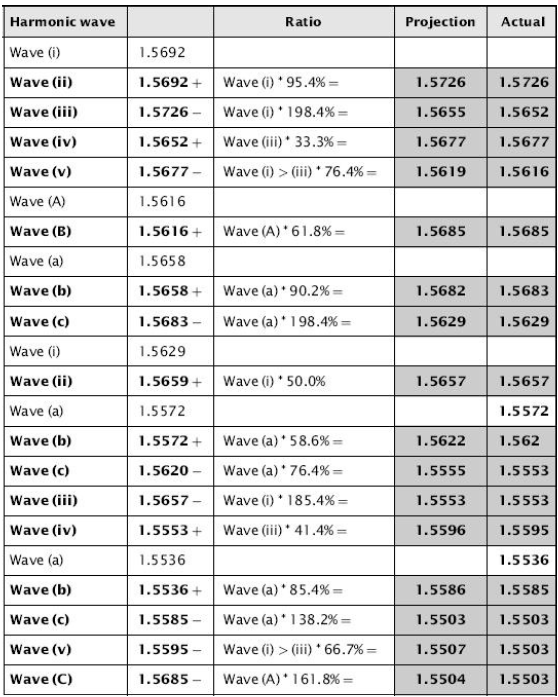

Figure

4.12 labels this completely differently as a three-wave decline. There will be

many Elliott Wave practitioners who will question this, but the evidence for

the count comes through the wave relationships which in this case provide

exceptionally accurate ratios that provided me with a much easier call for a reversal

higher.

Figure 4.12 A

Harmonic Three-Wave Decline in GBPUSD

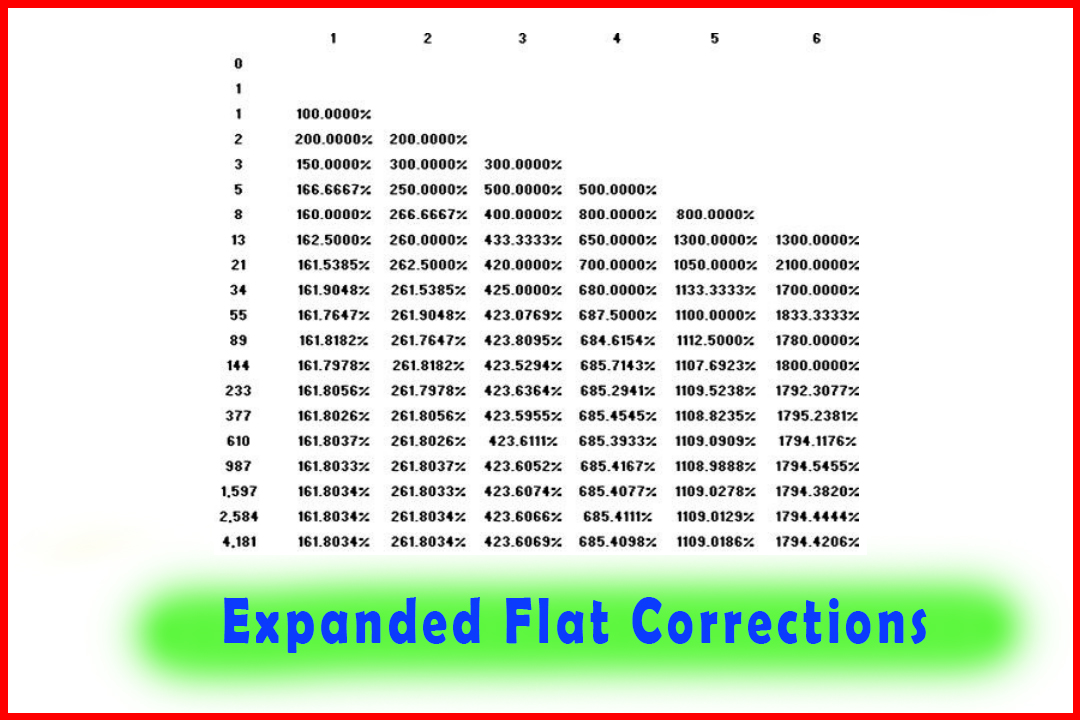

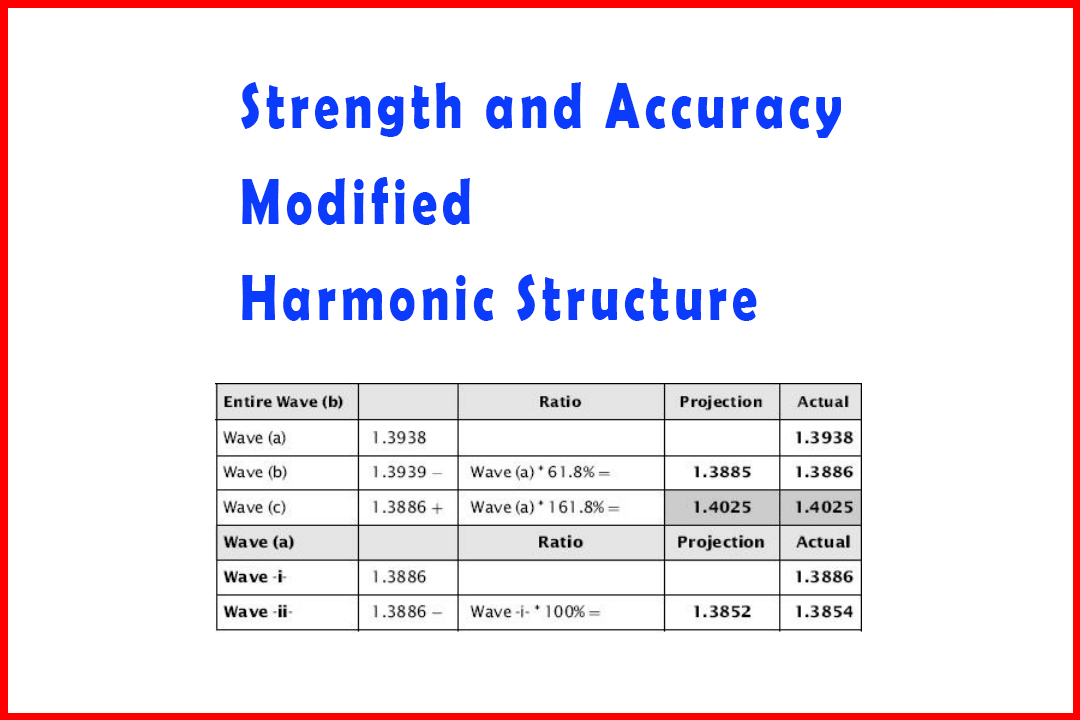

The

clarity of the wave relationships stands out from the first five-wave decline

in Wave (A) (as shown in Table 4.7). All relationships are common for their

position; the 198.4% projection in Wave (iii), the 33.3% retracement in Wave

(iv), and the 76.4% projection in Wave (v). The maximum variance was just three

points.

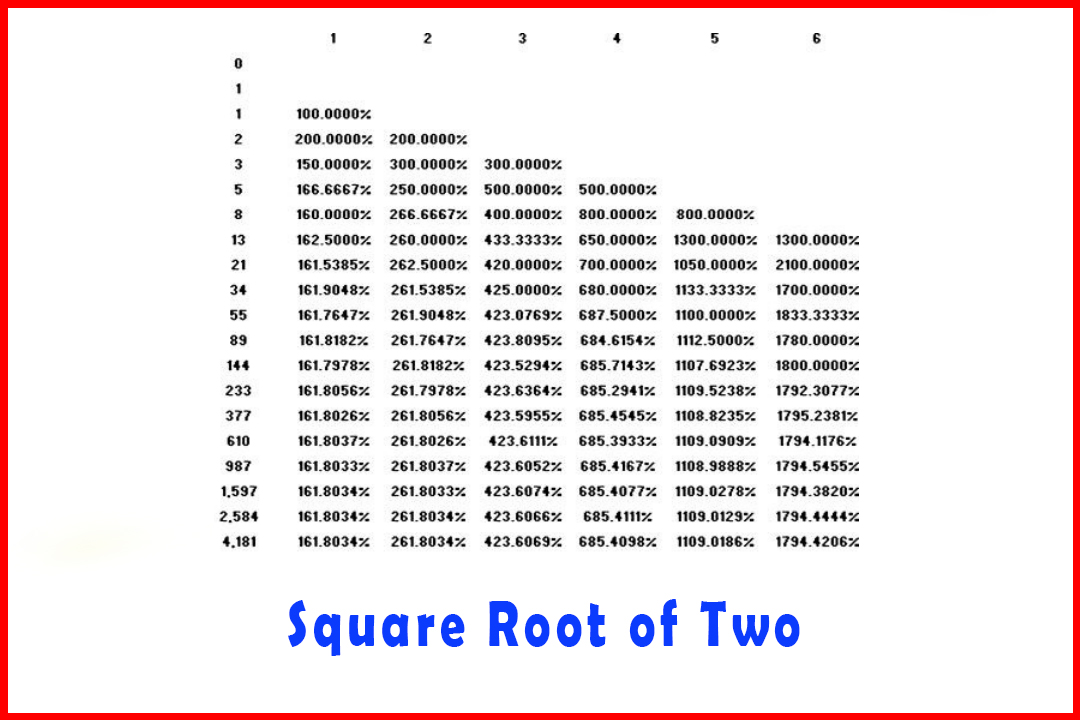

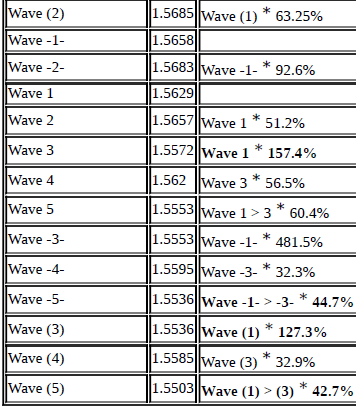

Table

4.7 Wave

Relationships for Three-Wave Decline in Figure 4.12

The

correction in Wave (B) developed as an Expanded Flat with the pullback being

exactly 61.8%. These common relationships continued throughout the entire

decline, even to the end where the extension in Wave (v) of Wave (C) was only

four points while the projection in Wave (C) was one point away from the exact

161.8% projection of Wave (A).

Figure

4.13 displays the resulting reversal higher to confirm the accuracy of the

harmonic structure.

Figure 4.13 Rally

Following the (A)(B)(C) Decline in GBPUSD

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Elliott wave structure, Harmonic Pattern, Five wave pattern, harmonic wave structure - Elliott Structure versus the Modified Harmonic Relationships

Elliott Wave | Forex | Fibonacci |