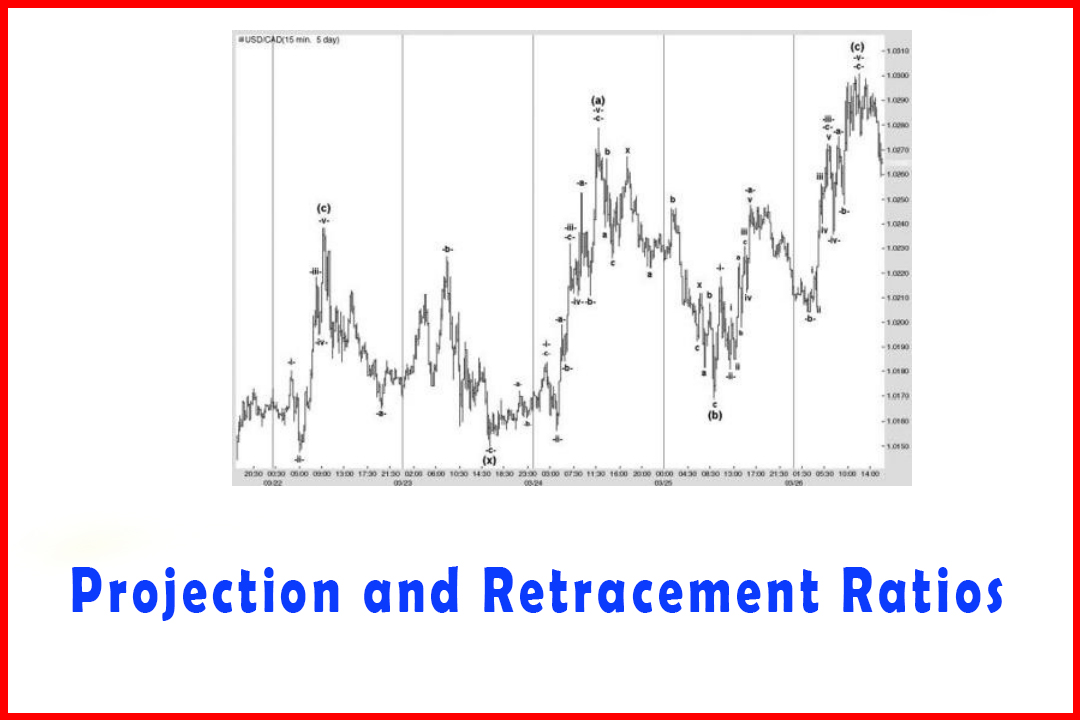

Deep Wave (x) in Wave (B) in USDCAD 15-Minute Chart

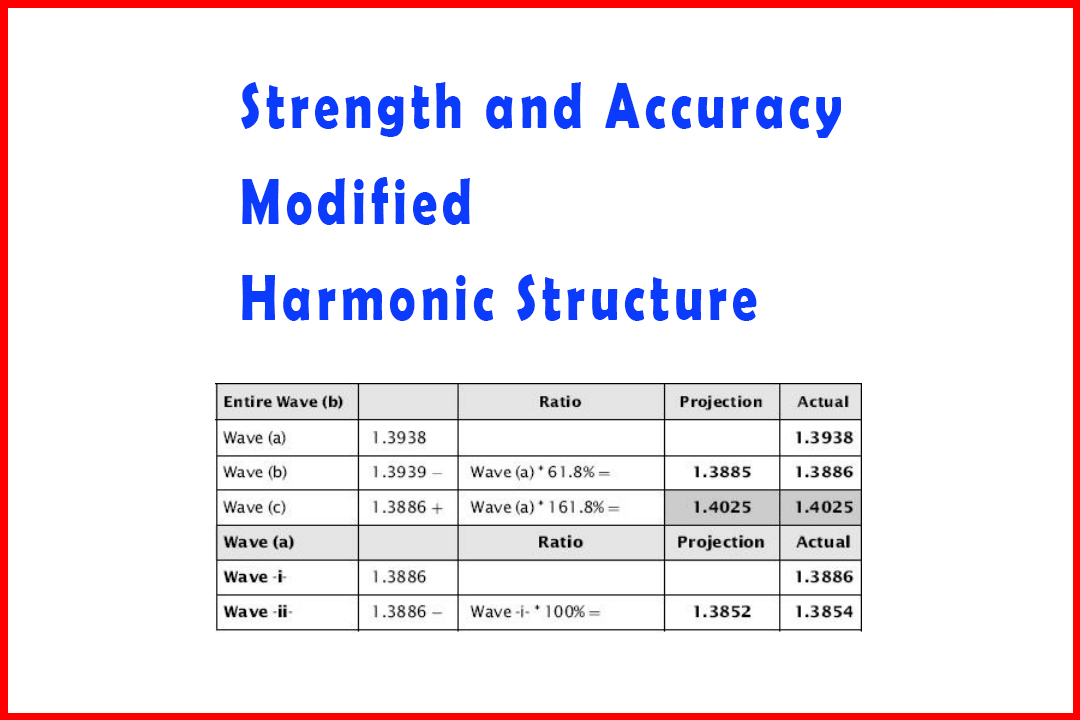

Trade retracement, Strength Harmonic Structure, Accuracy Harmonic Structure, Five wave pattern

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

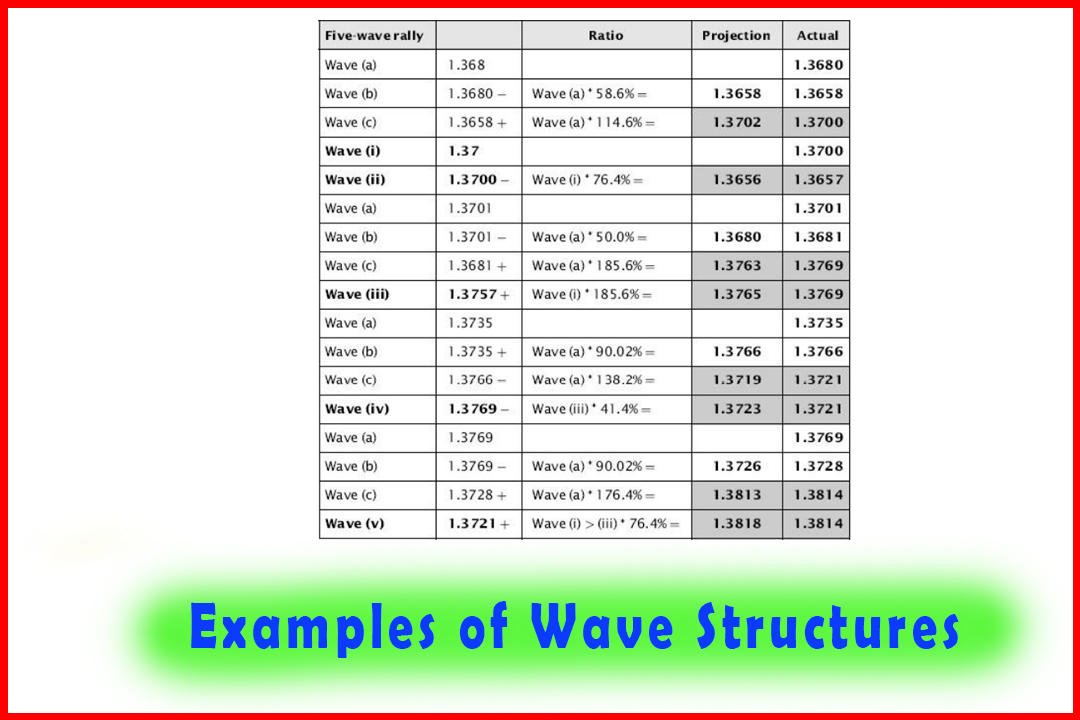

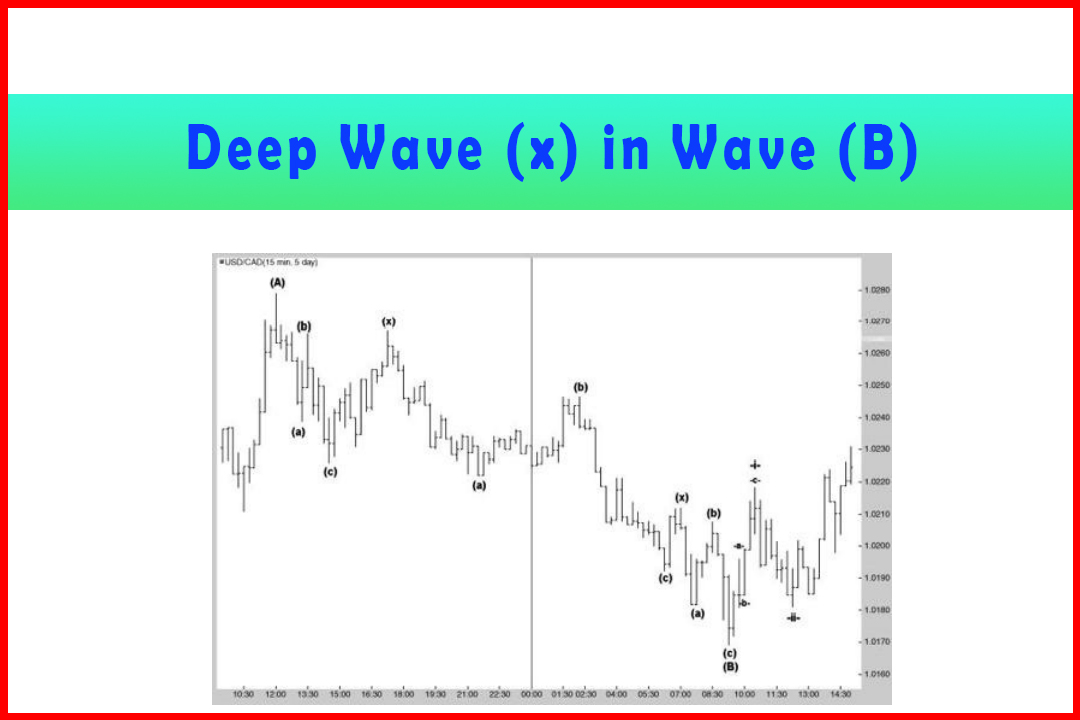

In Figure 2.8 in Chapter 2, I described the situation where a deep Wave (b) in a Triple Three can often cause a similarly deep Wave (x).

Deep Wave (x) in Wave (B) in USDCAD 15-Minute Chart

In

Figure 2.8 in Chapter 2, I described the situation where a deep Wave (b) in a

Triple Three can often cause a similarly deep Wave (x). I have reproduced the

Wave (B) pullback in Figure 4.19 to show more clearly how this develops.

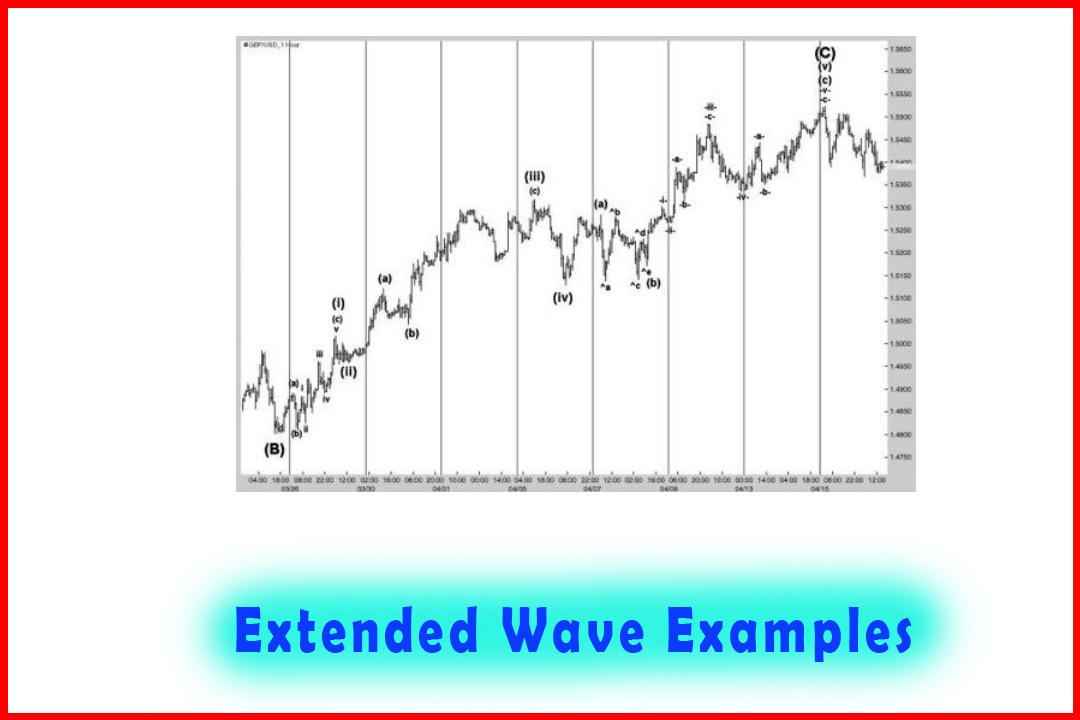

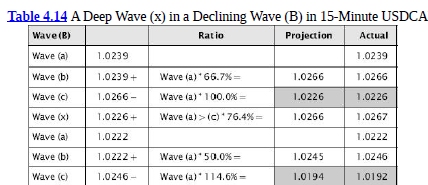

Figure 4.19 A deep

Wave (x) in a declining Wave (B) in 15-minute USDCAD

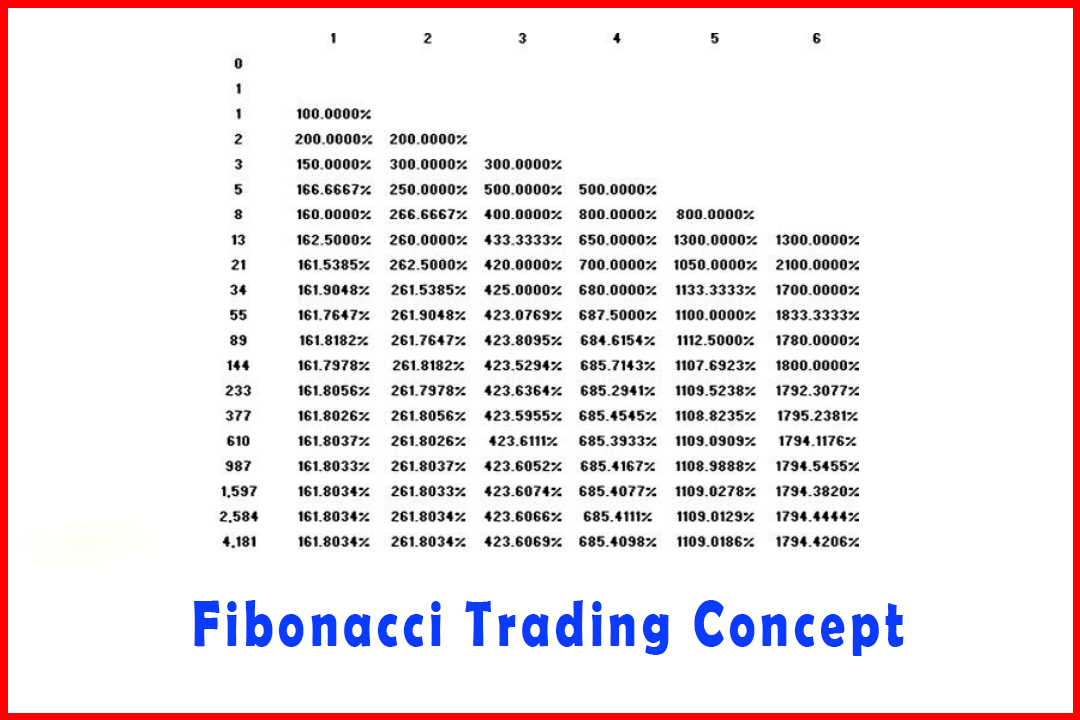

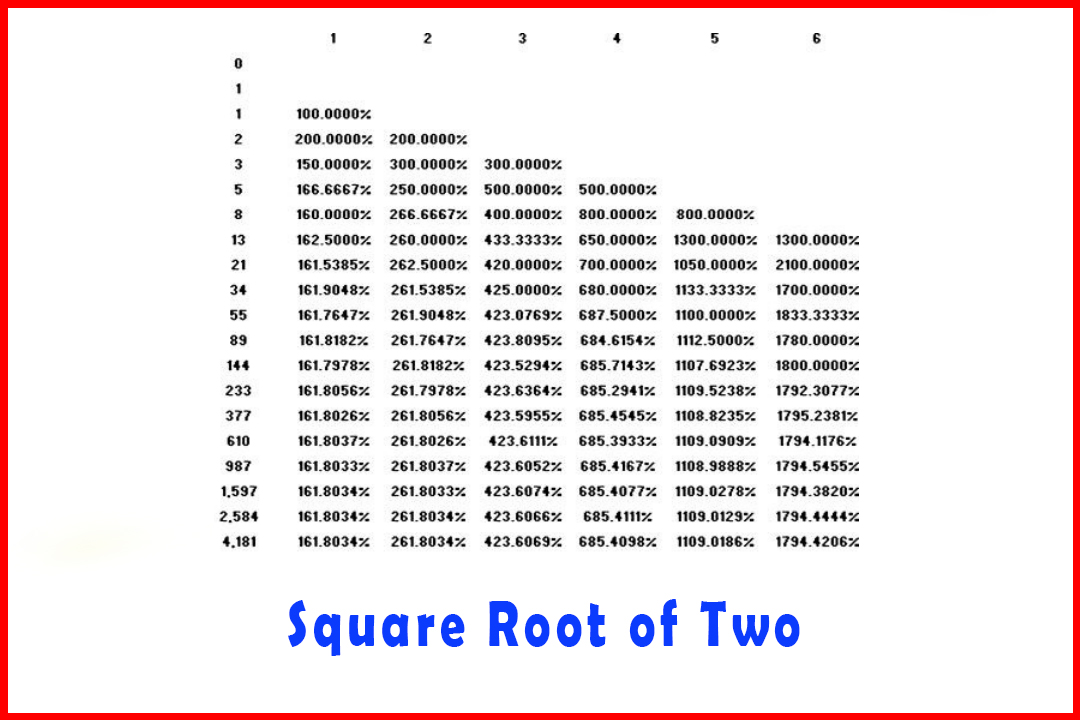

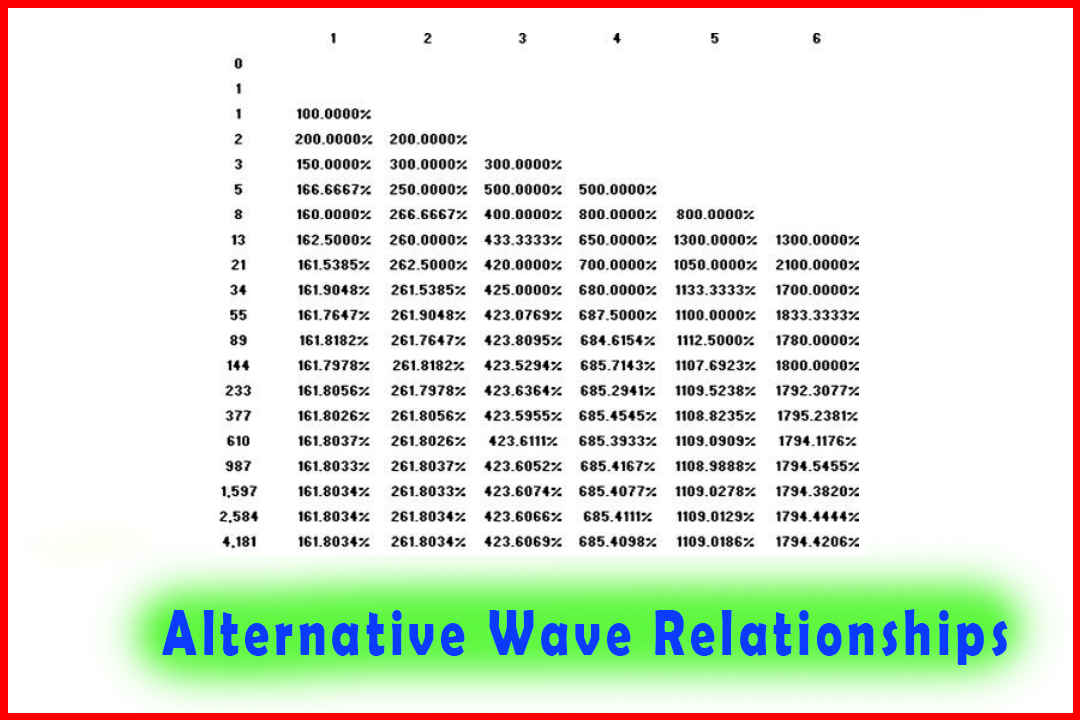

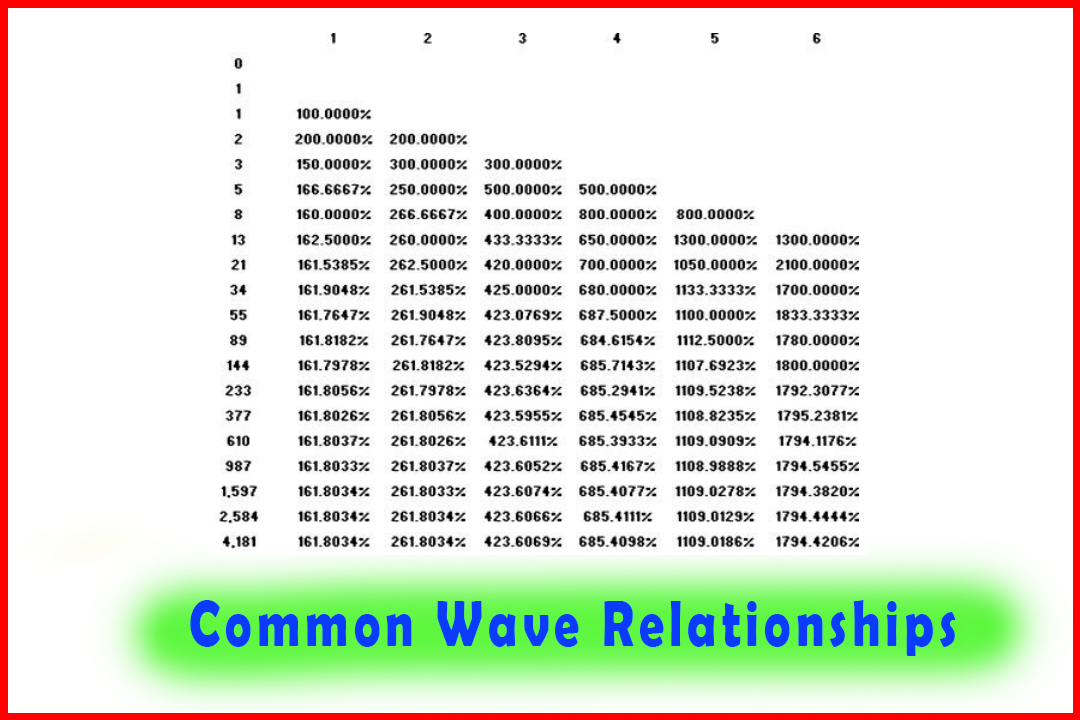

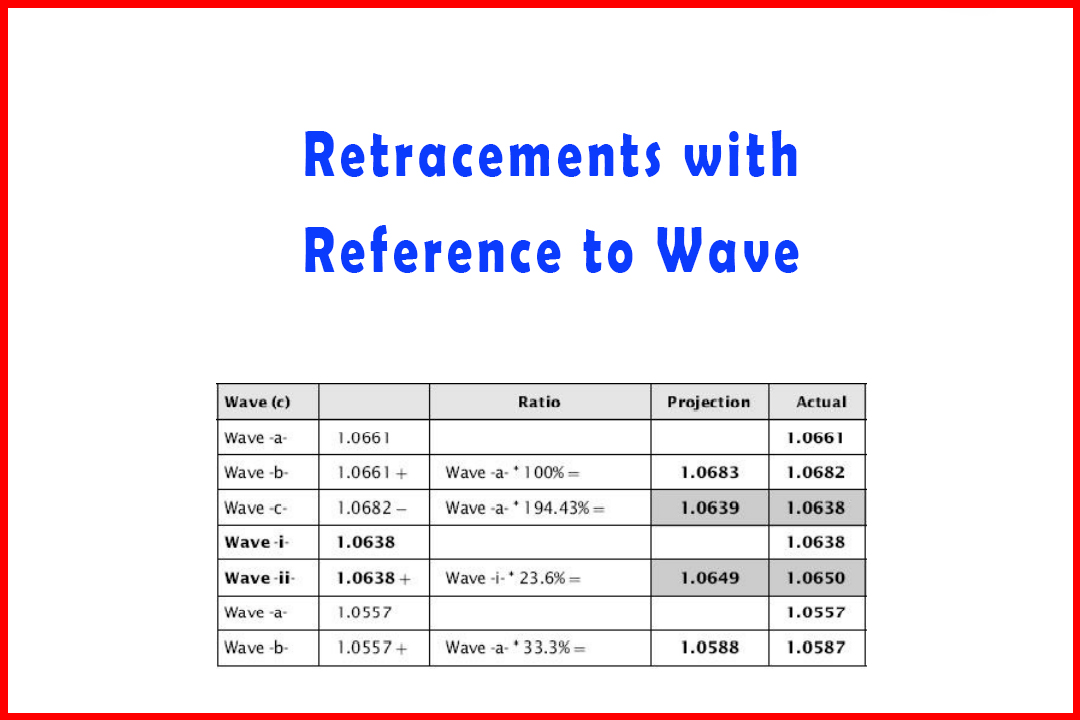

I have placed in the table displaying the wave relationships the entire Triple Three decline (Table 4.14). The first Wave (b) retraced by 66.7% and this was followed by a 76.4% retracement in Wave (x) to the same level (plus one point) at 1.0267.

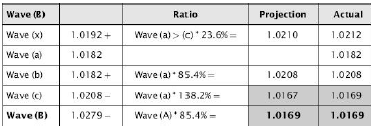

The

decline continued in two further (a)(b)(c) structures to reach a very deep Wave

(B) of 85.4% which was just 19 points above the prior Wave (x) at 1.0150.

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Trade retracement, Strength Harmonic Structure, Accuracy Harmonic Structure, Five wave pattern - Deep Wave (x) in Wave (B) in USDCAD 15-Minute Chart

Elliott Wave | Forex | Fibonacci |