General Observations on Using Ratios

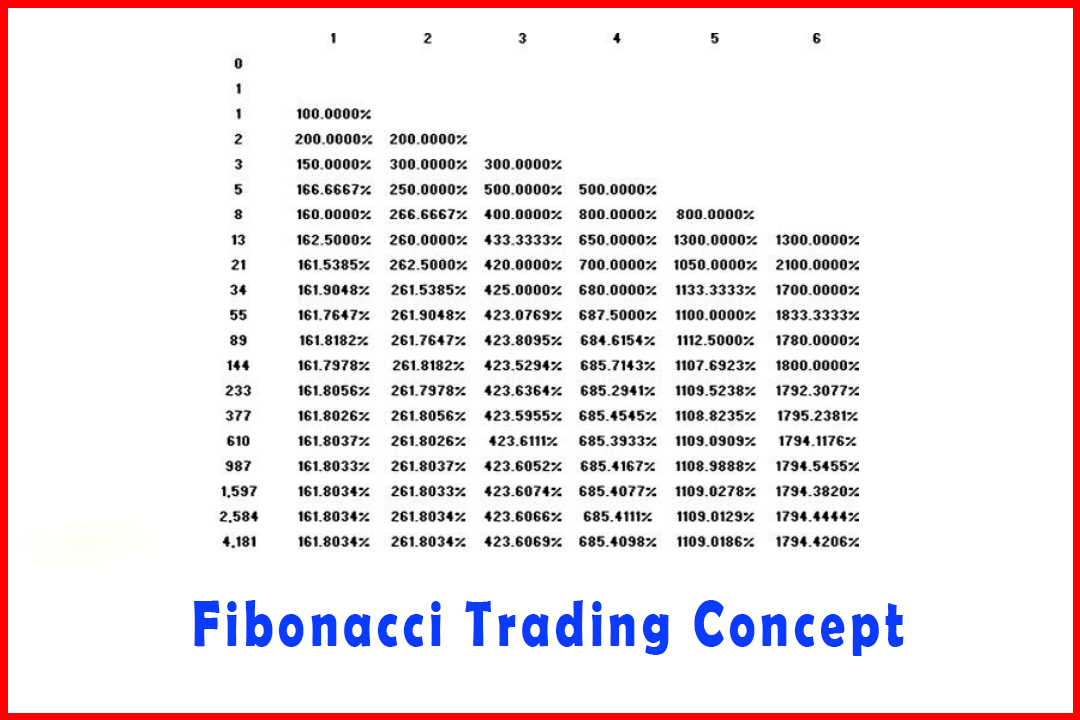

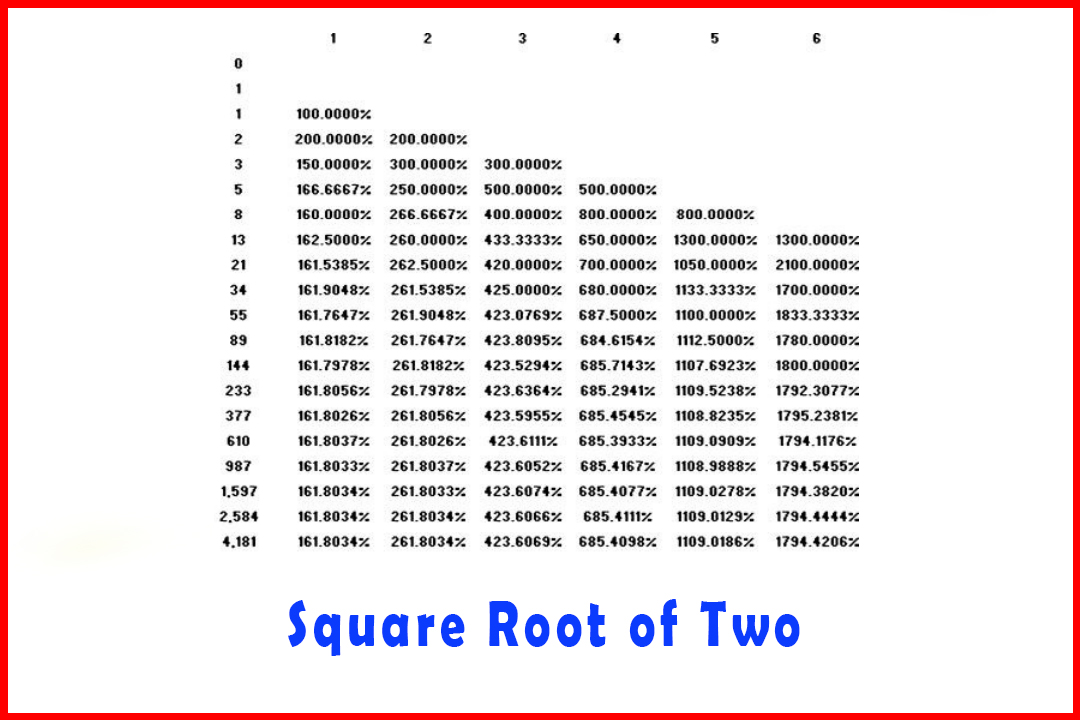

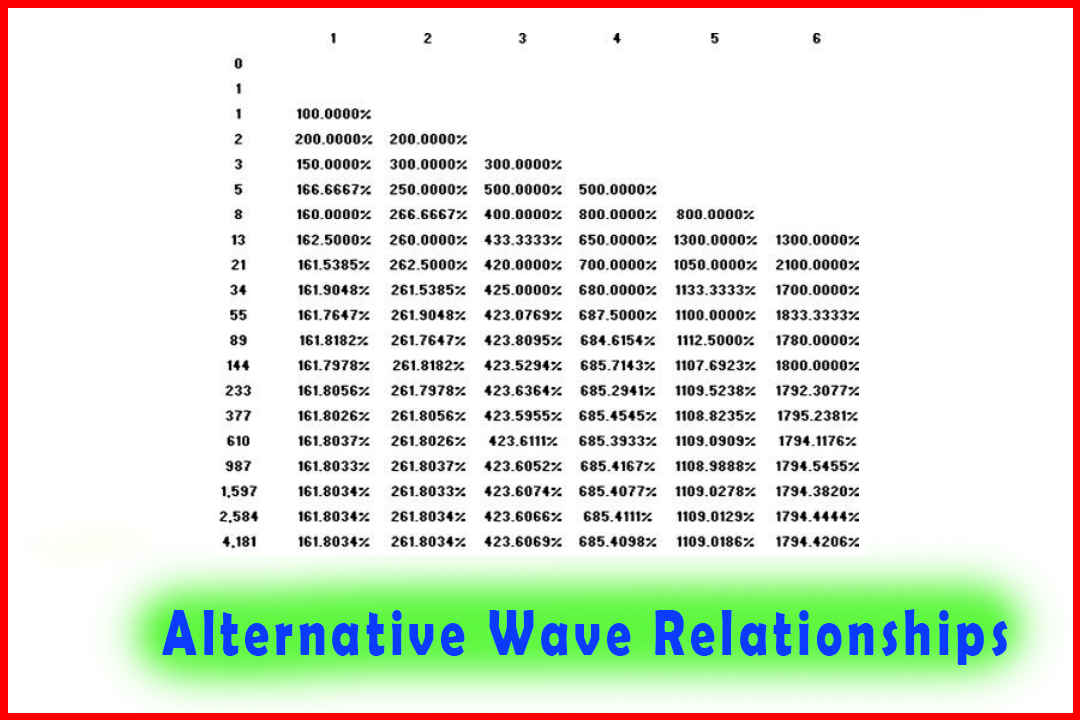

Fibo Retracement, What is Fibonacci, Fibonacci Trading Concept, Fibo basics, Types of waves

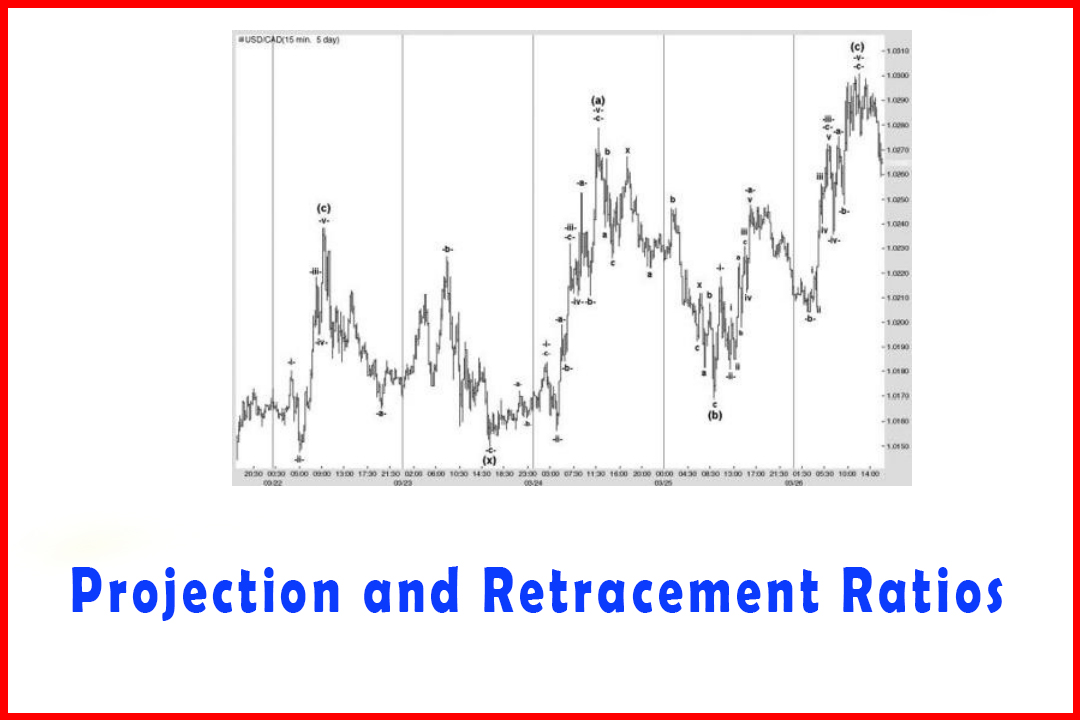

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

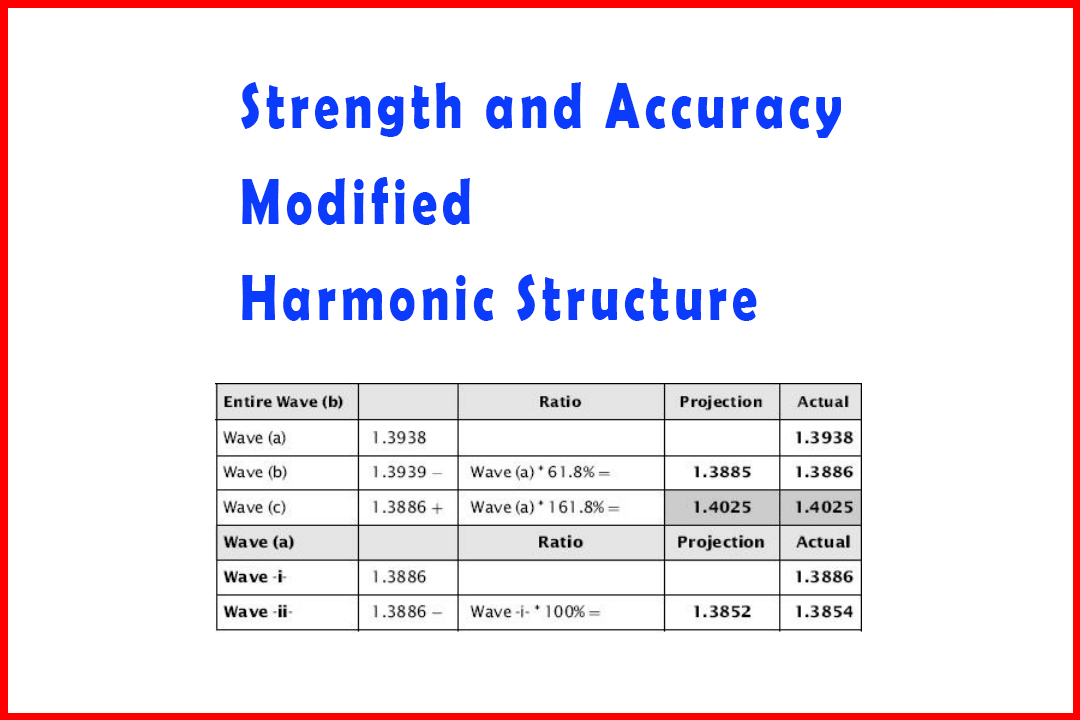

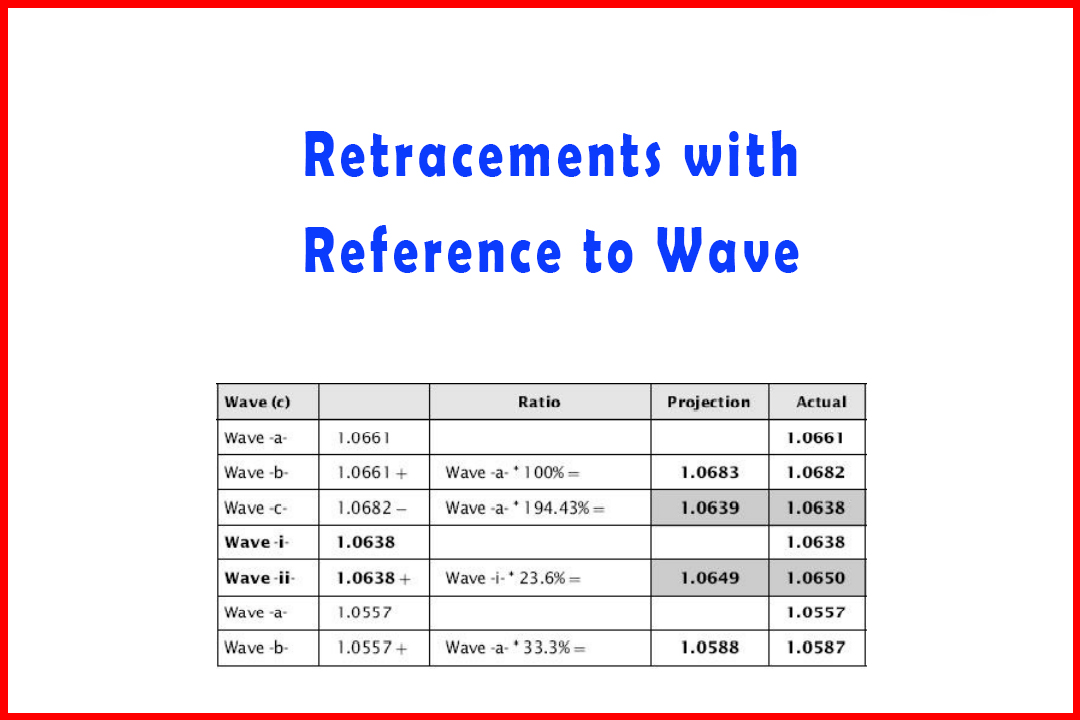

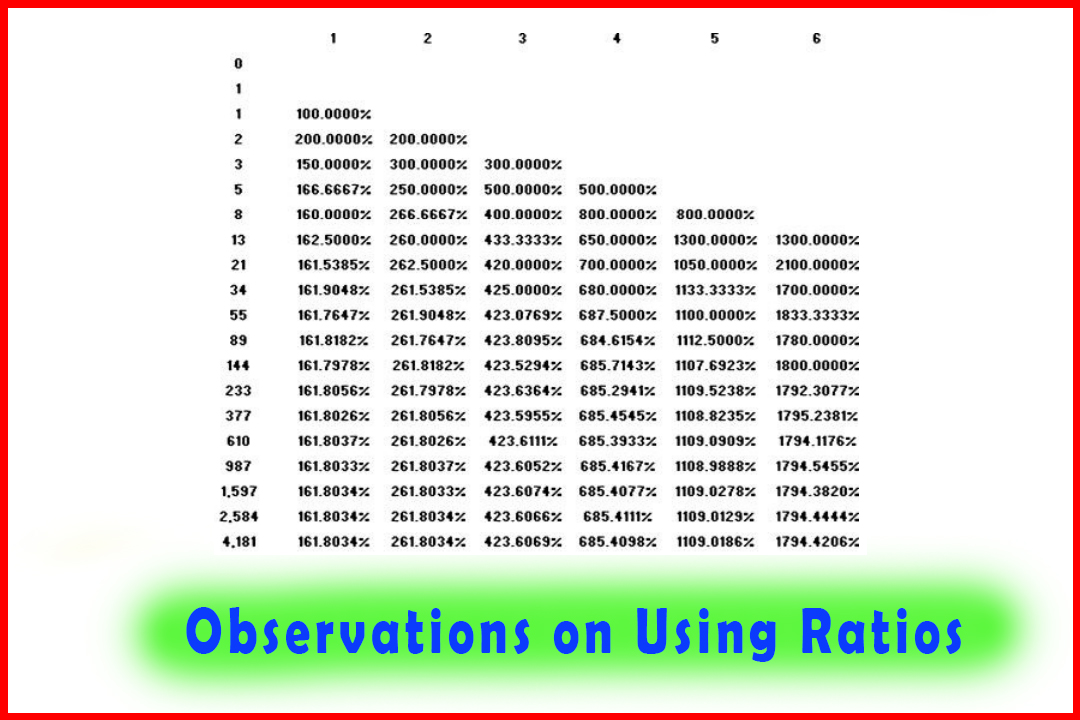

I have listed the ratios I tend to commonly find. However, each market tends to display its own characteristics as an “individual” price.

General Observations on Using Ratios

I

have listed the ratios I tend to commonly find. However, each market tends to

display its own characteristics as an “individual”

price. In addition, it can have different tendencies in a range of time frames.

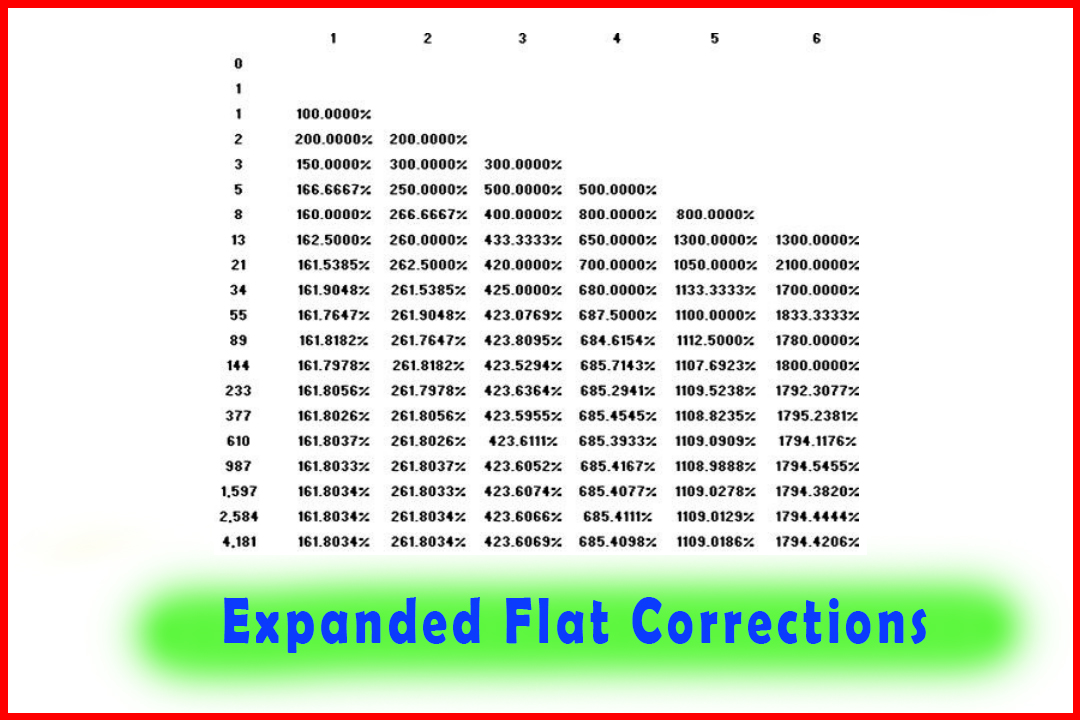

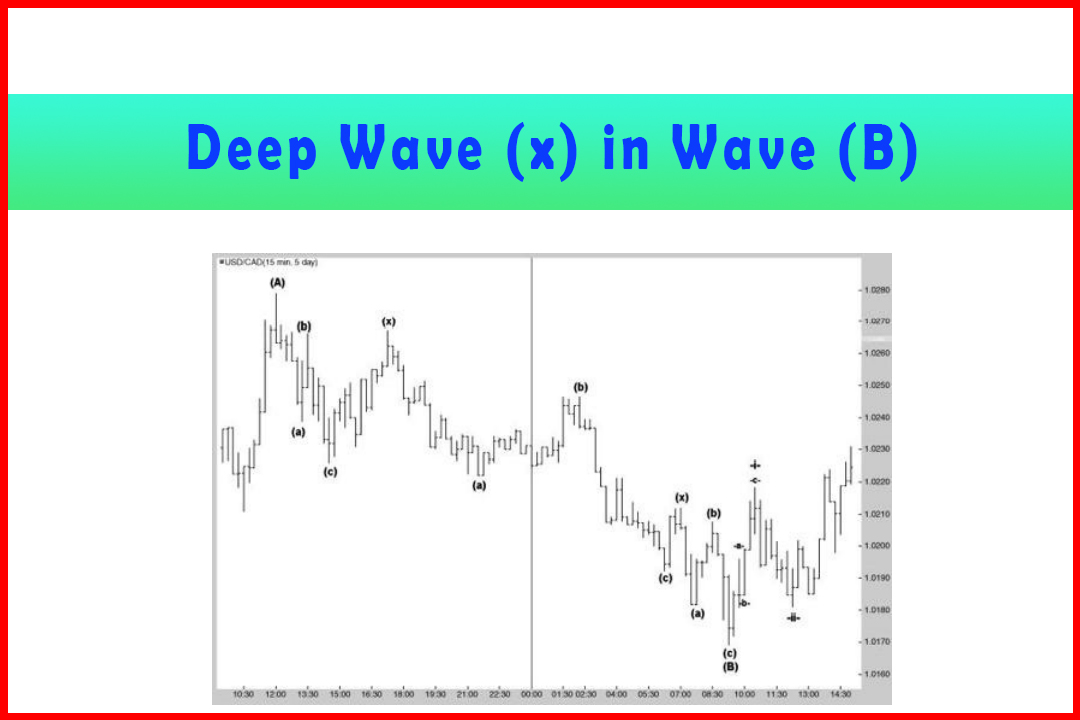

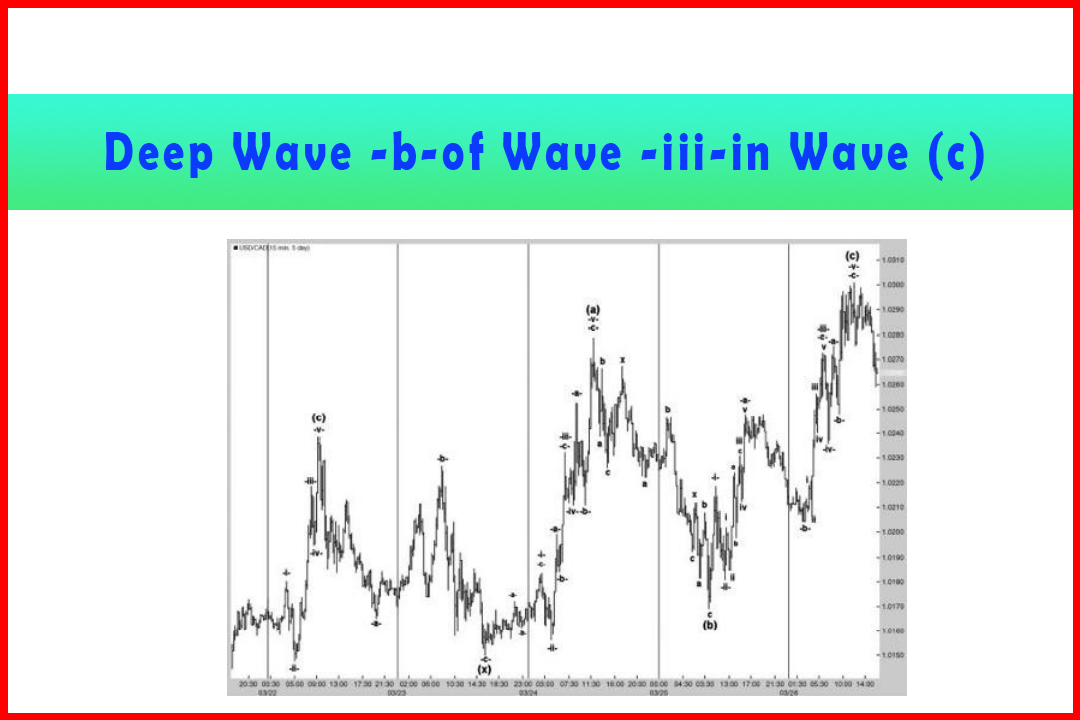

It may be that in a five-minute or hourly chart you may commonly see a 23.6%

expansion in Wave efb of an Expanded Flat, while a daily Wave efb may expand a

fuller 38.2%.

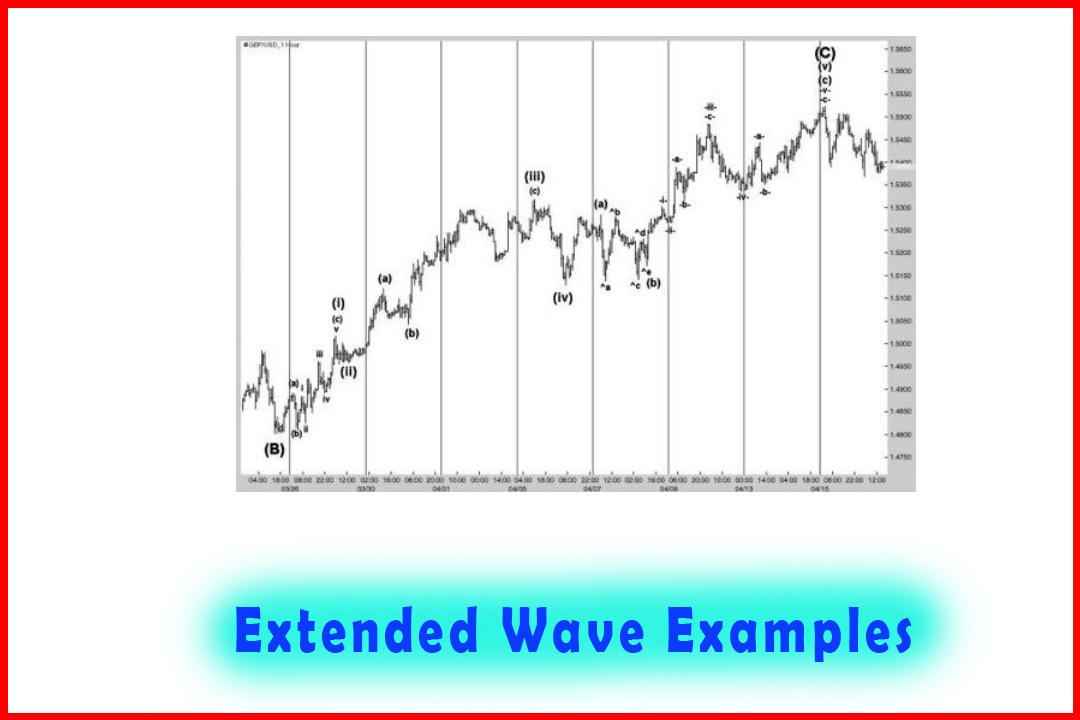

As

an example, in short-time frames I find the Euro-Dollar most often expands

38.2% while the Dollar-Swiss Franc expands mostly only 23.6%. It is always

important to get to know the markets you are analyzing and their

characteristics and foibles in all time frames.

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Fibo Retracement, What is Fibonacci, Fibonacci Trading Concept, Fibo basics, Types of waves - General Observations on Using Ratios

Elliott Wave | Forex | Fibonacci |