Forex Trading Guide for Beginners Learning

How to trade forex for beginners learn, How to trade forex, Forex trading course for beginners, How to make money on forex, How to start forex trading for beginners, How to make money in forex without

Course: [ Top Trading Strategy ]

Forex is the world's biggest market trading around $5 trillions a day. It includes all aspects of buying selling and exchanging currencies at current or determined price.

The FOREX (Foreign-Exchange)

Forex

is the world's biggest market trading around $5 trillions a day. It includes

all aspects of buying selling and exchanging currencies at a current or

determined price. The foreign exchange

market assists international trade and investments by enabling currency

conversion.

Forex

market is bigger than stock market. It’s open 24 hours a day 5 days a week. You

can make money at any time of the day.

We

discuss about with detail:

What is Forex?

Forex

is the largest financial market in the world and it involves all aspects of

buying and selling currencies.

Why

does it exist? And who is involved in this market?

Everybody

is involved, from the small investor to the major banks.

Why

is that? it's for the simple reason that

people All Around The World, investing in specific companies need to exchange

currencies in order to make the investment.

I

will give you simple example.

if

me, living in the UK so having the British pound as a currency, I wanted to

make an investment with apple.

Apple

is doing good, I want to make an investment, I want to buy shares in the

company. Apple is an American company so

therefore they will not accept my British pound, they would only take US

dollars.

Therefore,

to make that investment, I would have to exchange my British pounds into US

dollar so that I could buy the shares I want to invest in.

And

that’s the very basic concept of the forex market. it exists here for the sole

reason people need to exchange money in order to make investments.

Whether

that's a small investor who wants to make in an investment like I just said or

major banks making major investments for

huge amount of customers, for strategic purposes.

It

all involves the same thing investing in a foreign investments requires you to

exchange currency.

And

therefore it creates the second aspect

of the forex market which is more or less betting on the right exchange.

If

I feel like Apple is going will and I think a lot of people are going to invest

in the currency, therefore I can start buying used dollars because I think

people are going to exchange a lot of their money into USD in order to make

that investment.

So

it's a huge market the dash change at this date 5.8 trillion dollars a day.

So

it’s is also one of the most liquid, if not the most liquid market in the world.

Who is involved in Forex Market?

Let's

talk about the variety of trading pairs and who are trading them. The mostly

traded currencies are the U.S. Dollar, The Euro and the Japanese Yen. A few

other popular trading currencies are the British Pound, the Australian Dollar,

the Swiss Franc, Canadian Dollar and the Swedish Krona. You can trade them in

every pair that you can think of. But hold on... What is a pair? We all know

you need two to tango, right? The same is true of Forex. The whole basis of the

market is to buy and sell a certain pair, which means you are predicting the

strength of one currency against another. For example, the EUR/USD is the most

popular pair. But you can also trade the GBP/SEK. This is the British Pound

dancing with the Swedish Krona, and the GBP/SEK price represents how many

Swedish Krona you can get in exchange for one British Pound. Now you have a

good understanding of the currencies and the pairs, so what else do we need to

know? Who are all the players involved? Earlier I summarized them for you but

let's zoom in a little bit more on the players in the market:

THE BANKS

Banks

are the biggest players at the Forex market. The corporate and bigger banks are

responsible for, give or take, 50% of the transactions made at the Forex market

on a daily basis. We call this the INTERBANK MARKET. In other words, I am

talking about the Foreign exchange between banks and financial institutions.

Some of these trades are made by costumers, but this is just a small part. The

majority of these trades are made for the Banks' own purpose. Because, let's

face it; a bank has money and wants to make more money. Therefore, they invest and

part of these investments are trading the Forex market.

Investment funds and investors

The

second biggest players are the investment funds and investors since they have

access to a large amount of capital, which they can trade with. They simply manage

collected funds from their clients. You should understand that the bigger the

amount you can invest, the more revenue can be made (for example if you grow

10% on 1000 USD that is 100 dollars, but if you grow the same 10% on 10,000

USD, that is a 1000-dollar gain).

Companies

Another

important part of the Forex market are companies all over the world. For

example: a German car producer imports American parts to build cars and then

sell the cars in England. How many Forex trades do you think are made in this

simple and short example? The right answer is 2. First, the Euro is traded with

the USD, and then the Euro is traded with the GBP.

Central Banks

Other

big influencers are the central banks. Central banks are used to manage a

certain country or region. Think of the European Central Bank (ECB), Bank of

England (BOE) or the Federal Reserve of the United States. Central banks are

responsible for fluctuations and the interest rates.

Small traders and small investors

When

we talk about small traders, we are talking about you and me the traders who

trade from their comfortable homes on their own accounts. As you can imagine,

our influence on the Forex market is not big at all, but does it have to be

big? As long as we get a small piece of that big pie I was talking about

earlier right? With the ease of modern day technologies and the supply of all

the online platforms, the amount of small time traders is rapidly growing.

To

be a successful trader you are facing one of the toughest challenges in the

world. It is all about being mentally tough and strong, since trading success

can be 80-90% mentally and emotionally dependent. The hard truth is that maybe

5-10% of traders will make it. After you've read this course you have made your

first step towards being a successful trader. I'll tell you more about the

different strategies and risk management later on so stay tuned!

Forex traders handled different strategies

The

difference between a professional Forex trader and an amateur is like a boxing

match between an Olympic champion and your neighbor. A professional trader is

able to predict the future better due to good strategies that he or she has

developed. The professional trader knows everything about risk management and

how to keep himself under control and never let emotions get the better of him.

Where as an amateur obviously does not.

You

have got to be psychologically strong to make more and more winning trades,

like the boxer has to be psychologically strong to win more and more fights.

However, you are not always going to make winning trades, sometimes you will

make a bad one. The art of the game is to minimize your loses and maximize your

winnings. Sounds simple right? Keep on reading and you will learn how to do

this.

"A trader who has never lost, is not a

trader yet." -Aristotle.

It's

very important to read and be able to analyze the graphs very well. In the end

it is all about recognizing patterns that have occurred in the past and may

well be happening in the future again - then knowing when and how to act on

what you see. Remember the Forex market is always on the move.

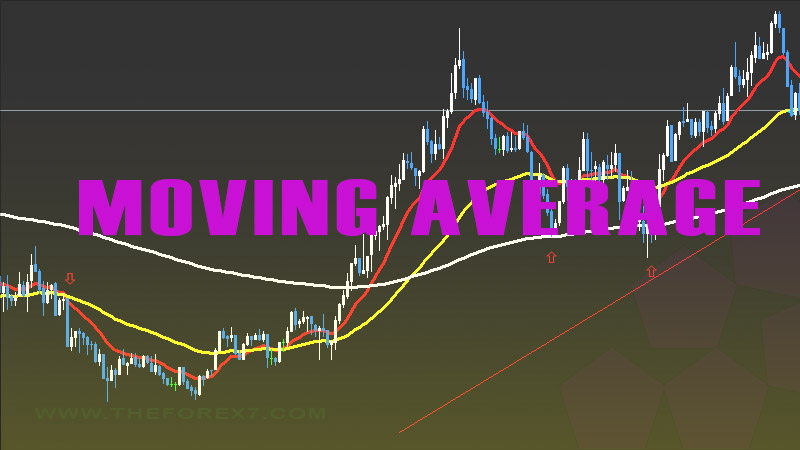

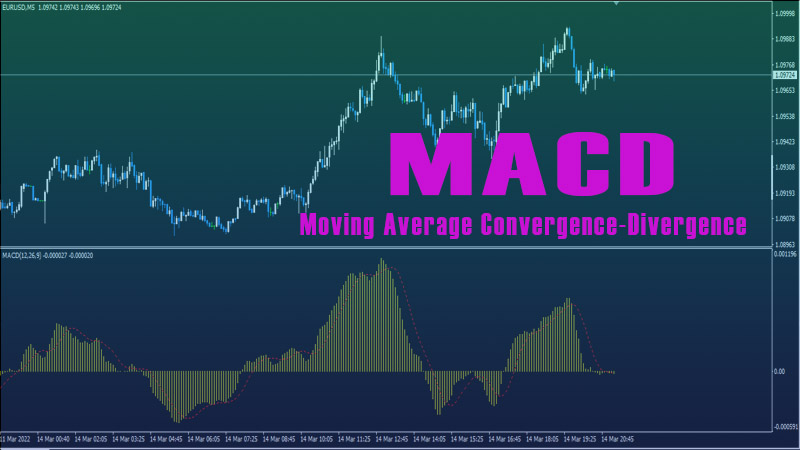

Technical analysis

It

is like dating - you have got to get to know the other person really well to

press the right buttons for him or her. In trading, technical analysis of a

certain pair is really important. Get to know the pair you are trading to predict

any movement in the future. Ask yourself questions like: What is the price at

the moment? What was the price before? What happened when the price was at this

certain level? The answers on these questions will give you a possible outcome

in the future, thus show you a possible opportunity to make your winning trade.

You don't think this is the only strategy right? Good, as there are a lot more

strategies at use at the Forex market. For example: Drawing trend lines,

support and resistance lines, using candlesticks and the different indicators.

Every trader uses its own way to analyze the market.

Fundamental analysis

Fundamental

analysis is also called the 'old-fashioned way' since it is used by traders who

mainly focus on the economic news. The idea of trading the economic news is

that the currency will follow the economic news. It is certainly important

since it can change the prices but it is very common for the Forex market to

react to news in a different way than expected. Take the Brexit as an example.

This had a bad influence on the value of the GBP, but at other times it has a

good effect, so the effect is not easily predictable all the time. You will see

that traders who trust in fundamental analysis get confused when it goes the

other way.

Swing Trading/Trend Trading

Swing

trading is (the word gives it a way a bit) trading on a swing. Simply, traders

are looking for a pair with a predictable big swing ahead. Swing traders are

the hit and run kind of people. They make a trade, get a few percentages profit

and close their trade. Most often swing traders are cautious traders. Like a

leopard, they wait for the right moment to attack and give it their all when

that slightly weak deer is running by. The swing traders work with a Stop-loss

that protects them from big loses. More about Stop- loss later on.

The

strategy for a trend trader is pretty plain and simple: make sure you are there

when it happens and stay as long as you can until the trend reverses. The

thought process of a trend trader is that the price will keep moving in a

certain direction, otherwise it would not be a trend, right? If the price

unexpectedly moves the other way it is not a trend and the trend trader gets

out of the hot kitchen before he burns his fingers. These particular trading

styles can be very successful if you have the right patience and know where to

go for the kill. Mostly you will go for the kill at a retracement point. I will

explain this later on in this course.

·

Up Trend: If the trend

goes up the currency is worth more.

·

Down Trend: If the

trend goes down the currency will lose value.

·

Sideways Trend: Prices

move in a narrow range.

Day Trading and Scalping

A

common style of trading is Day Trading. Day Traders are traders who strive to

make money on a daily base on the Forex market and make as little as 5 to 10

trades a day. Day Traders usually refuse to hold on to their positions

overnight, and often trade with a real tight Stop-loss and hold on to their

good positions. For example, the EUR/USD pair is the ADHD kid of the class who

can not sit still and is the pair that moves the most - an average of 80 PIPS

(More about PIPS in a few moments) per day. So, these movements need to be top

focus for a day trader.

Scalping

is a form of day trading. Scalpers trade in a relatively short timeframe, as

short as five minutes. Every trade they make will have a target of between 5-10

PIPS. Imagine going for a 10km walk and every 10 meters you find yourself a

dollar on the ground. You will finish your walk with $1,000 in your hand. This

is similar to a scalper's mentality, you see, a lot of small trades will end up

being a big one. Scalping is for the thrill seekers among us - it requires

constant focus.

Pick

the strategy that fits you as a person. If you like to analyze and wait for the

right moment do not go scalping but if you are that thrill seeker, do not go

and bore yourself with longer term analysis. Start Scalping!

ACTIVE TRADING HOURS

The

Forex market is active 5 days a week and 24 hours a day. Some information about

trading times will give you a good understanding of the ideal concept of Forex.

The market is divided in to 4 trading zones: Sydney, Tokyo, London and New

York. The tables underneath will show you the times when the markets open and

close in each location.

Summer time

|

Time

Zone |

EDT |

GMT |

CET |

|

Londen

open Londen

close |

03:00

AM 12:00

PM |

08:00

AM 05:00

PM |

09:00 18:00 |

|

New

York Open New

York Close |

08:00

AM 05:00

PM |

12:00

PM 09:00

PM |

13:00 22:00 |

|

Sydney

Open Sydney

Close |

04:00

AM 01:00

AM |

09:00

PM 06:00

AM |

22:00 07:00 |

|

Tokyo

open Tokyo

Close |

06:00

PM 03:00

AM |

11:00

PM 08:00

AM |

00:00 09:00 |

Winter Time

|

Time

Zone |

EDT |

GMT |

CET |

|

Londen

open Londen

close |

03:00

AM 12:00

PM |

07:00

AM 04:00

PM |

08:00 17:00 |

|

New

York Open New

York Close |

08:00

AM 05:00

PM |

01:00

PM 10:00

PM |

14:00 23:00 |

|

Sydney

Open Sydney

Close |

04:00

AM 01:00

AM |

09:00

PM 06:00

AM |

22:00 07:00 |

|

Tokyo

open Tokyo

Close |

06:00

PM 03:00

AM |

11:00

PM 08:00

AM |

00:00 09:00 |

CHARTS

The Charts

There

are three different charts of use when trading at the Forex market. Let me

introduce you to them: line charts, bar charts and candlestick charts. We have

a strong preference for the candlestick charts because they give us the most

information.

Line Charts

A

chart with just one line the shows us the movement of the quote price. Line

charts are easy to read and show us the trend. They are also useful to see the

Support & Resistance levels. Although the line chart gives us information

about the history of the pairs price, it is hard to see the individual prices.

Bar Charts

The

Bar charts show us individual prices for a certain time period. Every bar has

it's own information and so will give you a more accurate view of your

positions. The bar has an open, high, low and closing point.

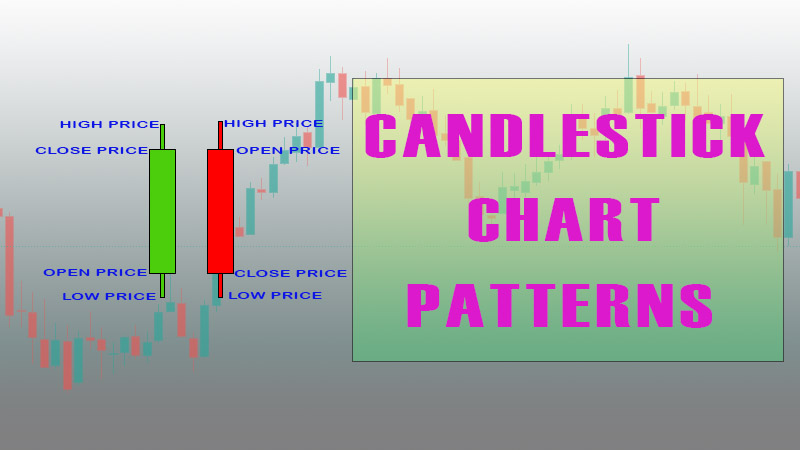

Candlestick charts

Most

traders use the candlestick chart because they tell us a lot of clear

information, especially as the Price Action is very recognizable and easy to

see. Do not get confused, the candlestick shows us the same information as the

bar charts, however it is easier to read. Candlesticks give good information

about the highs and lows in a certain period of time.

FUNDAMENTALS

What

exactly are fundamentals? Important financial or economic news is thrown at us

every day. Fundamental announcements are a very important factor to remember

when trading at the Forex market, or even when trading at any market.

Fundamentals could cause a sharp movement in the market in a shorter timeframe.

Take the Brexit for example as mentioned earlier.

With

fundamental trading, we focus on the one economy versus the other economy. For

example, Europe against USA or Great Britain against Japan etc.

Let's

take a look at the most important fundamental indicators that will have a great

impact on the market or certain pairs.

An

increased interest rate of a certain country will result in a growth of value

of the currency of that country, since investments will rise due to a higher

interest rate.

A

lower interest rate will result in weaker currency since there will be less

investments due to the lower rate of return.

Production

data is a strong indicator for the industrialized countries. It is Bullish if

the numbers are higher than expected and Bearish if the numbers are lower than

expected.

Next,

employment data. Higher employment numbers will be Bullish for a currency so

lower employment is naturally Bearish. Higher inflation and higher consumer

confidence is a positive economic signal and therefore has a Bullish impact on

the currency. In contrast, a weaker inflation and lower consumer confidence is

a Bearish signal for a currency.

GDP

(Gross domestic product) is more of a lagging indicator (indicators that are

generally used to confirm a trend that has already begun), but obviously a

higher GDP encourages Bullish price. And the lower the GDP, the more Bearish.

Checking for major news releases like these is how a good Forex trader starts

the day. First you must look at the economic news and how it can have any

effect on the pairs you want to trade.

Top Trading Strategy : Tag: Top Trading Strategy, Forex : How to trade forex for beginners learn, How to trade forex, Forex trading course for beginners, How to make money on forex, How to start forex trading for beginners, How to make money in forex without - Forex Trading Guide for Beginners Learning