Initiating a Trade with Candlestick Pattern

what is a trade summary, How to put order, stop loss analysis, indicates a new trend, Bearish Engulfing signal

Course: [ How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies ]

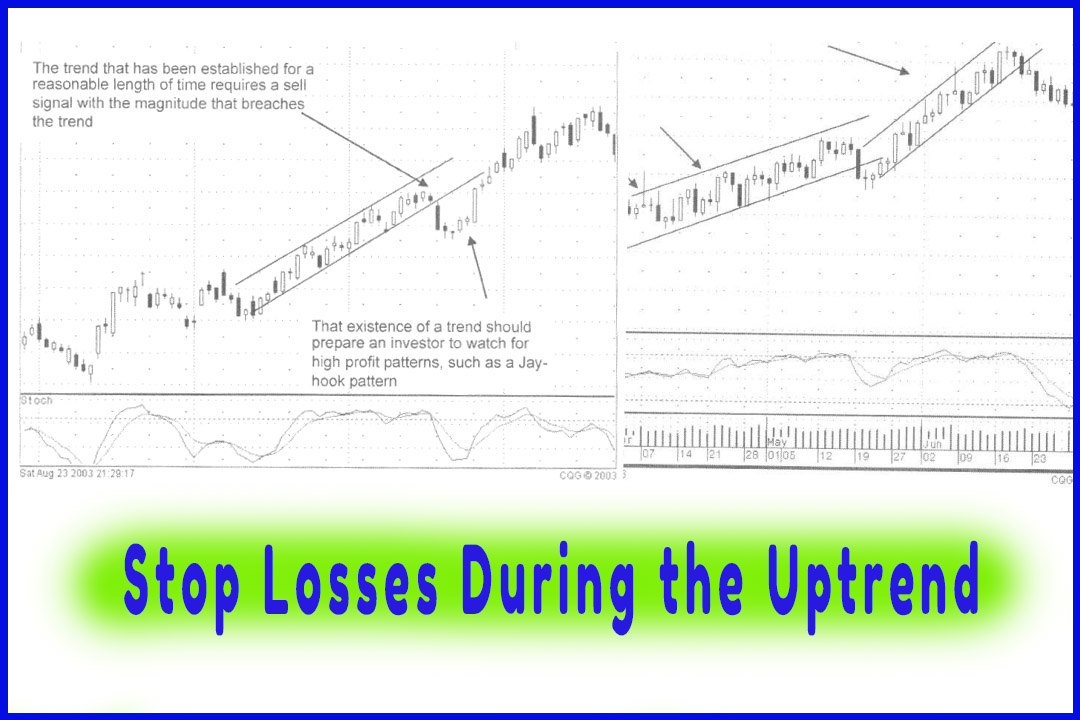

A signal has significant meaning. Knowing that, the thought process for when to stop out of a trade becomes easy. A buy signal indicates a new trend. What would counter that “indication”? Being in that trade has favorable odds for profitability, not any guarantees.

Initiating a Trade

A signal

has significant meaning. Knowing that, the thought process for when to stop out

of a trade becomes easy. A buy signal indicates a new trend. What would counter

that “indication”? Being in that trade has favorable odds for profitability,

not any guarantees. Even though a majority of the trades should work from using

the signals, it also means that some trades will not work. Keeping that mindset

in focus, stop loss analysis creates a format for identifying when a trade is

not working and getting out of the trade as soon as possible.

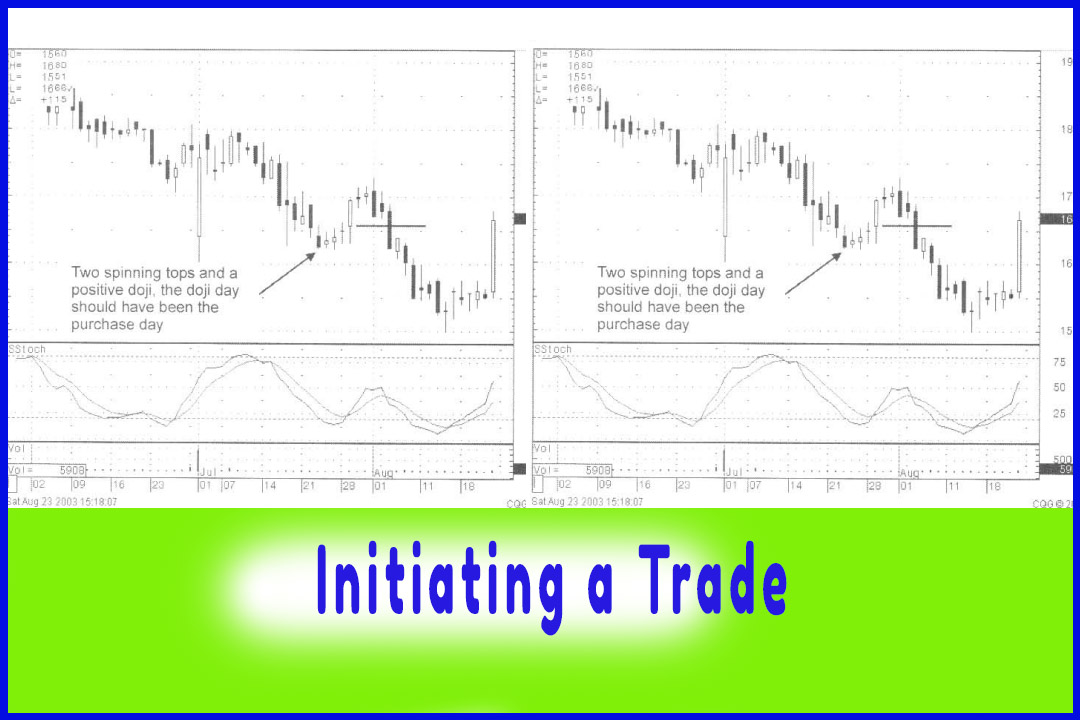

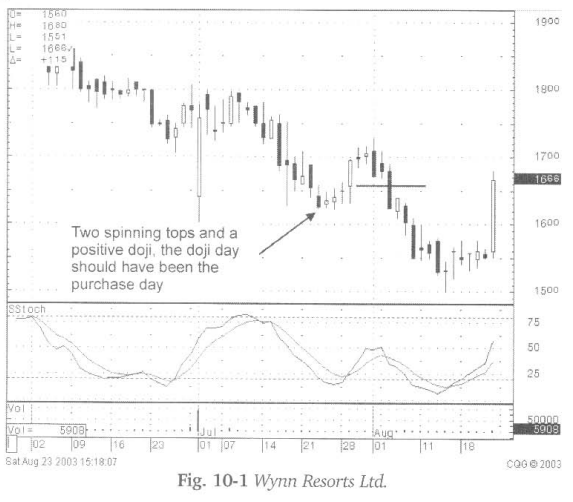

Establishing

the stop loss point is using the same commonsense approach that is incorporated

throughout the candlestick method. Examine the chart of Wynn Resorts Ltd. Fig.

10-1. Note the three spinning tops on July 23,24, and 25

The gap

up on July 28 should have been the buy signal, the entry being at $16.50. A big

bullish candle forms the next day followed by a couple of Doji. The Bearish Engulfing signal the

following day, with stochastics still heading up, may not have convinced

anybody that this uptrend is over. What becomes an obvious level that would

indicate that they were not taking the trend up anymore? That is where a stop

should be placed. The bottom of the large white body on the 29th becomes a

logical level. If the sellers take it back down through that level, the trend

is obviously not ‘up’ anymore.

What does that do for profits? Break even. But

if you can break even on the bad trades, that is not bad at all. Built into the

candlestick trading concept is a factor not evident in most other trading

systems. The signals provide an extra day or so, getting in earlier than the

other technical methods; other technical methods needing more confirmation

than what the candlestick signals provide. Getting in at a more optimal level

makes the sellstop more effective. The negation of a ‘buy’ signal is less

extensive. For example, getting into a position at $10.00, when the $9.50 level

indicates a failure of that trade, is much better than getting in the trade,

using other techniques at $10.70. The failure level, after entering the trade

using a candlestick signal, makes the loss much smaller and less time

consuming.

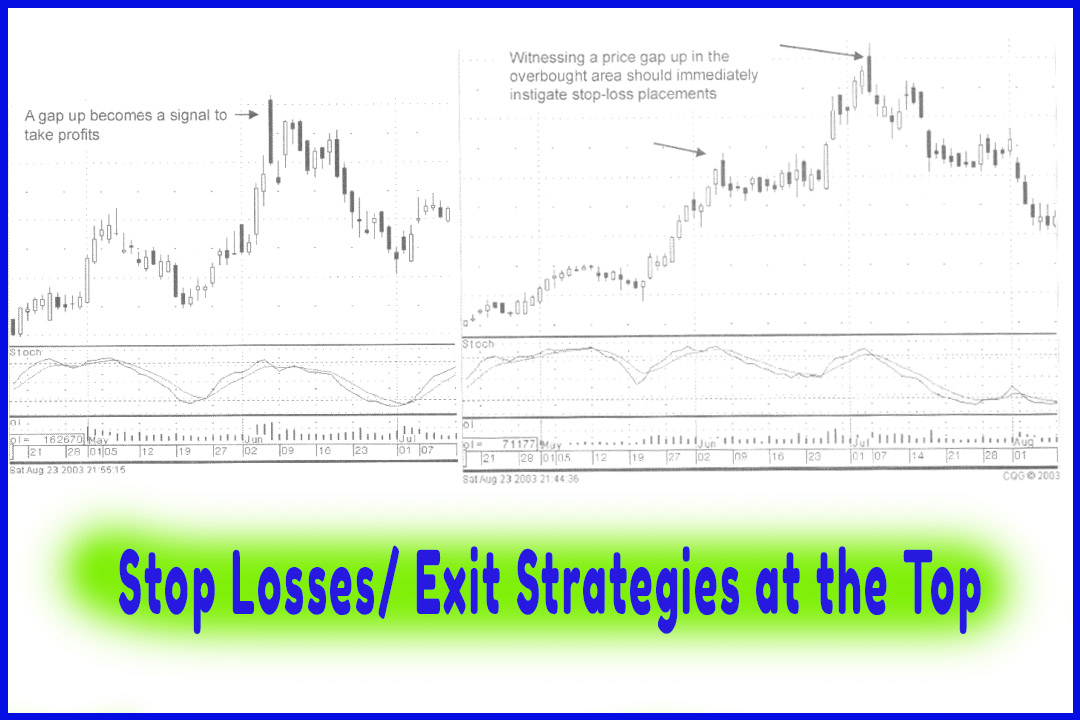

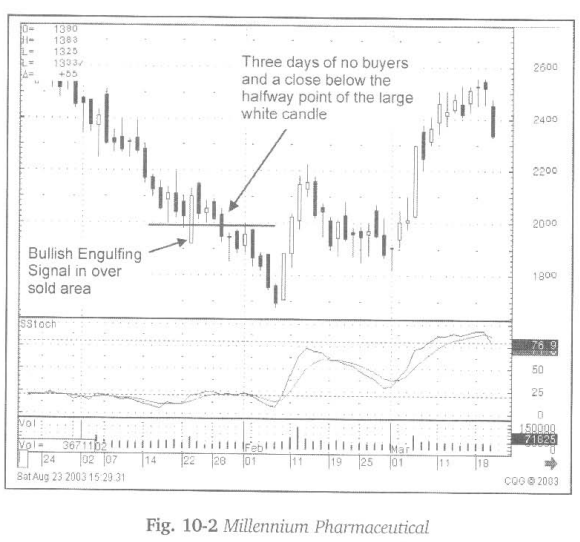

What are

you expecting to witness after a buy signal? More buying, of course! That

sounds trite but that is exactly what the buy signals should reveal. Note in

Fig. 10-2, the Millennium Pharmaceutical chart, the Bullish Engulfing pattern

on January 23, 2002.

Stochastics

oversold and turning up, and the Bullish Engulfing signal followed by a gap up

open the next day, repressents is the perfect buy scenario. However, as we see,

it closes lower that day. Not disconcerting, it is not unusual to see residue

selling from the previous trend still around. The important point is that a

Bullish Engulfing signal, in an oversold area, has appeared. The following day

a Spinning Top signal, a good sign, the selling of the previous day may have

stopped. The following day begins with a higher open, but then closes lower.

What should now be gleaned from the chart? The obvious, there is no extensive

buying now for three days after the buy signal. Common sense tells us that if a

buy signal occurs, then we should see the buyers continuing the trend.

The

fourth day after the bullish engulfing signal results in a close more than half

way down the Bullish Engulfing candle body. The half-way point of that body

represents an important factor. The sellers are now more evident than the

buyers that formed the white Bullish Engulfing signal. The sellers are

stronger, get out of the trade. Plus it is now four days after the buy signal

and no additional buying has been evident. The trend is not up. Move to a

better trade.

The

half-way point of a body, that created a signal, is the pivotal point.

At that level, the existing trend has negated the new trend indicator. This

works for both directions, bullish and bearish trend reversals. Does that mean

the trade should be ignored? Definitely not! The reason for buying in the first

place was due to a buy signal appearing in oversold conditions. The conditions

have not changed. It is still oversold, and there were buyers that stepped in

once at these levels. If the first entry does not work, keep an eye open for

the next buy signal. That will be stronger because the sellers will see that

even though the sellers overcame the first buying signal, another buy signal

illustrates that new buying is starting again. The sellers usually give up and

get out of the way.

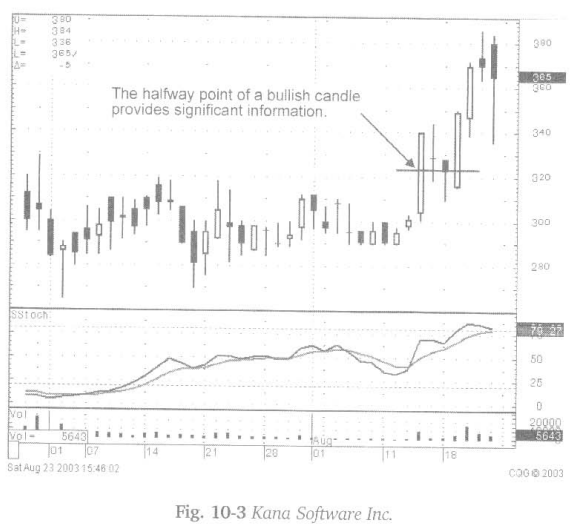

The

halfway point is crucial. As seen in Fig. 10-3, the Kana Communications chart,

the bullish breakout signal indicated new investor sentiment. Trading at the

$3.00 range for six weeks suddenly experiences a new dynamic coming into the

price of the stock. This is a good time to buy. But the next day it backs off.

Should that be a worry? Not really. Remember, it is not unusual to see some

residue selling after a big percentage move. A Harami is formed. At this point

in the new trend, the Harami indicates a day or two of consolidation before the

next leg up.

The next

day continues to back off. However, note the candle formation, a Hammer. That

alone reveals that the buying has started back in. Secondly, notice where it

closes, above the half-way point of the body of the white candle that initially

indicated the new sentiment in the stock. More importantly, that day reveals

the buying has presented itself again. It illustrated that the buyers were

still slightly in control.

Now the

stop loss decision making process becomes simplified. If the price closes below

the halfway point of the large white candle on the third day after the bullish

candle, it should be obvious that the buyers are not around anymore. The

sellers are a stronger force. Close the trade. On the other hand, the

overriding facet to this trade was that strong bullish candle day. That should

have been evidence that a new attitude was being applied to this stock price.

The direction will persist until there are signals to indicate the direction

has been negated. Expect the ‘probabilities’ to continue the uptrend. As seen

in the chart, the third day showed the buyers continuing what the first big

bullish candle indicated.

To

reiterate, use the half-way point of the bullish candle as the level that would

demonstrate that the buyers were not in control anymore. Also, a buy signal

should represent that the buyers were taking control. After the third day, if

no new buying becomes apparent, that should imply that the buyers are not

around. Take those funds and move to a better “probability” trade.

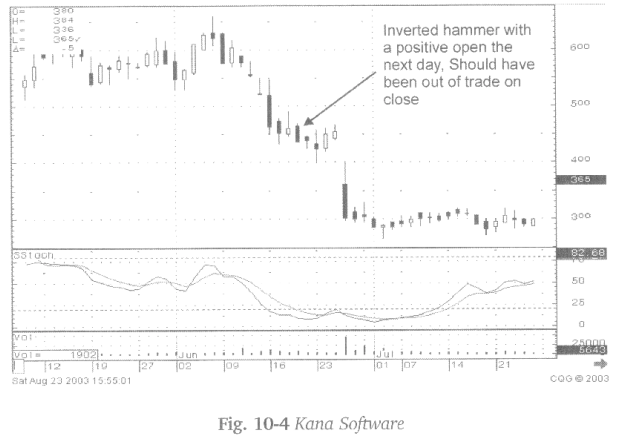

The

Inverted Hammer is an excellent buy signal. Remember the basic rule when

witnessing an Inverted Hammer signal. Seeing the price open positive the

following day, with stochastics in the oversold area, the probabilities are

extremely high this will be a profitable trade. As expected, the trend should

continue upward. With that knowledge, placing a stop becomes very logical. A

positive open indicates that the trend should be up. It will usually continue

up immediately, but if it does close below the open of the previous day, the

bottom of the Inverted Hammers small body, that would indicate that the signal

did not work. Put the ‘sell stop’ at the previous days open price and be ready

to close out immediately

Review

Fig. 10-4, the Kana chart again. June 16, 2003 created the perfect set up for an

Inverted hammer trade. It opened higher that day with stochastics curling up.

This is the exact proper set up for starting an up move from the Inverted

Hammer signal. But there was no follow through in the buying.

The

price, moving back down through the previous days open, the bottom of the white

body of the Inverted hammer, would be the telling story. The buyers are not

present, as hundreds of years of candlestick charting analysis revealed that

they should be. Breaching that point should be the stop loss level.

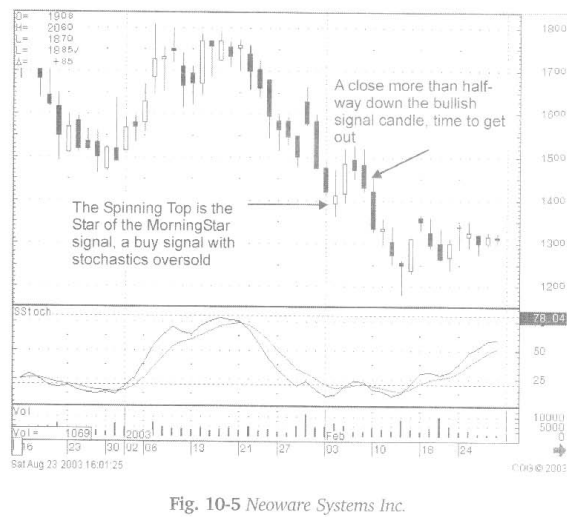

The same

analysis can be seen in Fig. 10-5, the Neoware Systems Inc. chart. The Spinning

Top signal, followed by the bullish candle creates a perfect Morning Star

signal in the oversold stochastics area. Two days after the Morning Star signal,

a black candle closes more than halfway down the white body of the Morning Star

“buy” formation. The sellers are still dominant. Take those funds and move to

a higher probability trade.

The same

rationale can be applied to the Hammer buy signal. To review, upon seeing a

Hammer signal in the oversold stochastics area, with a positive open the next

day, indicates that the buyers are back in the trading. There is a high

probability that the trend has reversed. That given, the trend should be moving

up from that point. Rarely will you see a Hammer in the oversold area, with a

positive open the next day, fizzle and move back down. That is the reason that

we utilize the signal after hundreds of years. The signal discloses that a new

investment sentiment has entered the stock price. However, the operative word

is “rarely”.

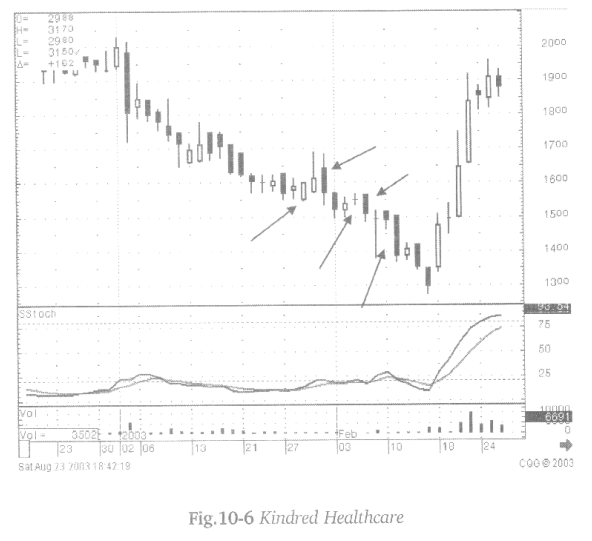

This same

scenario should not see a positive open and a close below the body of the

Hammer signal. A close below the body, whether a white or black body, negates

the concept of the bullish implications of the signal. Close the position. As

seen in Fig. 10-6, the Kindred Healthcare stock price, the buy signals are

followed by sell signals. Even what should be considered a strong Doji/Hammer

signal, confirmed the next day with a positive open, immediately shows

weakness. This now becomes a trade that has no follow through buying, not a

trade you want to be in.

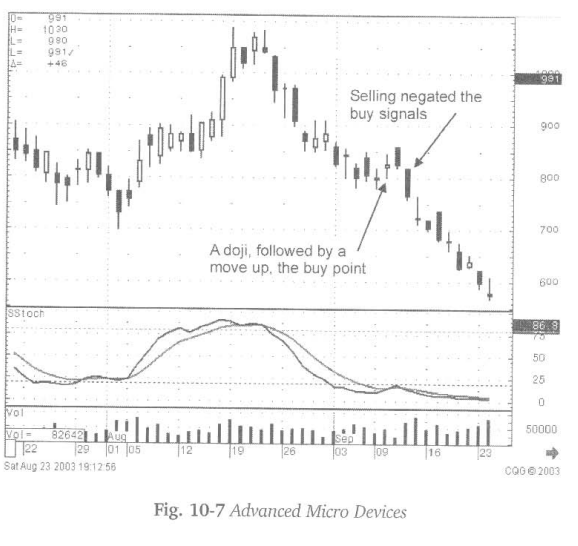

Fig. 10-7

Advanced Micro Devices illustrates a chart pattern dial set up with a Doji at

the bottom. Followed the next day with a positive open, a strong buy indicator.

Even the next day it gapped open to the upside. But it traded lower from that

point, creating a black candle. The black candle, three days after that Doji,

becomes a significant indicator. The close, being lower than the Doji that

first indicated the reversal to the upside, now reveals that the sellers have

overpowered the buyers. Not a position that represents buying anymore. A bad

trade? Close it and move those funds to a strong chart.

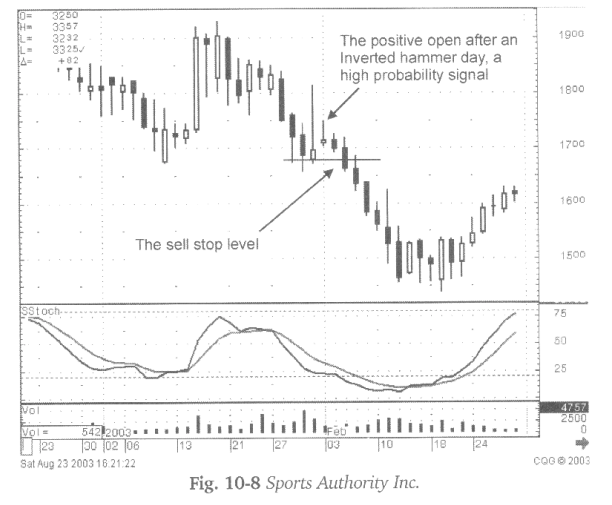

Illustrated

in Fig. 10-8, the Sports Authority Inc. chart is another Inverted Hammer that

is set up exactly as it should for producing a profitable trade. The

stochastics nearing the oversold area and a strong Inverted hammer should have

prepared the candlestick investor for an opportunity the next day. That

opportunity would have presented itself by revealing a positive open after the

Inverted hammer signal. Buying on the open that next day was the right execution.

The little selling day after that did not change the direction of the trend.

However, the fact that the sellers could push the price back down through the

body of the Inverted Hammer gave a clear indication that the sellers had overpowered

the buyers.

As

illustrated in the chart examples, the basis for proper stop loss levels, using

candlestick analysis, boils down to one simple observation, what level demonstrates

more sellers than buyers. That revelation can occur the next day or after three

days or more. If no new buying has come into the stock price, the buy signal is

not being confirmed. Take those funds and move to a chart that shows buyers.

Does that

mean that trade is dead? No. Watch it. It has already been evaluated as being

oversold. The buyers may still be ready to buy in at that price level. Again,

the next buy signal will reveal that the buyers are back again. This same

message will be noticed by the sellers. They may start backing away from their

selling or start covering their shorts.

How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies : Tag: Candlestick Pattern Trading, Option Trading : what is a trade summary, How to put order, stop loss analysis, indicates a new trend, Bearish Engulfing signal - Initiating a Trade with Candlestick Pattern