Stop Losses During the Uptrend

How to put stoploss, how to put uptrend stoploss, how to put a stop loss on a put option, candlestick analysis, longer-term position holder, price broke the trend lines

Course: [ How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies ]

The next strategy to consider is, “what should be done when the uptrend has started.” This again incorporates commonsense planning.

Stop Losses During the Uptrend

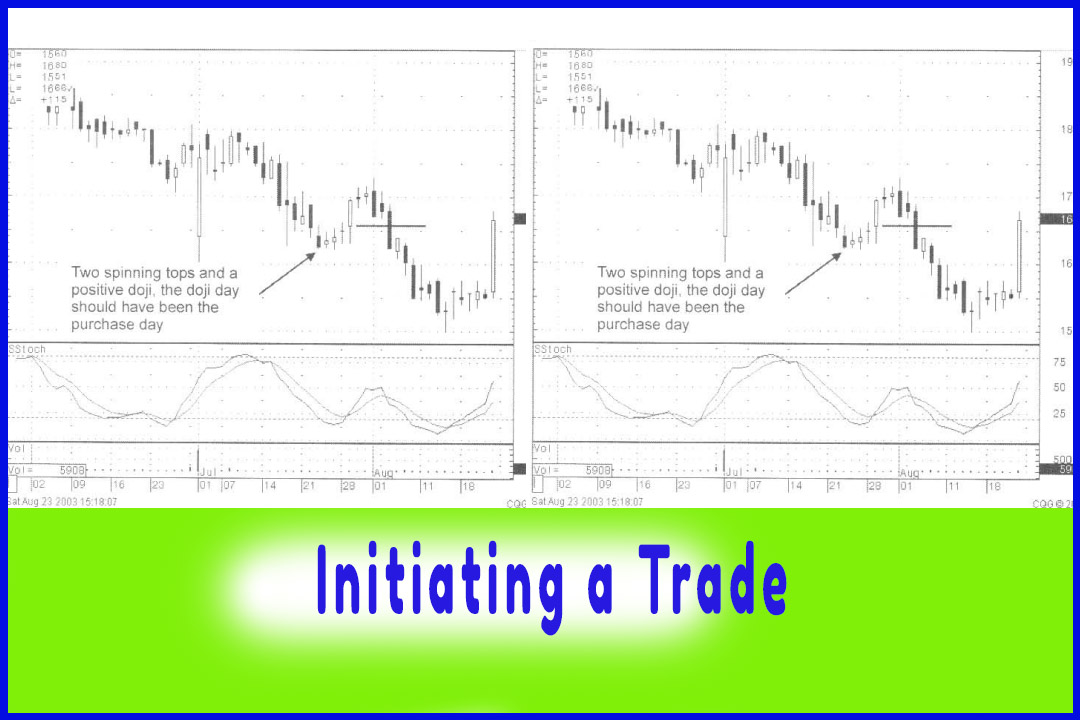

The

previous examples were illustrating stop loss reasoning in the initiation of a

trade. The next strategy to consider is, “what should be done when the uptrend has started.”

This again incorporates commonsense planning. Back to the basics, what does

the candlestick buy signal represent? It is the change of investor sentiment,

the “trend” should be up. Does a trend go straight up? As much as we would like

it to, there will be zigs and zags in tire price movement. The only reason for

putting a stop loss on, during a good trending situation, is to protect

yourself from that rare catastrophic announcement. Otherwise a stop loss, too

close to the price oscillations, could stop you out at a low point of an up-

trending trade.

Once the

trend starts, candlestick analysis can be applied. The same thinking process

can be used for evaluating whether a trade is still working or not. A price

level can be predetermined as to where it would be indicating that the sellers

have taken control. During an uptrend, more latitude can be given. The longer

the uptrend continues, the more definite a ‘sell’ signal needs to be to reveal

that the trend has terminated.

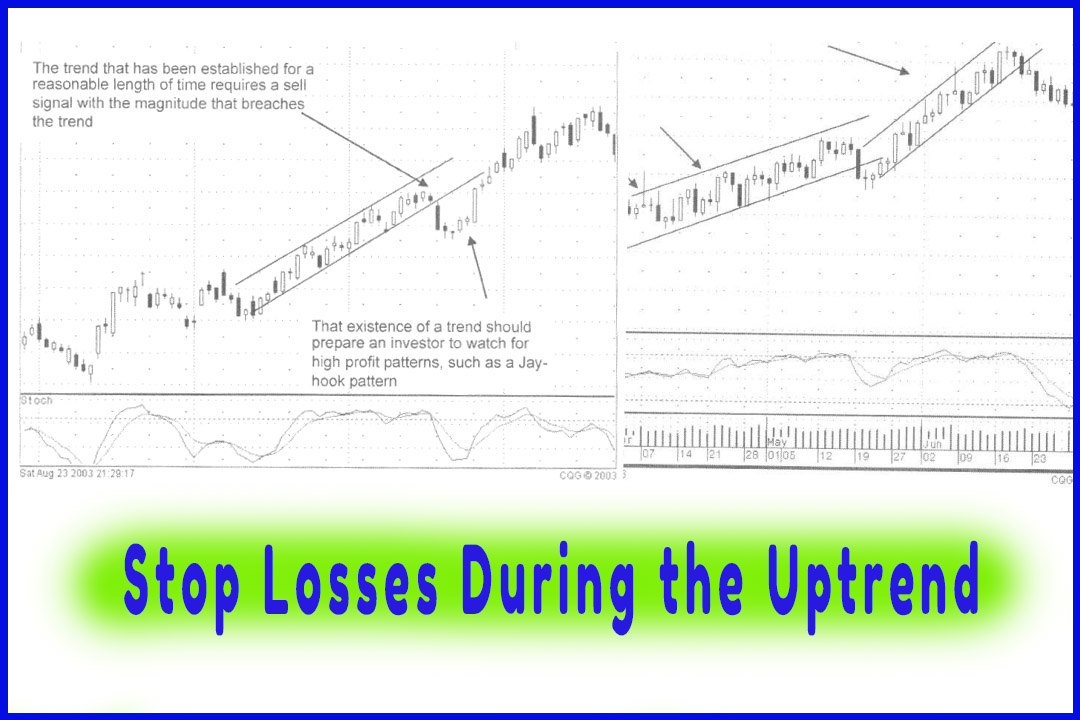

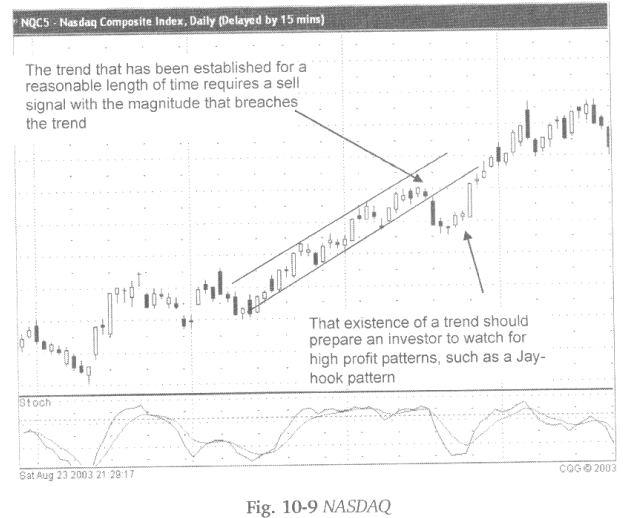

Note in

Fig. 10-9, the NASDAQ chart the trend was apparent until the gap down in price

broke the trend lines.

Since

March 10, 2003, the NASDAQ chart has shown a steady uptrend. These trends would

continue for a month and a half at a time. Upon closer observation, it will be

seen that there were definite sell signals in those periods. Does that diminish

the validity of the signals? No, the signals need to be heeded. However, they

need to be evaluated based upon the environment that they are being viewed.

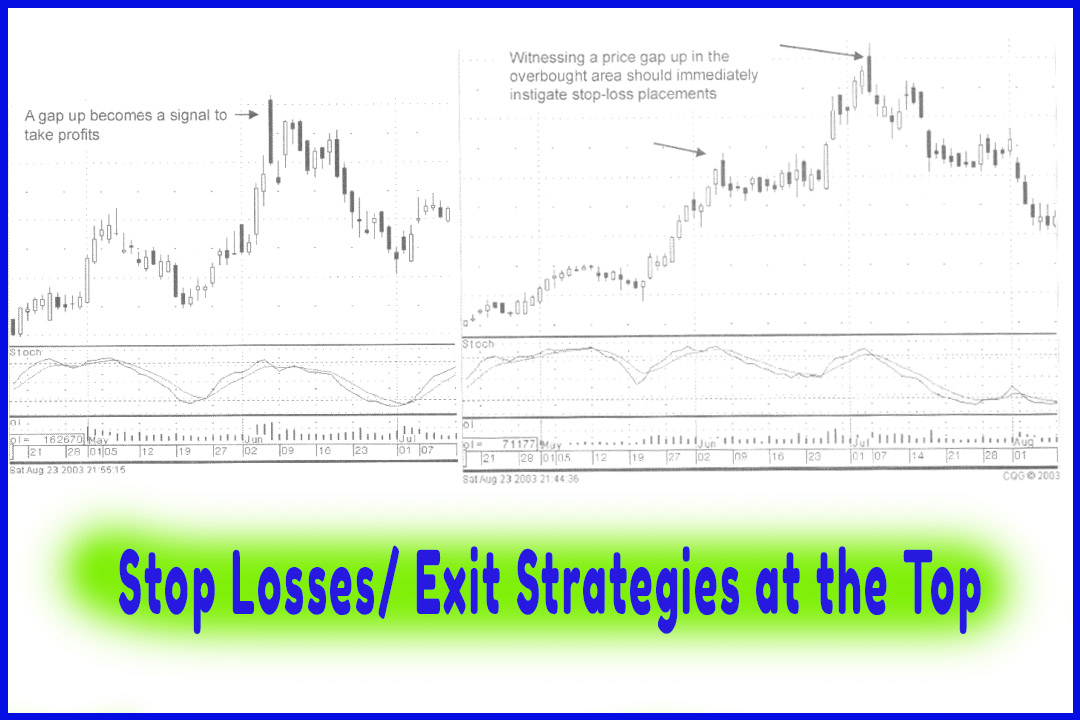

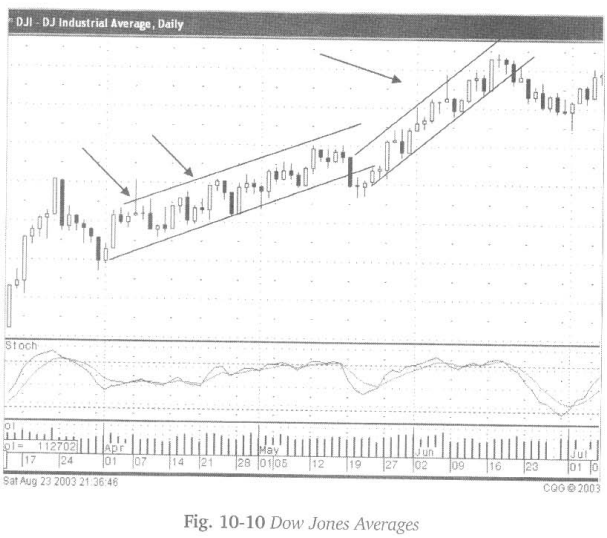

As seen

in Fig. 10-10, the DOW chart, the signals divulge selling at the top of the

trend channel. That provides valuable information. For the short-term trader,

it becomes evident that the upside channel is not going to be breached. Individual

stock charts may have already produced a strong run up. The charts showing

toppy signals can be liquidated. Why own a stock that appears to have great

probabilities of going back down? Take profits! Positions can always be bought

back when sell signals are negated.

Will the

stocks with toppy chart patterns be finished as far as further upside? That can

be determined by seeing what the next down move will do. Observation reveals

that for the past few weeks, the pullbacks have been supported by the bottom channel

trendline.

If not as

aggressive a trade, the longer-term position holder can sit through a pullback,

using the bottom of the trend channel as a guide, alleviating the need for

bopping in and out of a trade.

Note the

third week in May; the bottom of the trend channel is breached, occurring about

three months after the start of the uptrend. Not a bullish sign. Take some

profits. But keep in the back of your mind that a strong reversal signal is

required to change the trend. The longer the trend, the more powerful the

reversal has to be demonstrated. That is a function of the investment psychology

in the markets. The longer a trend continues the more compelling a sell signal

needs to be to show investors that the trend is finally over. The optimistic

(or pessimistic) attitudes that are being ingrained during the trend are hard

to dispel as the direction of the trend changes.

Further

analysis of the NASDAQ chart shows that the selling that broke through the

bottom of the trend immediately stopped with the appearance of a couple small

hammers, and then continued buying. Other technical analysis would have

evaluated this as consolidation in the beginning of a downtrend. The

Candlestick analyst has the benefit of visually seeing that buying is occurring,

stochastics at the bottom, curling up. Instead of a full fledged selling

program, the candlestick investor would be watching to see if continued

strength was coming back into the market.

Would a

sell stop have been prudent when the trading breached the lower trend channel?

The “probabilities” indicated that the sellers were taking control. However,

the individual stock positions should have been evaluated as to what their

chart signals indicated. This would have eliminated a mass selling spree.

Seeing the hammers, after the bottom of the trend channel was breached, gave a

forbodence of the downtrend not being a powerful move. If stopped out, it was

probably done in positions that had good profits from the preceding uptrend.

That does not preclude an investor from getting right back in to the same

positions after they have consolidated and started moving back up. Better yet,

those funds could be moved to new sectors/positions that were coming out of

oversold conditions, with much greater upside potential and lower downside

risk.

How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies : Tag: Candlestick Pattern Trading, Option Trading : How to put stoploss, how to put uptrend stoploss, how to put a stop loss on a put option, candlestick analysis, longer-term position holder, price broke the trend lines - Stop Losses During the Uptrend