What Does the Signal Tell You?

what does your signal strength show, trading signals strategies, Negating the Signal, candlestick signals, candlestick investor

Course: [ How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies ]

The signal itself is still the result of centuries of observations. Observations that were reinforced by profitable trades! The signals have meaning. They represent the change in sentiment of the buyers and sellers.

What Does the Signal Tell You?

Keep in

mind, not all trades work. “Probabilities” of a successful trade, after

witnessing all the parameters that make for a successful trade, is the key

word. Although the probabilities are greatly in your favor, there is also the

small probability that a trade will not work.

The

signal itself is still the result of centuries of observations. Observations

that were reinforced by profitable trades! The signals have meaning. They represent

the change in sentiment of the buyers and sellers. The signal comprises that

new change. The candle formation is the basic element of the reversal signal.

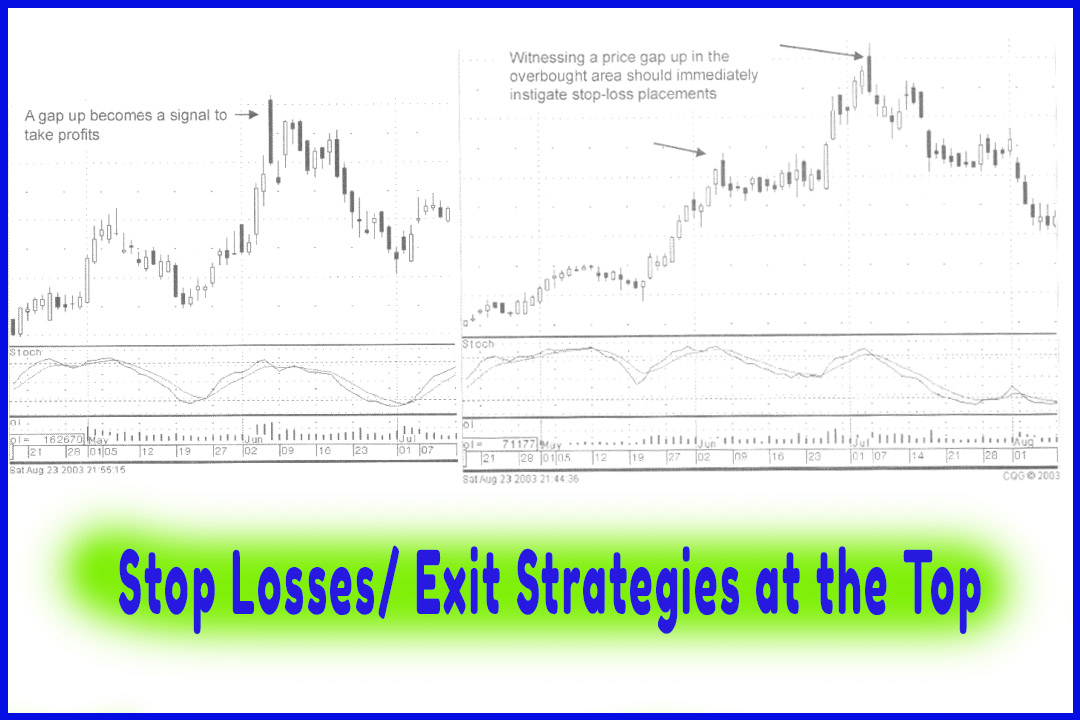

However, when that reversal signal illustrates that a new force has entered

the market but it is immediately negated by the original trend force, that

makes it clear that the new trend is now nullified. Get out of the trade immediately.

Does that

mean the analysis was not correct after identifying the signal? No. If a buy

signal was formed in an oversold condition, Candlestick analysis establishes

that there is a high “probability” for that trade to make money. Again the word

“probability” is what needs to be addressed. The trade should make money.

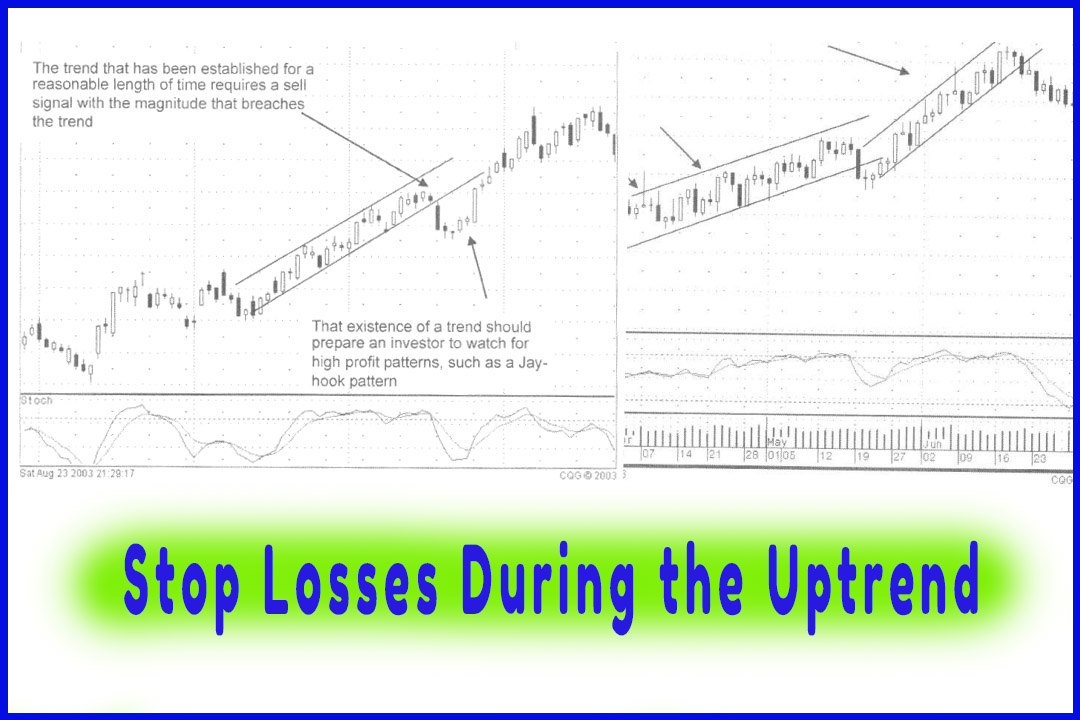

However, if the trend does not establish itself, it becomes obvious when

knowing the candlestick signals. Your stop loss strategy now becomes customized

to that particular trade setup. This is an easy visual process. Take each

signal setup, knowing what makes it work, and set your stop loss price based

upon where that signal would be negated.

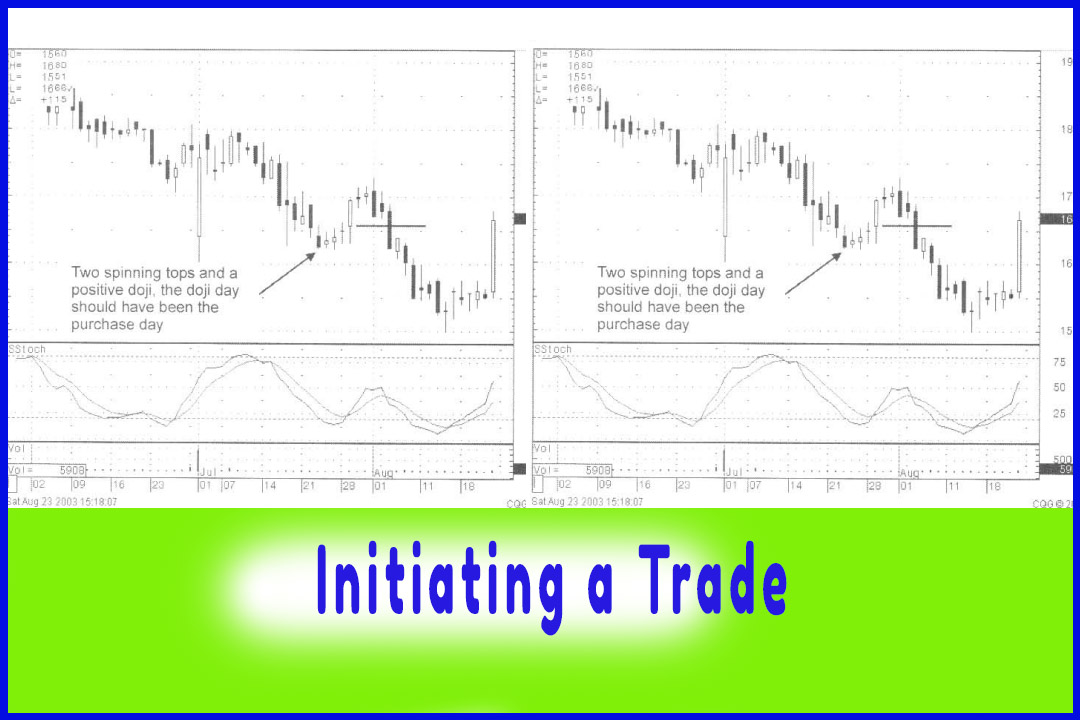

Negating the Signal

What

created the signal? The Bullish Engulfing pattern, the Doji followed buy a

bullish confirmation day, a Hammer signal confirmed, a Kicker signal? When a

signal is created, we will see the candle formations that established the new

trend. Trading back down through the signal formation indicates the sellers are

still in control. That becomes the stop loss criteria. The same rules for what

makes a successful signal can be used for showing what makes the signal unsuccessful.

A

candlestick investor is able to establish the level where the signals demonstrate

the trade is not working, gaining more control in the investment psyche.

Establish where to get in and out of the trade instead of arbitrarily setting

stops that have nothing to do with how a trend should be performing. That

control can be directed to making pro-active decisions versus reactive

decisions. It also allows the candlestick investor to prepare strategies to

re-establish a trade in the same position, selling when the trade was not

working and getting back in when the trade was working again.

How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies : Tag: Candlestick Pattern Trading, Option Trading : what does your signal strength show, trading signals strategies, Negating the Signal, candlestick signals, candlestick investor - What Does the Signal Tell You?