Candlestick Stop Loss Strategies

How to put Stoploss, How to find stoploss, which is better stop loss or trailing stop loss, candlestick pattern stop loss, candlestick stop loss techniques, what is the meaning of stop loss in trading

Course: [ How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies ]

Protecting your assets is the main function of putting on stop losses. It is to provide a point where the reason for “buying” becomes null and void. Many trading strategies incorporate them into their trading formulas for closing a trade that has gone sour.

Candlestick Stop Loss Strategies

“Progress always involves risk; you cannot steal second base and

keep your foot on first.”

Protecting

your assets is the main function of putting on stop losses. It is to provide a

point where the reason for “buying” becomes null and void. Many trading

strategies incorporate them into their trading formulas for closing a trade

that has gone sour. Usually this is done by establishing a percentage loss as the

parameter. The Candlestick method completely disregards a preset formula for

stopping out.

There is

a major flaw in using a prescribed percentage loss as the stop loss. Your

purchase price becomes an important function of where you are to stop out. Some

investment advisors recommend three percent as the stop out level. Others

suggest eight percent. But where you buy a trade position now becomes the

quantitative element of where you should place your stop. A couple of extreme

disadvantages become apparent.

A buy

recommendation is placed on a stock. You are advised to place a stop at a

preset number, for example, three percent below your entry price. The buy is

placed on a stock at $50.00. However, by the time you get executed, you have

paid $50.80. Buying the stock at $50.00 would have meant your stop out level

was $48.50. Your entry at $50.80 now means that the stop loss is to be placed

at $49.27. As often mentioned in candlestick analysis, where you bought a stock

or sell a stock does not mean a hill a beans to the market. Your arbitrary

level of where to come out of a trade has absolutely nothing to do with what

the price trend should be doing. What if $48.50 is a level that negates the

uptrend move, but $49.27 does not change the trend direction.

Your entry

level, although may not have been the ultimate point to get in, does noy have

anything to do with what the trend is doing. Prices coming back down through

S49.27 may not be a level that affected the uptrend. The “percentage stop” may have stopped you out

while the trend direction was still valid.

“Everything comes to he who hustles while he waits.”

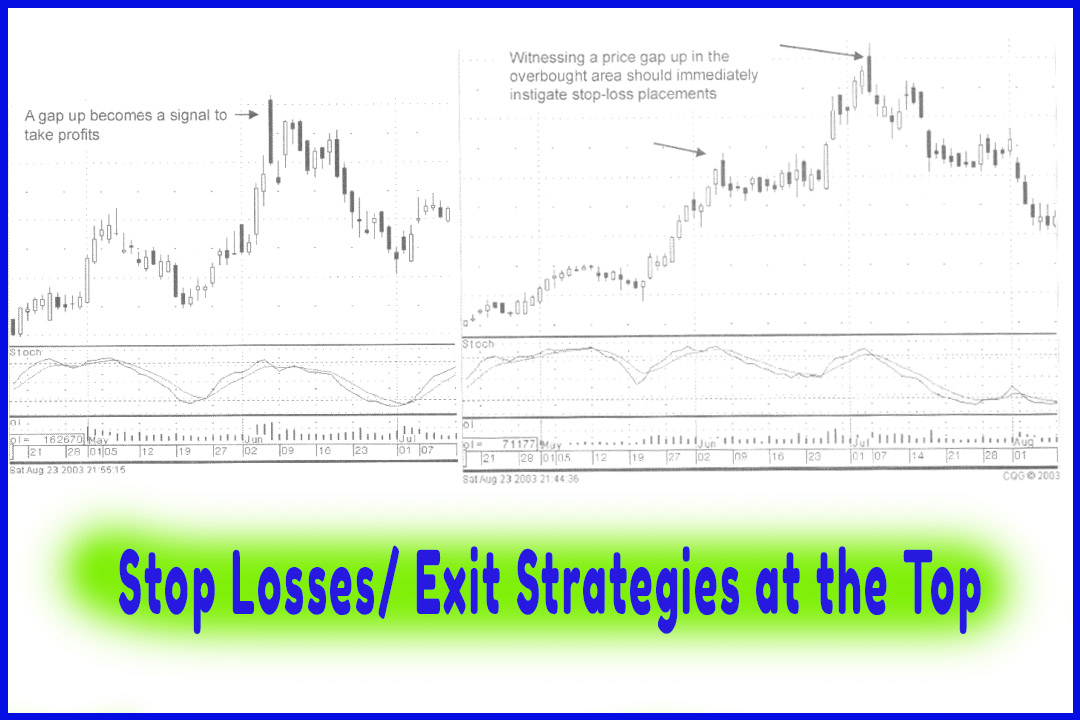

Additionally,

the volatility of a particular stock has a great bearing on whether a trend has

been affected. A three percent pullback on some stocks might be more than big

enough to reverse a trend, while a ten percent move in others stocks is common

and isn’t a factor on the trend direction.

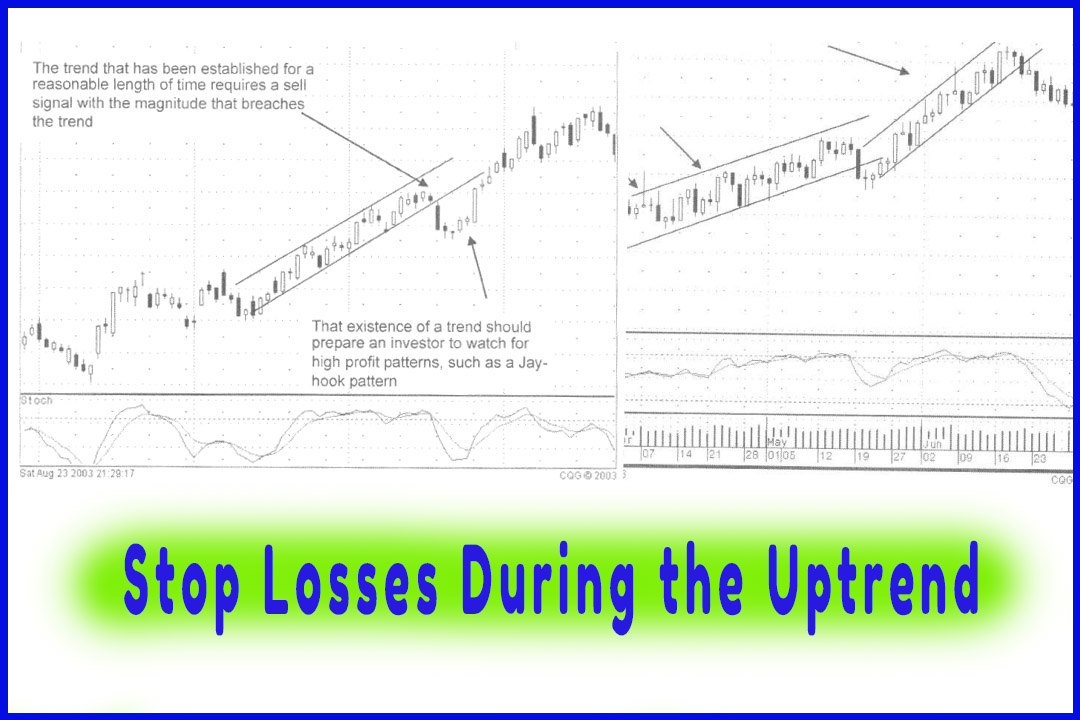

The most

important factor for establishing a stop loss is very basic. What price point

would indicate drat the established trend has been negated? This now becomes a

stop loss level that is established based upon the trend being stalled and/or

negated. As with all of Candlestick analysis, this becomes a “common - sense” evaluation. If you have

put on a long position, based upon a bullish buy signal, where would the price

have to pull back in order to confirm that tire sellers were still in control?

The

simple visual evaluation establishes the proper stop loss point as it pertains

to that specific stock position, taking into consideration the volatility of

the stock and the signal that created the buy signal. A stop loss on one stock

may be relevant at a close level whereas the next stock position requires

greater latitude. Candlestick analysis allows the investor to establish a stop

loss that would logically indicate when the sellers were still in control, and

the buyers have been overcome.

How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies : Tag: Candlestick Pattern Trading, Option Trading : How to put Stoploss, How to find stoploss, which is better stop loss or trailing stop loss, candlestick pattern stop loss, candlestick stop loss techniques, what is the meaning of stop loss in trading - Candlestick Stop Loss Strategies