Candlestick Stop Loss Reasoning

candlestick trading method, profitable candlestick analysis, candlestick stop loss techniques, candlestick pattern stop loss,

Course: [ How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies ]

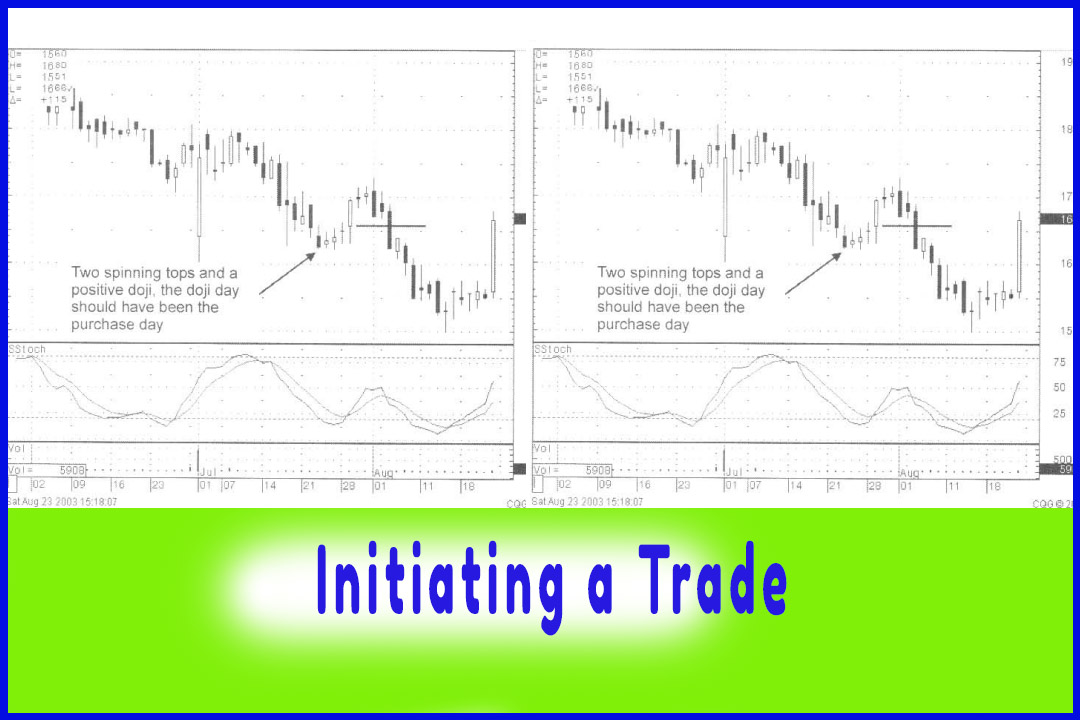

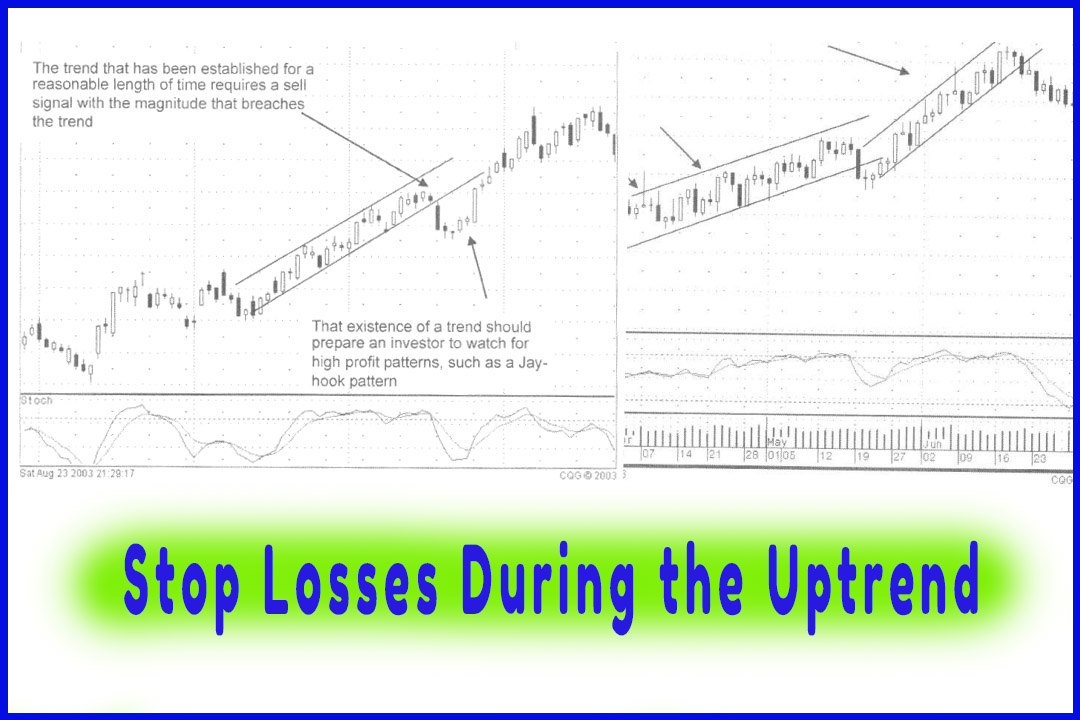

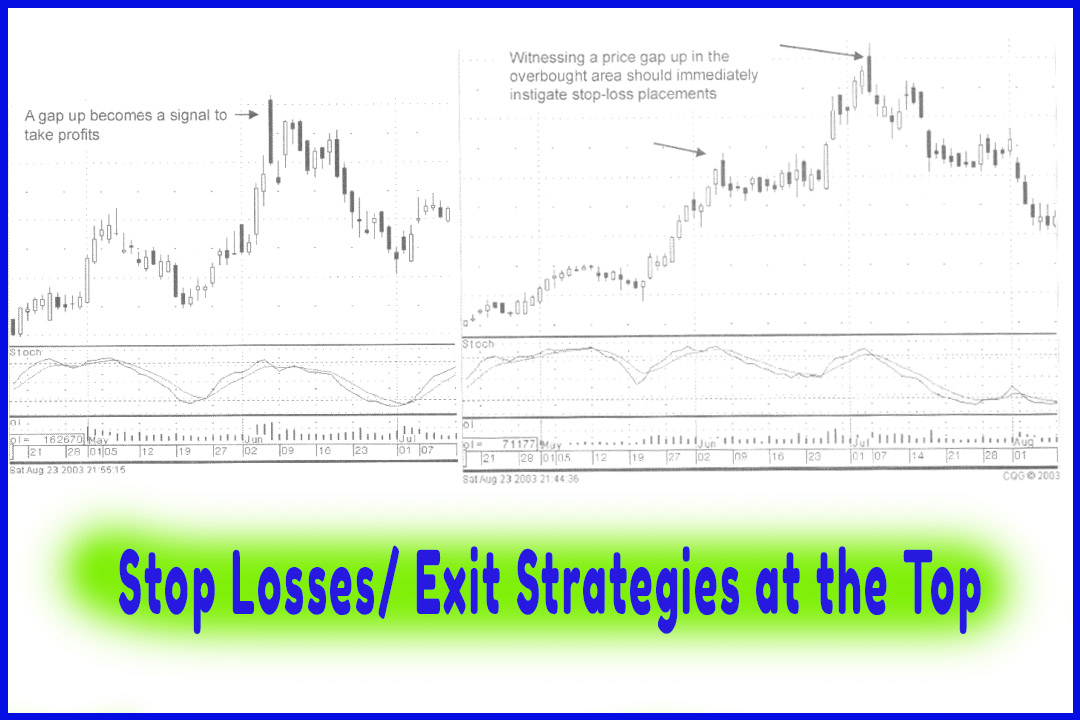

Limiting your losses, using visual analysis, with the candlestick method has immense advantages. Understanding the signals, knowing why it is time to enter a trade, makes it easy understand when to be out of a trade.

Candlestick Stop Loss Reasoning

Limiting

your losses, using visual analysis, with the candlestick method has immense

advantages. Understanding the signals, knowing why it is time to enter a trade,

makes it easy understand when to be out of a trade. Applying arbitrary percent

movements do not pertain to what the price movement is expected to do.

The basic

premise being that the majority of trades will be profitable utilizing

candlestick analysis. That still means some trades are not going to work.

Having a prepared mind set for addressing the losing trades keeps funds moving

to the best probabilities. Most investment programs teach very little about

getting out of losing trades. Cutting losses short is prudent advice. Yet very

little is taught on how to recognize tire losing trade. Even less is taught on

how to effectively close out the losing trades.

Learning

when a trade is not working has two benefits. Limiting the loss is tire obvious

benefit. Additionally, getting those funds out of a nonproductive trade and

placing them immediately back into a potentially positive trade greatly

enhances the ability for those funds to create gains for tire portfolio. Doing

so immediately creates more opportunities to make profits. Plus it keeps the

mind clear, not having to use mental energy worrying about a position that

should be closed out.

How often

do we hear investors say when their stock position is going down, “that’s alright, I’m in this position for the long term, and it

will come back?” Poppycock!!!

That is the answer of somebody that does not have a strategy for coming out of

a position.

Know why

you are going into a position. Know why you want to be back out. That gives you

control of your portfolio management. The price moves are not throwing you

around; you are maintaining control of your portfolio. The constant cultivation

of placing investment funds where they should be or closing positions that are

not doing what the signals indicated will greatly enhance the profit potential

of a portfolio. Remember, this is not rocket science, this is simple

commonsense evaluation of what tire buyers and sellers are doing.

How To make High Profit In Candlestick Patterns : Chapter 9. Candlestick Stop Loss Strategies : Tag: Candlestick Pattern Trading, Option Trading : candlestick trading method, profitable candlestick analysis, candlestick stop loss techniques, candlestick pattern stop loss, - Candlestick Stop Loss Reasoning