Traders Know the Reversal Patterns with Trading Examples

The Harami Pattern , Tweezers Tops and Bottoms, Belt-Hold Lines, Upside-Gap Two Crows, Counterattack Lines

Course: [ JAPANESE CANDLESTICK CHART AND TECHNIQUES : Chapter 4: More Reversal Patterns ]

They show that the bulls have taken over from the bears (as in the bullish engulfing pattern, a morning star, or a piercing pattern) or that the bears have wrested control from the bulls (as in the bearish engulfing pattern, the evening star, or the dark-cloud cover).

MORE REVERSAL PATTERNS

“Put a lid on what smells bad.”

Most

of the reversal formations in Chapters 2 and 3 are comparatively strong

reversal signals. They show that the bulls have taken over from the bears (as

in the bullish engulfing pattern, a morning star, or a piercing pattern) or

that the bears have wrested control from the bulls (as in the bearish engulfing

pattern, the evening star, or the dark-cloud cover). This chapter examines more

reversal indicators that are usually, but not always,

Less powerful reversal signals include

·

The Harami Pattern

·

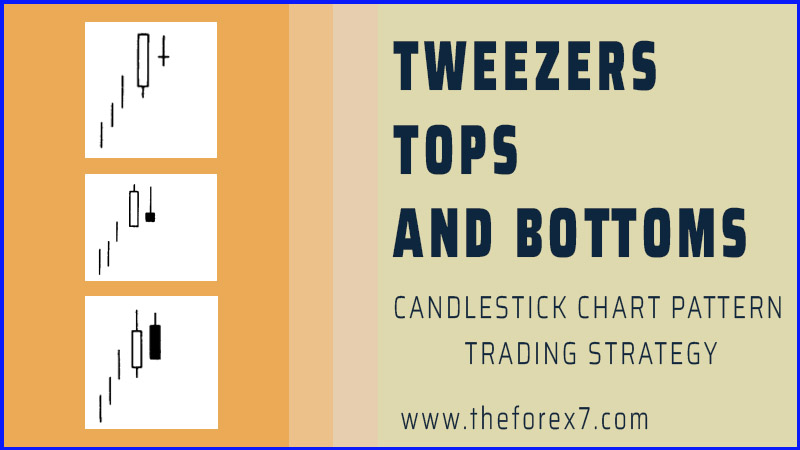

Tweezers Tops and Bottoms

·

Belt-Hold Lines

·

Upside-Gap Two Crows

·

Counterattack Lines

This chapter then explores more potent reversal signals that

include

·

Three Black Crows

·

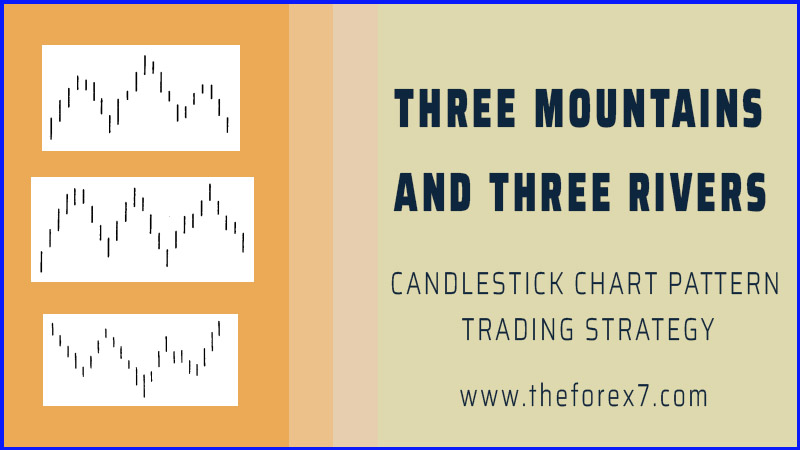

Three Mountains and Three Rivers

·

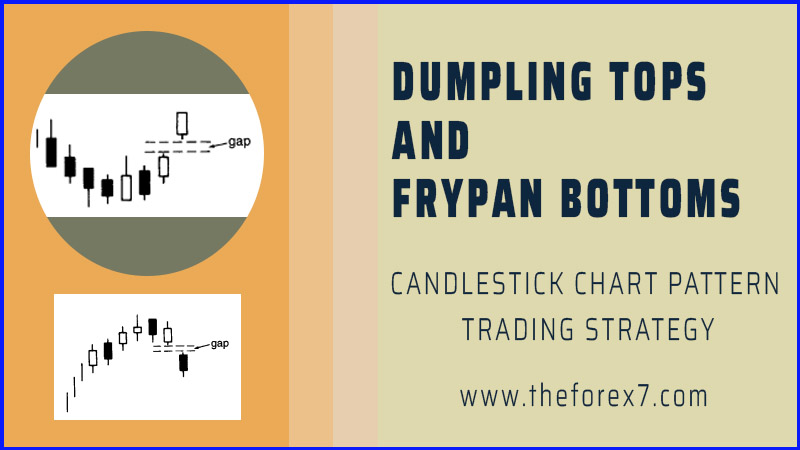

Dumpling Tops and FryPan Bottoms

· Tower Tops and Bottoms.

JAPANESE CANDLESTICK CHART AND TECHNIQUES : Chapter 4: More Reversal Patterns : Tag: Candlestick Pattern Trading, Forex : The Harami Pattern , Tweezers Tops and Bottoms, Belt-Hold Lines, Upside-Gap Two Crows, Counterattack Lines - Traders Know the Reversal Patterns with Trading Examples