All News Affects Markets Equally

Fundamental Events, News Analyst

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex ]

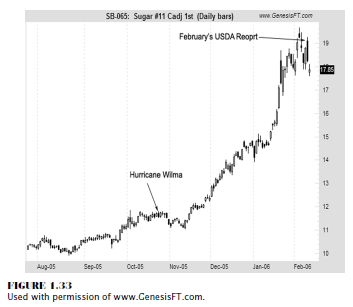

Hurricane-related damage in 2005 played a major role in the reduction of supplies to the sugar market more so than it did in orange juice.

NOT ALL NEWS AFFECTS MARKETS EQUALLY

Hurricane-related

damage in 2005 played a major role in the reduction of supplies to the sugar

market more so than it did in orange juice. Also, the fundamental backdrop of

the sugar market was more significant than the orange juice market because it

has a dual role: Sugar is a food product, and it is used as a biofuel to make

methanol. It set record price gains in 2005, especially as energy prices

surged. Raw sugar prices more than doubled in 2005, climbing and making new

24-year highs. Brazil, the world’s largest producer, uses most of its crop to

make fuel because of the high cost of gasoline. With that information, we would

expect that after Hurricanes Katrina and Rita impacting the Louisiana crops and

then Hurricane Wilma making a direct hit on Florida’s crop, prices would take

off like a rocket! But don’t forget that sugar is produced all over the world

and that there are sugar beets and sugar cane. It is almost impossible to

measure inventories from all growing regions of the world, and the market knew

that after Hurricane Wilma hit. The fundamental event that impacted the orange

juice market had a different effect there than it did on the sugar market.

As you

examine Figure 1.33, notice that prices actually decline after Hurricane Wilma.

It took almost one month for the market to realize that there was a significant

loss in Florida’s crop, and speculative money pored into the market to take

advantage of higher prices. A Trend Traders technical price break signals to

get long this market, and substantial profits were made. It may appear that the

fundamental and technical outlooks were not in sync; and by late January/early

February of 2006, traders started to sense that the market was getting slightly

ahead of itself, or overbought. Traders who were long started to liquidate some

positions in preparation for the USDA’s monthly crop report. If you look

closely at Figure 1.33, the very high of the market was formed by a candle

pattern named a shooting star. (Chapter 7 focuses on how to spot reversals like

this one.) The market did not behave according to what the fundamentals

dictated. Prices rallied in a delayed effect and then continued higher on

speculative buying interest.

What I want

to illustrate next is how markets do not act according to the following:

· What fundamentals dictate.

· Common sense.

· Rational emotional intelligence.

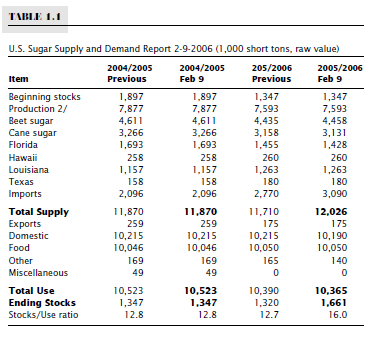

The high

was made in the sugar market on February 3 at 19.65, one week earlier than the

USDA crop report. Table 1.1 shows the actual government report, the boldface

type indicating that total sugar supplies increased from 11,870 to 12,026! But

best of all, total usage declined from 10,523 to 10,365! Ending stocks show

there are more surplus inventories. Since that report, prices have declined

significantly.

Therefore,

remember: Fundamentals do not always jibe with what the charts show. Think like

a fundamentalist but trade technically.

The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex : Tag: Candlestick Trading, Stock Markets, Pivot Point : Fundamental Events, News Analyst - All News Affects Markets Equally