Spread Trading Tips

spread betting tips today, spread betting tips and tricks, how does spread work in trading, how does the spread affect trading

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex ]

If you decide to take advantage of a spread trade, you should realize that it is a risky business. You could be on the wrong side of both markets.

SPREAD TRADING TIPS

If

you decide to take advantage of a spread trade, you should realize that it is a

risky business. You could be on the wrong side of both markets. Since spreading

involves selling short one stock and simultaneously buying another stock, if

the price goes in the opposite direction of both trades, you can lose on both

sides of the trade. Selling short is a hard concept for many traders, both

novice and experienced, to grasp. Believe it or not, there are some folks who

are not aware that you can sell first without owning the security. Short

selling means you are betting that the price of a given product will decline;

therefore, you would be selling first without owning the underlying product

with the hopes of buying back later at a lower price. Selling short is

considered highly speculative for stock traders; the process involves

“borrowing” the stock from the brokerage firm, if the firm has that security in

inventory. Shorting stock is very similar and should not scare investors. It is

a very simple concept; in fact, it is just the opposite for longs. You want to

buy low and then sell out later at a higher price. With shorting, you are

selling first and buying back later, hopefully at a lower price to generate a

profit.

There are

certain restrictions; for one, you need to set up a margin account with your

brokerage firm. Another restriction carries potential execution risks: Due to

Securities and Exchange Commission (SEC) regulations, there is what is known as

the “uptick” rule. The uptick rule was established in the 1930s to prevent a

bear market raid on a stock. In order to execute a trade, the stock needs to

trade at a price higher than the preceding transaction price in the same

security. For example, if you wanted to enter a spread by selling Dell Inc. and

buying Apple, you would have been anticipating or looking for Apple to

outperform Dell’s price gains. Or if both stock prices decline, you would want

Dell to decline more than Apple. But in order to effectively execute that

strategy, you would want to enter the sell side of the spread first because there

are no restrictions on entering the long side, just on the short side of the

transaction. Let’s say you enter the long side first without confirmation that

you were filled on the short side; if the market on the position you hold—the

long side—goes down and if both markets moved in tandem, you would need an

uptick on the short side in order to be in the spread. Imagine if you went long

first and the stock dropped. Then when you are finally able to execute the

short side, the market has plunged. That would translate into an actual loss.

So if you do not get filled first on the short side, the worst that can happen

is that you lose a trading opportunity. This is a great example of why traders

have the obligation of knowing all there is about the market they trade in. As

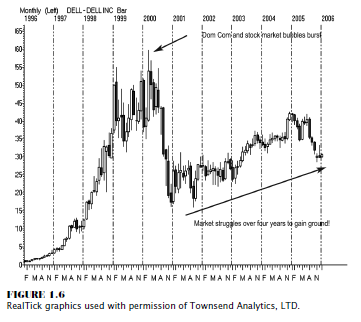

you can see in Figure 1.6, Dell has moved in the same direction as Apple, but

Apple has outperformed as a price leader. The spread opportunity between these

two computer manufacturers, long Apple and short Dell, would have generated a

tidy profit.

Another

example of a spread opportunity within competitors of the same industry or

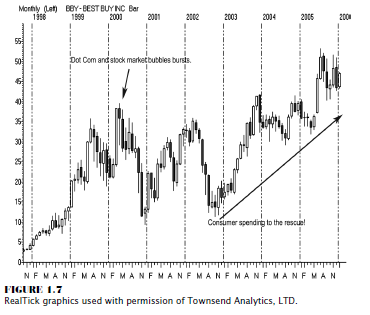

sector would be Best Buy versus Circuit City, as shown in Figure 1.7.

As

consumers flocked to retail malls before the holidays to purchase gifts such as

Apple’s iPods, if you want long Best Buy as the sector leader and short Circuit

City, Best Buy stock outperformed Circuit City stock. As you can see from the

chart, after the stock market bubble burst in 2000, Best Buy managed to

maintain a positive trend higher. It is the leadership of the company and the

consumer loyalty that really have helped to support this company’s growth and

profitability. One reason is Best Buy continued to sell appliances versus one

of their rival competitors and as a result they saw sales rise 7.7 percent from

2004 through 2005. They also had aggressive gains in web sales, and online

revenue jumped 40 percent as more customers shopped and redeemed gift cards

online for the same time period.

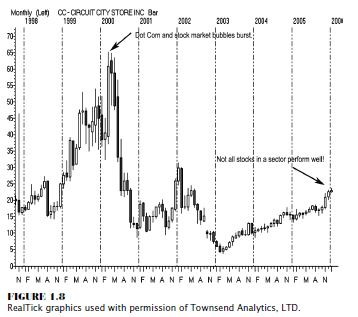

Best Buy’s main competitor, Circuit

City, decided or needed to cut back and close stores and then discontinued

selling appliances to stay afloat. It depended on increasing DVD and CD sales

and on electronic products. As the housing boom materialized soon after that

decision, Circuit City gave up market share to Best Buy; and no doubt companies

such as Home Depot and Sears picked up increased revenues in appliance sales.

Therefore, it was hard for Circuit City to re-enter selling that product line.

As you

can see in Figure 1.8, Circuit City’s stock just had not been a great performer

in that sector. The company was founded in 1949, so it has a long history and

may survive the competition. However, if consumers start to spend less on home

electronic products in 2006 and 2007, this company may have trouble getting its

stock price back up to the 2000 high near 65 per share. Circuit City will need

consumers to continue to buy and upgrade new televisions, camcorders, and

digital cameras to boost revenues. I personally have no intentions of buying

another camcorder; I barely use the one I have. As for game software, game

hardware, and personal computer software, those are competitive products; so I

believe Circuit City will have to do more to survive the next few years of what

is being forecast as a consumer electronic sales recession. Therefore, one

would need to look closer at these two companies and decide which one has more

to gain or which one has more to lose; once a decision is made, this would be a

good pairs market for a spreading strategy.

Investors

have many trading opportunities with stocks, as you can see from the preceding

few pages. There are many ways to analyze a company, from taking a simple look

at the P/E ratio to using technical analysis studies. Investors can see which

company is the leader in a specific sector and invest with that leader. As you

can see in the cases of Apple versus Dell and Best Buy versus Circuit City,

holding a diversified portfolio of stocks may help investors see profits or a

positive cash flow. Realistically, you can’t own shares in every stock.

Longer-term investing—you know, the buy-and- hold mentality, sometimes referred

to as the Warren Buffett method—helps toward generating big gains in solid companies.

But remember that WorldCom and even Lucent Technologies were solid companies at

one point. So the message here is that investors need not only to be selective

in which markets they buy and hold but also to monitor their positions. There

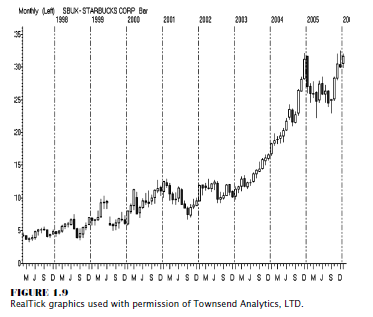

is the idea that you can buy stock in a company to which you relate or from

which you purchase products . . . companies like Starbucks, as shown in Figure

1.9. This company has solid growth, great coffee; it carries with each 20-

ounce cup, named a Vente, a solid jolt of caffeine. That is what keeps me going

back, day after day, dropping two dollars per cup for the Starbucks “experience.”

Starbucks

has made stellar gains and is a great moneymaking stock. It has solid industry

leadership, textbook marketing concepts, and, more important, customer loyalty.

These are all the qualities to look for when selecting a long-term purchase.

The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex : Tag: Candlestick Trading, Stock Markets, Pivot Point : spread betting tips today, spread betting tips and tricks, how does spread work in trading, how does the spread affect trading - Spread Trading Tips