Stock Trading Opportunities

stock market trader jobs, stock trading internship, equities trading jobs

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex ]

Stocks offer opportunities to long-term investors based on a company’s performance. There are many advantages and disadvantages when trading stocks.

STOCK TRADING OPPORTUNITIES

Stocks

offer opportunities to long-term investors based on a company’s performance.

There are many advantages and disadvantages when trading stocks. Some feel that

stocks should be a buy-and-hold investment vehicle, and I agree to some extent.

I believe the world and business move in cycles, as does any industry or

business sector. Investors need to monitor which sector or industry is hot or

running cold, as the dot-com bubble demonstrated. Since we can learn from

history and a picture speaks a thousand words, let’s go over a few chart

examples if you want to know more about the disadvantages of investing in

stocks. If you were invested in these companies, had a bad experience, and do

not want to be reminded, just flip through these next few pages. If you are new

to the investment world and want to know how fast fortunes and retirement

accounts were lost, just ask investors who bought Enron, WorldCom, United

Airlines, Kmart, and FAO Schwartz just before these companies filed for

bankruptcy. And that is just a few of the companies that took major dives.

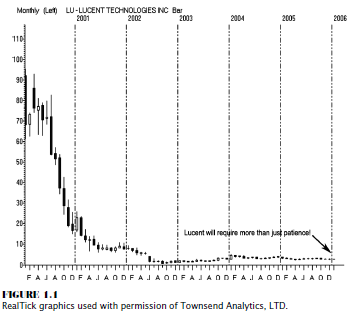

There are those investors that are hanging onto hopes of their stocks coming

back to life, companies like Lucent, as shown in Figure 1.1. Lucent

Technologies, Inc., engages in the design and delivery of systems, services,

and software to communications service providers, governments, and enterprises

worldwide. It will take a lot more patience to see this stock come back to

life. This stock was going to be the next IBM of the telecommunications world,

which goes to prove that you can’t believe everything you hear.

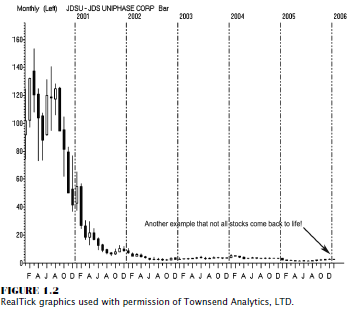

Then

there was the new age revolution of fiber optics. Remembers JDS Uniphase? This

company provides communications test and measurement solutions and optical

products for telecommunications service providers, cable operators, and network

equipment manufacturers. The company operates in three segments: Optical

Communications, Commercial and Consumer, and Communications Test and

Measurement. As Figure 1.2 shows, this stock has just never come back to life.

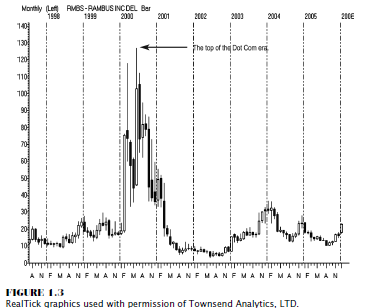

Then

there are some companies that had investors gleaming with joy— that there was

never a chance those stocks would drop, but drop they did. However, not all

stories have bad endings. Take a look at Rambus, Inc., a company that provides

chip interface products and services. Its memory interface products include XDR

memory interface, RDRAM memory interface, and DDR controller interface

technologies, which provide an interface between memory chips and logic chips.

Figure 1.3 shows that there is life and hope for some stocks, this one

included.

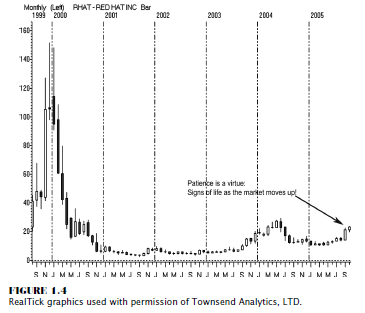

One more

darling from the Internet craze was Red Hat, Inc., which provided a competitive

operating system to Microsoft. Red Hat has related software and services based

on open source technology for various enterprises.

Its

products include Red Hat Enterprise and Linux Red Hat Application Solutions,

which include software for managing web content and software development. The

Linux systems and storage availability was a sure thing for investors, one of

those “can’t lose” propositions. As Figure 1.4 shows, that is not how Wall

Street saw it in the long run or how it rewarded the stock price. However,

there is hope; and as you can see, the stock is springing to life. The examples

here illustrate how investors need to watch over their own investments. The

markets generally overreact both on rallies and on declines. Sectors and

business cycles change; competition can force companies to lower prices, thus

resulting in lower profit margins. Business models, consumer spending habits,

and the leadership or management of a firm can change. That can have a direct

impact on and can change the morale and the business structure of a company.

And that is what can affect a company’s bottom line.

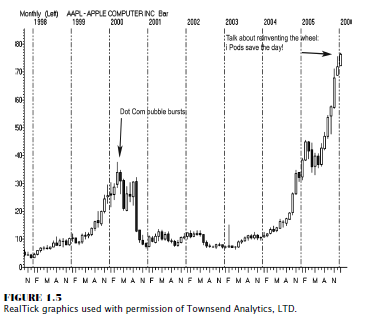

The

dot-com implosion and stock market crash did not wipe out all companies; and,

of course, some companies fared better than others. A great example of bringing

a company back to life is, without a doubt, Apple Computer, Inc.! This company

manufactures, designs, and markets personal computers and related software, services,

peripherals, and networking solutions worldwide.

The

company’s products and services include the Macintosh line of desktop and

notebook computers. It was the introduction of the iPod portable digital music

player, accessories, and services that helped propel this company into a killer

performer and one of the best comeback stocks from the dot-com and stock market

peak in 2001. Steve Jobs is the cofounder and CEO of Apple; and as I stated a

moment ago, it is leadership and motivation that can help inspire a company to

great fortunes, as Figure 1.5 shows.

When you

look at a strong performer of a stock in a specific sector, traders and

investors are obviously looking for appropriate risk/reward opportunities to

trade that stock. There are many choices and various strategies to employ. This

is the selection process of what we do in “finding opportunities and selecting

the right strategy.” Once again I call it the “let’s make a deal” game. What we

are doing is simply looking for the best strategy that maximizes our level of

expected returns while minimizing our risks. We are looking for the optimal

trading strategy. Traders can examine and weigh what is the most appropriate

risk/reward perspective:

· Door Number One: Could be an outright stock purchase with a selective stop-loss.

· Door Number Two: Could be utilizing the options market. That can be an exciting and worthwhile exploration of a simple purchase of a call option to utilize leverage or the use of a more complex strategy, such as a bull call spread, or a hedging program, such as a collar strategy. The latter uses the premiums collected from the sale of an out-of-the-money call option to purchase a close-to-the-money put option, which in turn protects the price erosion of an underlying stock position.

· Door Number Three: Could be taking a trading opportunity by implementing a spread strategy, which would involve buying one stock and selling short another. This is a sophisticated strategy and one that beginners should study extensively prior to implementing. However, if you enjoy following and understanding who and what the competitor is in a specific sector or industry group, this could be your cup of tea. Selecting the right stocks requires extensive research and a good working knowledge of the fundamentals of that sector or industry. After all, you are looking for one company to outperform the competitor, so you need to know as much as possible about that business.

Trading

decisions and correct stock selection involve more than looking at a chart and

a few technical indicators. I believe it helps to look a little deeper in

expected earnings forecasts and price-to-earnings (P/E) ratios to see if the

stock is expensive or cheap relative to current prices. Calculating P/E ratios

is an easy concept; for example, if a stock is trading at $40 per share and has

an earnings of $4 per share, the P/E ratio would be the price of the stock

divided by the earnings—$40/$4, or 10 times earnings.

The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex : Tag: Candlestick Trading, Stock Markets, Pivot Point : stock market trader jobs, stock trading internship, equities trading jobs - Stock Trading Opportunities