Leverage System in Future Markets

Stock Index Futures, Tandem Trading Techniques, A Case in Point

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex ]

We will go over several techniques for helping you identify trading opportunities in the futures markets. So far we have gone over using exchange traded funds versus stocks; pairs trading in related stocks; and using commodities for identifying opportunities in ETFs, such as the oil service.

FUTURES MARKETS: LEVERAGE SYSTEM

We

will go over several techniques for helping you identify trading opportunities

in the futures markets. So far we have gone over using exchange traded funds

versus stocks; pairs trading in related stocks; and using commodities for

identifying opportunities in ETFs, such as the oil service.

HOLDRs

(OIH) or the U.S. Oil Fund (USO) versus crude oil futures. The Euro Currency

Trust (FXE) is a more direct move for stock traders playing the euro currency

futures versus the U.S. dollar. Then there is the street- TRACKS Gold ETF (GLD)

compared to the CBOT electronic gold futures contract, or now a trader can use

the iShares Silver Trust to trade against the physical silver market.

Stock

traders can now apply and take advantage of so many commodity markets; but as I

mentioned, the futures market is a great investment vehicle to many savvy and

financially well-funded traders. Even smaller-sized traders can benefit from

trading the futures market through the responsible use of the margin system,

otherwise referred to as a “good faith deposit.” What is a futures contract? It

is a legally binding agreement to buy and sell a commodity or financial

instrument sometime in the future at a price agreed upon at the time a

transaction was made. Contracts are standardized according to delivery points

of interest, quality, quantity, and time of accepting or making a delivery. It

is estimated that less than 3 percent of all transactions actually result in a

delivery. In the case of stock index trading, there is a cash settlement over

the value of the contract.

Stock Index Futures

For day

or swing traders following the stock market, the futures market offers an

advantage over stocks from tax liability perspective. Always check with your

accountant; but, generally speaking, profits generated in a futures account are

taxed at a rate significantly lower than that for a stock account.

One

confusing aspect and perhaps a drawback for many traders switching from

equities or even forex to trading futures is that there are so many products

with various contract sizes. There is no consistency or constant in tick value

fluctuations or dollar value in the price changes. For example, the CBOT

mini-Dow contract is $5 times the overall Index. When the Dow was at 10,500,

the overall value was 52,500. The margin was set at $2,600, or just under 5

percent. E-mini-S&Ps are 12.50 per tick (four ticks per point). If the

point value is $50, the overall value of the contract if the S&P is at

1,200.00 is $60,000. In the currency markets, the euro is 12.50 per tick; the

Canadian dollar is 10 per tick; the British pound is 6.25 per point but trades

in a minimum two-tick fluctuation. (In my first book [A Complete Guide to

Trading Tactics, Wiley, 2004], I listed all the commodities and the contract

sizes on pages 8 and 9; please refer to that for a comparison. Or you can ask

your futures broker to provide the listing of contract specifications.)

The

exchanges where the individual futures products are traded set the margin

requirements. Generally speaking, an initial margin requirement on a futures

product runs anywhere from 2 percent up to 10 percent of a contract’s overall

value. So now a trader needs to know which exchange the product is traded on,

how much risk capital is needed to invest per contract, and how much each point

value is. Let’s look at the New York Mercantile Exchange’s crude oil contract:

The contract size is 1,000 gallons; every tick or point fluctuation equals $10.

A $1 move per contract is a $1,000 price move. When prices were at $65 per

barrel, the contract value was $65,000. The margin requirement was, at one

point, nearly $9,000 per contract, almost 14 percent of the overall market

value. The extremely high margin requirement reflected the extreme level of

volatility and the inherent risk associated with that increased volatility.

The

futures markets also have a value for stock traders to make decisions on asset

allocations to their stock portfolios. In the agriculture sector, for example,

you can study the price direction of soybeans, use traditional technical

analysis tactics to determine the strength of a trend, and see if corresponding

stocks linked to that market are worth switching or allocating funds toward. In

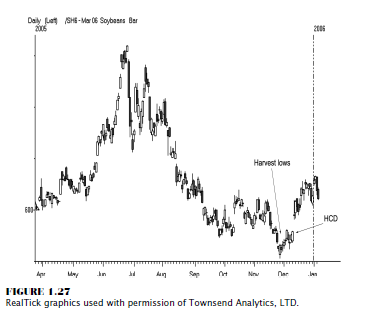

Figure 1.27, we see soybeans making a seasonal harvest bottom at the end of

November.

Another

advantage futures have is that you can trade signals to diversify in other

investments. Anticipating that the market may establish a seasonal bottom, you

may want to explore stocks directly linked to the agriculture industry, instead

of being exposed to potential risks due to what might appear to be an

overleveraged investment vehicle, such as a futures contract. After all, every

penny in soybean futures was $50 at the time that I was preparing this book,

and the minimum margin requirement was $1,148. That means that on a small 20

cent move, you could lose nearly 95 percent of the initial investment per

contract.

There are

other considerations you could use, such as an options strategy, to effectively

reduce risk exposure, such as going long a futures contract and buying a put

option for protection; but in this strategy, you need to time the right option

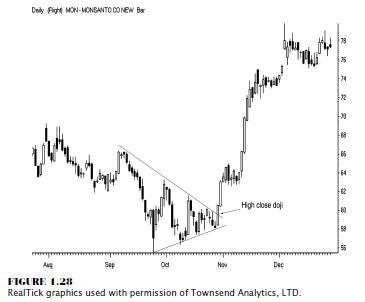

expiration. An alternative strategy would be going long a related market, such

as stock in Monsanto shown in Figure 1.28.

Notice

that this stock exploded in early November. The best part here is that there

were seasonal factors to support a buy signal; and the technical picture shows

what I call a “high close doji trigger,” which we will disclose in this book.

In fact, this is a great example to demonstrate why using a like or related

market analysis approach can help you achieve better results in your trading.

Cycle and seasonal studies can really help you in selecting stocks. The futures

markets can certainly aid in that analytical process. Not only do commodities

move in cycles, but the economy and businesses do as well.

There is

one man who sticks out above the rest as the premier expert in the field of

intermarket relationships—John J. Murphy. He has written many books on the

subject; the latest, titled Intermarket Analysis: Profiting from Global Market

Relationships, will really help you in your educational journey.

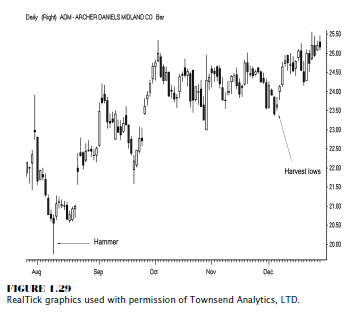

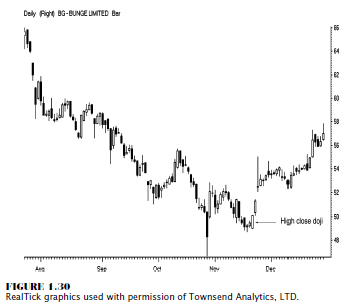

Let’s

look at two more agriculture related stocks: One in Figure 1.29 is Archer

Daniels Midland, which as you can see did rise but not significantly; however,

it did rise in tandem with the soybean market. The other stock is Bunge

Limited, shown in Figure 1.30, which mirrored the chart pattern in Figure 1.29

and moved higher at almost exactly the same time that the bottom in the soybean

futures was formed.

Tandem Trading Techniques

Intermarket

relationships have existed for years. It is very easy to track and look for

trade setups in futures from a historical perspective, but timing a trade can

be difficult due to the magnitude of the leverage as previously discussed.

Don’t get me wrong; futures are a very viable investment vehicle. I have made a

very lucrative living trading commodities for the past 26 years. I just want

you to learn that you can use futures to help make diversified investment

decisions on a broader scale.

The key

to making money in the markets is managing risk . . . end of story. Knowing the

right strategy and having exposure to other markets and strategies can help you

achieve your financial goals. Using similar or like markets or those that trade

in tandem, especially markets that have strong relationships, traders can

develop trading techniques or strategies by using signals based on one market

and applying them to another, such as commodities and stocks or an ETF. Keep in

mind that not all relationships work all the time. Look at past market

relationships, such as the dollar and gold: Generally when the dollar goes up,

gold goes down; but that certainly was not the case in 2005. How about when the

Fed raises interest rates? Generally, long-term bond yields rise as well; but

that did not occur in 2005 either. In fact, commodities and bond yields usually

trend together; and that did not occur in 2005. Federal Reserve chairman Alan

Greenspan called the decline in long-term yields a “conundrum.”

As we saw

commodity prices rise, we saw the Federal Reserve raise rates at a “moderate”

pace, acting at 16 consecutive meetings to adjust the Fed funds rate by 0.25

percent each time. This was in response to the perception that inflation was

rearing its ugly head. (As of the printing of this book, the Fed was still in

rate-hiking mode!) Due to higher energy costs and as reflected in the Producer

and Consumer Price Indexes, we had seen a pickup in inflation; and historically,

many commodity prices rise besides gold and silver, such as sugar, coffee, and

cotton.

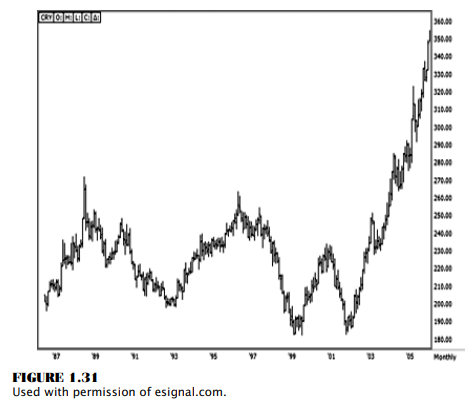

The

Reuters/Jefferies CRB (Commodity Research Bureau) Index, originally developed

in 1957, is one of the most often cited indicators of overall commodity prices,

offering investors a broad and reliable benchmark for the performance of the

commodity sector. It is traded on the New York Board of Trade and started

trading back in 1986. The “RJ/CRB” Index was revised in 2005 to reflect 19

commodity futures prices: aluminum, cocoa, coffee, copper, corn, cotton, crude

oil, gold, heating oil, live cattle, lean hogs, natural gas, nickel, orange

juice, silver, soybeans, sugar, unleaded gasoline, and wheat.

If you

examine the chart of the RJ/CRB Index shown in Figure 1.31, the stratospheric

rise is obvious and would indicate that inflation was or will be trickling down

to consumers.

Again,

price increases in commodities historically signal a rise in inflationary

pressures.

Investors

and traders can use stocks or ETFs to capitalize on commodity plays; but at

times, it pays to diversify and have a commodity account. Not all stocks offer

participation in all commodity moves, so it is wise to explore using commodity

markets as an investment.

A Case In Point

A

fundamental event, besides an increase in demand, that helped create a shortage

of supplies in energy and other commodities in 2005 was the weather. Hurricanes

Katrina, Rita, and Wilma gave a lift to sugar and orange juice futures while

harming certified coffee facilities in New Orleans and, to a lesser extent,

Miami. These weather-related events were pure commodity market plays. Let me

walk you through one of these 2005 events: The day before Hurricane Wilma

passed through Florida, my wife and I had watched the Weather Channel intensely

and decided to stick around because all the news reported that the hurricane

would be downgraded to a tropical depression by the time it crossed over Naples

and exited on the other side of Florida, in Palm Beach. The day before, we had

played golf; and it was a splendid day: 83 degrees or so, a light breeze, and

not a cloud in the sky. We were planning to leave for Chicago the following

Sunday, and we could have easily changed our tickets and left early. Well, at 6

a.m. on October 24, we woke up and discovered that Wilma had gained strength

and merged with another storm, named Alpha; and Wilma had turned into a

low-grade Category 3 hurricane! All I could think of at the moment my wife

turned the TV on was, “I better make some coffee because we are going to lose

power.” By the time the coffee had finished brewing, click, all the lights went

out.

However,

we were prepared: The cars had gas, the shutters were up, and we had a

generator; so life was not so bad for that week. The morning of the hurricane,

CNBC had called to see if I was in Florida and asked me what I thought would

happen to the orange juice crop. I did a live interview via my cell phone,

reporting on the weather conditions and what might happen to the orange crop. I

stated that “we could see at least a 10 percent price gain from the 1.11 level

to possibly as high as 1.25, as the storm would pass through sections of Indian

River County.” It was also that storm that devastated the soon-to-be-harvested

sugar cane crop. As it turns out, that was a solid prediction and exactly what

played out in the markets. If you had a commodity account, you may have taken

up that opportunity in orange juice. In fact, orange juice eventually moved as

high as 164 by May 11, 2006.

The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex : Tag: Candlestick Trading, Stock Markets, Pivot Point : Stock Index Futures, Tandem Trading Techniques, A Case in Point - Leverage System in Future Markets