Funds for Exchanging Trade

Personalized Mini-Mutual Fund, The Birth of ETFs, Hot Sectors, Hot Stocks, Currency ETFs, Commodity ETFs, The Hot Stock

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex ]

Exchange traded funds (ETFs) are listed on different exchanges and are traded on the open market.

EXCHANGE TRADED FUNDS

Exchange

traded funds (ETFs) are listed on different exchanges and are traded on the

open market. Choosing this kind of product allows an investor to select the right

sector of performance, rather than pinpointing an individual stock. The

benefits of trading ETFs compared to a mutual fund are enormous: They allow

diversification; they incur more effective transaction costs; there is pricing

transparency; and they are tax efficient. After all, it is almost impossible

for an individual trader with limited trading re-sources to effectively track

and trade every stock in all sectors of the market. ETFs are index-based

investment vehicles and are traded as a share of a single security based on an

entire portfolio of stocks. The advantage here is that the trader can mix the

benefits of applying technical analysis and fundamental analysis to a

combination of stock and index trading.

In the

most recent development, ETFs have started to include products related to

commodities such as crude oil, gold, and silver; but also they have expanded

into the forex arena by launching a euro currency product.

Personalized Mini-Mutual Fund

Instead

of agonizing over which stock will outperform in a certain sector, you can use

ETFs as an investment vehicle that has certain stocks in a basket as one unit,

listed as a sector fund. This allows individual investors to invest in a group

of stocks in a sector, rather than relying on a mutual fund to do it for them.

Moreover, many mutual funds charge management fees and at times do not fully

invest all an investor’s cash in the market. Because ETFs trade like a stock,

the price of which fluctuates daily, an ETF does not have its net asset value

(NAV) calculated every day like a mutual fund. By owning an ETF, you get the

diversification of an index fund plus the ability to sell short, buy on margin,

and purchase as little as one share.

Another

advantage of an ETF is that the expense ratios for most ETFs are lower than

that of the average mutual fund. When buying and selling ETFs, you have to pay

the same commission to your broker that you’d pay on any regular order. ETFs

allow you to sell without the uptick rule, so you can short right away, even

after the market is in a strong downtrend. You do not have to wait until the

close of the day settlement price as happens in a mutual fund. Another benefit

is the tax consequences because of shielding from capital gains due to the fact

that ETFs do not change holding like a mutual fund does. So purchasing shares

of ETFs is a viable alternative to investing in mutual funds for individual

investors. Keep in mind that many of the ETFs available today have access to

trading options around the ETF. Therefore, you can develop simple or more

complex hedge or spreading strategies tied around an ETF. There are some

negatives, such as the three- day settlement restriction and a bid/ask spread

just like any other market; but the benefits certainly outweigh the negatives, especially

for longer-term swing and position traders.

The Birth of ETFs

The

original ETF was offered to the investing public back in 1993 by the American

Stock Exchange (go to www.amex.com for more listings) and was known as the

SPDRs, which stands for Standard & Poor’s Depositary Receipts and

corresponds with the price movements of the Standard & Poor’s 500.

The more

actively traded and by far more popular ETF came with the QQQs, which directly

correspond with the Nasdaq 100. Then there are the Diamonds, which move in

correlation to the Dow Jones Industrial Average. ETFs have since expanded, and

there is now a new breed of investment vehicles to capture opportunities in

sectors known as HOLDRs. These trading vehicles are based on certain stocks in

a certain sector, known as a basket of diversified stocks in a specific sector.

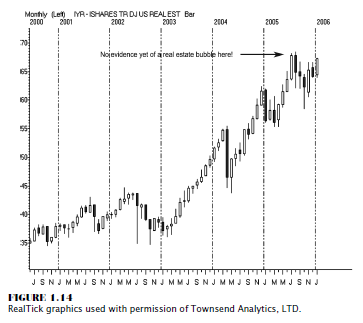

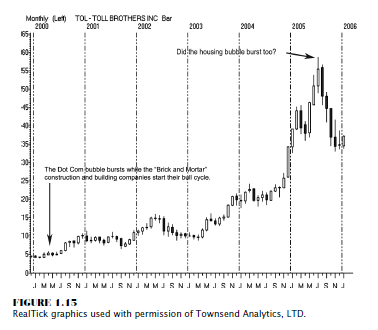

Just as

the examples comparing the U.S. Real Estate Trust (IYR) shown in Figure 1.14 to

Toll Brothers, ETFs can offer investors a relationship to overall sector

performance that is better than outright exposure in just one stock if you are

wrong in your investment decision. As we go forward in the book, I will show

you a technical analysis method such as pivot points using a longer-term time

frame and how it can help you determine entry and exit targets, such as

targeting almost the exact high in Toll Brothers, as well as other stocks.

As you

can see in the comparison of the two charts in Figure 1.15, Toll Brothers took

a nasty hit while the Real Estate Investment Trust ETF rebounded from the

correction.

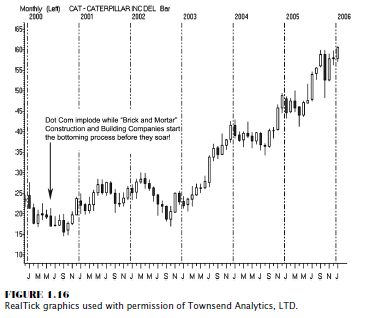

Looking

at a related or similar stock, such as Caterpillar in Figure 1.16, you would

assume that if the construction or housing and real estate markets could

experience a setback due to the 14 interest rate hikes orchestrated by the

Federal Reserve, then a company that manufactures construction and heavy

equipment might suffer a significant correction as well.

However,

that was not the case, as the chart illustrates. In fact, it is quite the

opposite. So by utilizing an ETF and investing in an overall sector, an

investor has a better chance of gaining a better rate of return. By using the

technical analysis methods that will be covered in this book, an investor can

apply those signals to ETF markets. Keep in mind that options will eventually

be available for most ETFs as well. That will offer investors quite an edge as

far as hedging or protecting against adverse market moves, too.

Hot Sectors, Hot Stocks

In order

to take advantage of a hot sector of the market, such as energy, biotechnology,

technology, Internet, brokers, semiconductors, telecom, and cyclical, to name a

few, how would an investor identify the best stocks in that sector and then

narrow it down to one or two stocks and be right? That is generally the tough part

of investing. Trading an ETF or a HOLDR can help remove that difficulty and may

help a longer-term investor achieve that goal. Moreover, it can also allow an

individual to literally trade like a hedge fund through means of diversified sectors

and allow for implementing simple to sophisticated trading strategies

integrating options as stated earlier.

With

market liquidity and market transparency, traders using ETFs can buy or sell at

current market values rather than at assigned market values based on the close,

as is the case when investing in mutual funds. In fact, some mutual funds may

not be fully vested in stocks at a given time. This means your cash may not be

working at 100 percent capacity.

Currency ETFs

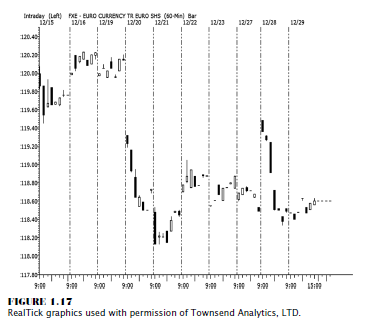

This book will also reveal more about

the forex markets or foreign currency trading. And on that subject, there was a

new ETF that may appeal to those who want to participate in currency investing

but have neither the time capacity nor the desire for excessive leverage

exposure. Rydex Investments launched the first-ever currency-based

exchange-traded product back in December 2005.

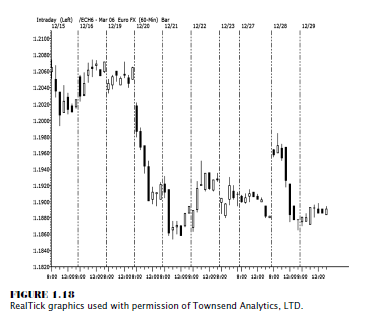

The Euro

Currency Trust (FXE) is an ETF that tracks the price of the euro, with each

share representing about 100 euros plus accrued interest. Shares of the trust,

called “Euro Currency shares,” trade on the New York

Stock

Exchange (NYSE). The ETF has a 0.4 percent annual fee. Investors generally pay

commissions to buy and sell ETFs, which trade daily on exchanges as stocks do.

Initially, the trust registered 17 million Euro Currency shares, for a total

offering price of about $2 billion. Shares of the ETF can be sold short and are

eligible for margin, as most ETFs are. Notice the correlation of price movement

in the ETF shown in Figure 1.17 with the euro FX currency futures contract

shown in Figure 1.18.

Granted

there is more liquidity in the price of the euro futures contract; but keep in

mind the that the euro ETF was in its third week of trading after its initial

launch date. I suspect that by the time this book is published, the volume and

liquidity will improve dramatically.

Commodity ETFs

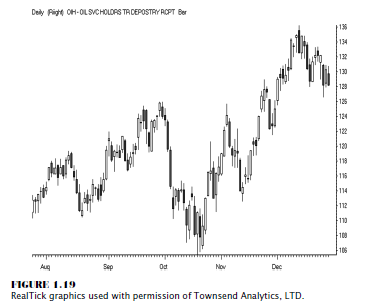

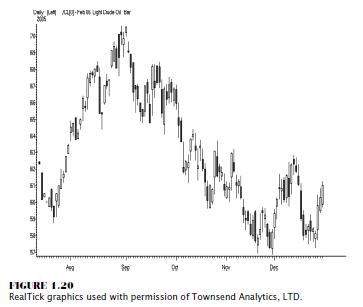

Not all

ETFs track the price movement of the underlying derivative market exactly. Take

for example the OIH chart shown in Figure 1.19. As you compare moves in the underlying

commodity of crude oil, as shown in Figure 1.20, you will see that at times the

correlation is not 100 percent exact.

In fact,

at times the ETF has actually been a leading price indicator of the underlying

commodity price move! Now there is an ETF that is more closely correlated to

crude oil, such as the United States Oil Fund (USO).

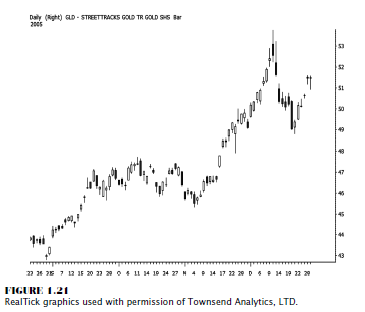

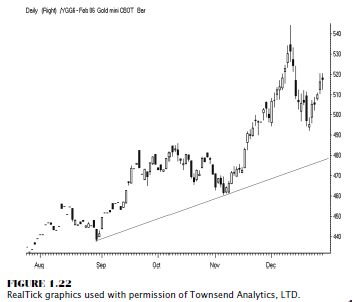

The

example in Figure 1.21 is street TRACKS Gold ETF, traded on the NYSE. It was

launched in late 2004; and as of December 2005, when I started writing this

book, it was trading roughly 2.1 million shares a day. It has attracted $5.65

billion from investors. Each share of the ETF represents one-tenth of an ounce

of gold, which allows mutual funds or private investors to invest in gold

without actually owning the metal. It mirrors or tracks the price movement of

gold almost exactly, as you can see from Figure 1.21 when compared to the gold

futures chart in Figure 1.22.

The

objective of the trust is for the value of its shares to reflect at any given

time the price of gold owned by the trust at that time, minus the trust’s

expenses and liabilities. The trust is not actively managed. It receives gold

deposited with it in exchange for the creation of baskets of iShares. The trust

sells gold as necessary to cover the trust’s liabilities, and it delivers gold

in exchange for baskets of iShares surrendered to it for redemption.

The trust

is not an investment company registered under the Investment Company Act of

1940 nor a commodity pool for purposes of the Commodity Exchange Act. This is

traded on the American Stock Exchange (AMEX).

Figure

1.22 shows the CBOT gold mini contract; and as you can see as you compare the

two charts, the price movement in the gold ETF shown in Figure 1.21 mirrors

almost exactly the price movement in the gold futures contract.

For

silver bulls, bears, or spread traders, the newest ETF addition was the AMEX

iShares Silver Trust (SLV). It is a fund based on the daily price of one ounce

of silver as set by the London Bullion Market Association. Those spread traders

buying gold or selling silver now can use ETFs. The key in showing you the

various markets as compared to the ETFs is that you realize that once you

identify the opportunity, you then can make a good decision on which

opportunity best presents itself. While futures offer the leverage, you may

want to invest longer term; and an ETF would be right up your alley without

having to pick a gold or silver mining stock. If you are bullish on precious

metals but don’t want to buy the physical metal and if you have the luxury to

trade options, then an ETF would be the right choice.

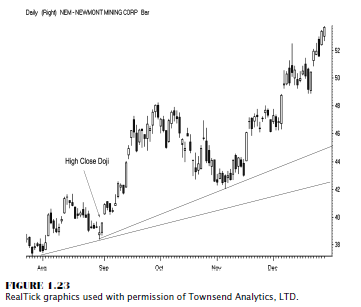

It does

not go without saying that an outright stock selection can provide a great

return and can at times outperform the sector and even the underlying market.

Look at the price move for Newmont Mining in Figure 1.23. This stock took off

and never looked back, even when the price of gold and the gold ETF made a

price correction. There are times when that can happen. Even if you were to

purchase long call options, the most profitable rate of return comes from the

leverage of an outright long call option position in a straight up move, such

as Newmont experienced. The question is how many times can that trade and, more

important, the timing of such an event be replicated.

Another

advantage of an ETF is the availability and structured use of iShares. If you

are trying to match the most liquid investment vehicle with a specific sector

or group of like stocks, this may be the right investment choice. IShares are

considered to be like an open-ended mutual fund that reinvests dividends. This

investment class is always fully invested in the market; so when the market

moves up and you are long, you would fully benefit. These index funds also

trade just like stocks. Each fund share represents a proportion of ownership in

each stock that makes up the index. As we have briefly discussed, to make the

right choice in an investment and choose the right stock, you can utilize

fundamental analysis, such as earnings per share and market capitalization, to

determine what the potential futures earnings might be. This data can help you

determine if the stock is ripe as a buying opportunity or if the price is too

high or overvalued and should be avoided.

Considerations

that can never be determined are the hidden demand for a company’s product and

the way the company is run, to see if the profit margins are high or if

operating costs and deep discounts to retailers cut into the company’s bottom

line. Therefore, it could be prudent to possibly play the sector through an

ETF, which effectively would eliminate the issue of selecting the wrong stock

or the underperformer of that specific sector.

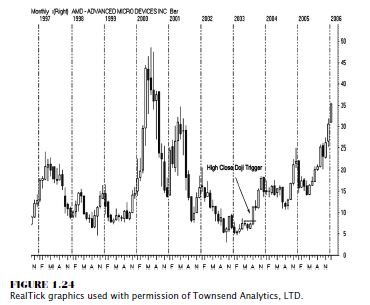

The Hot Stock

Take, for

example, one of the most amazing come-from-behind stories in 2005 and early

2006. Advance Micro Devices (AMD) triumphed, surpassing Intel’s price level. It

would have taken patience and discipline to stick with this winner; but

outperform it did, and what a hot stock it was, as the chart shows in Figure

1.24!

For a

specific ETF or iShare that would list AMD and Intel, you would look at the

iShares Goldman Sachs Semiconductor (IGW) listing. The top 10 holdings as of

12/31/2005 were Texas Instruments, Intel, Motorola, Applied Materials,

STMicroelectronics NV, Marvell, Technology Analog Devices, Broadcom, Advanced

Micro Devices, and Maxim Integrated Products.

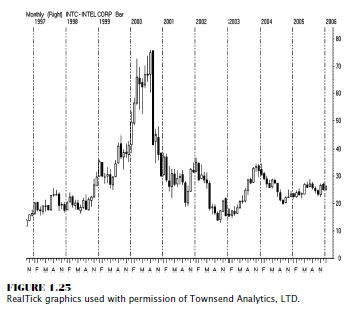

Intel was

a darling among institutional traders and mutual funds, but it had not

performed well, let alone offered enough volatility to day trade or even swing

trade a position. There was just not enough movement in this stock, as Figure

1.25 shows.

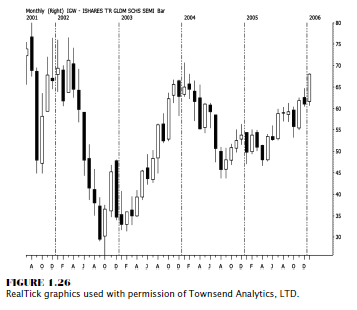

So how

was an investor to make money, and how would one possibly choose to invest in

AMD instead of Intel? Actually, once a few simple concepts of identifying

market price momentum through candle charts are covered in the next few

chapters, you will see how and why to stick around when a market goes into a

trending phase. Also, once you learn these techniques, it will be pretty easy

to help select the right stock. Another simple investment decision would be to

buy the iShares Goldman Sachs Semiconductor ETF! As you can see from Figure

1.26, the semiconductor ETF moved up. It would have been a far better trade

simply being outright long AMD from under 15 in March 2005, but the torture of

watching Intel go nowhere would have been a reason to buy the semiconductor ETF

and participate in a profit.

The key

in using these vehicles is for those who like a specific sector and do not have

unlimited resources to buy a wide spectrum of stocks. It is also appealing to

those who want longer-term trades and who hold a regular day job and cannot day

trade for a living, at least not yet.

Once

again, the difficulty of choosing the right stock in a competitive industry in

a specific sector can be overcome; and it may be more profitable by considering

trading an ETF. The previous comparisons of Best Buy and Circuit City, Dell and

Apple, and AMD and Intel all are excellent examples of how an investor may have

a difficult time anticipating which stock outperforms another in a specific

sector. Therefore, for a longer-term stock trader, ETF investment vehicles

could be a solution, helping to boost the bottom line, and can be added to his

or her investment portfolio.

ETFs and

some HOLDRs have the greater advantage of trading put and call options within a

prescribed period of time. An investor can even buy calls such as on the

pharmaceutical HOLDRs. Here is a tactic that I have used before with some

success, especially if there are buy signals on several individual stocks

within a sector. Go ahead and purchase, with a reasonable time until

expiration, an in-the-money or close-to-the-money call option on the HOLDR

itself. The pharmaceutical HOLDRs can be traded based on signals from Abbott,

Merck, and Pfizer.

So you

can utilize ETFs and their respected relatives and apply several strategies;

also you can use intermarket relationships to determine buy or sell signals and

devise a trading strategy dependent on those signals. Once you have a good feel

for a stock that correlates or links best with an ETF, then you can use a

spread or “pairs” trading strategy or even a hedge strategy using options.

Deciding what is best for your risk capital making, using an ETF, you no longer

need to make a precise pick for a stock in a specific sector.

In

conclusion, trading opportunities exist in these investment vehicles for all

investors; and best of all, they respond quite well using technical analysis to

project support and resistance levels as derived from pivot point analysis and

the momentum techniques that certain candle patterns indicate, which are the

specific techniques disclosed in this book. This knowledge should give you, the

individual investor, quite an edge in the market!

The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex : Tag: Candlestick Trading, Stock Markets, Pivot Point : Personalized Mini-Mutual Fund, The Birth of ETFs, Hot Sectors, Hot Stocks, Currency ETFs, Commodity ETFs, The Hot Stock - Funds for Exchanging Trade