Become the Next Warren Buffett

how to become the next warren buffett, becoming warren buffett

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex ]

I believe that stocks should be traded as an investment, but there are many ways to capture a profit. I must say for all investors and for every trader, you can start your own mutual fund. It requires discipline not only to open a stock account but also to fund it and add to it every month.

BECOME THE NEXT WARREN BUFFETT

I

believe that stocks should be traded as an investment, but there are many ways

to capture a profit. I must say for all investors and for every trader, you can

start your own mutual fund. It requires discipline not only to open a stock

account but also to fund it and add to it every month. If you are a new

investor, just reading this book to see if trading for a living is for you, it

is imperative that you start somewhere and start with a select stock account

first. The discipline is that you should add money in the account every month,

like you are paying a bill. If you are under 30, consider it your retirement.

You are paying your bills in the future now. That is some of the best advice

anyone gave me, and I think it is worthy of passing on to you. Once you gain

more experience, you can separate long-term investing from short-term

speculative trading, which is one form of diversification. After all, you may

see a long period of flat performance in one of your core holdings. Short-term

day trading, if you have the time and resources, can be a rewarding experience.

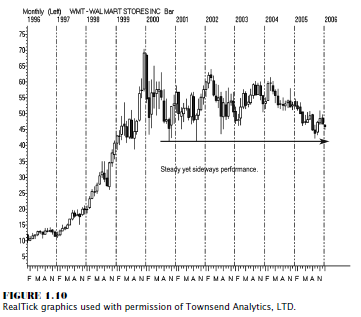

Imagine owning Wal-Mart and for literally seven years experiencing a loss to a

flat performance. Figure 1.10 illustrates the market’s sideways move in one of

the world’s biggest retail stores.

If you

are considering supplementing your investment techniques, one of the many

drawbacks of trading stocks for a short-term day trader with a small trading account

is that you are limited to how many trades you can make, especially if your

account is less than $25,000 and you are not signed up for a margin account. In

that case, you are limited to five round-trip buy- and-sell trades per week due

to SEC rules. So short-term trading would not be a good consideration for

stocks. That is where trading stock index futures and forex markets takes over,

as I will explain in the following pages.

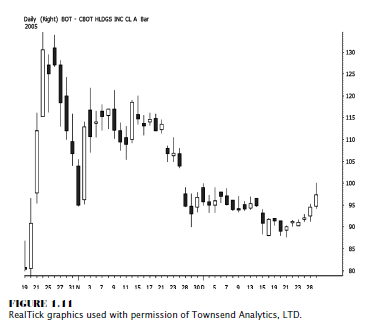

There is

one high-risk, high-reward method of trading stocks that I have not covered

yet: getting in on an initial public offering (IPO) stock. Those investors

lucky enough to get in on an IPO like Google (goog), the Chicago Mercantile

Exchange (CME), or even the Chicago Board of Trade (CBOT— stock, BOT) were able

to double, triple, quadruple, or even better, their initial investment dollars.

The Chicago Board of Trade has been

around for over 155 years, and I imagine it will likely continue to be around

for another 155 years, with little competition in products traded on its exchange

and with the increase in popularity on the electronics metals products, such as

gold and silver, plus the huge volume of trades generated in the grain markets.

And with

the action in the U.S. Treasury notes and bonds and Federal (Fed) funds

contracts, the CBOT certainly has a positive longer-term outlook for profitable

revenue growth. Figure 1.11 shows that the price exploded to nearly as high as

134 but has managed to trade back as low as 86 as of this writing. The BOT

stock illustrates that not all IPOs are guaranteed money makers; in fact,

depending on your entry, these offerings can be hazardous to your financial

well-being. The phrase “invest wisely” means “not putting all your eggs in one

basket.” Find out which is the sector leader, and go with that stock, unless

you like the underdog. In this case, the underdog would be BOT compared to CME.

As you

can see in Figure 1.11, BOT stock initially shot up from the 80s to a little

over 130. At the time I was preparing to write this book, it had not managed to

get back over 130 but traded as high as 119. I do feel that once the Treasury

reinstates issuing the 30-year Treasury bond, volume will increase, which will

translate into more revenue for the exchange. Therefore, the profitability

should improve through the next few years. If a drought scare causes the grain

complex to go through the roof, you will see this stock price move like a

rocket.

Many see

the Chicago Board of Trade mimicking the Chicago Mercantile Exchange success

story. As Figure 1.12 shows, in just three short years, CME stock went from

under 40 to close to 400 by late November 2005.

The

biggest surprise of the three had to be the gains by Google, as Figure 1.13

shows. After the dot-com implosion in 2001, not many were willing to experiment

with any Internet stock. That mentality may be the one reason why this stock

had such a move, from a contrarian point of view, that is.

The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex : Tag: Candlestick Trading, Stock Markets, Pivot Point : how to become the next warren buffett, becoming warren buffett - Become the Next Warren Buffett