Best Time to Trade

Best Session to trade, New York Session, London Session, Tokyo Session

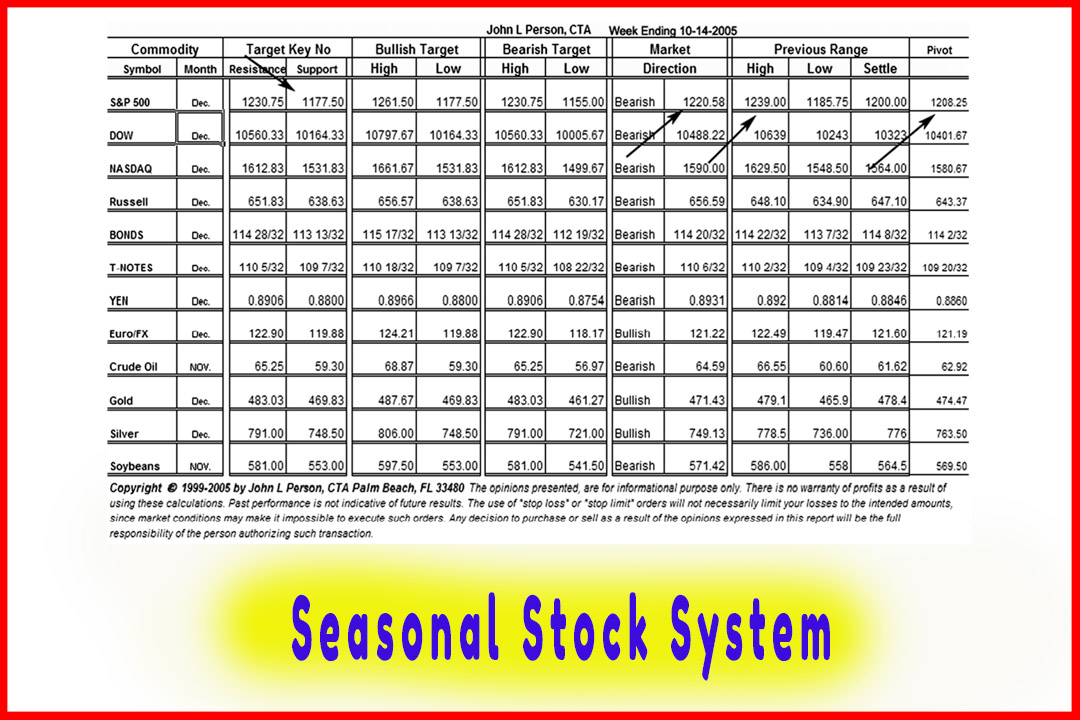

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 11. The Sample Analysis ]

“When is the best or the worst time to trade?” From a simple yet elegant standpoint, the answer for day traders in equities is lunchtime. This is substantiated by volume levels generally declining during that time frame.

WHEN IS THE BEST TIME TO TRADE?

Remember

I stated in Chapter 1 that traders need to ask more questions? Well, the more

you learn, the more you know what to ask. As a systems trader, asking how a

system performs during different times of the year is a novel idea, especially

as seasonal forces can impact a market. Ask questions such as, “When is the

best or the worst time to trade?” From a simple yet elegant standpoint, the

answer for day traders in equities is lunchtime. This is substantiated by

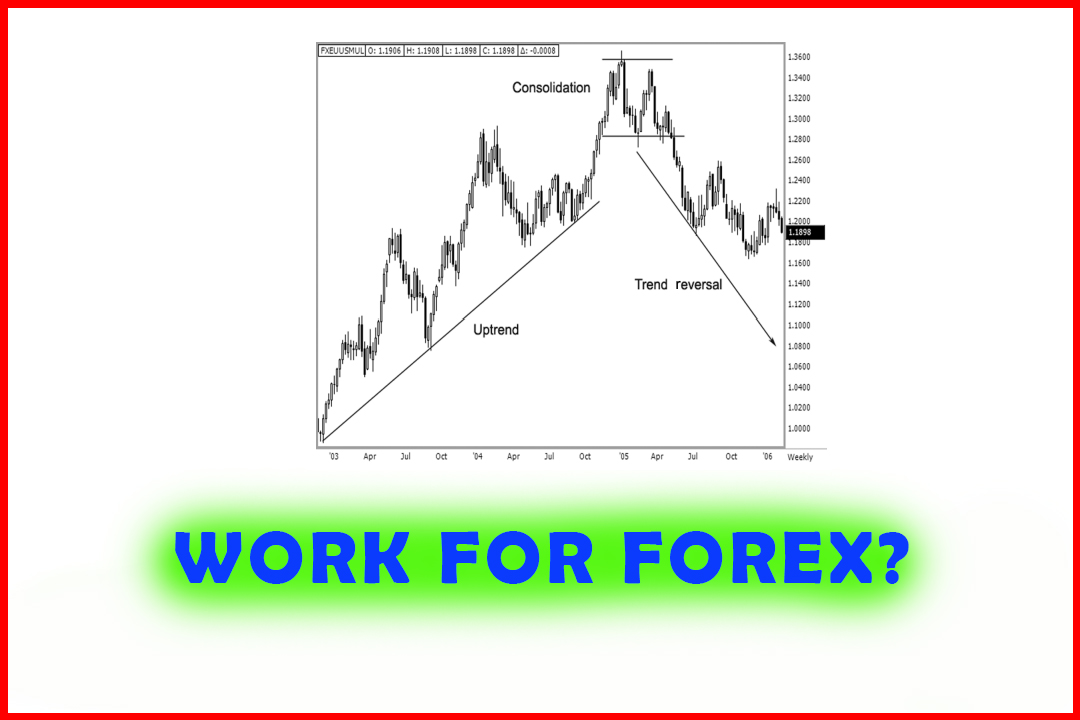

volume levels generally declining during that time frame. Forex traders note

that trading activity is light from 10 p.m. (ET) until 1:30 a.m. (ET), as we

discussed in Chapter 1. What about on a weekly or monthly basis? When does our

system perform best?

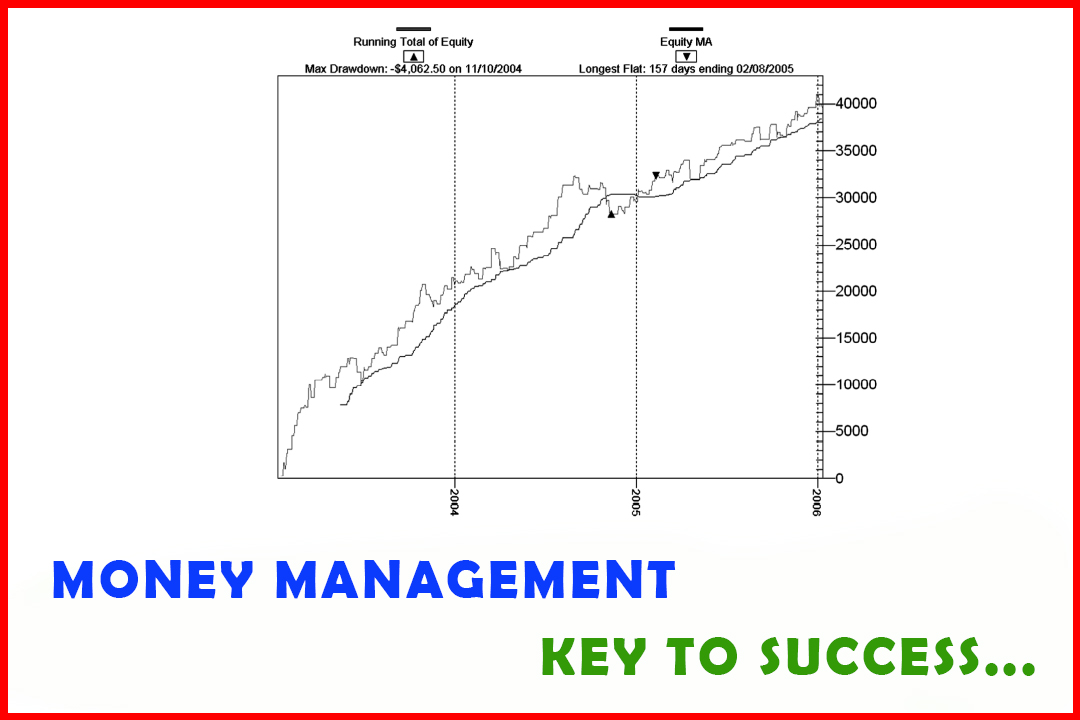

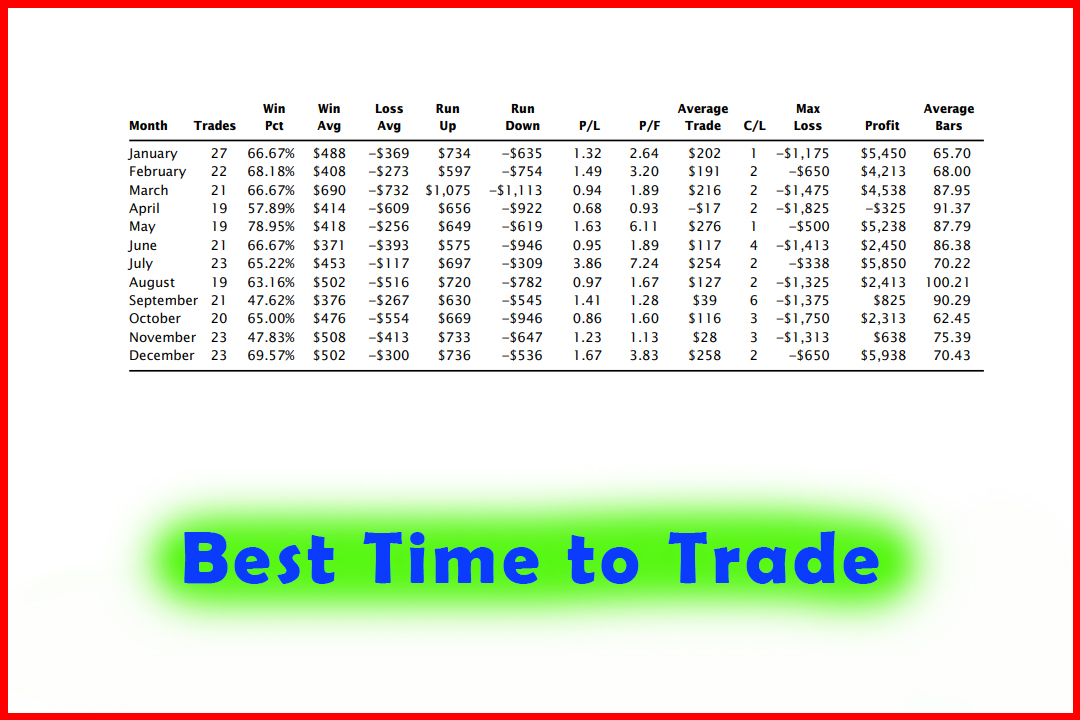

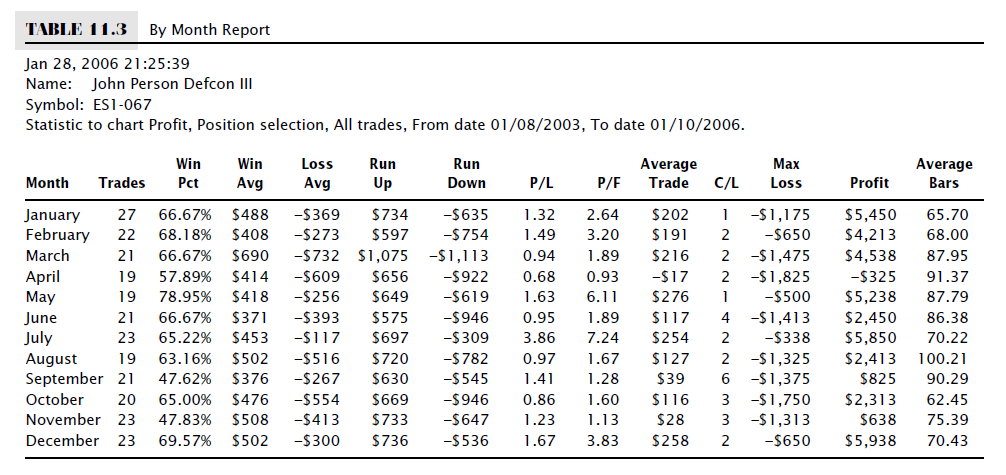

By

tracking trading performance, as shown in Table 11.3, from a historical

perspective, we can form an opinion of when the system is at peak performance

or when the market we are trading is in sync with seasonal factors. There is

never a guarantee that past performance is indicative of future results, but we

can and do benefit from studying history. Without a doubt, I do not want to go

on a major tangent here; but we are trading in a new frontier environment. The

new age of technology has more people trading online, and more people are more computer

savvy. We have intricate globalization of our economy. Trading partners with

China and even India is not like what we had just five years ago. So with that

perspective, my opinion is that looking at seasonal tendencies of a market

starting from 2000 up through 2005 would not be a huge statistical event, but

it would be more relevant than a testing period in 1990 through 1995. With that

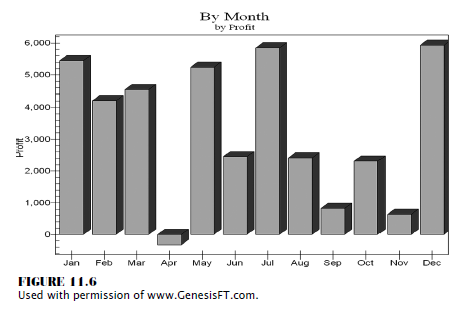

in mind, we ran a test, as the results show in Figure 11.6, to see which months

perform best with the “Defcon III model.”

Using the

Genesis Software product and asking the right questions (e.g., When is the best

time to trade?), I can get a reasonable answer. In fact, I wanted to know which

months are the best and which months are the worst in which to trade. Using the

Genesis Software, I can run backtests to see what the performance from a

seasonal perspective with the Defcon system looks like on a monthly performance

basis. Using a test period over the past three years, I am able to conclude

that April is a month to avoid trading! Based on a three-year average, this is

the month consistently delivers drawdowns. With that statistical

information, I have a slight edge in the market, as it relates to my system.

I can make a decision either to lower my contract sizes or to avoid trading

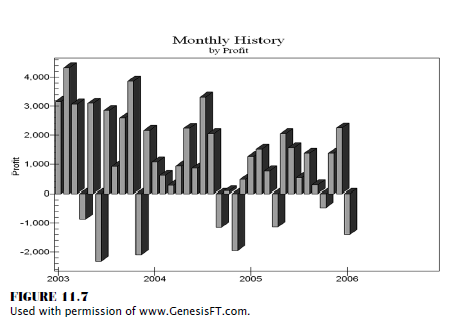

entirely. Figure 11.7 shows the yearly breakdown of the compiled results.

The more

statistics I have, the better prepared I am; and with that knowledge, I have

stacked the odds in my favor. This is the ultimate in trading tools and system

designs: being able to identify opportunities and discover the weakest link in my

chain of the trading systems.

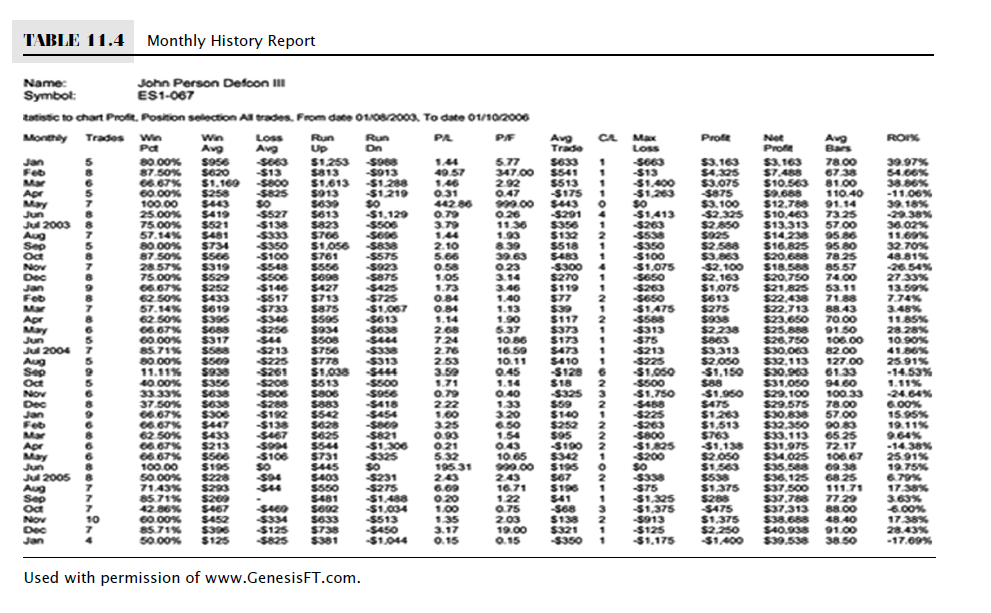

Table

11.4 dissects each month’s performance from the three-year test period which

really shows the poor seasonal performance made in the month of April for those

years back-tested.

The Candlestick and Pivot Point Trading Triggers : Chapter 11. The Sample Analysis : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Best Session to trade, New York Session, London Session, Tokyo Session - Best Time to Trade