The Sample Analysis

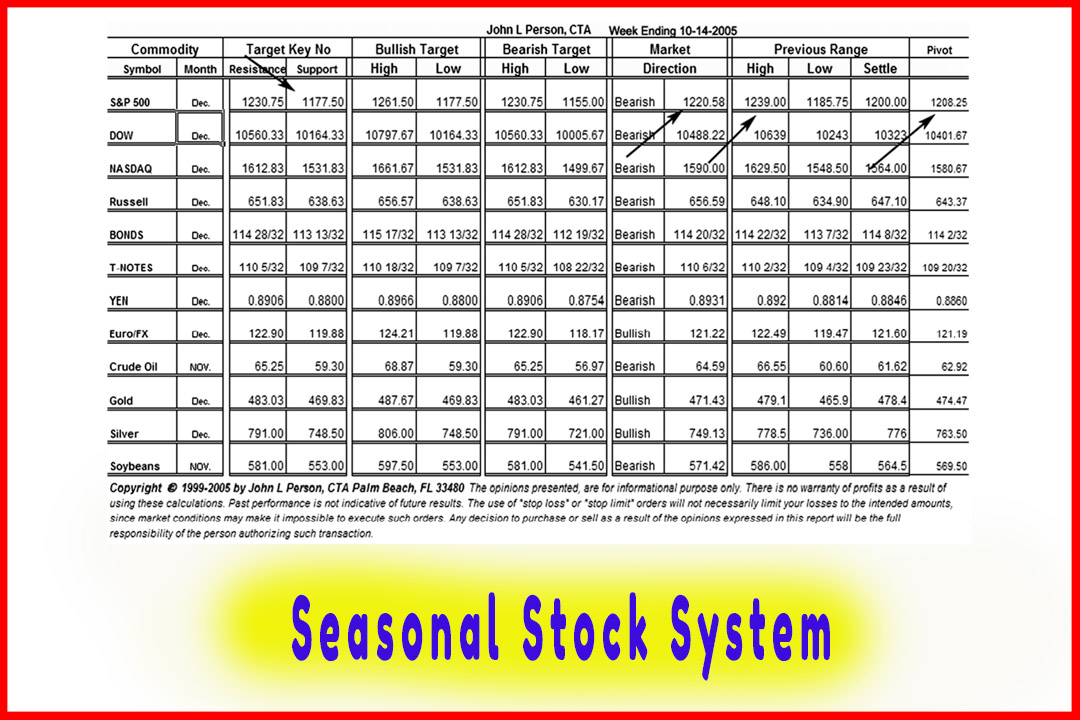

How to back testing in mt4, Back test, three-period pivot point moving average

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 11. The Sample Analysis ]

Short-term system traders make their money, leave the game, and wait to execute the next setup; they don’t have to worry about being an economist. They get in when the signals indicate and get out when the signals dictate.

The Proof Is in the Back-Testing

Short-term

system traders make their money, leave the game, and wait to execute the next

setup; they don’t have to worry about being an economist. They get in when the

signals indicate and get out when the signals dictate. It has been stated many

times and proven by history that traders who consistently make money are those

who follow a program or a set of predefined rules. These rules have been

tested, and they correspond in a variety of time periods and with diversified

or non-correlated markets.

You may

have made observations on changes in the market, such as when the stock index

futures are trending up by 10:30 a.m. (CT) on a Friday, the market has a

tendency to trade higher through the end of the day. With that said, once

you have a trading idea about the way a market moves, through your own

observation, you can apply it to computer code and have a computer generate an

alert to inform you when a signal is generated.

Through

the proficiency of computers, we can take historical data and back-test the

results to see how reliable and accurate the theories are. Not all systems work

well. Some are good in trending market conditions, and others will work well in

non-trending market environments. Therefore, it is important to back-test a

methodology for various time periods and in various noncorrelated markets to

see if the principles are sound and stand the test of time. So far, with what

we have gone over, you can develop your own rules based on pivot point and candlestick

patterns.

One such

example is if we assign a positive (+) value to a candle with a higher close

than open, if you have a sequence of three positive values after a succession

of, say, five negative (-) values, and if the low of a given candle is within

two ticks, or 5 percent of, the average daily range on a 10- day average, then

a buy signal is triggered. Another way of stating this is:

- For a positive assigned candle:

Close (C) is greater than open (O) ( C

> O)

- For a negative assigned candle:

Close is less than open (C < O)

- For a doji candle, with a neutral (=) assigned value:

Close is equal to open (C = O)

- You can program your own system to generate an exit strategy based on an average holding period of, say, seven or eight periods or until the market forms a lower close than open (C < O) or a negative assigned value and if that time period closes below the prior time period’s low.

Another

methodology or system that is a simpler program would be to combine a

three-period pivot point moving average with a five-period pivot point moving

average. After a series of lower closing lows, once the three- period moving

average crosses above the five-period moving average and if the market was

within five points above or below a pivot point first support level (S-1)

target number, then a buy signal would be generated. For added optimization,

you could add a filter that if the stochastics indicator was below the 20

percent line, once %K and %D crossed and closed back above the 20 percent

level, a buy signal would trigger.

Using the

value of the pivot point resistance target of R-1 while combining the

three-period pivot point moving average with the five-period pivot point moving

average, once the three-period crossed and closed below the five-period pivot

point moving average, within five points either above or below the R-1, a sell

signal would be generated. For added fine tuning, you could add another

element, such as a stochastics reading, so if both moving averages were above

the 80 percent level and once %K and %D both closed back below the 80 percent

level, a sell signal would be triggered.

The hard

part in coding is comprehending or understanding the software language and then

thinking like a computer. You can’t just state “sell”

when stochastics gives a sell signal. The software or computer program

does not know what your interpretation of a sell signal is.

If you

recall, in Chapter 1, I suggested that traders need to ask more questions. That

is what a system trader does. In order to develop a trading plan or a

mechanical system, you need to search for answers to question such as:

- Will this be for day or position trading?

- Will volume studies be used and, if so, how?

- What will be the average holding period?

- What methods do we want to use and what parameter will we choose?

A trader

needs to use various tools to get the job done, so to speak. That is why I have

several trading platforms and quote services. Genesis Software allows me to

develop my own “black box” of algorithms and indicators and to back-test the program.

In order to develop a good system, you need to decide if the trading concepts

are valid. Once you have come up with your set of rules or criteria, then you

can start to optimize the program. You have heard of the “Keep It Simple” rule? Leonardo da Vinci is credited with saying “Simplicity is

the ultimate sophistication.” If Leonardo liked things simple, well

then, it is good enough for me, too!

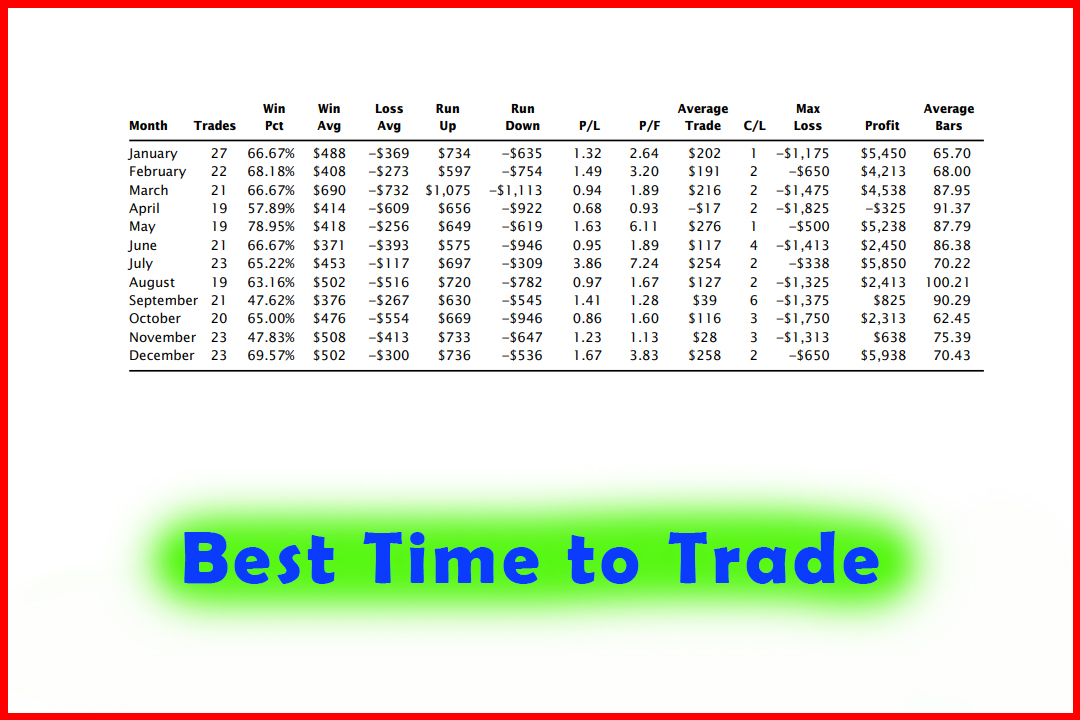

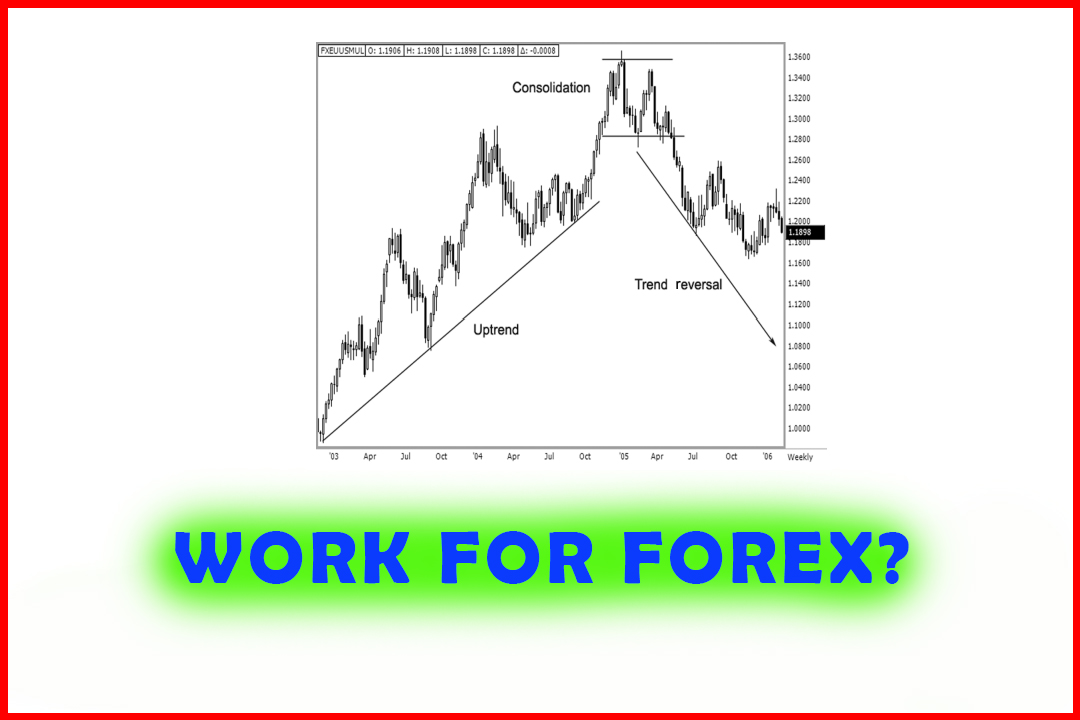

A trading

system should be designed from simple yet effective rules that blend key

concepts of momentum changes and trending conditions. A well-defined trading

strategy can be developed to generate buy and sell signals in most markets in

various time periods. Believe it or not, designing a trading system is easy to

do once you have an idea of what the call to action, or the trigger, will be to

enter a position. In this book, we have gone over several good techniques with

which you can start, such as when indicators correspond near pivot points like

the stochastics 80 percent/20 percent close line technique or the moving

average convergence/divergence (MACD) zero-line cross signal. You can develop a

system based on these two indicators and then determine how many time periods,

or the length of time, a position should be in the market. Now all you need to

determine is how many holding periods (such as 4 or 8 periods) are needed

before an exit strategy is triggered. You can develop a trigger on moving

average crossover to initiate a signal, just like the pivot point moving average

we went over in Chapter 6 or a simple moving average using 5-period versus

10-period parameters. You will want to test the system over a lengthy time

frame and with various non-correlated markets. If there is any validity to the

rules or methods, then you should see positive performance across the board.

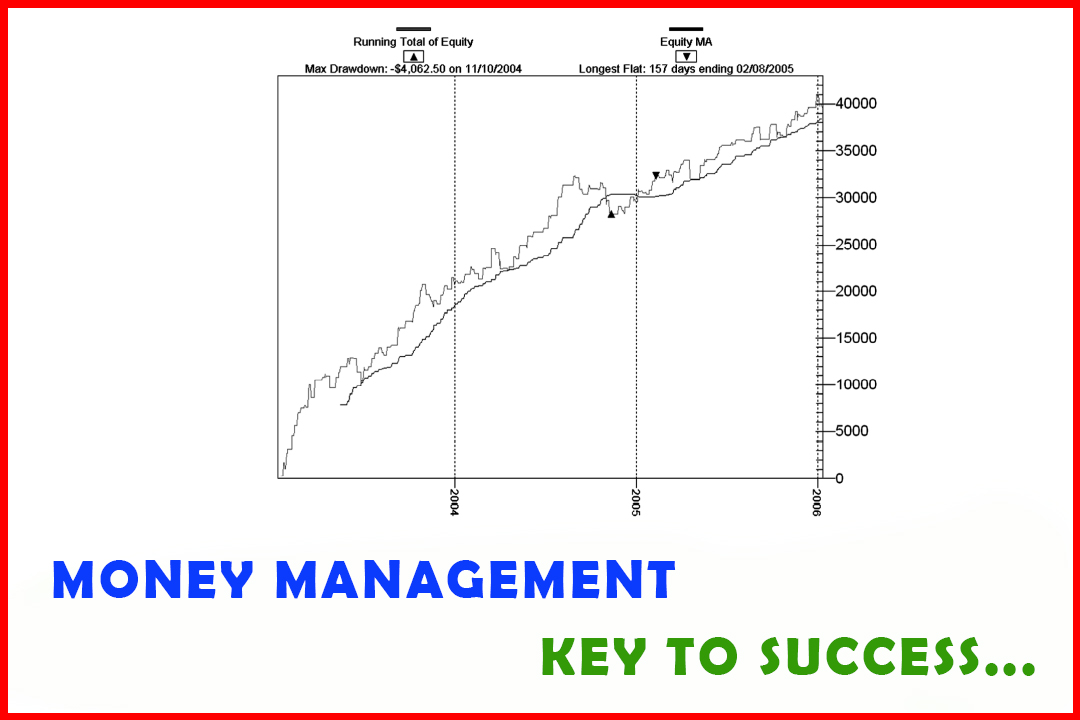

Not all

systems that show results of extremely high profit levels are best. A system

also depends on drawdowns, or periods of equity loss. Also, it is important to

have software that will show you a trading system’s weakness or will help point

out specific time periods or time frames in which you should not trade. Being

able to closely follow your drawdown patterns is a huge benefit to the

computer-friendly active systems trader, finding answers to such questions as:

What is the recovery period to gain back losses? What is the depth or magnitude

of the losses? These are very important questions because if a system has great

returns but absurd equity draw downs for long periods, then it is most likely a

poor system for an average investor to trade. When you are designing your

system, ask yourself what you want this system to do. The obvious answer is to

make money; but you also want to know how long and how deep the drawdown

periods are or whether there are consistently more winners than losers. As a

trader you need to evaluate new techniques, especially ones that increase your

profitability while reducing your risk and exposure in the market. Systems need

to be developed with the idea of triggering a turning point in the market earlier

than other indicators and other traders do. Considering that most indicators

are lagging, you need a signal that identifies turning points as they occur,

and you need to use indicators to confirm that the position is valid. Pivot

point analysis does just that, especially when combining support and resistance

levels and by implementing a moving average approach

One of

the best features or benefits to using mechanical trading systems is that they

alert a trader to initiate a trade or to act on a signal as it occurs, rather

than on a hunch or on the two main destructive emotional elements, fear and

greed. Based on a system that is tested, you have statistical evidence to

validate the entry; and that should help eliminate trading on a hunch, a rumor,

or a feeling, which is what drives most trading decisions from inexperienced

traders. As this book has demonstrated, it is not my intention to portray the

ability to buy the exact low or sell the exact high. In most cases, I am

looking for a definitive trend or price reversal to occur; and then I act on

that signal and carry a position until the market demonstrates a loss in

momentum, the time to exit the trade. The keys to winning are the ability to

practice patience and wait for the setup to develop and the discipline to act

on the trigger. Mostly, it is the ability to exit a losing trade as the signals

dictate, not to hang onto the loser. So when using a system, you will know and

understand that the mechanics are never 100 percent right and that you will

have a certain number of trades that do not work out. Once you come to grips

with that fact, it will be easier to embrace your losses rather than become

emotionally wrangled when they occur. Hopefully, you can learn from a trader

with long-term positive experiences. Good advice will get you ahead more

quickly than if you have to learn everything on your own, and it will help you

avoid costly mistakes. Take my advice: Learn a system, back-test it to see the

strengths and weakness of the method, and then trade on these testable signals.

The Candlestick and Pivot Point Trading Triggers : Chapter 11. The Sample Analysis : Tag: Candlestick Pattern Trading, Forex, Pivot Point : How to back testing in mt4, Back test, three-period pivot point moving average - The Sample Analysis