Money Management is the Key to Success

Money management, Risk management, Risk Reward Ratio

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 11. The Sample Analysis ]

Simply having a rudimentary knowledge of placing stop-loss orders is not the definition of knowing sound money management techniques.

MONEY MANAGEMENT IS THE KEY TO SUCCESS

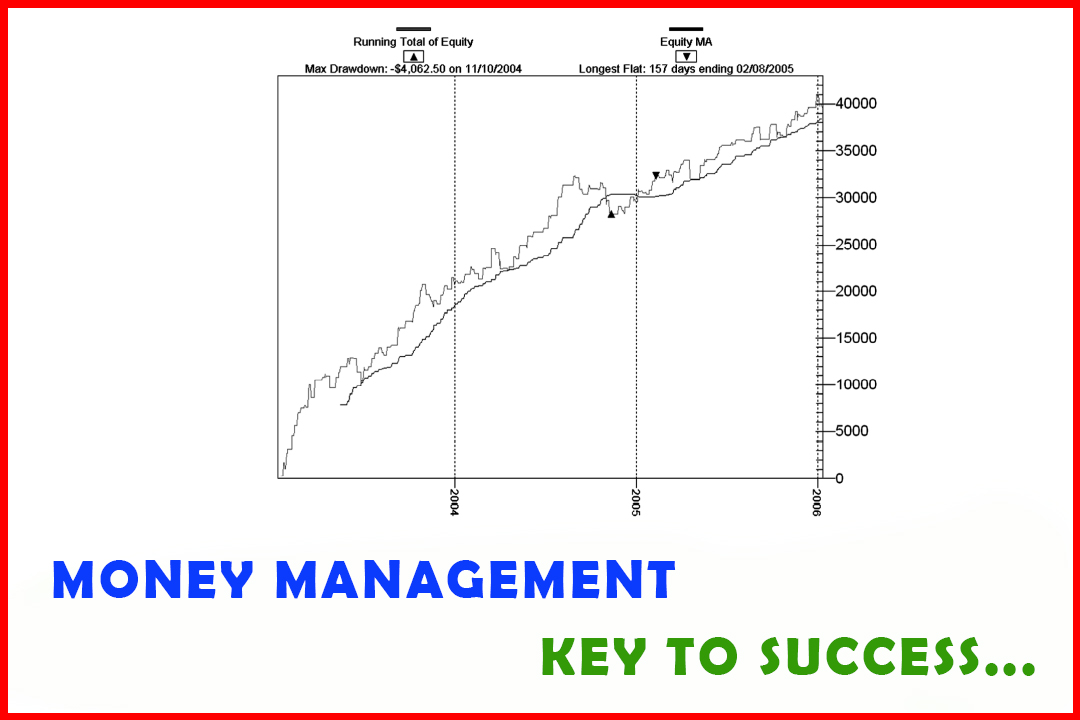

Using the

Defcon trading system, we started with a trading account balance of $10,000.

The overnight initial speculative margin for the CME’s e- mini-S&P, as of

2/15/2006 was $3,938 per contract. Therefore, with trading just one contract,

we had committed 39 percent of our trading capital at any one time. Since our

account starts with $10,000 and the system only generates less than two trades

per week, we need to define when it is appropriate to increase our lot sizes.

Aha! This is a novel idea and is what truly helps traders get wealthy knowing

when to fold, hold, or add on.

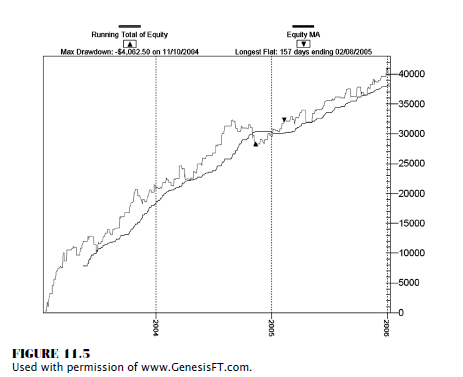

If you

look at Figure 11.5, you see a chart with an equity curve showing some pretty

good gains with an occasional bump in the road. Recoverable as it is, a

drawdown in profits occurs. Using system analysis can help you determine most

consecutive wins and losses and what the largest loss is. Armed with that

information, you can now go on to trading like a true megastar professional

fund manager—or simply a downright happy camper. Why? Because that information

will help you determine the next level of profits you have to build in order to

increase your lot size. If you do not manage your money properly and double or

quadruple your position size before doubling your account size, you could be in

for a rude awakening. As you can see, the maximum drawdown experienced is

-4,062.50 on 11/10/2004. If that was the day you decided to mistakenly increase

your lot size, it may have potentially wiped your account out.

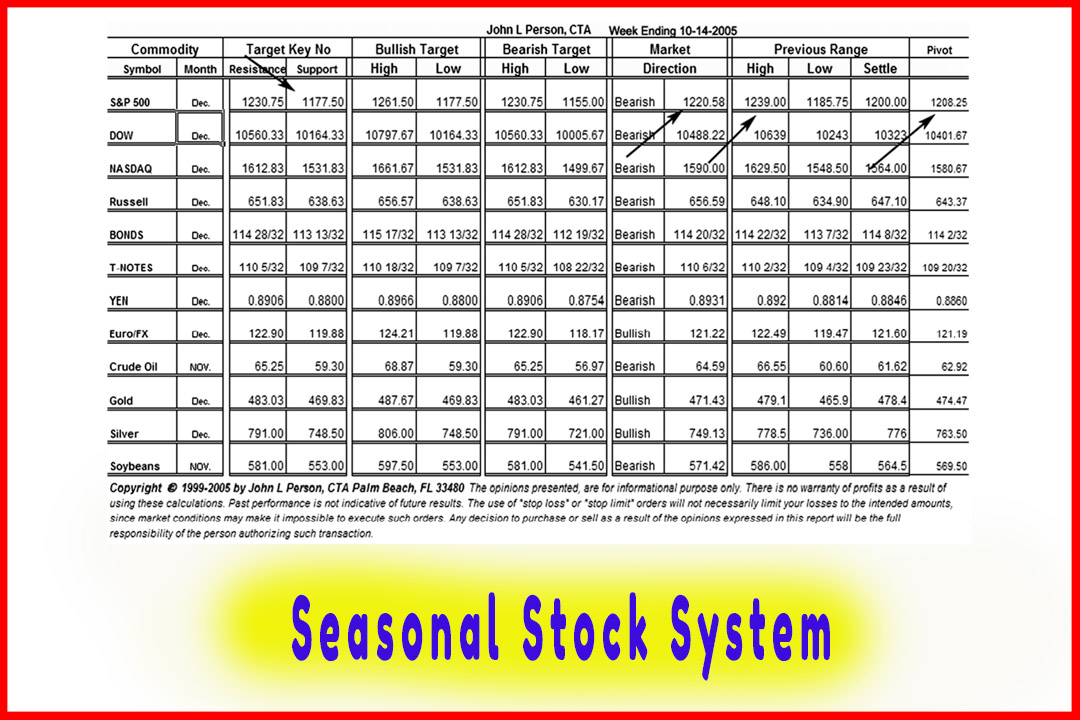

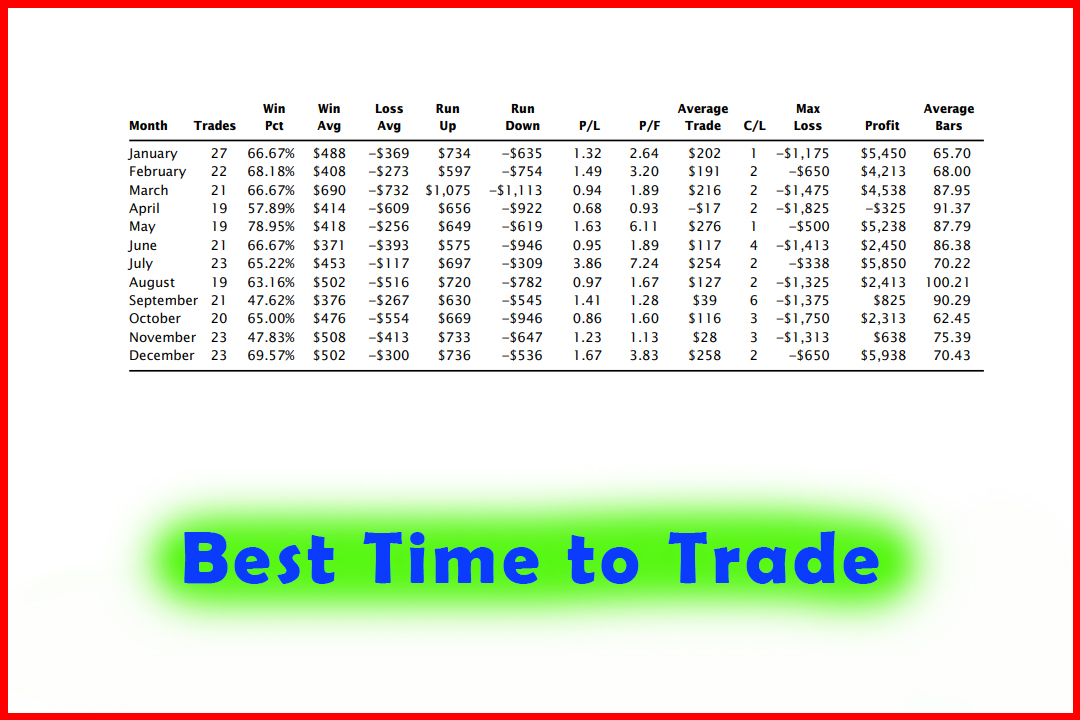

In Table

11.2, observe that the largest loss is $1,825. By increasing your lot size

prematurely or by having an imbalance to largest loss in relationship to

account balance, such as having four or more contracts on at any one time, you

could wipe out not only your gains but also the majority of your account. Using

statistics and mathematical formulas is what will give you an edge in the

markets, from both a business stance and an emotional stance. You will be

better prepared, and that should help make you a better trader.

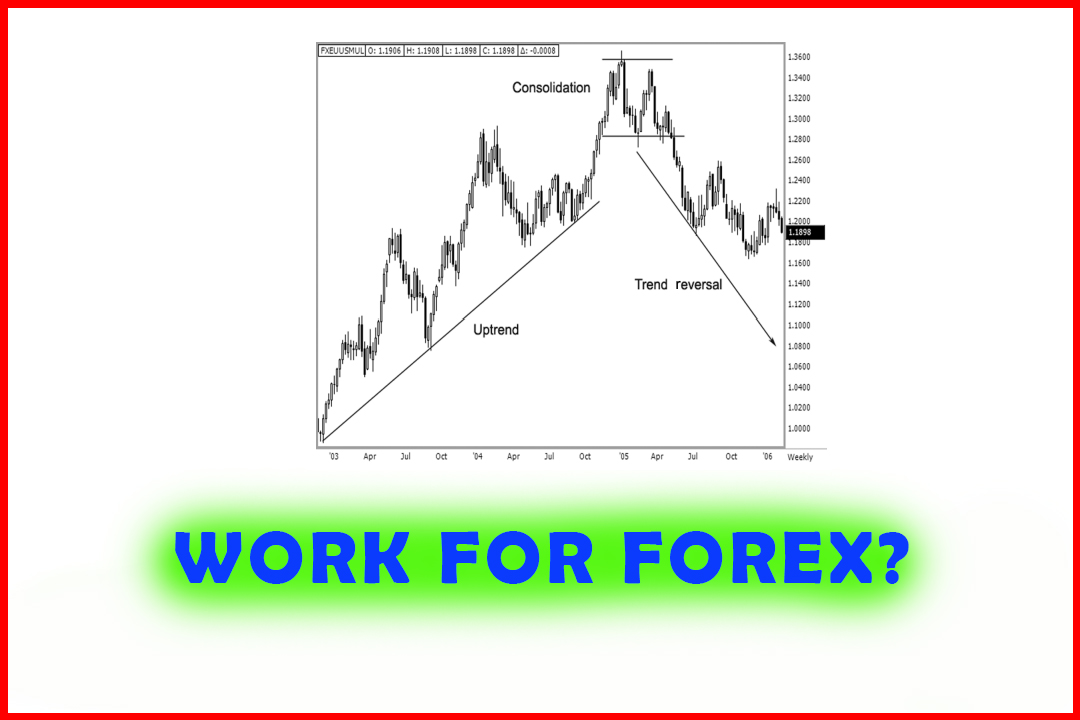

In

conclusion, one of the greatest values of data derived from back-testing a

system is that it will reveal hidden intricacies about the system. Simply

having a rudimentary knowledge of placing stop-loss orders is not the

definition of knowing sound money management techniques. You must expand your

knowledge in managing your money properly by either under- or overleveraging

your trading capital. We went over a seasonal trading strategy that Stock

Trader’s Almanac uses in the equity markets using the MACD indicator. I showed

you how you can optimize that method by introducing the use of pivot point

analysis. With the ability of back-testing a strategy, we can back-test this

theory on our own; and more important, we can learn if our system or trading

method has a seasonal factor that performs best or worst at certain times of

the year. Then, you can also determine, based on your equity size, the number

of positions you should have on while maintaining a proper risk/reward ratio.

The Candlestick and Pivot Point Trading Triggers : Chapter 11. The Sample Analysis : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Money management, Risk management, Risk Reward Ratio - Money Management is the Key to Success