What is the best day Trading Confirmation Trigger to Program?

Best trading confirmation, Best profitable trade, Best trading Strategy

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 11. The Sample Analysis ]

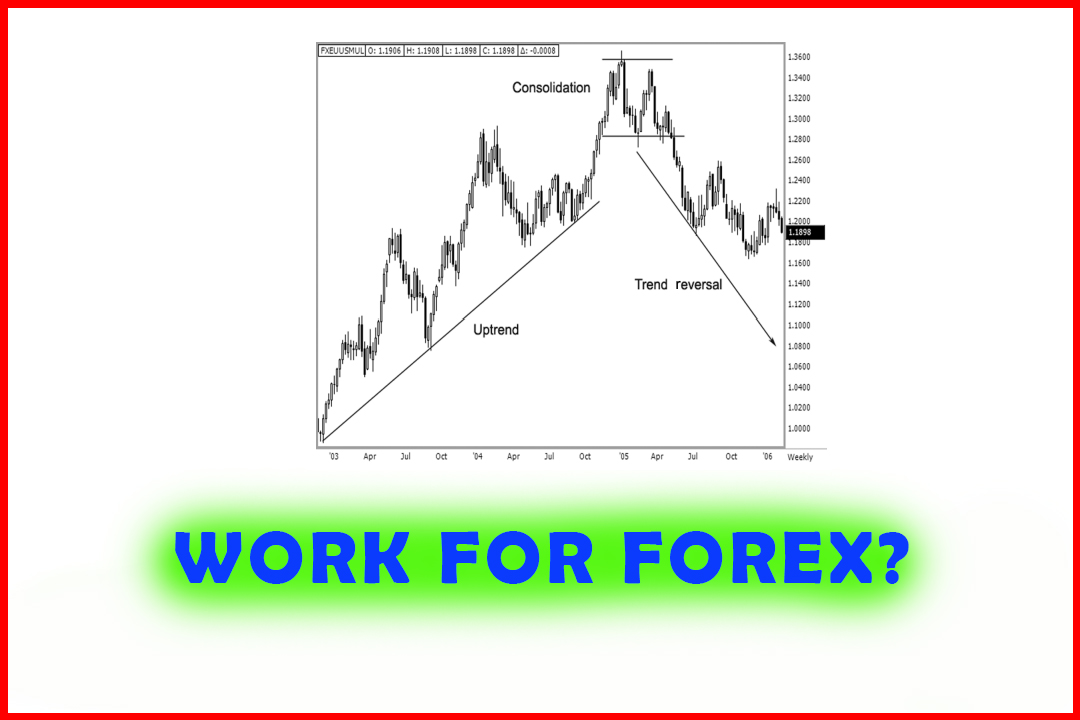

The most reliable trading signal is when the 5-minute time period triggers a buy when the 15-minute time period is also in a buy mode; in other words, the best signals are when the 5-minute period is in sync with the 15-minute time period in a pivot point moving average crossover system.

WHAT IS THE BEST DAY TRADING CONFIRMATION TRIGGER TO PROGRAM?

The most

reliable trading signal is when the 5-minute time period triggers a buy when

the 15-minute time period is also in a buy mode; in other words, the best

signals are when the 5-minute period is in sync with the 15-minute time period

in a pivot point moving average crossover system. We see this occur as it

applies to day trading the spot forex British pound as the chart in Figure 11.4

shows.

Look on

the right-hand side of the chart; in the upper right-hand corner is the

5-minute period, and directly below it is the 15- minute chart. See how the

5-minute generates the sell signal first, as it is against the projected pivot

point resistance targets; and the 15-minute chart beneath it confirms that sell

signal. This is exactly what we want to see—a sell signal triggered against resistance;

and the higher time period, such as the 15-minute component to the 5-minute

sell signal, confirming that action.

SHOW ME THE PROOF

As a

systems trader, once you have set your variables or your best selected set of

rules or criteria and have defined the parameters such as time periods, then

you can go and back-test the method. I want to show you that any system worth

following needs to show sizable profits with reasonable risks. No system is 100

percent accurate, at least none that I know of in reality. If one existed, I

would believe through the laws of probabilities that it was due for a

breakdown. There are several categories on which you want to focus that will

enlighten you as to the true validity of the methods. In essence, back-testing

allows you to closely examine your system’s inefficiencies so you can correct

the flaws. Looking at the back-test results will also help you understand when

to increase position sizes, when to avoid trading, and how to facilitate

improvements.

You want

to see if the reasons you make decisions to execute a trade consistently

generate more profits when you are right than losses when the system or trade

fails. If less than 70 percent of trades result in winning trades, you want the

winners to outgain the losses. It makes no sense to have a 70 percent winning

system that generates more losses than winners and longer holding periods.

Imagine what that will do to your psyche, not to mention your trading account.

It is

important that you understand what elements trigger a trade when the

transaction is entered or exited. This helps in determining another way to

account for slippage. For example, if the system generates buy and sell signals

on the close or on the next open, if this is a day trading program, then there

may be less chance for price gaps. However, if the system executes based on the

closing price or on the next open, such as what we have disclosed in the high

close doji pattern or the low close doji pattern, then on overnight positions

you may experience poor entry or exits. With that knowledge, you can change

your program to include the next available open, which would include night

sessions.

Let me

clarify what the night session is for various trading vehicles. As we know,

there is no official close in spot foreign currencies. Therefore, you need to

assign a daily close and then an open. In Chapter 1, I revealed that I use the

New York Bank settlement of 5 p.m. (ET) and use the open as the next

five-minute interval. As for futures, different exchanges on which various

markets trade have specific official closes and reopens for their after-hours

trading markets. The Chicago Mercantile Exchange (CME) has

GLOBEX,

the CBOT has the e-CBOT, and the New Mercantile Exchange (NYMEX) started using

the CME’s electronic trading platform in June 2006. The partnership between the

CME and the NYMEX begins a 10-year deal that allows the NYMEX to use the CME’s

GLOBEX platform to electronically trade both energy and metal futures and

options. This promises to give better access to traders worldwide for those

specific markets.

If you

are reading this book, I assume that you already know the various market hours;

but if not, visit www.nationalfutures.com, where they are listed under Trading

Tools, which has the current margin requirements, contract specifications, and

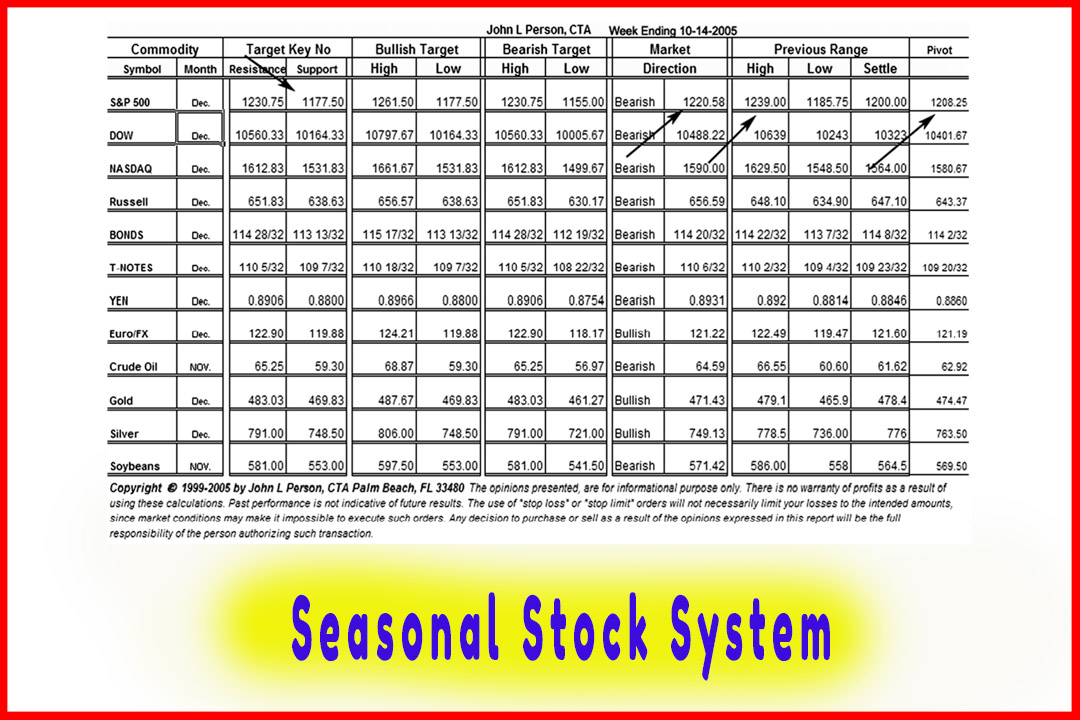

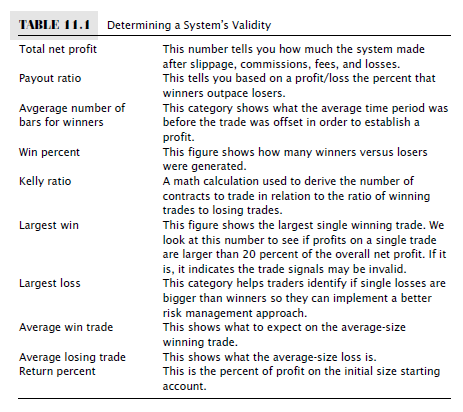

trading hours listed. In Table 11.1, I have a description of the categories

that are important in helping to determine a system’s validity.

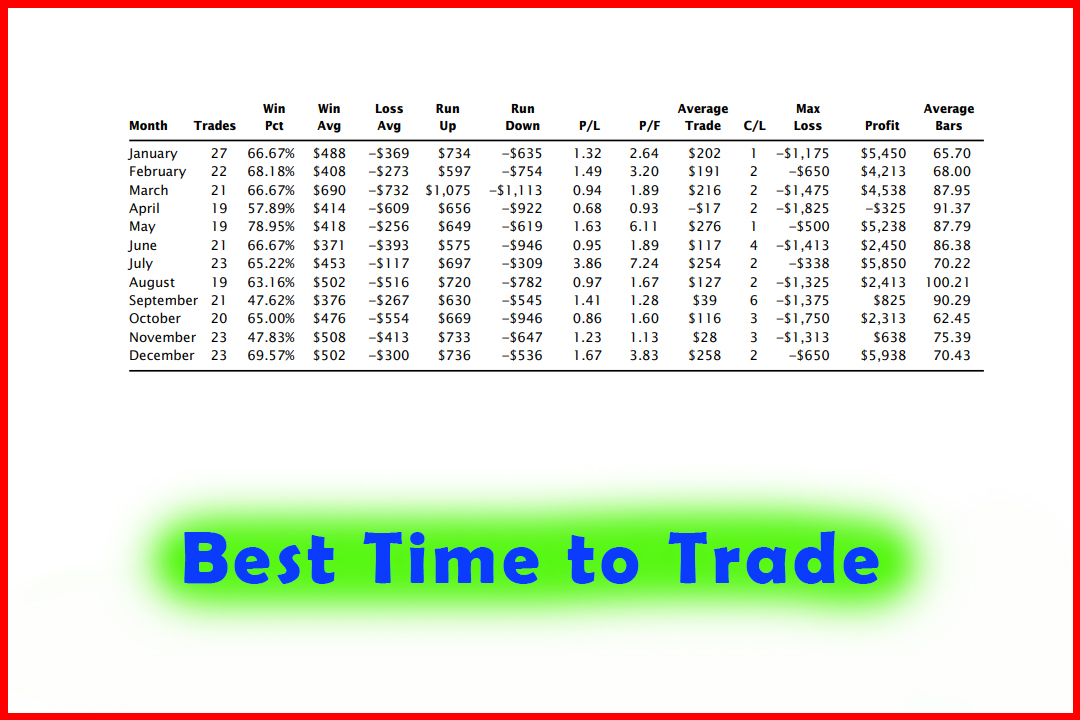

In Table

11.2, we have results from a pivot point moving average system I developed with

the help of Pete Kilman at Genesis. It is what I call the “Defcon”

day traders’ program system. As I stated before, this is not 100 percent

accurate. I do not know of any system that is; but it is a fairly reliable and

robust system with a 63.6 percent overall win ratio in the e-mini-S&P 500

futures.

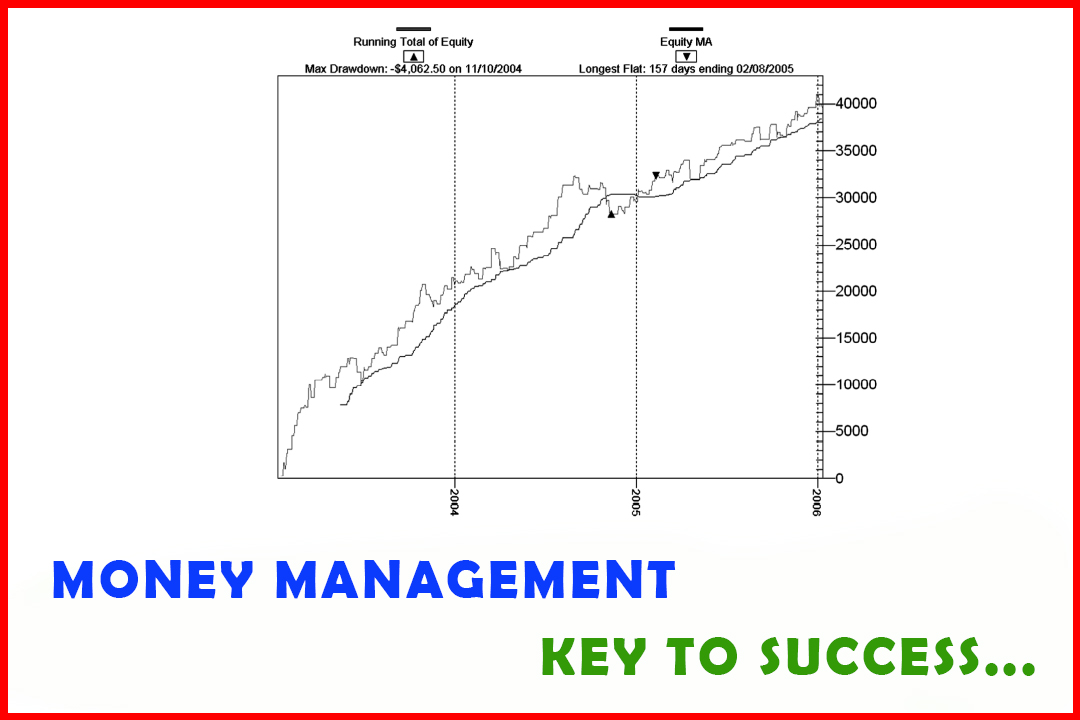

The

sample testing period was conducted during open outcry session only, from 9:30

a.m. (ET) until 4:15 p.m. (ET). There were no stops or loss parameters; this

was simply a reversal system, which means we were always in the market and out

on the close of business. The trades were all done on just one single contract;

so we did not have a money management position scale-up program designed, which

means we did not increase lot size as profits accrued. This system is based on

pivot point analysis and the principles outlined in this book; the trading

signals were based on a 15-minute time period, and the testing period was three

years.

All trade

signals were taken from 01/08/2003 to 01/10/2006. This time period was one of

the most active trading times in recent decates, so I feel this was a good

sample period to back-test. A starting account was set up with $10,000, taking

one contract per signal. A $50 commission and slippage were assigned per trade.

Generally, the electronic commission rates are as low as 3.50 and as high as

25, depending on which brokerage firm was used; so again this was an adequate

figure to use. With those variables, the system generated close to a 500

percent return. As we examine the system closer, we see it generated 258

trades, of which only 164 were winners. That means we must have bigger winners

than losers, and we do. The average win is $469, compared to $398 per loss on

average. The neat feature in this system or with this sample back-test model is

that the largest drawdown in wins is 1,663. This is the kind of information

that will give you a statistical edge in trading. You now know that you have a

system that generates buy and sell signals with a 64 percent win ratio. This

information should help you stay emotionally grounded by achieving two things:

(1) not getting too upset when losses occur; (2) not over positioning yourself

in trades if and when you have a win streak with more than eight or nine

consecutive trades.

Most

people lose big as they see their systems or methods generate huge profits many

times in a row. They get this feeling that their trading is invincible or

impervious to losers. And then, wham, that’s when a drawdown period occurs!

Generally, it is at this point that a trader goes from trading 10 contracts to

50 contracts. All it takes is one bad trade, and you have wiped away your

trading profits or, worse, your entire trading account.

The Candlestick and Pivot Point Trading Triggers : Chapter 11. The Sample Analysis : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Best trading confirmation, Best profitable trade, Best trading Strategy - What is the best day Trading Confirmation Trigger to Program?