Candlestick Warnings to Exit a Swing Trade

short-term trade, Exit a Swing Trade, Candlestick Warnings, candlestick reversal patterns, Bearish Engulfing Patterns

Course: [ How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights ]

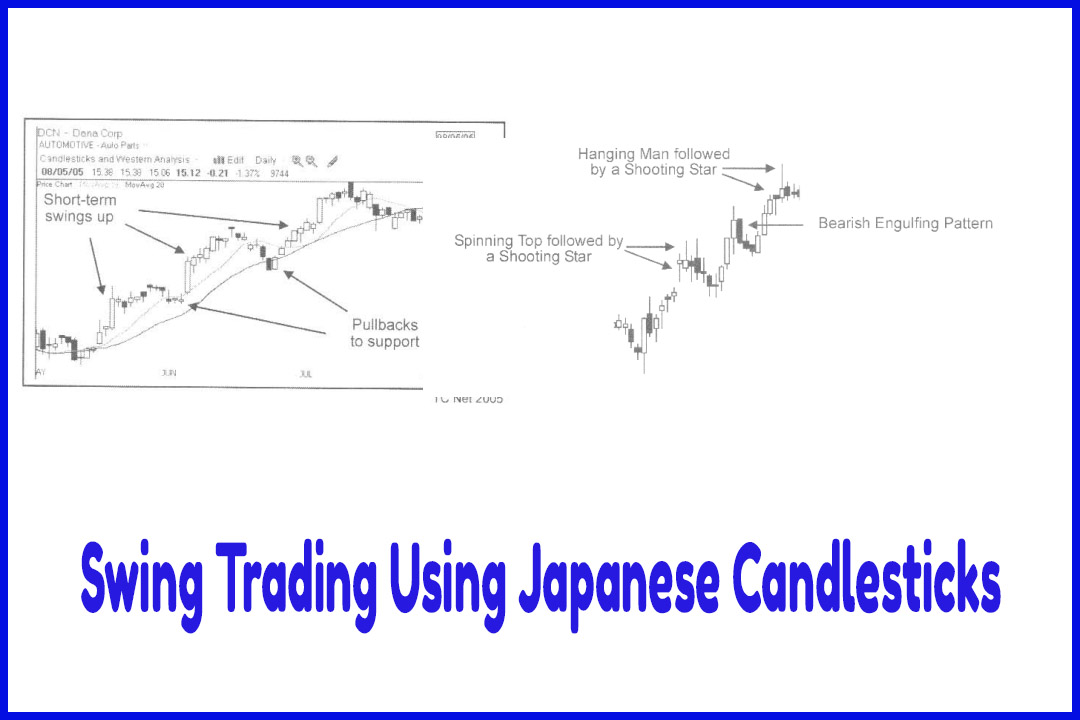

One-way traders can gain an edge is to recognize a timely sell signal that warns that the swing up is probably over. That’s where Candlestick charting can be very helpful.

Candlestick Warnings to Exit a Swing Trade

One-way

traders can gain an edge is to recognize a timely sell signal that warns that

the swing up is probably over. That’s where Candlestick charting can be very

helpful. One type of warning traders may see, at or near a swing high, is one

of the many bearish candlestick reversal patterns. These patterns can inform

traders that price may be about to pull back. With some reversal patterns, by

the time the pattern can be identified, it is too late. Once the pattern becomes

apparent, the pullback is already beginning and the gains from the swing trade

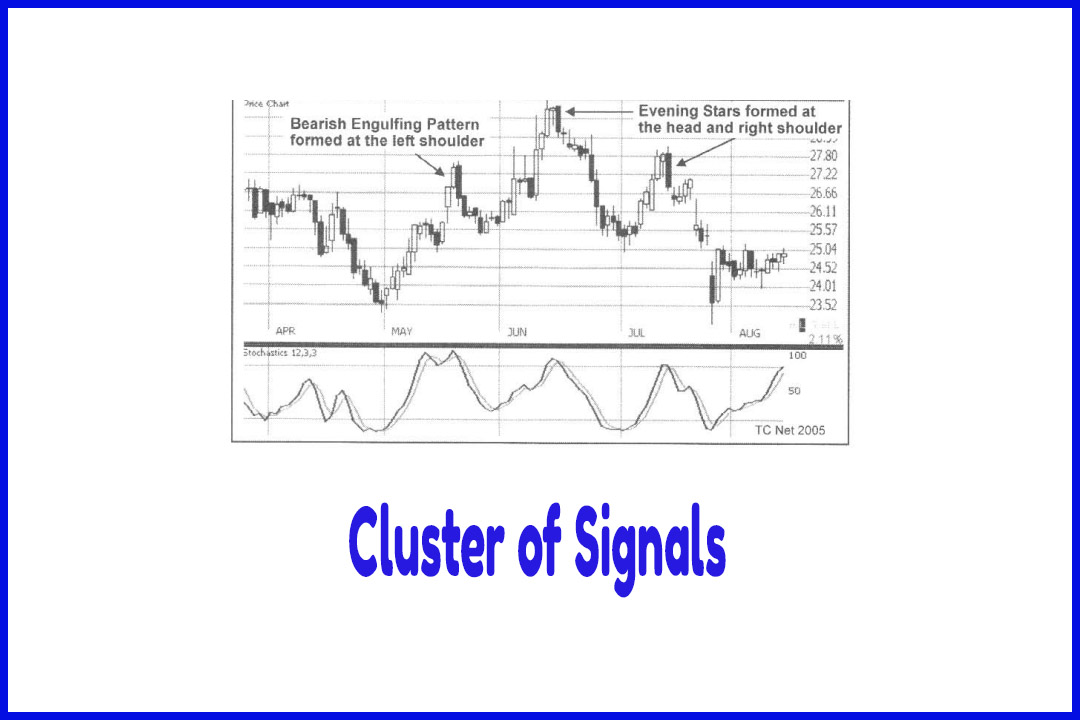

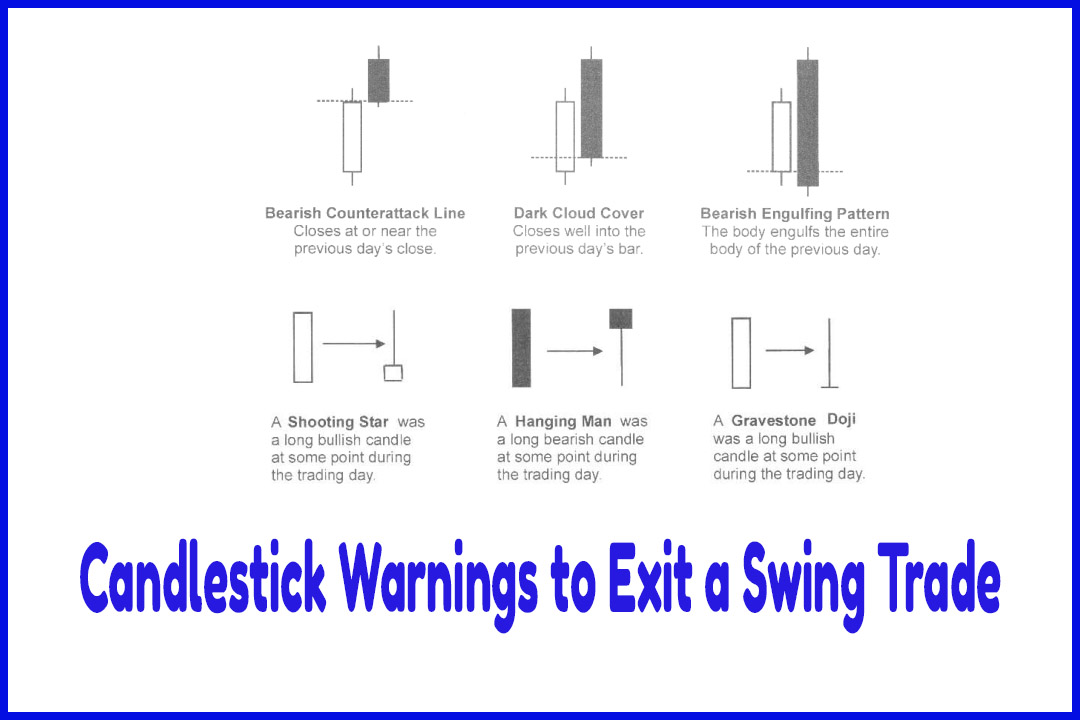

are slipping away. The Dark Cloud Cover and Bearish Counterattack (Meeting)

Line patterns both start out as an opening gap. Some, but not all, Bearish

Engulfing Patterns also start as an opening gap.

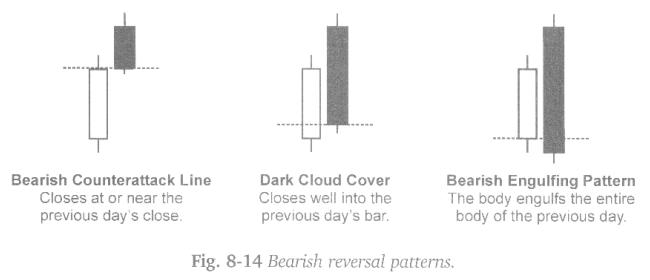

Fig 8.14

illustrates these three bearish pattern. The difference between the patterns is

the depth of which the bearish candlestick intrudes into the previous day’s

bullish candle. The deeper the bearish candle, the further price is into a

pullback by the close of the bar.

The

Bearish Counterattack Line stops at, or near, the previous day’s close. The

additional gains that could have been locked in at the open are erased. The

Dark Cloud Cover is more ominous. It closes more than midway down the body of

the previous day's bullish candle. The additional gains at the open, plus most

of the previous day’s gains, are erased. The Bearish Engulfing Pattern engulfs

the entire body of the bullish candle. It erases even more of the gains than

the other two patterns.

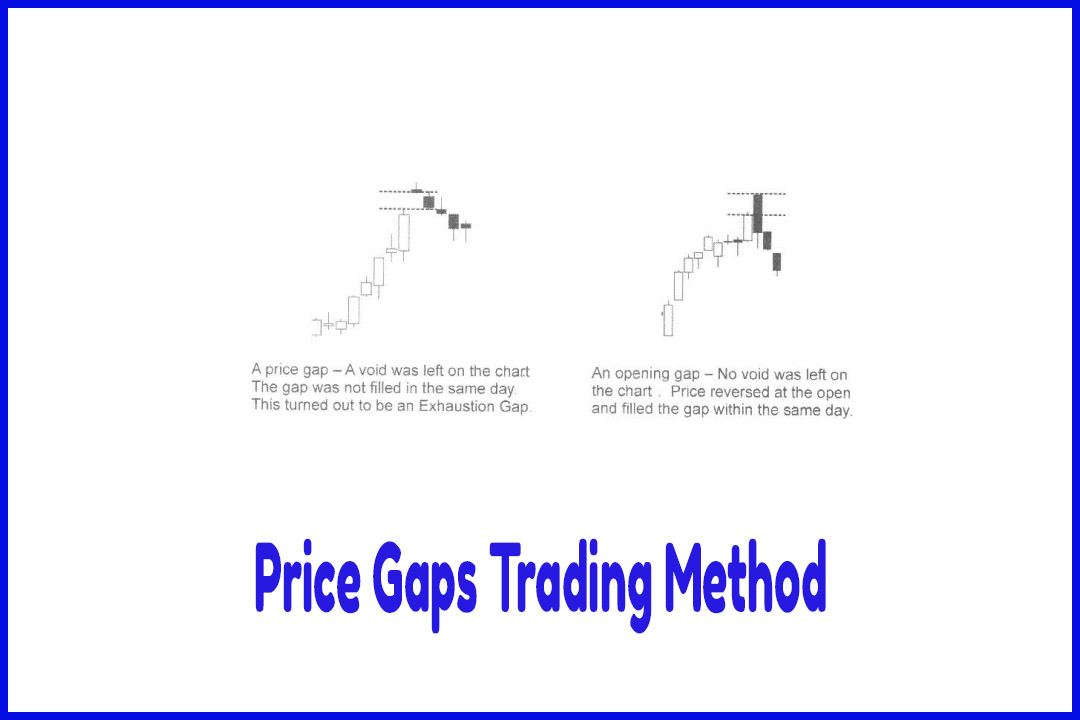

For a

swing down, the inverse of the patterns mentioned above are the Piercing

Pattern, the Bullish Counterattack Line and the Bullish Engulfing Pattern. In

most instances, when price gaps up after an advance, or gaps down after a

decline, exiting at the open is the best strategy for a short-term trade. Waiting

until the end of the day to exit would result in a less profitable trade. It is

true that traders cannot know for sure until the close of trading how the end

of day bar will look. However, because of the likelihood of an opening gap

filling within the same day, they can anticipate that the bar will probably end

the day bearish.

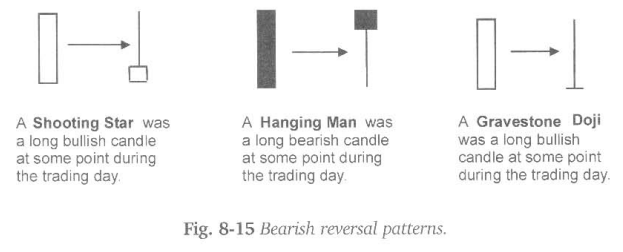

Many

Hanging Man patterns also start as an opening gap and can be exited at the

open. By the close, a trader can look back on this pattern and realize that

having sold at the open would meant not having held through the decline that

formed the long black candle. With this pattern, price does rise back up and

closes near the high by the end of day. However, the trader has to watch a

considerable amount of their profits disappear intraday before price turns back

up. Many traders may end up closing out the trade before price turns back up.

They could just sell the opening gap and avoid the roller coaster ride.

There are

other bearish reversal candlestick patterns that may not gap up at the open,

but by the close of the bar, it becomes apparent that the opportunity to sell

near the swing high was missed. For example, on those reversal patterns that

have long upper shadows, such as the Shooting Star or a Gravestone Doji.

Wherever an upper shadow remains, the candle was one a bullish body that traded

up to the high of the shadow. Vice versa for a lower shadow.

It is

always easy to look back on a chart and wish you had sold at a higher price.

These patterns aren’t as easy to anticipate as those that gap up at the end of

a swing. However, sometimes they can be excited with more profit if a target

has been calculated in advance. For instance, if there is ovethead resistance

on the chart, a target can be set for a bit below that resistance level.

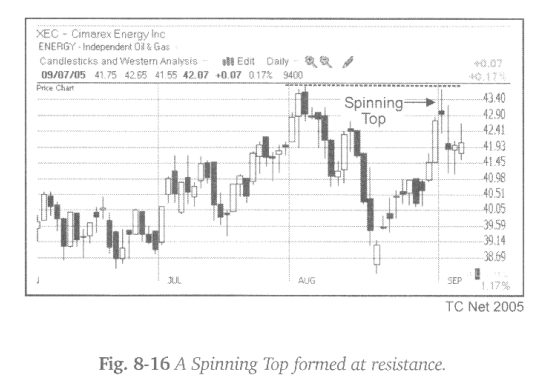

Figure

8-16 is an example where a sell limit order could have been placed in

anticipation of the resistance being tested. The sell order, set for just below

the ceiling, would have triggered while the candle was still bullish. By the

close, the candle had formed a Spinning Top and pulled back more the following

day.

How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights : Tag: Candlestick Pattern Trading, Option Trading : short-term trade, Exit a Swing Trade, Candlestick Warnings, candlestick reversal patterns, Bearish Engulfing Patterns - Candlestick Warnings to Exit a Swing Trade