Swing Trading Using Japanese Candlesticks

Swings within a Trend, Trading the Swings, Swing Trading, Japanese Candlesticks

Course: [ How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights ]

Swing trading can be a very profitable method of trading. It is a style that capitalizes on the concept that price does not usually move too far in one direction before pausing or pulling back.

Swing Trading Using

Japanese Candlesticks

Swing

trading can be a very profitable method of trading. It is a style that

capitalizes on the concept that price does not usually move too far in one

direction before pausing or pulling back. Swing traders can make substantial

gains during those short-term moves. They then exit before price turns against

them robbing them of their profits. This type of trade is generally held from

two to six days. Some swing trades may be held longer, but usually not for more

than a couple of weeks.

This

method of trading has become increasingly popular over the past few years. It

is not as demanding as day trading, and yet not as passive as a buy- and-hold

strategy. The savvy swing trader has the ability to adapt quickly to changing

market environments. Swing trading can be quite profitable in up or down

trends.

Swings within a Trend

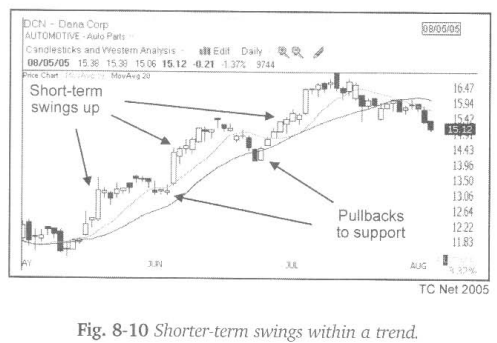

Intermethate-term

trends generally last from several weeks to a few months. Within the trend,

there may be several shorter-term price swings. A typical swing may consist of

a distance the equivalent of about four to five average size bars for that

particular stock. Every stock is different. The swings may vary dramatically

from one stock to another.

You can

enhance your swing trading skills by paying attention to overall market

conditions. In a choppy or bearish market, the swings up may be shorter. In a

bullish market, the moves up may be more significant as the broad market

rallies. Additionally, if a stock is in a strong sector, price swings may last

longer, and the dips to support may be shallower.

Sometimes

stocks will trend upward making very recognizable price swings. Other times the

swings are not as orderly. It takes practice to learn to trade the swings with

precision. However, those who acquire the skill are usually rewarded with a

steady stream of good trading opportunities.

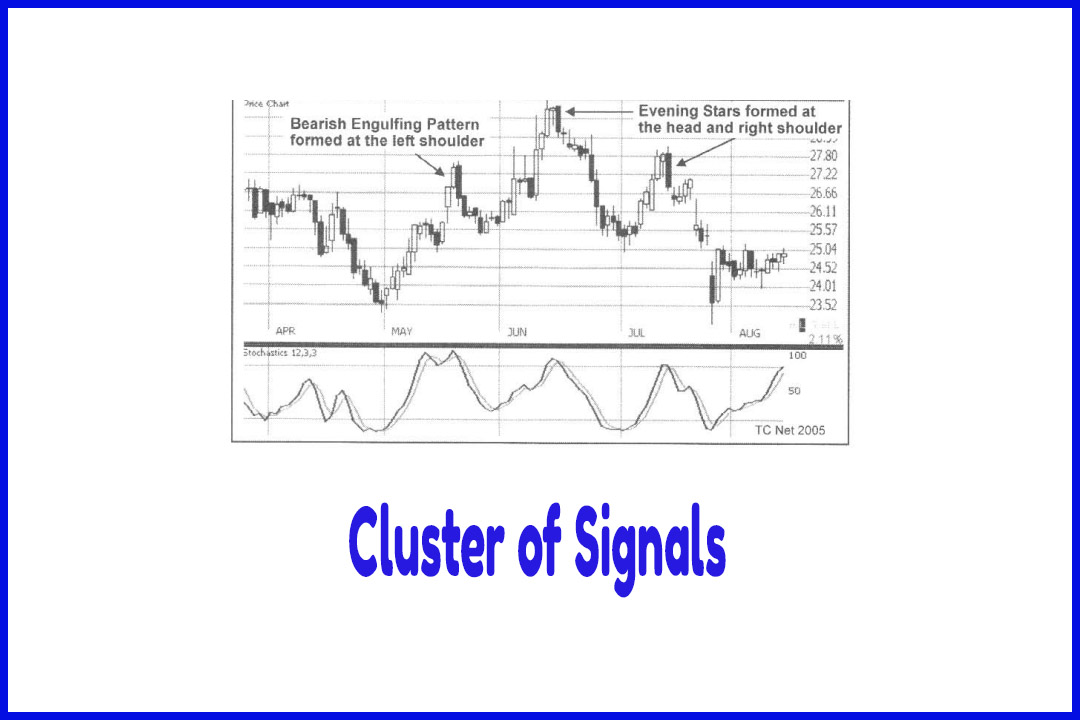

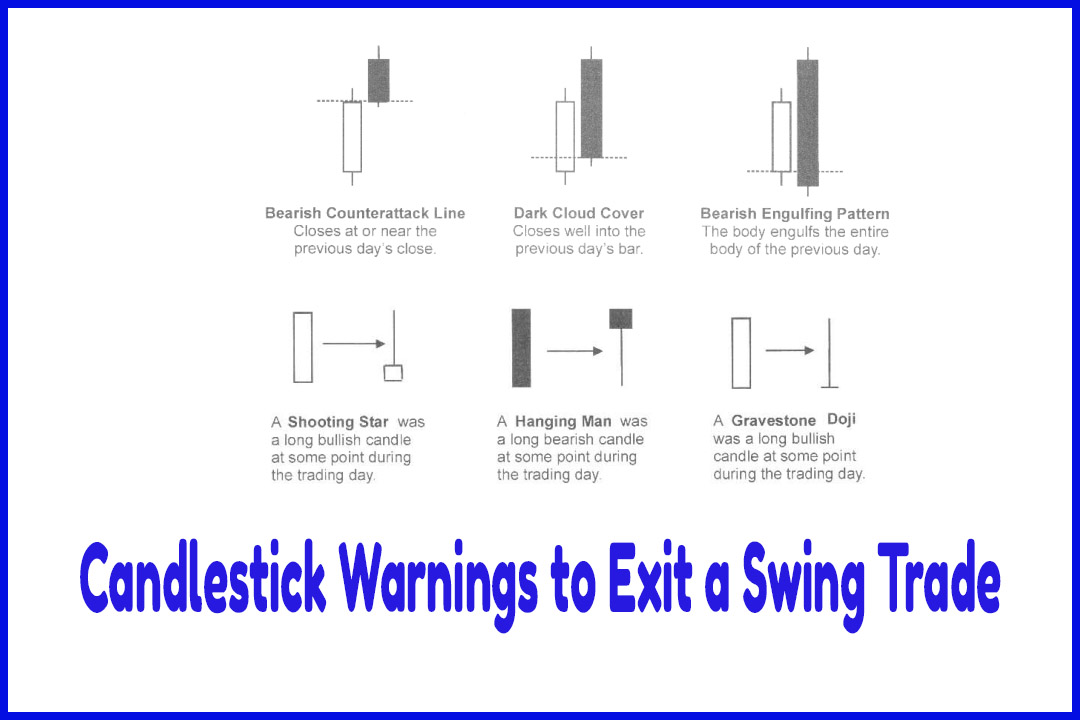

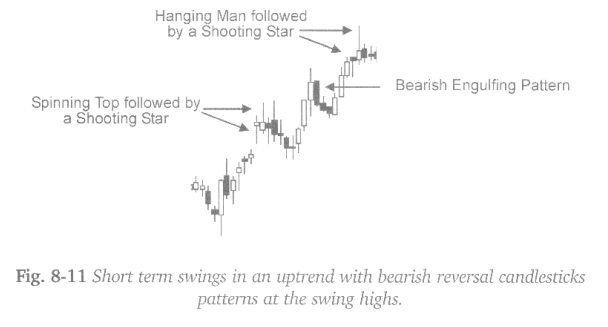

Bearish

reversal candlestick patterns often form at the end of an uptrend. But they

also are quite common at the end of the shorter-term swings within the trend.

These reversal patterns can be very helpful in assisting with exiting long

positions on swing trades. Conversely, bullish reversal patterns can be used to

fine-tune an exit on a short position.

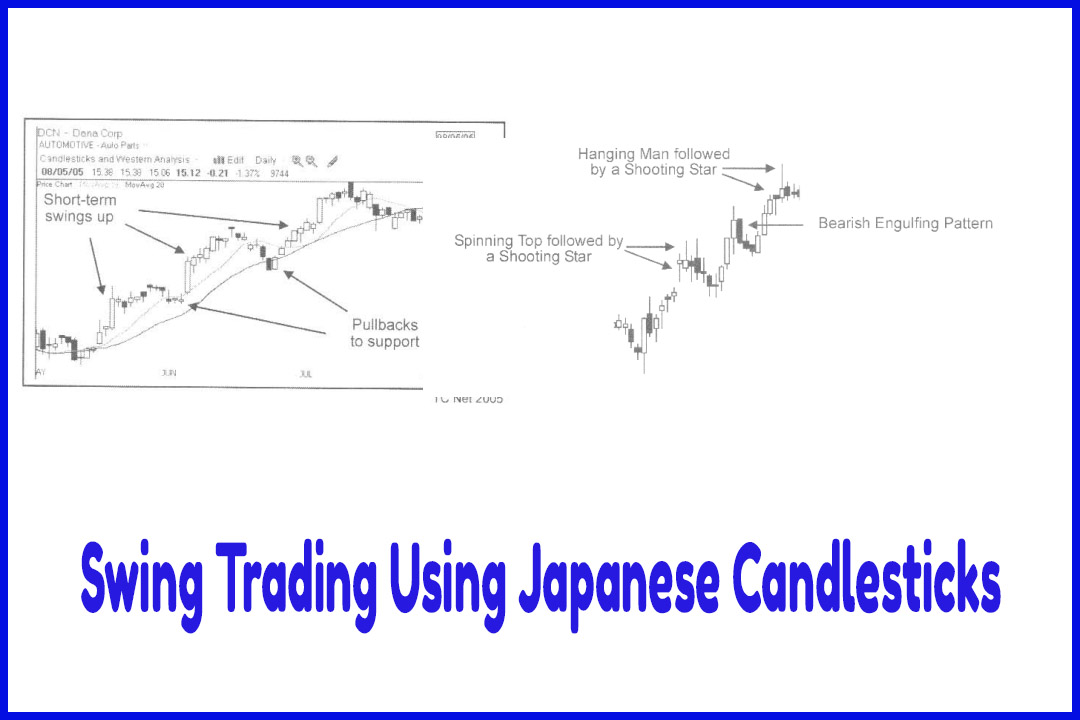

Trading the Swings

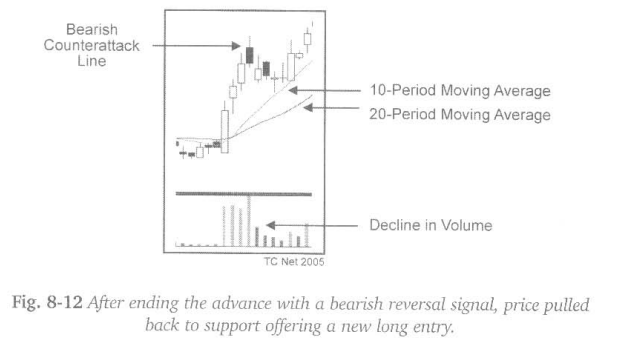

After a

swing up, the decline that follows is often referred to as a pullback, or a

dip, to support. Pullbacks are very common occurrences caused primarily by

profit taking by swing traders. When price swings up, it moves away from the

short-term Moving Averages. The 10-period and 20-period Moving Averages are

popular short-term indicators. Price then turns down, often finding support at

one of those short-term Moving Averages, but sometimes declining farther.

The

pullbacks are often on low or declining volume. This is an indication of profit

taking by short-term traders versus a more aggressive sell-off by a large

number of traders and investors. These swings, followed by pullbacks, may give

the appearance of a stair-step like motion in the trend.

The

inverse can often be seen on swings to the downside when a stock is falling.

However, it is not unusual to see downside declines of more magnitude than

upside swings. Panic sets in and traders rush to eliminate pain. A wise trader

once observed that, “The bull walks up

the stairway, but the bear jumps out the window.”

A

challenge with holding through a pullback in a trend is that you cannot be

certain how deep the decline will be. If price does not stop falling at the

near- term support levels, a trader could watch much, or all, of the profits

from the swing up disappear. Therefore, many swing traders attempt to sell the

high of the swing and buy on the dips near a support level. Because of the

short-term nature of this type of trade, traders can gain an edge by learning

the warning signals that so often occur at the end of a price swing. Learning

how to set price targets, and using protective sell stops, can also help

traders avoid giving back profits.

How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights : Tag: Candlestick Pattern Trading, Option Trading : Swings within a Trend, Trading the Swings, Swing Trading, Japanese Candlesticks - Swing Trading Using Japanese Candlesticks