Cluster of Signals

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights ]

Often more than one reversal signal occurs near the same price level. Multiple signals clustered together should give a trader more confidence that the set-up will follow through in the anticipated direction.

Cluster

of Signals

Often

more than one reversal signal occurs near the same price level. Multiple

signals clustered together should give a trader more confidence that the set-up

will follow through in the anticipated direction. An example would be when a

Japanese candlestick pattern forms within a larger western chart pattern. For

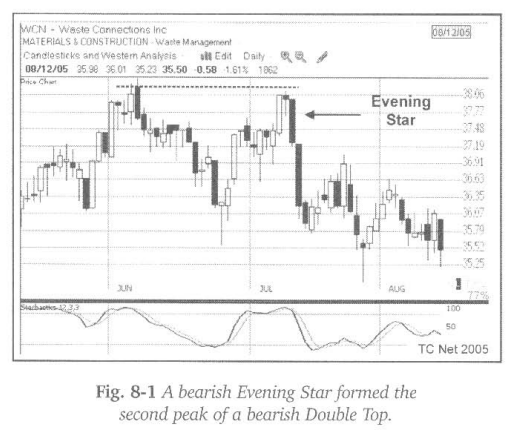

instance, often the second top of a bearish Double Top is a bearish candlestick

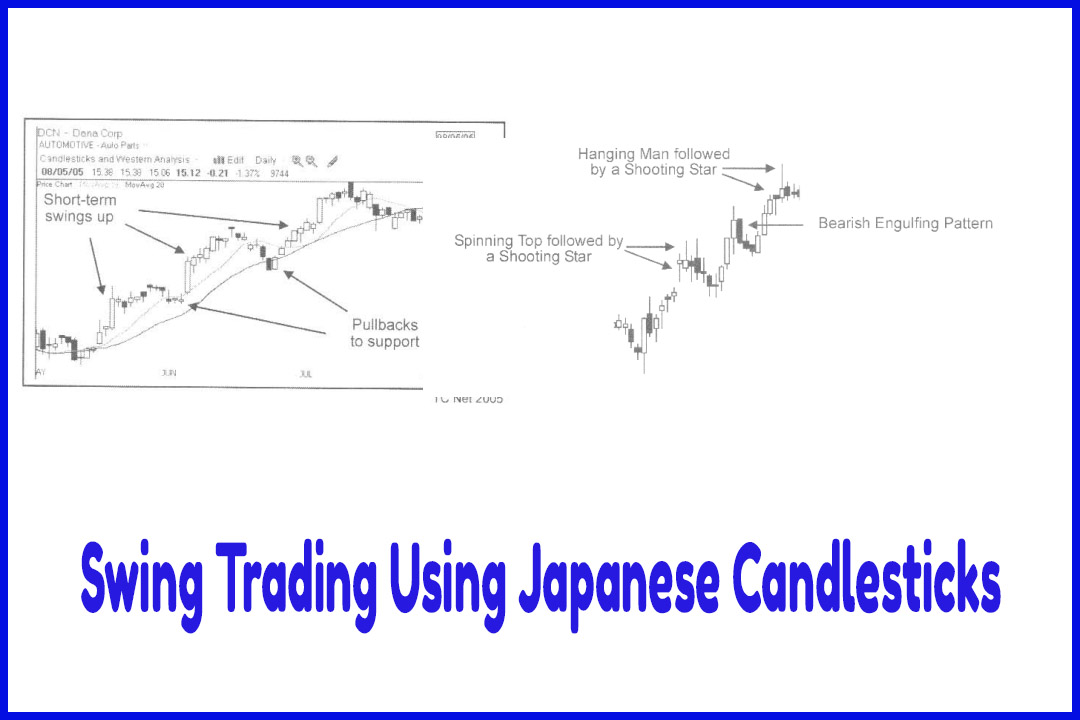

reversal pattern. Figure 8-1 shows a Double Top that formed on the Waste

Connections chart during the summer of 2005. An Evening Star formed at the

second peak of the larger pattern. Stochastics confirmed by turning down from

the oversold line.

Another

technical event that may make a set-up stronger is when price tests a long-term

Moving Average, such as the 50- or 200-period. These Moving Averages are

watched closely by experienced traders. They often provide support when price

declines to those levels. Conversely, when a downtrend reverses, longer-term

Moving Averages above may act as resistance.

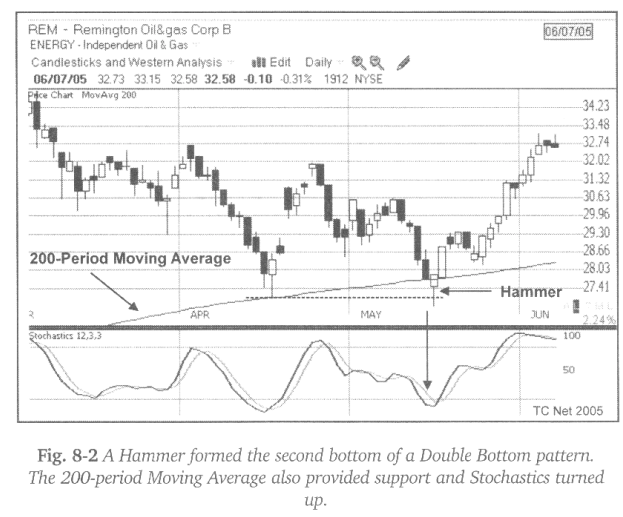

Figure

8-2 shows a chart of Remington Oil & Gas. This is a good example of several

signals coming together. A Double Bottom formed at the 200-period Moving

Average. The additional support provided by the strong indicator should

increase the likelihood of a reversal. In addition to the Western signals, a

bullish candlestick reversal pattern formed the second bottom of the larger

pattern. Usually the Stochastics will also curl up from the oversold level.

However, if the second bottom is slightly higher than the first bottom, because

of the loss of momentum on the second bottom, the Stochastics may not drop back

below the 20 line. It should still curl up though.

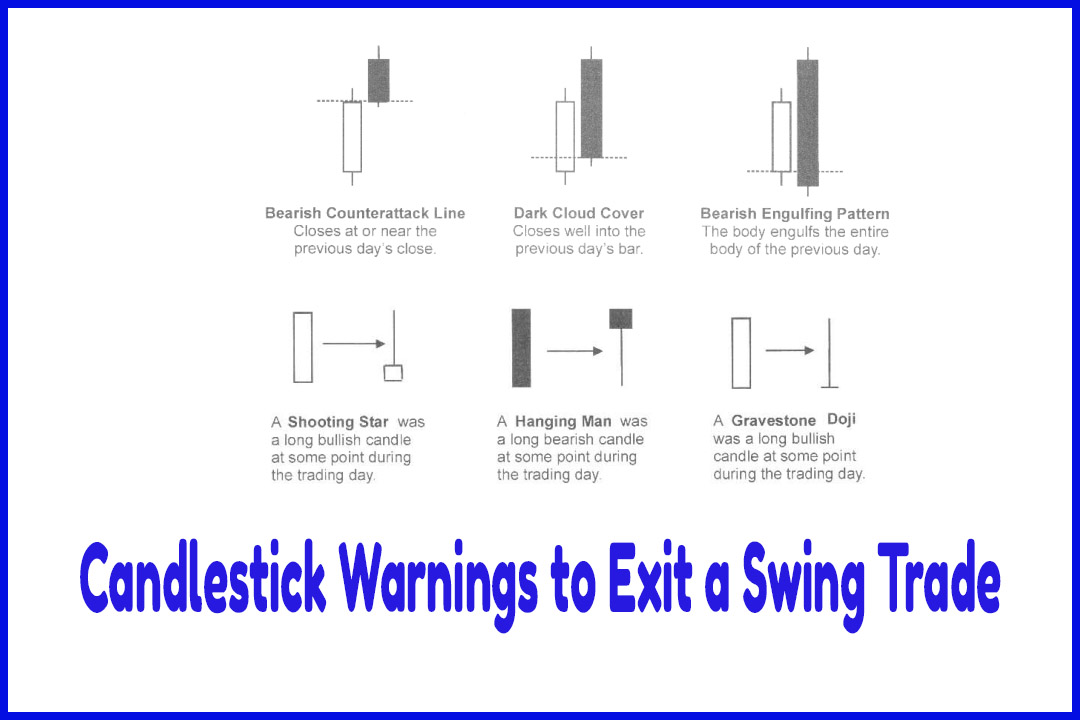

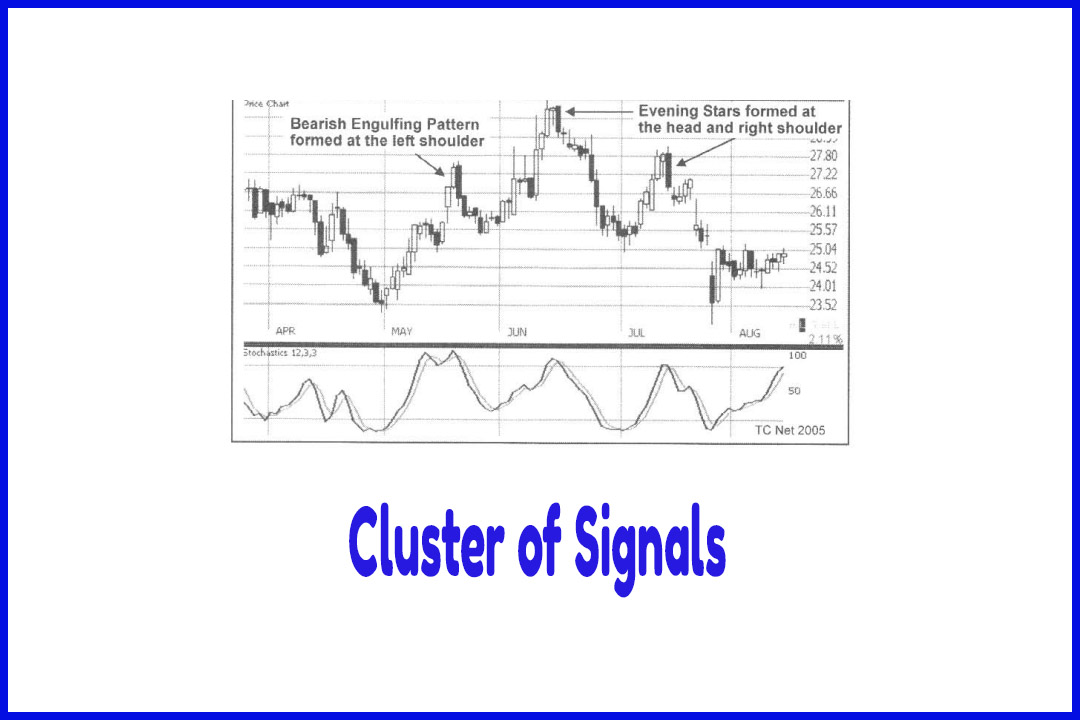

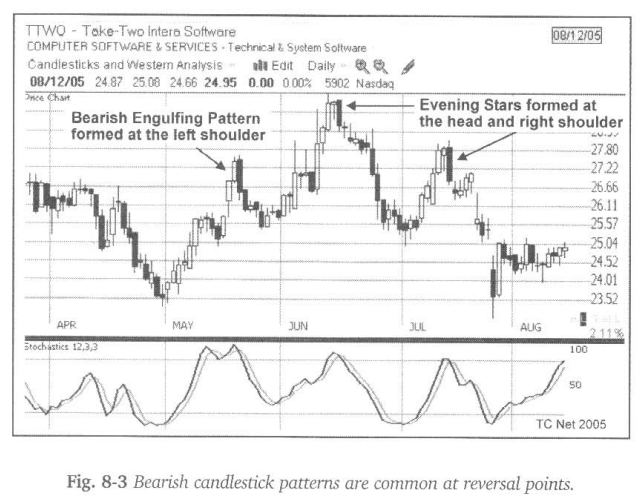

Candlestick

patterns are very common at reversal points. Figure 8-3 shows a bearish Head

and Shoulders Top that formed on Take-Two Intera Software. A bearish

candlestick pattern formed at each shoulder, and at the head, of the larger

pattern. The larger chart pattern alone is bearish. The formation of a bearish

candlestick at the right shoulder should increase the likelihood of follow

through to the downside. Stochastics also confirmed the turns. By the time the

right shoulder of the Head and Shoulders Top forms, price is already in a

downtrend. Because of that downward momentum, Stochastics may not rise back up

to the oversold level on the right shoulder.

To

confirm a short position, price should close below the neckline of the Head and

Shoulders pattern. The neckline touches the swing lows between the two

shoulders. Traders may choose to take an early entry rather than waiting for

confirmation, especially if there is bearish candlestick pattern that forms the

right shoulder. By that time the neckline is breached, the move is well under

way to the downside.

In the

Take-Two example, there is potential support at the May low. If a short

position is still open by the time price reaches a visible support level, it

should be covered. Price generally bounces, at least temporarily, at a strong

floor.

How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Cluster of Signals