Trading with Multiple Time Frames

Time and Price, different time periods, Best Time to trade, Analysis Multiple Time frame

Course: [ How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights ]

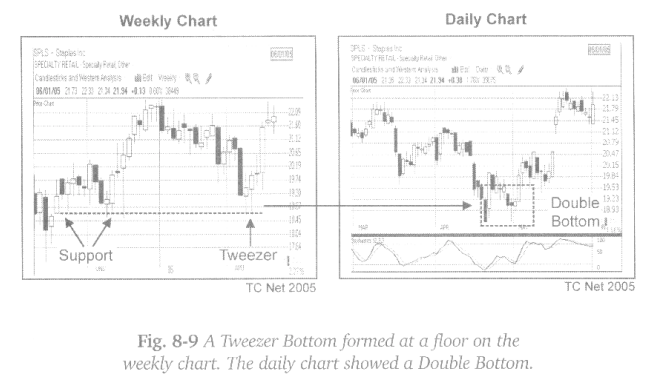

While browsing weekly charts, you may come across some interesting set-ups that offer great trading opportunities. For example, a Tweezer Bottom is a pattern where the lows of two or more bars are at, or very near, the same price.

Trading with Multiple Time Frames

While

browsing weekly charts, you may come across some interesting set-ups that offer

great trading opportunities. For example, a Tweezer Bottom is a pattern where

the lows of two or more bars are at, or very near, the same price. Often a

Tweezer Bottom on a weekly chart will be a Double Bottom down on the daily

chart. Vice versa for a Tweezer Top.

Figure

8-9 shows a weekly chart of SPLS with a Tweezer Bottom. The tweezer formed at a

floor that had been established several months prior. On the daily chart,

traders see a bullish Double Bottom. However, they may not notice that the

pattern is testing a strong floor unless they compress the daily chart or shift

to the weekly time frame. SPLS trended up for several weeks following the

successful retest of the strong support.

How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights : Tag: Candlestick Pattern Trading, Option Trading : Time and Price, different time periods, Best Time to trade, Analysis Multiple Time frame - Trading with Multiple Time Frames