Consult the Sector - Option

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights ]

When a sector or industry group is in favor, the component stocks may run up for several weeks or even months. Eventually the overbought condition will cause a period of consolidation or a correction. A correction can be identified by a retracement of the previous trend.

When a

sector or industry group is in favor, the component stocks may run up for

several weeks or even months. Eventually the overbought condition will cause a

period of consolidation or a correction. A correction can be identified by a

retracement of the previous trend.

A stock

in a strong sector may resume the uptrend once price has corrected

sufficiently. Traders who wish to participate in the resumption of the prior

uptrend should watch closely for signals indicating that the correction may be

ending.

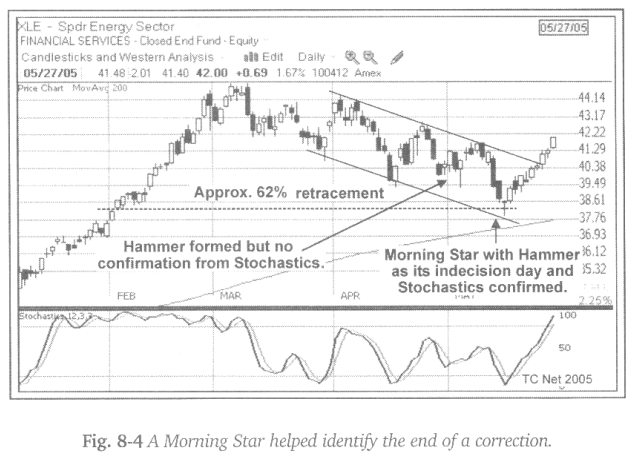

Many

stocks in the Energy sector made significant advances during 2005. Figure 8-4

shows XLE, the Spider Sector ETF for the Energy group. After the price advance

from the January low to the March high, price retraced a significant amount of

the previous uptrend. The retracement was approximately 62%, a well-known

Fibonacci level.

A bullish

Morning Star also formed near that level indicating a possible end of the

correction. Several days later price closed above the top trend-line of a

falling channel giving further evidence that price was rising again. The correction

provided an excellent opportunity for traders to purchase shares at lower

prices.

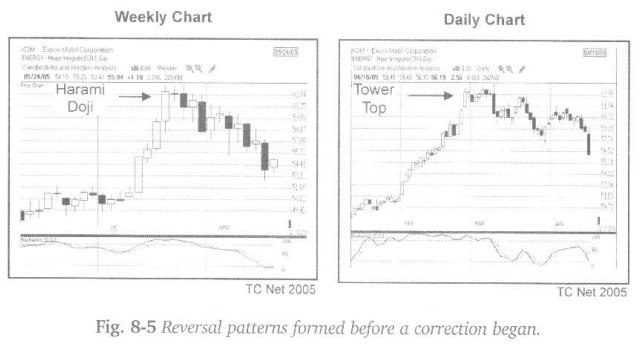

Oil

stocks were a hot commodity during 2005. They were a major contributor to the

run up in the XLE chart illustrated above. A challenge for traders was to know

at what point the stocks in this industry had run up too far. Figure 8-5 shows

a significant run up on Exxon Mobil. Traders who watched closely for reversal

signals received timely warnings that Exxon was about to reverse direction.

Reversal

candlestick patterns formed on both the daily and weekly time frames. Figure

8-5 shows a bearish Harami-Doji (also referred to as a Harami Cross) on the

weekly chart. Figure 8-5a shows a Tower Top on the daily chart.

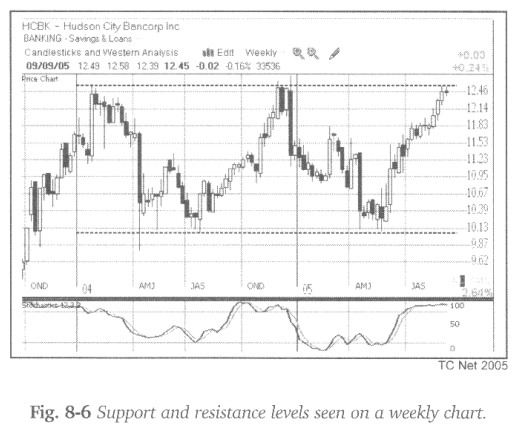

Traders

who primarily view charts on the daily time-frame can gain an edge by also

incorporating the weekly chart in their analysis. Support and resistance

levels, that may not be seen within the time-period displayed on the daily

chart, can easily be seen on the weekly chart.

Sometimes

support and resistance levels formed months, or even years, in the past.

However, they will be seen by chartists consulting the higher timeframes, such

as weekly or monthly. Just because a support or resistance level is “old,” does

not mean it is not still strong.

Figure

8-6 shows a weekly chart of Hudson City Bancorp. On this view, it is easy to

see that the stock has traded in a range for a couple of years. Looking at just

a few months of data on a daily chart does not give as thorough a picture as

can be seen on the weekly chart.

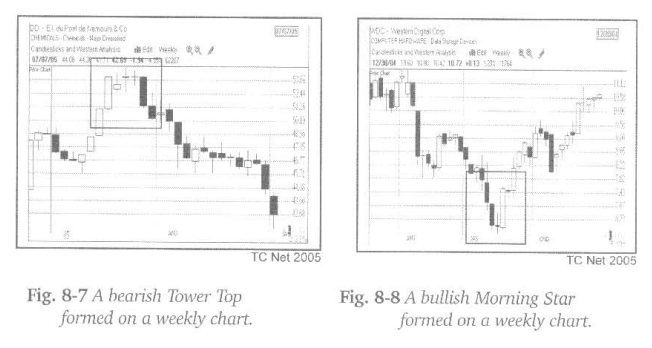

Candlestick

patterns are visible on all timeframes. The higher the time frame the more

meaningful the implication of the pattern. If a bearish reversal pattern forms

at the end of an advance on the weekly or monthly chart, ignore it at your own

peril!

How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Consult the Sector - Option