Maximizing Profits on Swing Trades

Sell the Opening Gap, pullback trading, swing high, Dark Cloud Cover formation, stop and reverse strategy

Course: [ How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights ]

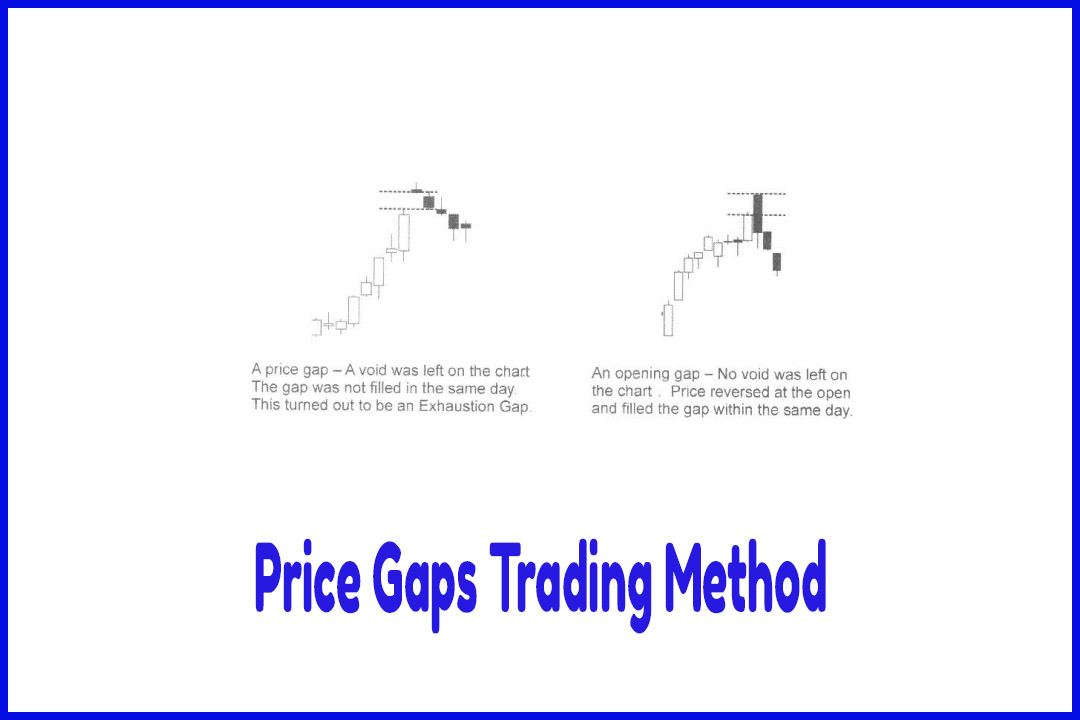

A gap up at the end of a swing is a warning. It is usually a last blast of buying just before a pullback begins. Once price turns down after a several day advance, there are no more buyers willing to pay the higher prices.

Maximizing Profits on Swing Trades

For

traders to increase their profitability, they must learn how to maximize the

profits on their trades—not through greed or fear, but through technique.

Sell the Opening Gap

A gap up

at the end of a swing is a warning. It is usually a last blast of buying just

before a pullback begins. Once price turns down after a several day advance,

there are no more buyers willing to pay the higher prices. Suddenly sellers

have to turn their sites downward io find buyers at lower prices. The stock

begins to collapse on the intraday time-frame. This is an unfortunate scenario

for inexperienced traders who bought at the swing high. They find themselves immediately

in a losing trade that continues to decline. The higher the volatility of the

stock, the more, and the faster, the pain will set in. They may end up exiting

during the decline, often just before price turns back up.

Skilled

swing traders know that the gap is a bonus at the end of a price move. It can

be looked at as a stern warning to take profits before a pullback begins.

A high

percentage of gaps that occur at the market open are filled within the same

trading day. This is true of gaps up or down. Often a trader can lock in

additional profits by immediately exiting an opening gap that forms at the end

of a price advance or decline. In some cases, the additional profits can be substantial,

for example, on a Dark Cloud Cover formation.

If the

stock is trading actively in pre-market and the spread is narrow enough, which

is likely if price is set to gap at the open, the stock can be exited before

the open. A limit order can be used to exit a trade in pre-market. Market

orders are held until the open—they will not be executed in pre-market or

after-hours trading.

If

waiting until the open to exit, traders can begin monitoring the price action

on a low intraday time-frame, such as a 5-minute chart. If price holds up in the

first few minutes, it may run in the opening direction for a short time after

the open. There is a good chance price will still reverse by approximately 30

minutes into the trading day. The first few minutes after the open, and again

near 10:00 a.m. Eastern Time, are strong reversal times.

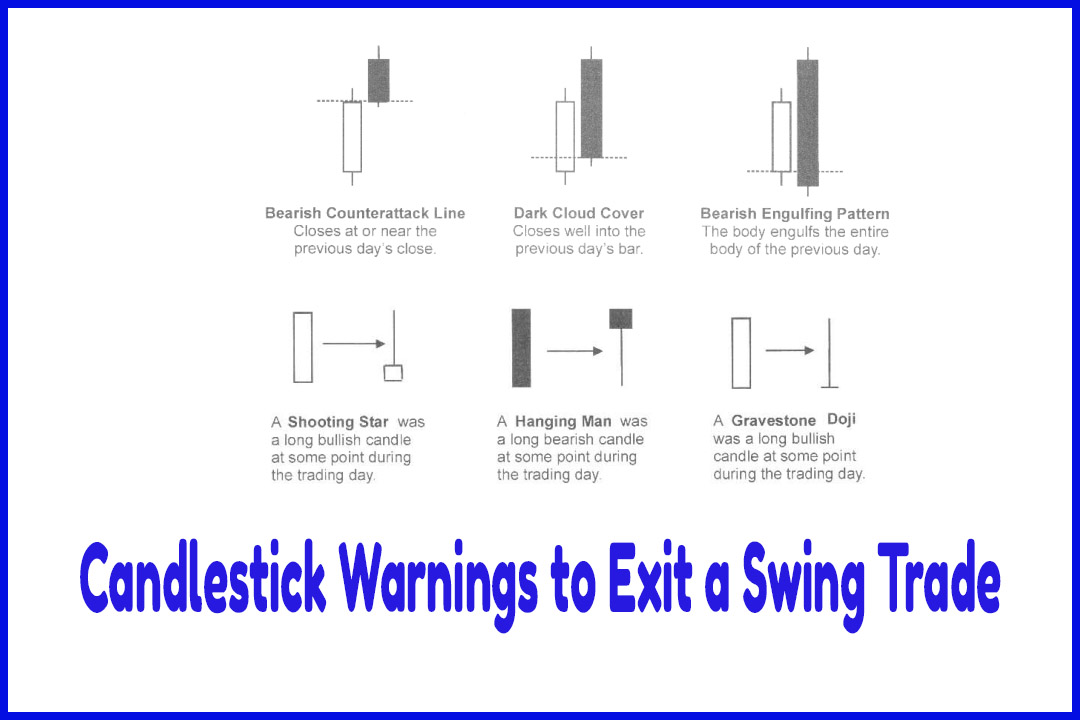

Some

traders like a “stop and reverse”

strategy. They may exit the long position and go short, or vice versa on a gap

down. They may sell short on the high likelihood of the gap filling. Traders

should be cautious shorting against a strong uptrend. The pullback may be

short-lived if the stock is in favor with traders or belongs to a strong

sector. The stop and reverse method may be more profitable if the swing up was

quite significant, or if the swing up encountered resistance.

How To make High Profit In Candlestick Patterns : Chapter 7. Profitable Trading Insights : Tag: Candlestick Pattern Trading, Option Trading : Sell the Opening Gap, pullback trading, swing high, Dark Cloud Cover formation, stop and reverse strategy - Maximizing Profits on Swing Trades