Deep Wave (b) in Wave (iii) in EURUSD Daily Chart

Trade retracement, Strength Harmonic Structure, Accuracy Harmonic Structure, Five wave pattern

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

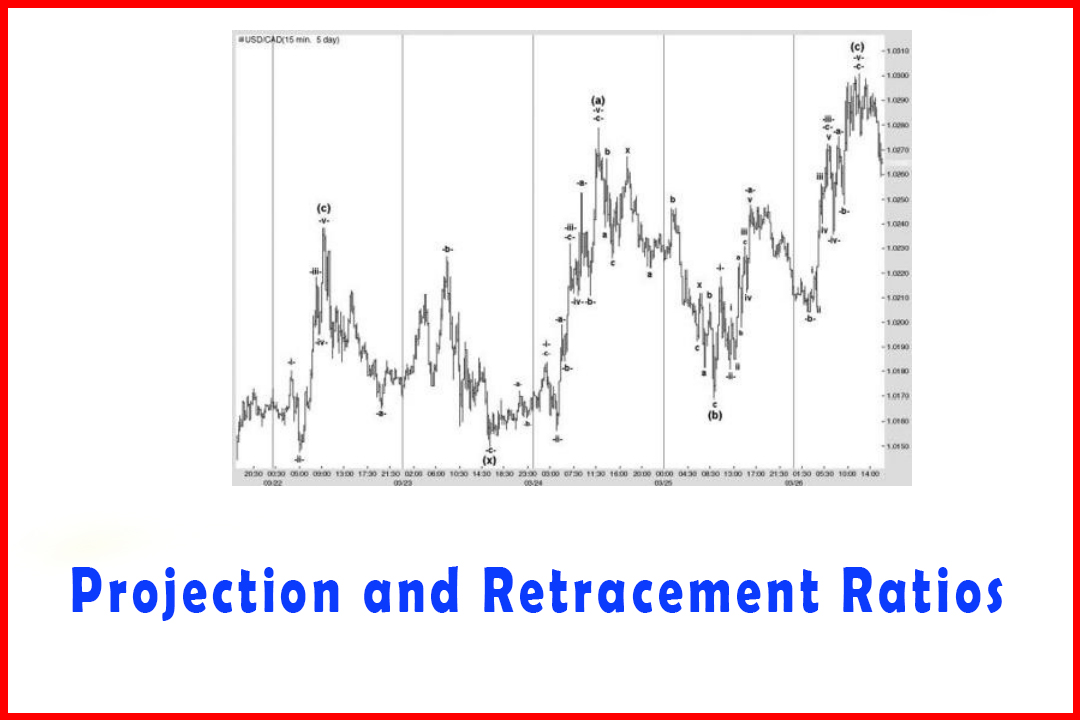

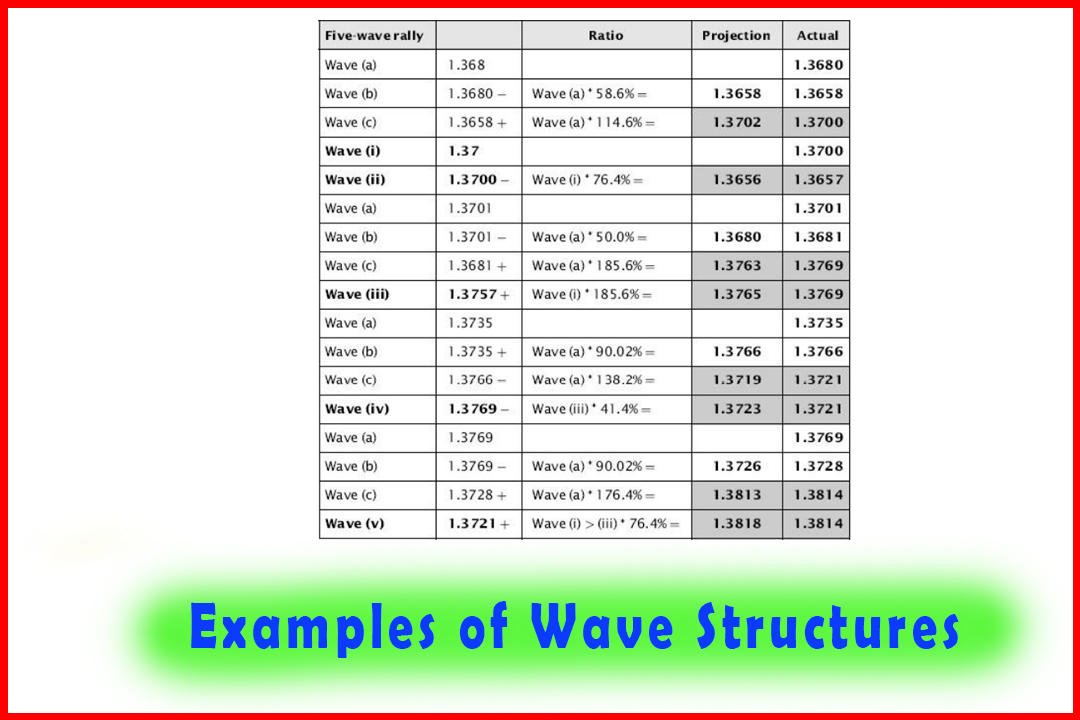

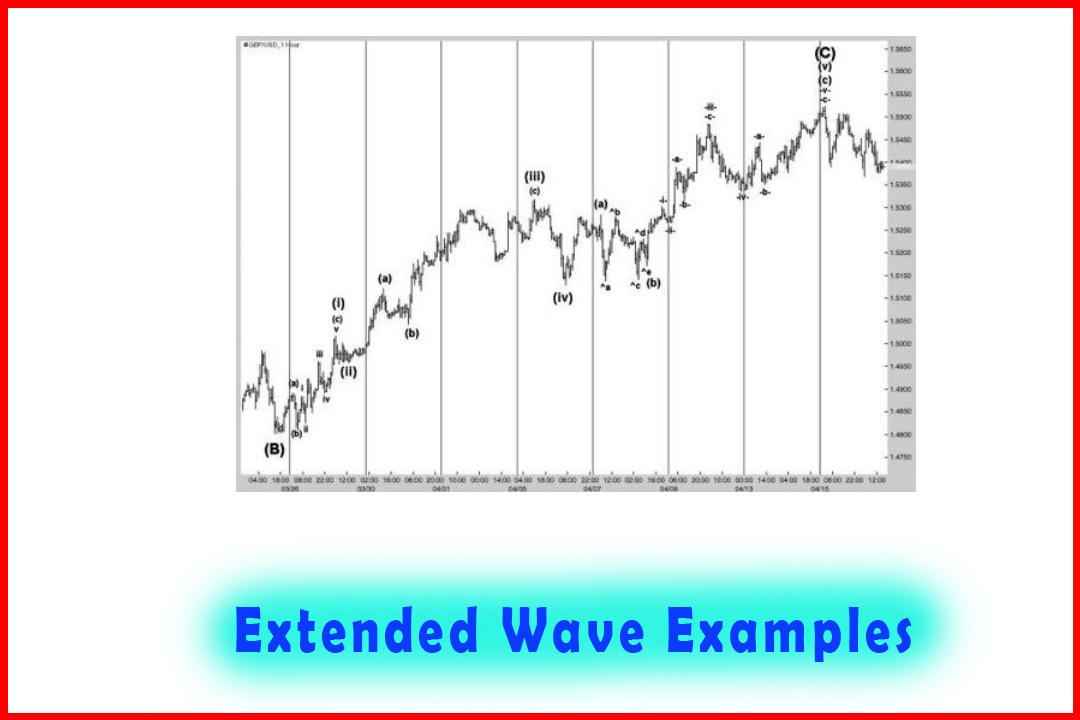

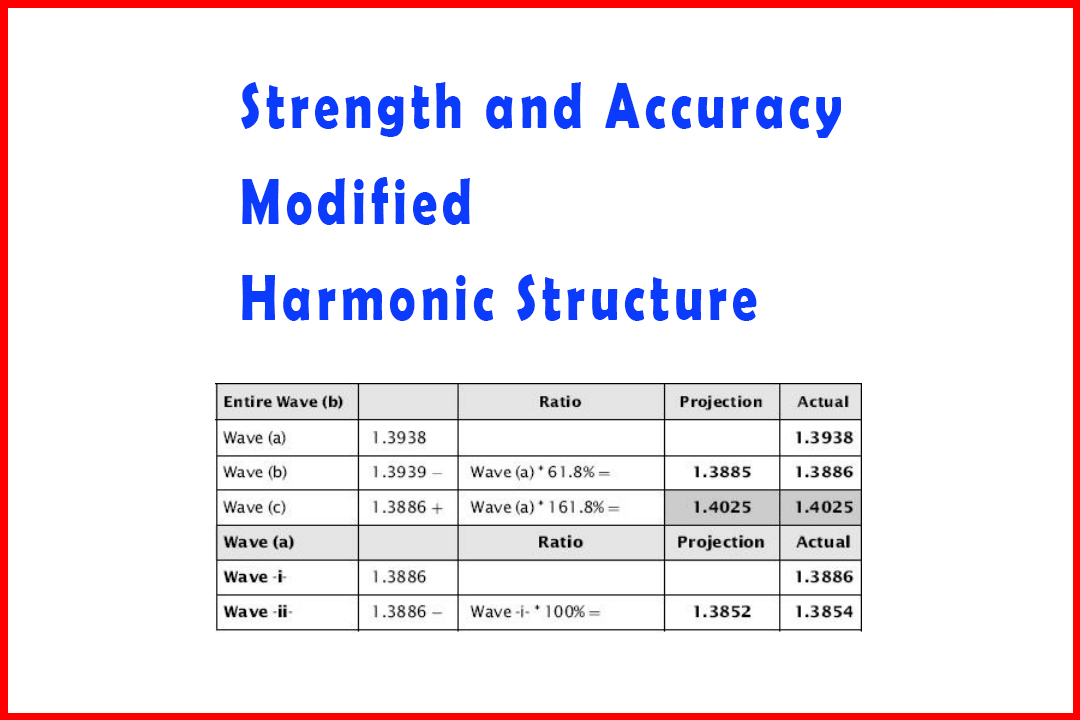

I have provided several examples of how accurate the modified structure can be within the short time frames.

Deep Wave (b) in Wave (iii) in EURUSD Daily Chart

I

have provided several examples of how accurate the modified structure can be within

the short time frames. Moving up the scale to daily charts (Figure 4.22), the

degree of variance in projections certainly becomes larger in point terms

(Table 4.18).

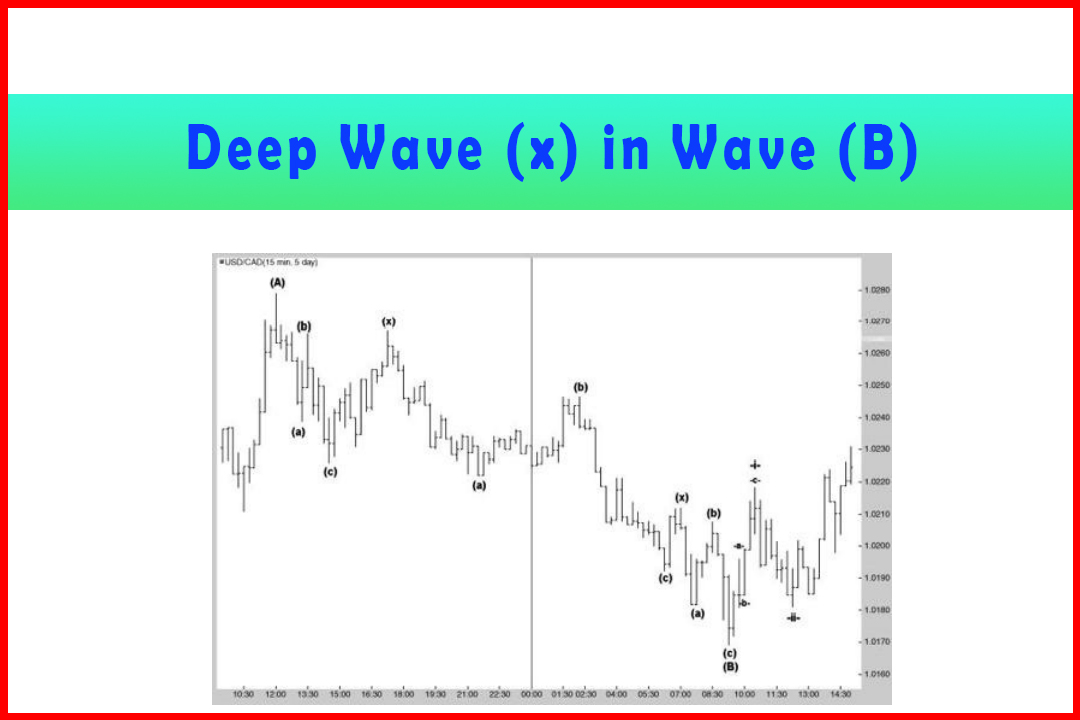

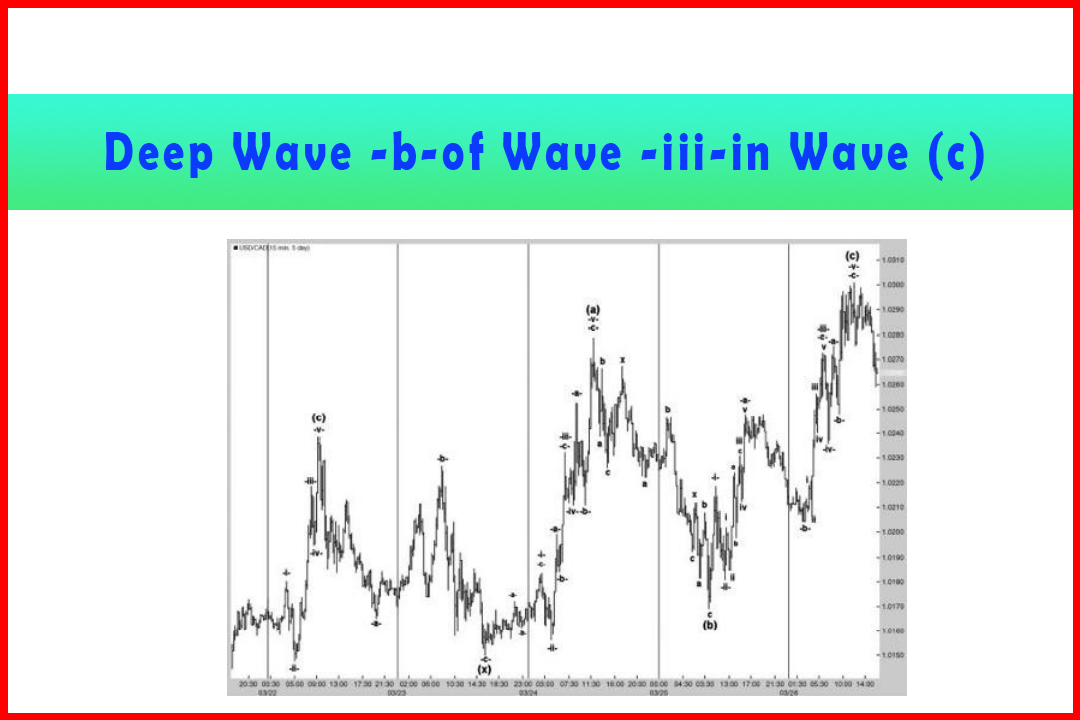

Figure 4.22

Potential Development of a Daily Triangle in EURUSD Including a Deep Wave (b)

of Wave (iii)

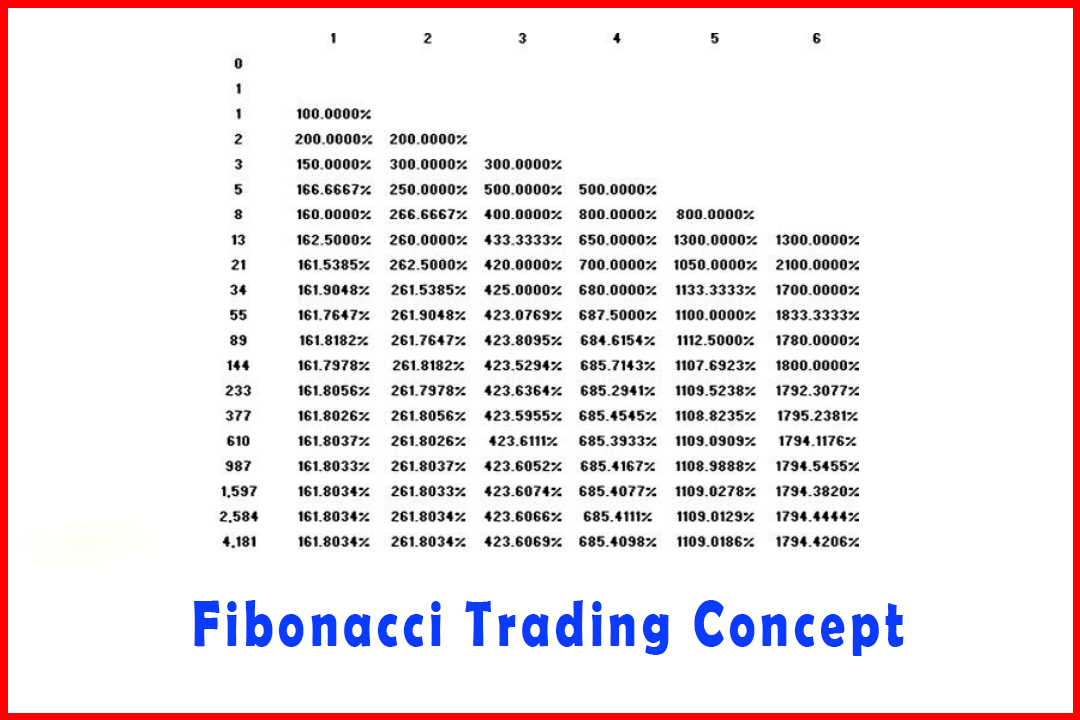

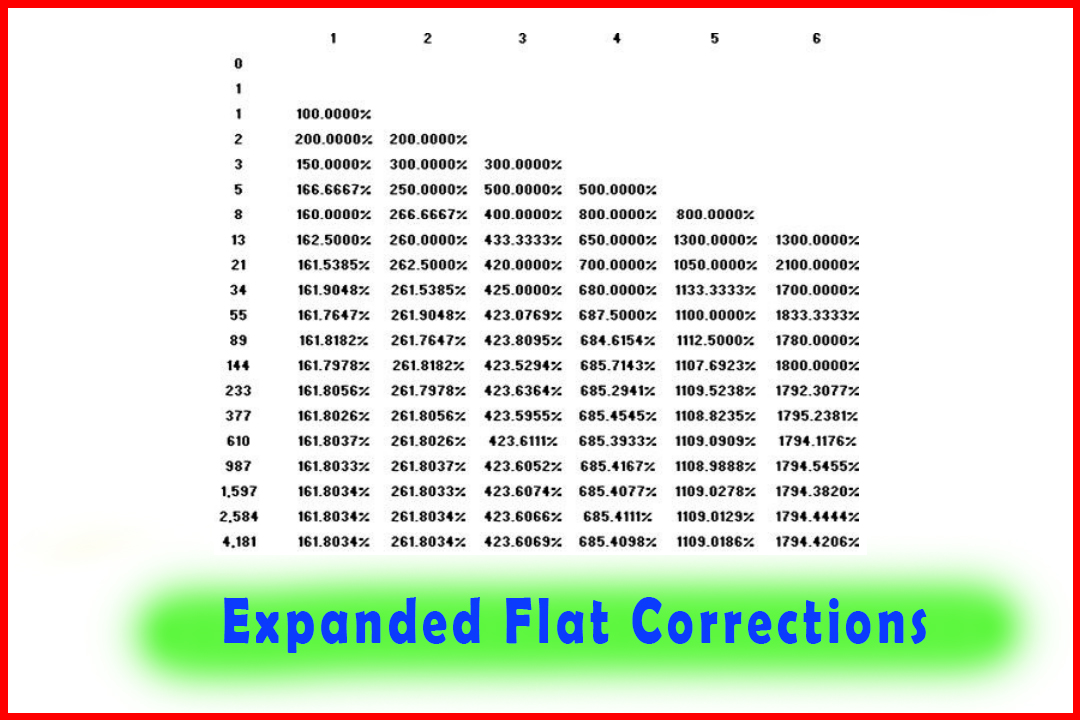

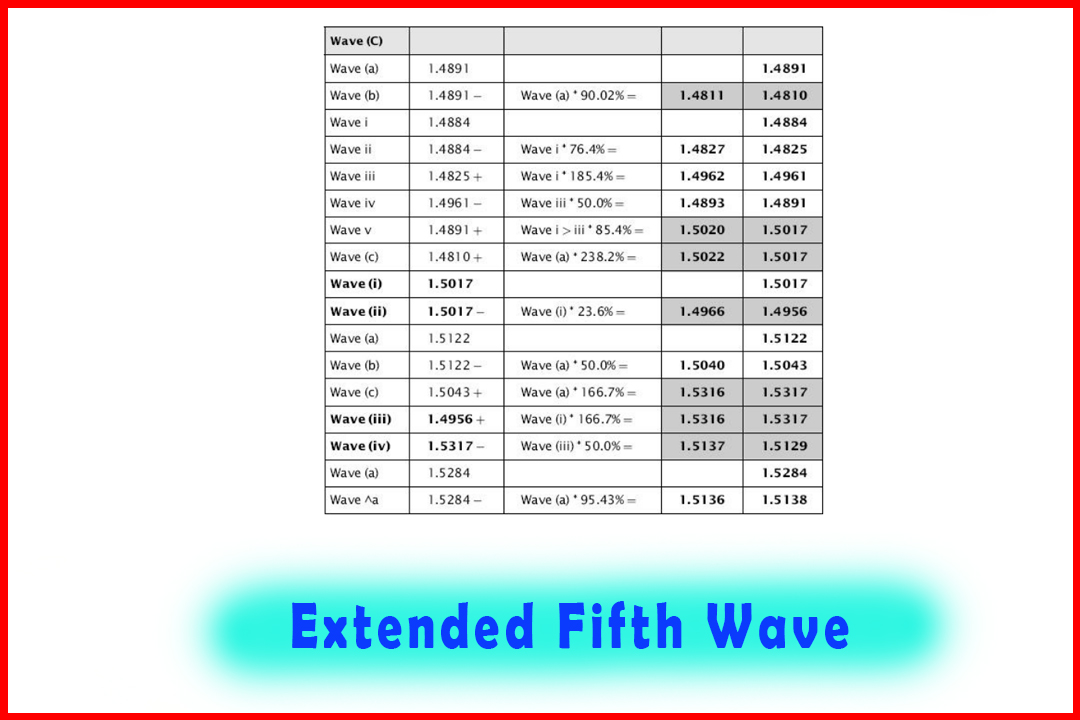

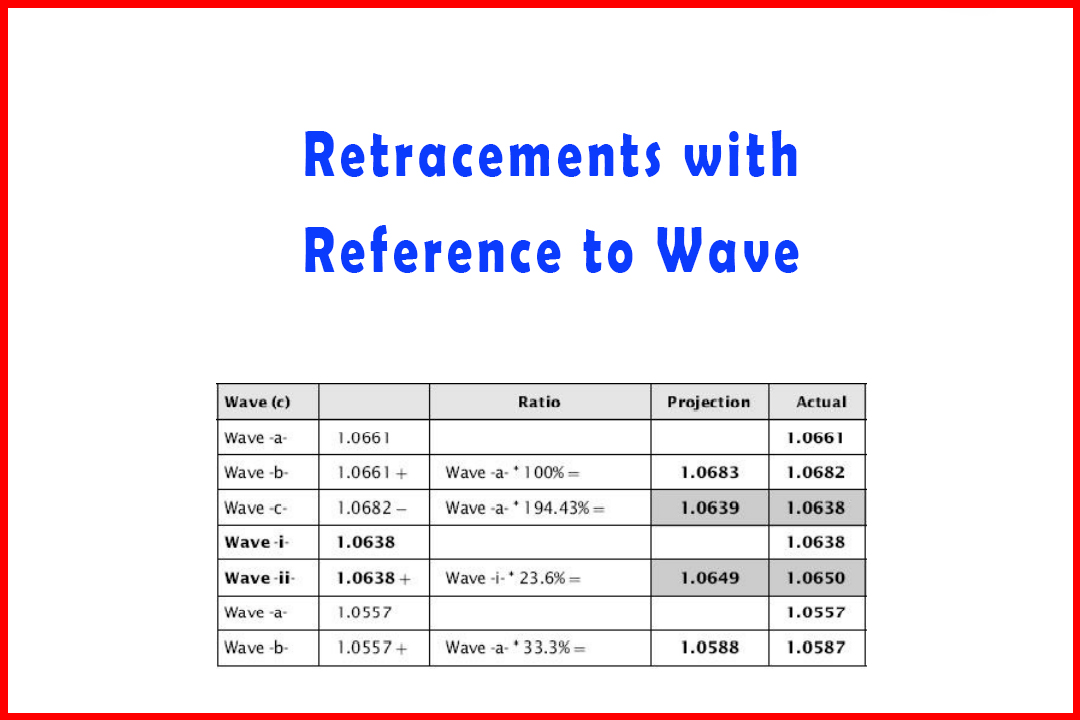

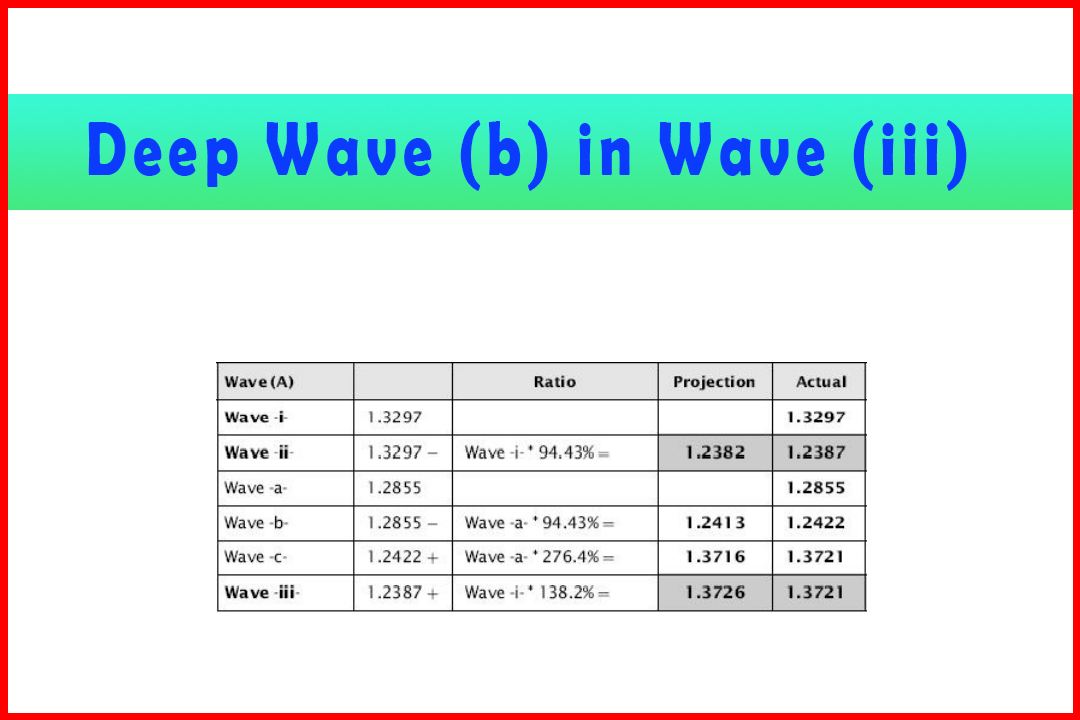

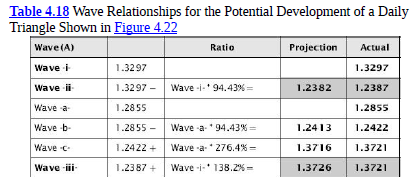

Table 4.18 Wave

Relationships for the Potential Development of a Daily Triangle Shown in Figure

4.22

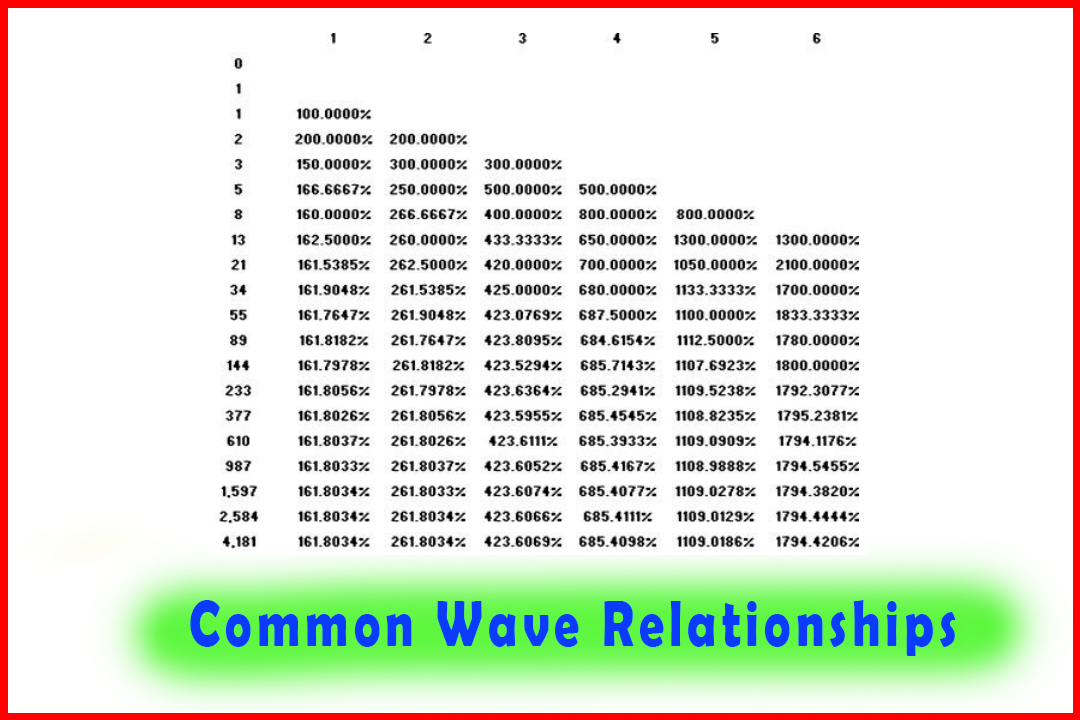

Very

clearly some of the ratios implied are rather unusual but closely related to

Fibonacci or harmonic ratios as an extension to prior waves. What it does

highlight is that while the ratios are all valid, forecasting can end up being

very trying.

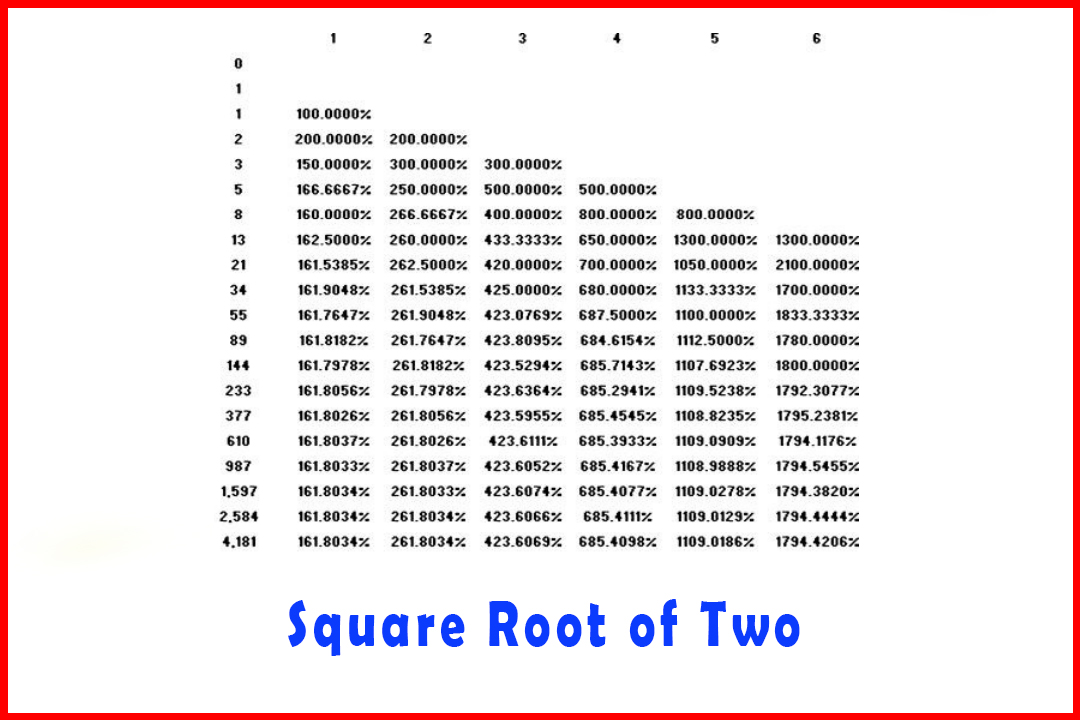

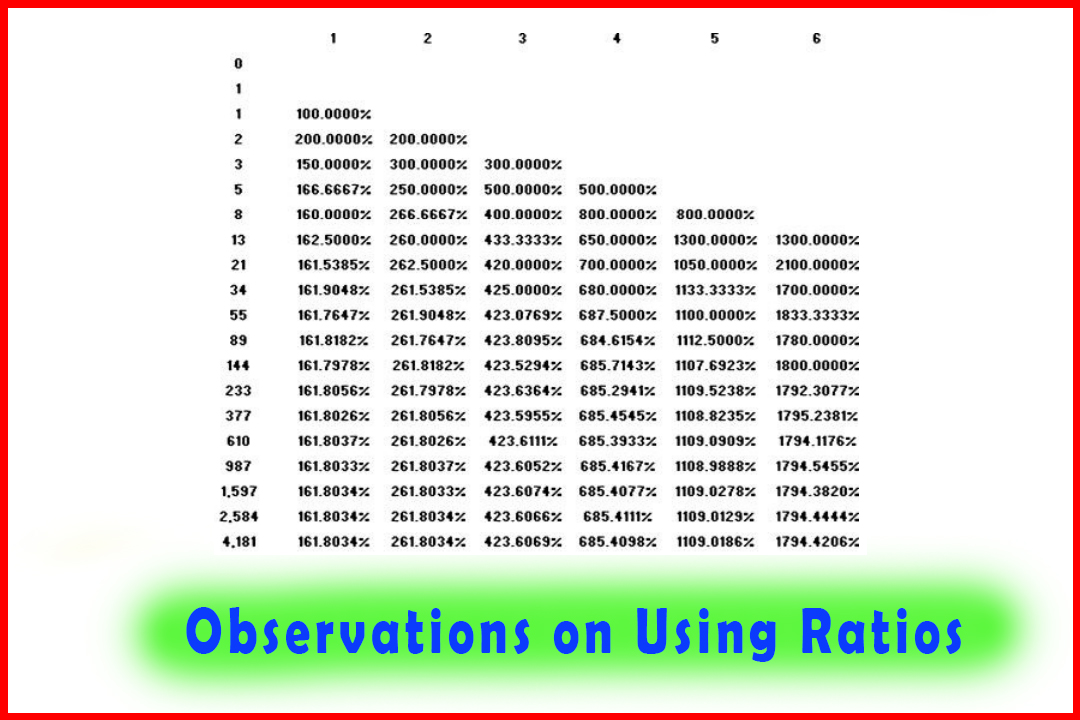

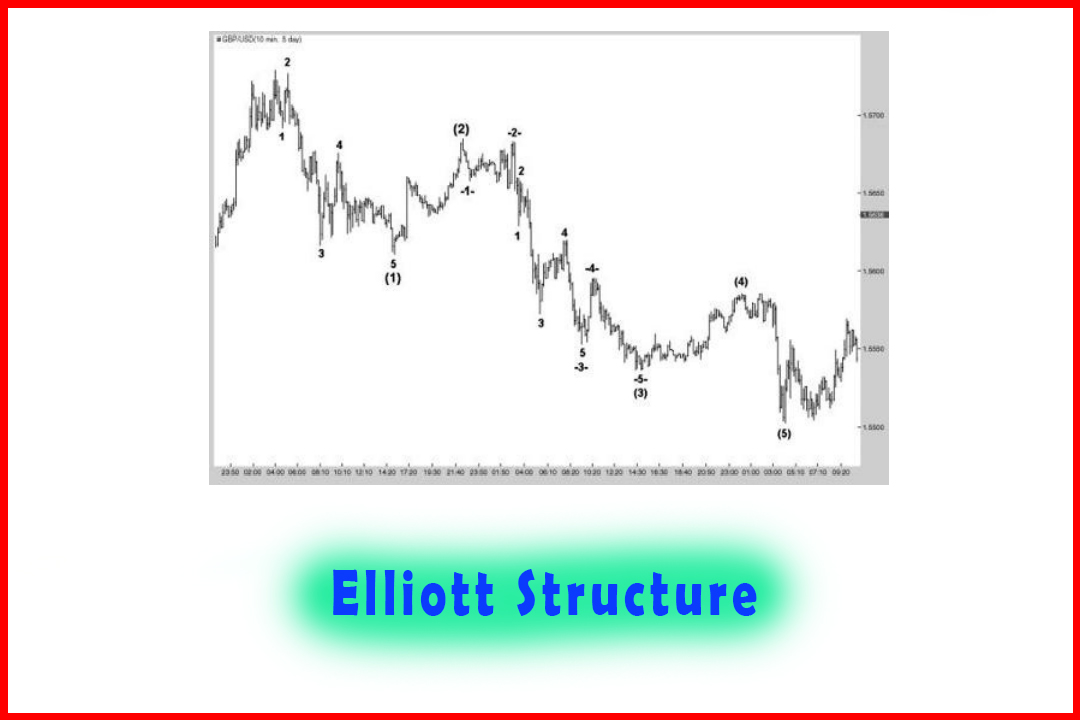

Such

events can end up being a 20/20 hindsight forecast, and certainly I found the

sequence in Wave (C) one of the most difficult. Strangely enough, I did

forecast the 1.5143 high, my target being 1.5146, but by using a different

structure in the move higher. Thus, once the decline developed I had been

looking for a much shallower correction, specifically at 1.4207 and 1.4048.

Indeed, there were reactions from 1.4217 and 1.4028 respectively, but by this time

the momentum conditions were still quite bearish and did not indicate any

potential for a reversal, and price actually penetrated the anticipated support

levels forcing a change in outlook.

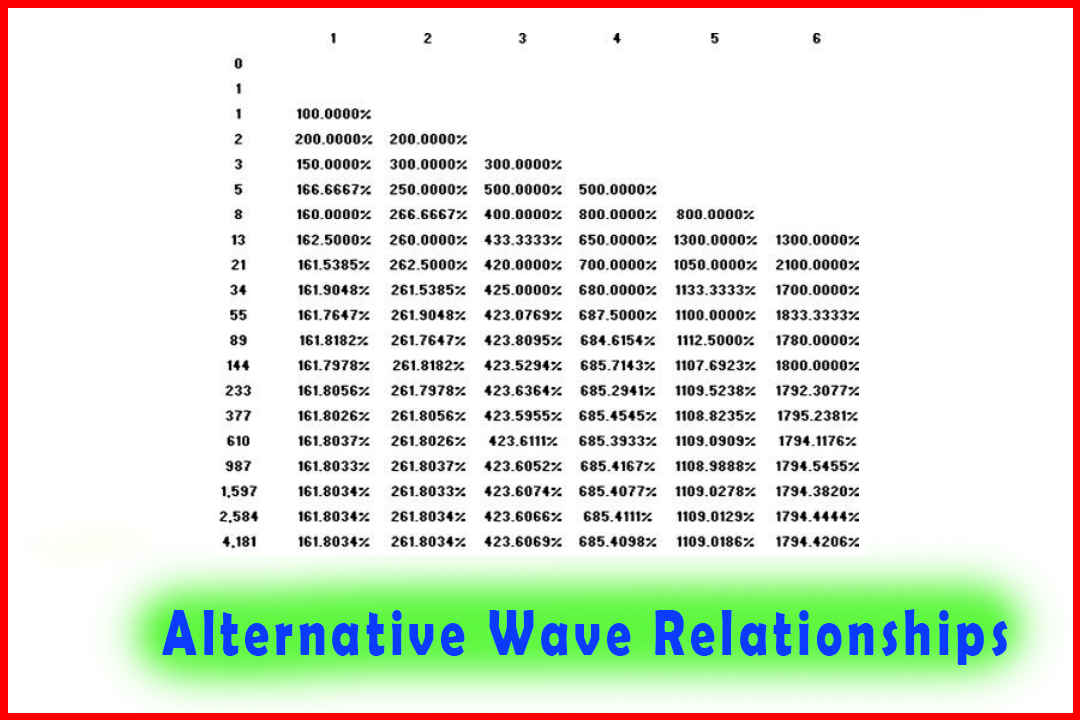

There

are always multiple potential projections in most areas of the wave structure,

and while tying together projections from different wave degrees, both higher

and lower, can generate high confidence areas of wave terminations, use of

other complementary techniques can help to fine-tune or even identify when a target

is not going to hold.

I

should stress that even if there are times when price conditions are clouded

and uncertain, the eventual end of a move that is finally realized after the

event does constitute valuable information since it actually provides clarification

of the wave structure of one higher degree. From that point it provides

guidance for the expectations of the subsequent wave development.

In

Chapter 5, I will cover this subject and provide some tips on how to approach

forecasting and recognizing when anticipated structures begin to break down,

and general signals that can forewarn you of confirmation or denial of

structures.

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Trade retracement, Strength Harmonic Structure, Accuracy Harmonic Structure, Five wave pattern - Deep Wave (b) in Wave (iii) in EURUSD Daily Chart

Elliott Wave | Forex | Fibonacci |