Working with the Modified Wave Structure in Forecasting

Best trading Analysis, Best Forecasting Analysis

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

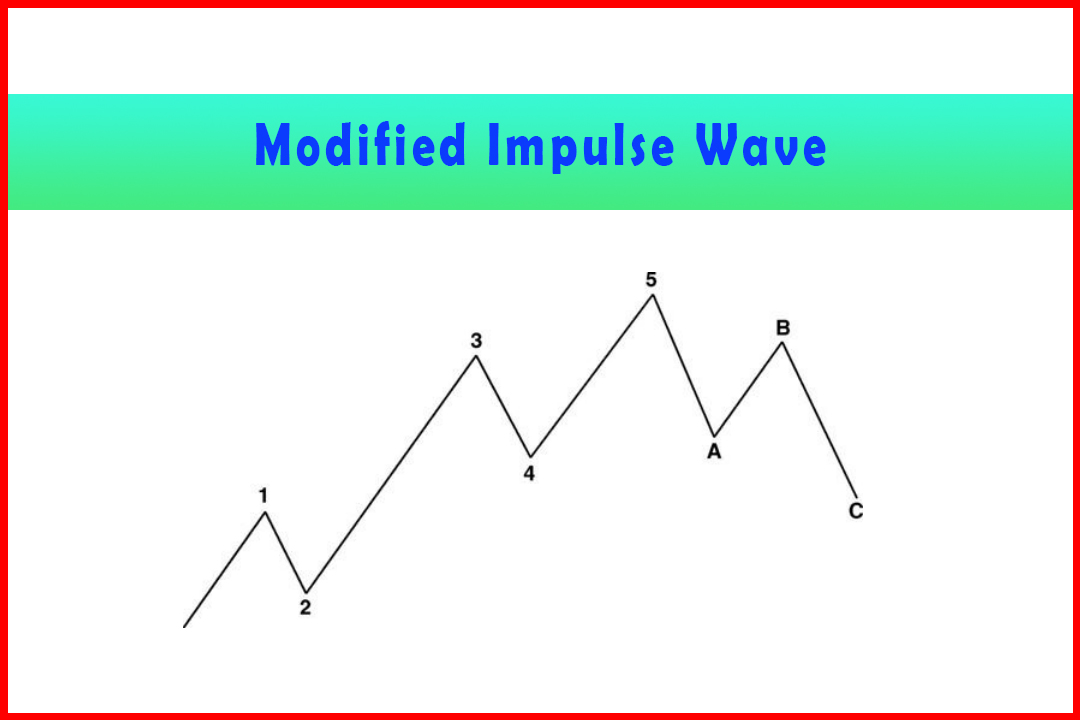

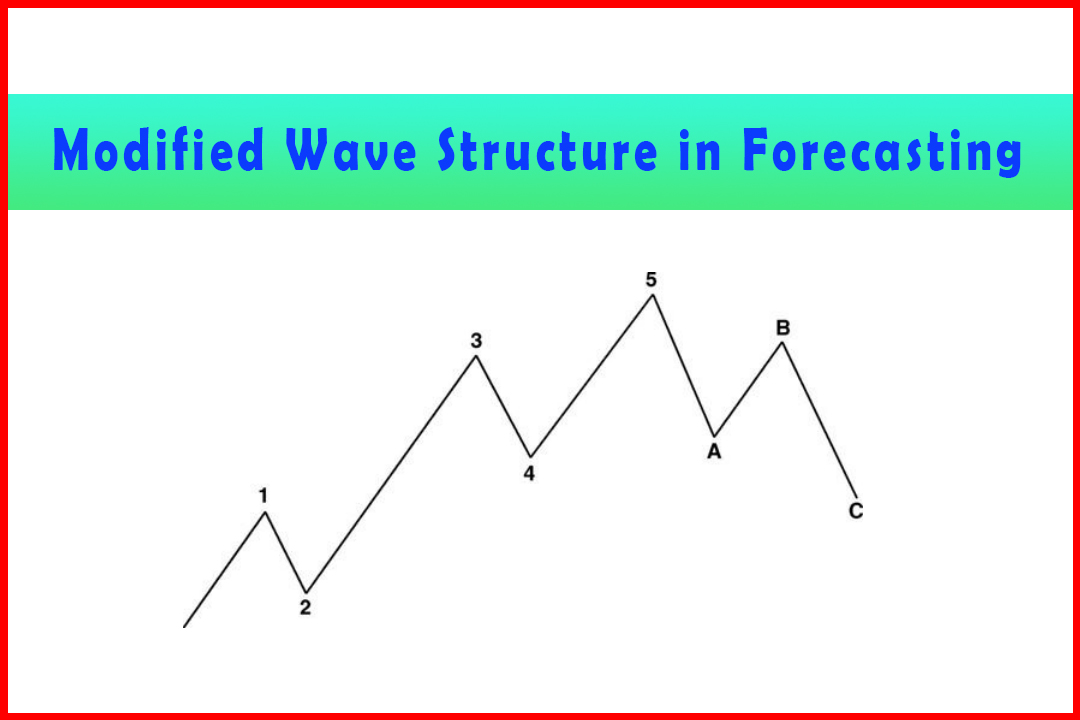

Until this point in the book, I have concentrated on describing Elliott's basically brilliant findings, his observations on the structure in which market prices develop, and then laying down the foundations for my claim that the impulsive wave structure was misjudged.

Working with the Modified Wave Structure in Forecasting

Introduction

Until

this point in the book, I have concentrated on describing Elliott's

basically brilliant findings, his observations on the structure in which market

prices develop, and then laying down the foundations for my claim that the

impulsive wave structure was misjudged. I repeat the view that Elliott did not

have the benefit of having modern spreadsheets which calculate a wide range of

projection ratios that can be used for any time frame, from one minute to

monthly. Elliott had to do all this in long hand, which limited his ability to

fully analyze wave relationships in detail.

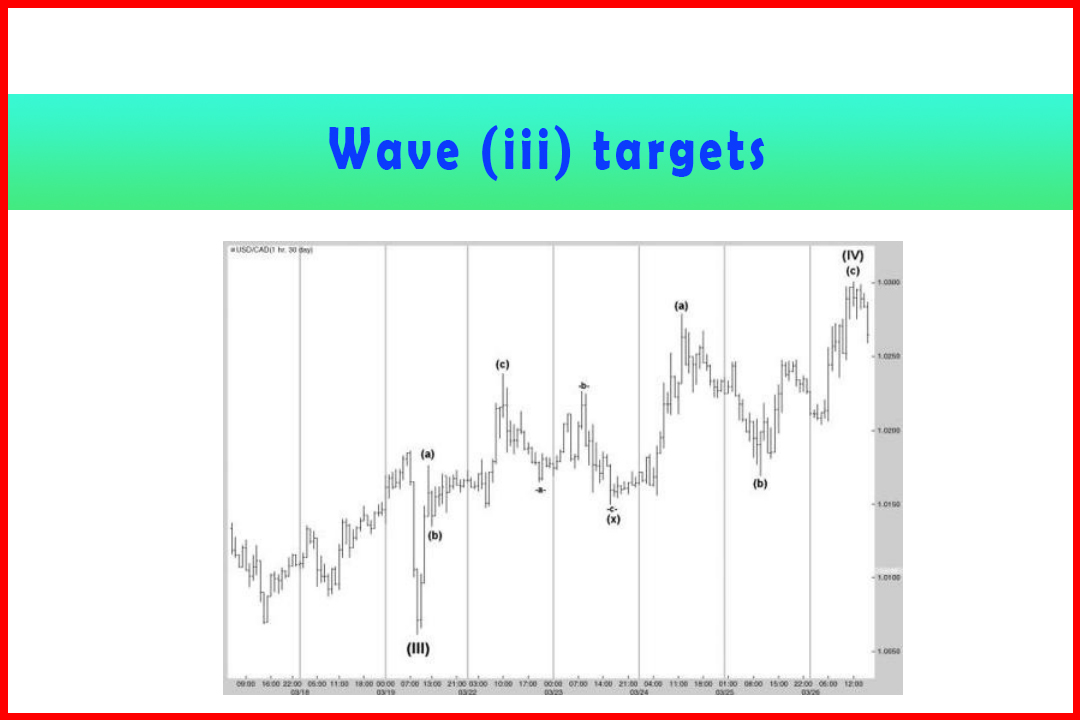

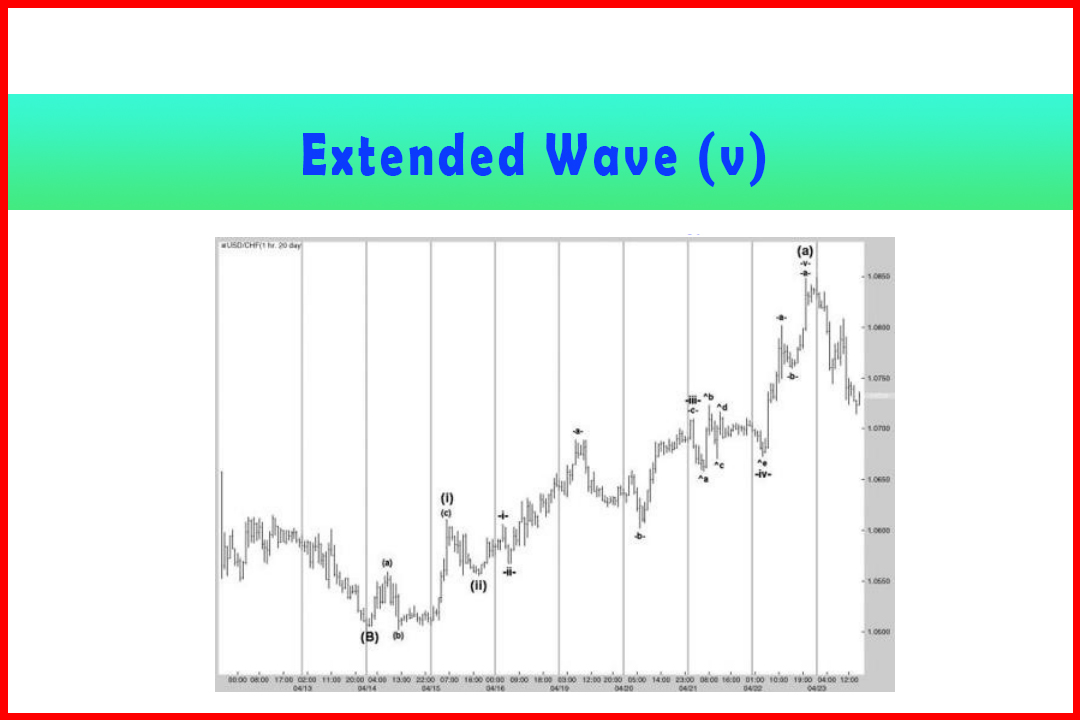

The

majority of examples I gave in Chapter 4 were live as I have been writing, and

clearly I have picked them as, in my opinion, they demonstrate the validity of

the modifications I am proposing and which I use every day in my analysis. The

ratios match not only in one wave degree but harmoniously across all wave

degrees. Above all, this attracts me as I feel this is the way the natural

order of the world works.

Did

I forecast all of the examples? No I didn't, but I did get quite a few

correct, and with pinpoint accuracy.

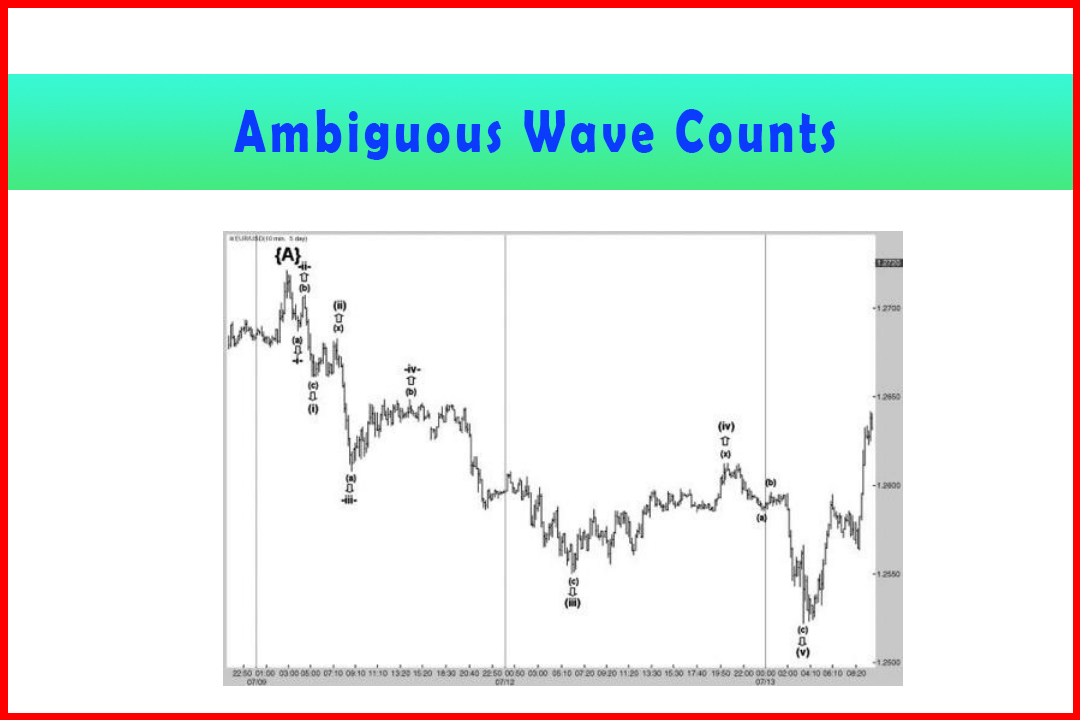

Is

this the Holy Grail? Not at all. It is a very intensive method of analysis and

requires constant attention. When it all comes together, the accuracy

astonishes not only my subscribers but even takes my breath away at times. Some

subscribers appear to think I am psychic. Unfortunately the new ones then

forget money management and raise the risk levels, so that when the structure

adapts or morphs into another pattern they lose too much.

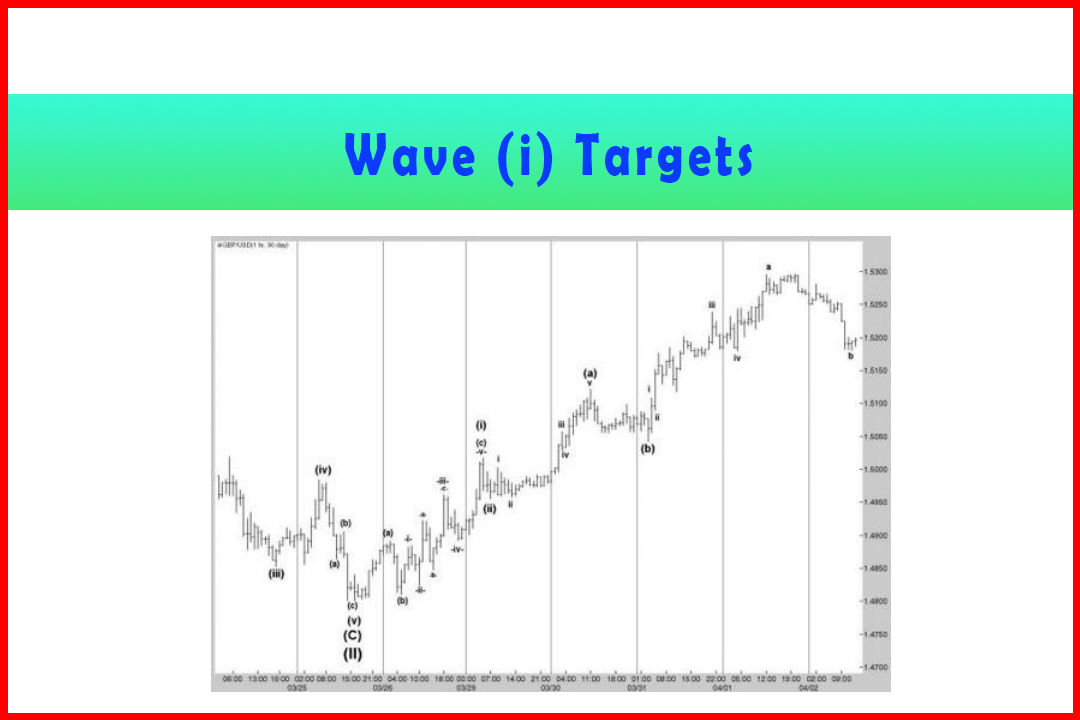

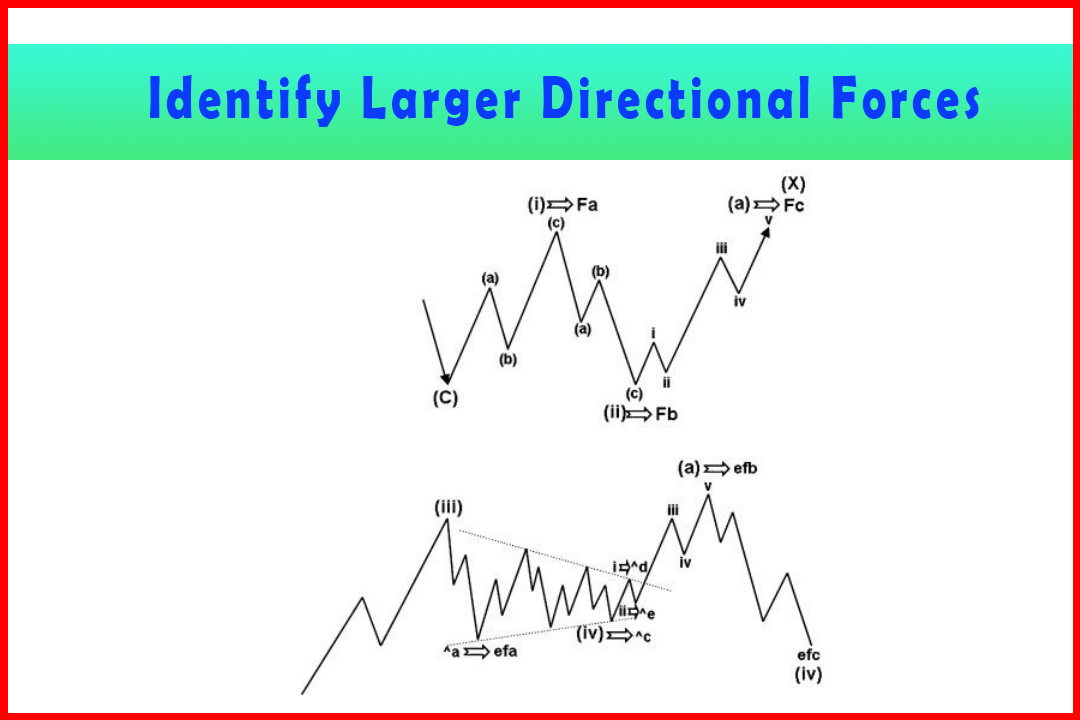

So

as in just about all books the examples look like great, shining examples of

the power of the technique; however, this chapter is intended to provide

guidance on how to approach the Harmonic Elliott Wave method, clues to spot

when the structure is breaking down, how to integrate the different wave degrees

to ensure a higher level of accuracy, and how to identify whether a projection

or retracement is going to hold a particular forecast level.

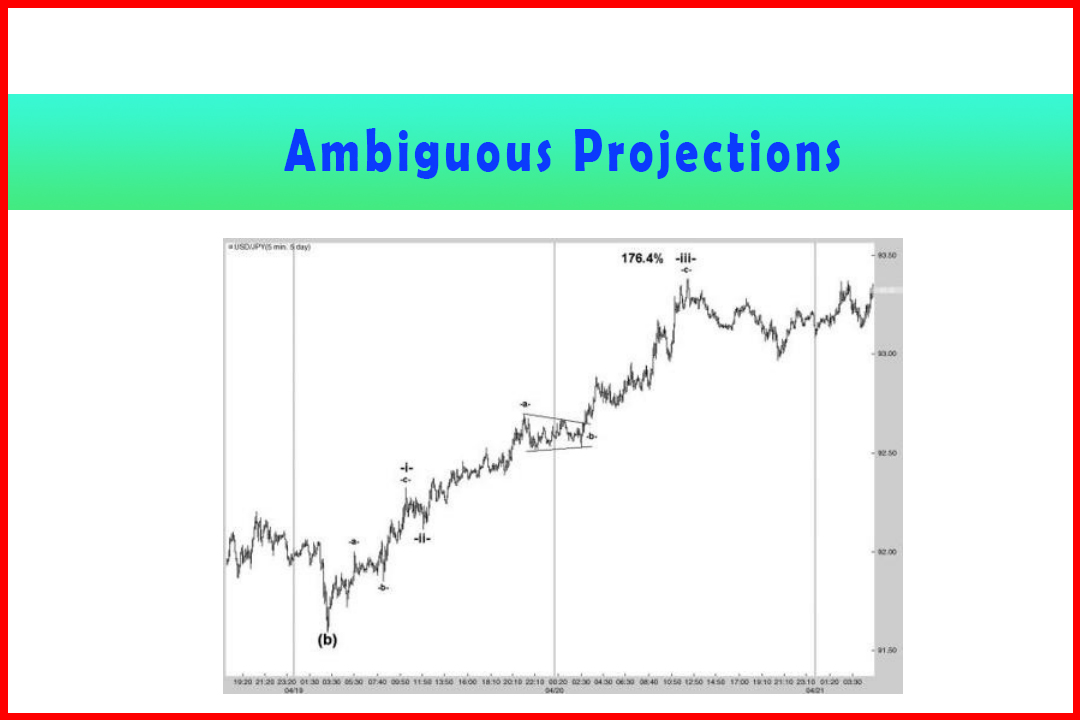

I

have chosen examples that replicate some of the issues I have faced after first

recognizing that Elliott's original impulsive structure was incorrect

and offering practical guidance in how to approach forecasting, the

difficulties that can be faced, and general hints and tips to assist your

progress in mastering the technique.

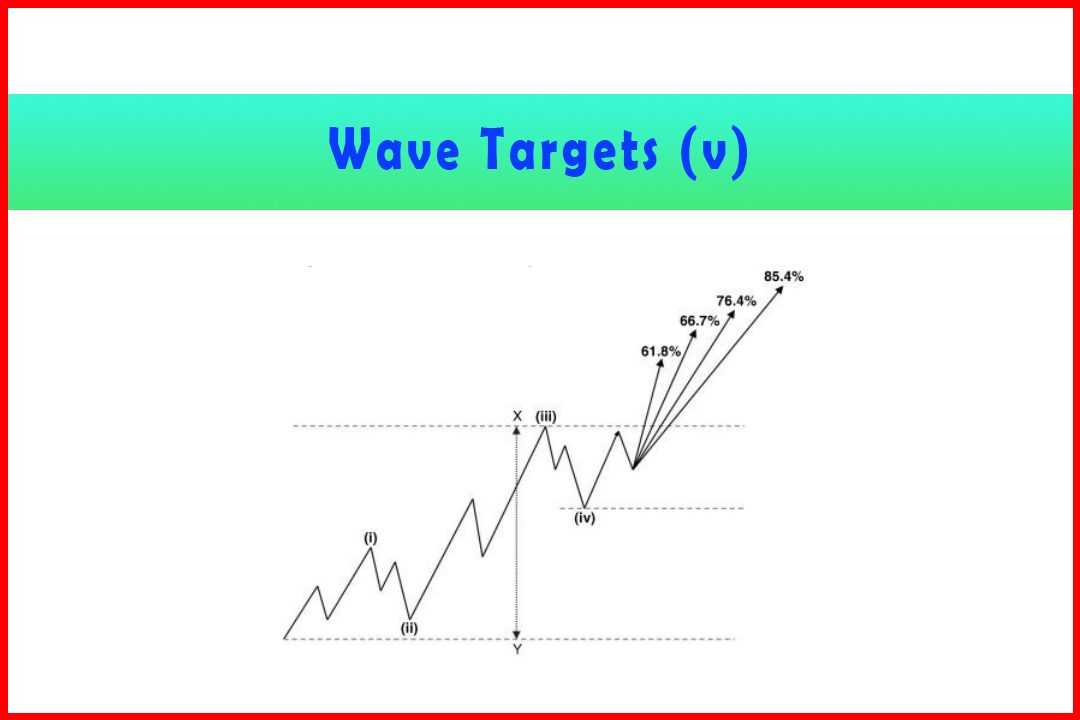

To

provide a reminder of the relationships between waves I shall repeat those

provided in Chapter 3.

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : Best trading Analysis, Best Forecasting Analysis - Working with the Modified Wave Structure in Forecasting

Elliott Wave | Forex | Fibonacci |