Deep Wave -b-of Wave -iii-in Wave (c) Higher in USDCAD

Trade retracement, Strength Harmonic Structure, Accuracy Harmonic Structure, Five wave pattern

Course: [ Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios ]

Elliott Wave | Forex | Fibonacci |

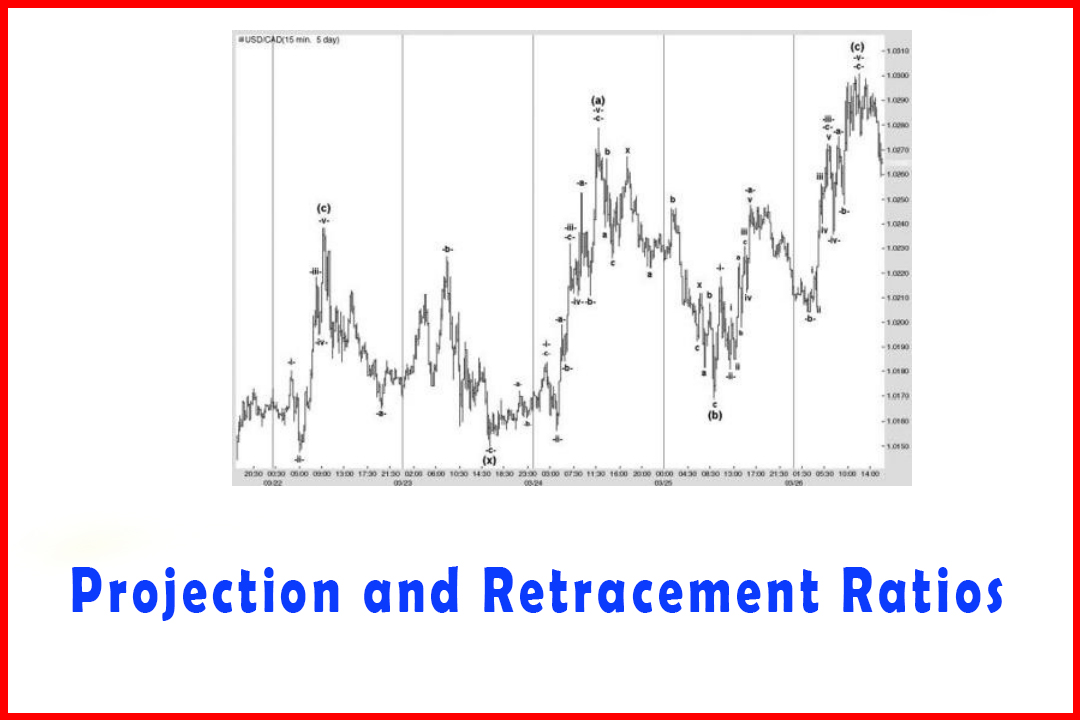

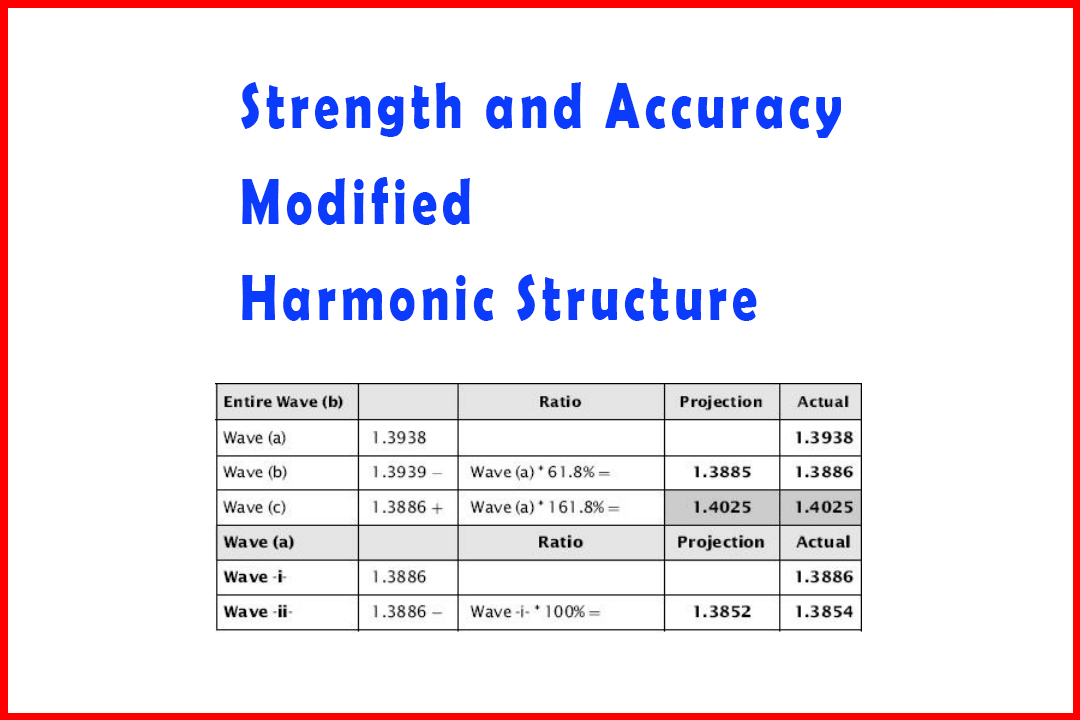

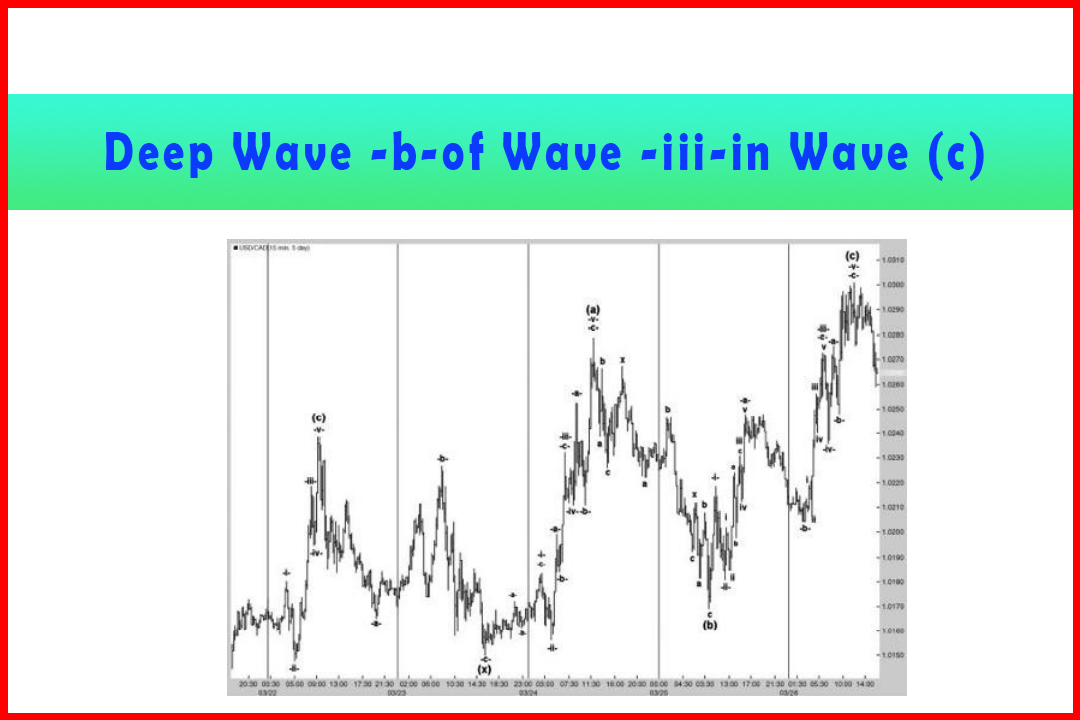

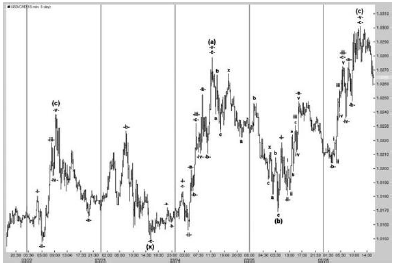

As another example of a deep Wave (b) Figure 4.20 was shown in Chapter 3 in which a Wave (IV) higher was developing in USDCAD

Deep Wave -b-of Wave -iii-in Wave (c) Higher in USDCAD

As

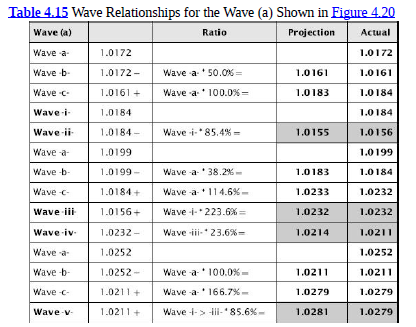

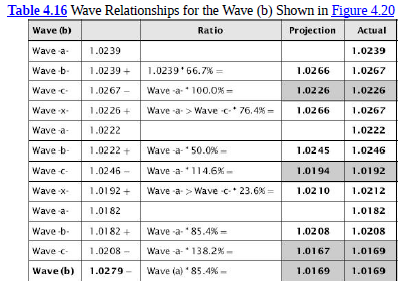

another example of a deep Wave (b) Figure 4.20 was shown in Chapter 3 in which

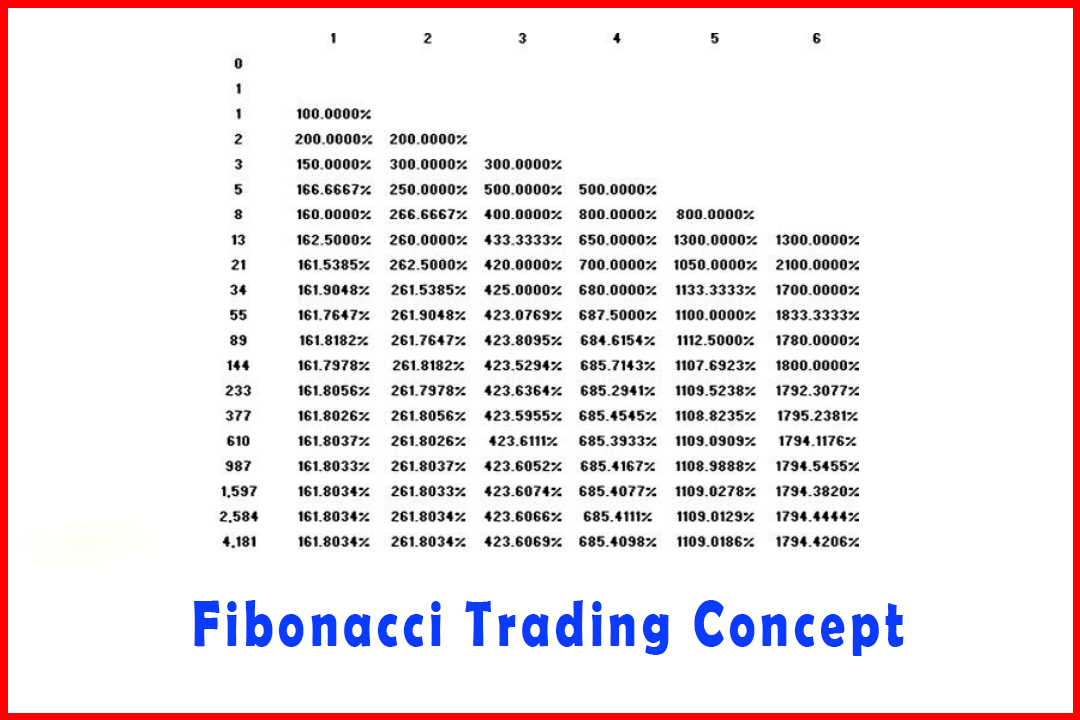

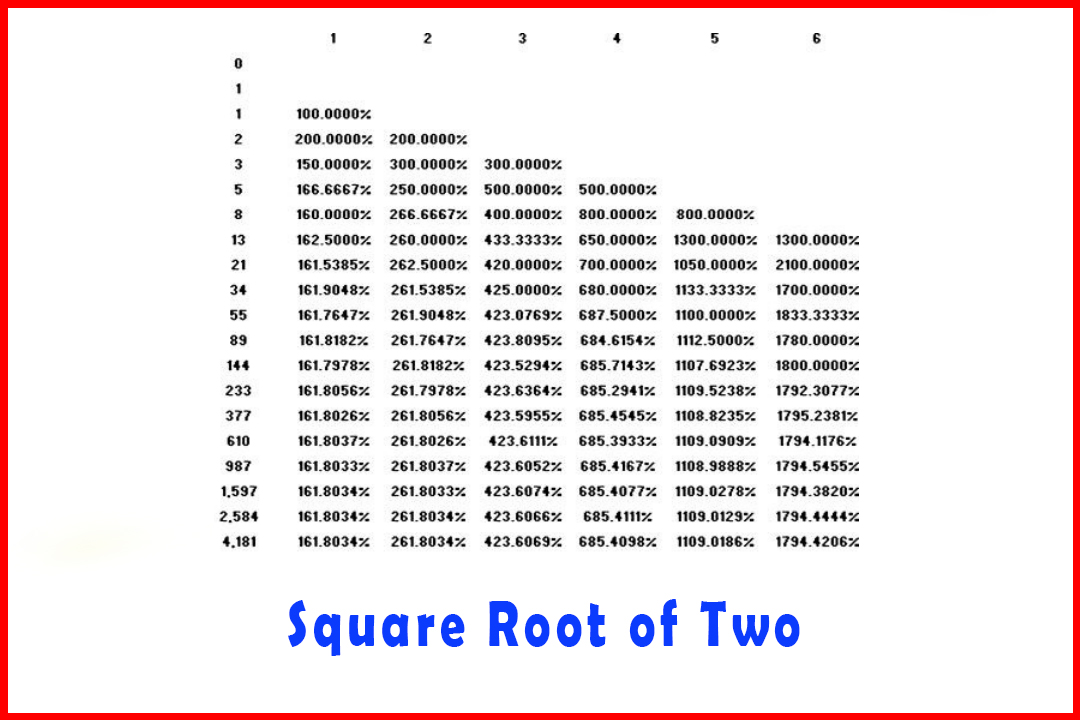

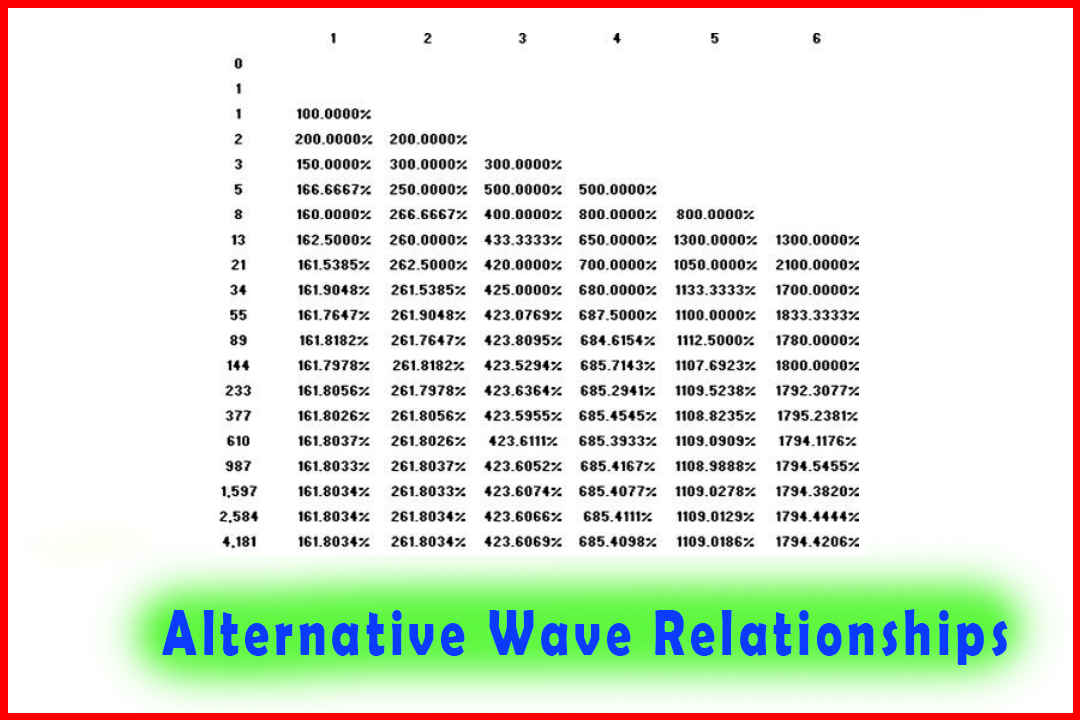

a Wave (IV) higher was developing in USDCAD. The ratios are quite startling

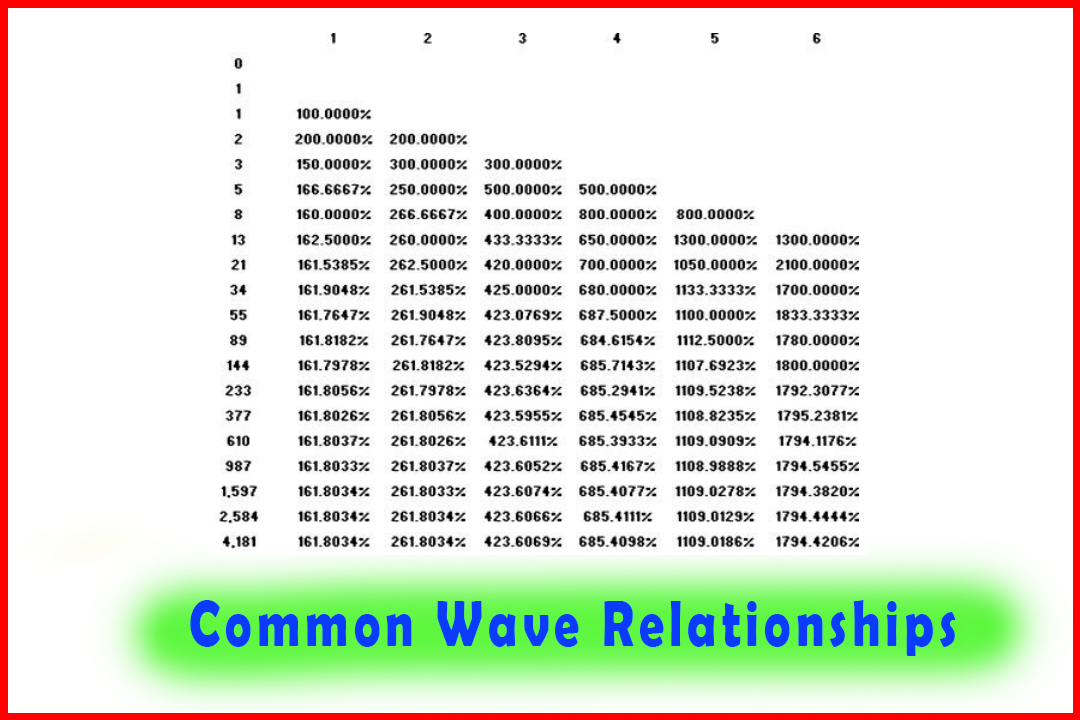

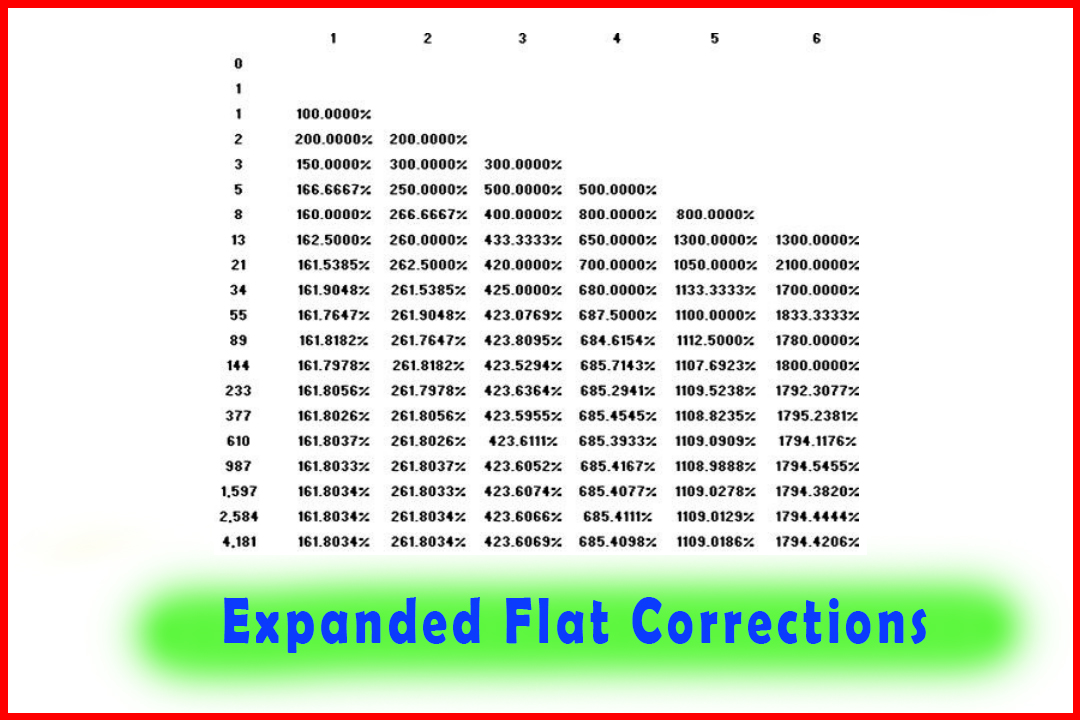

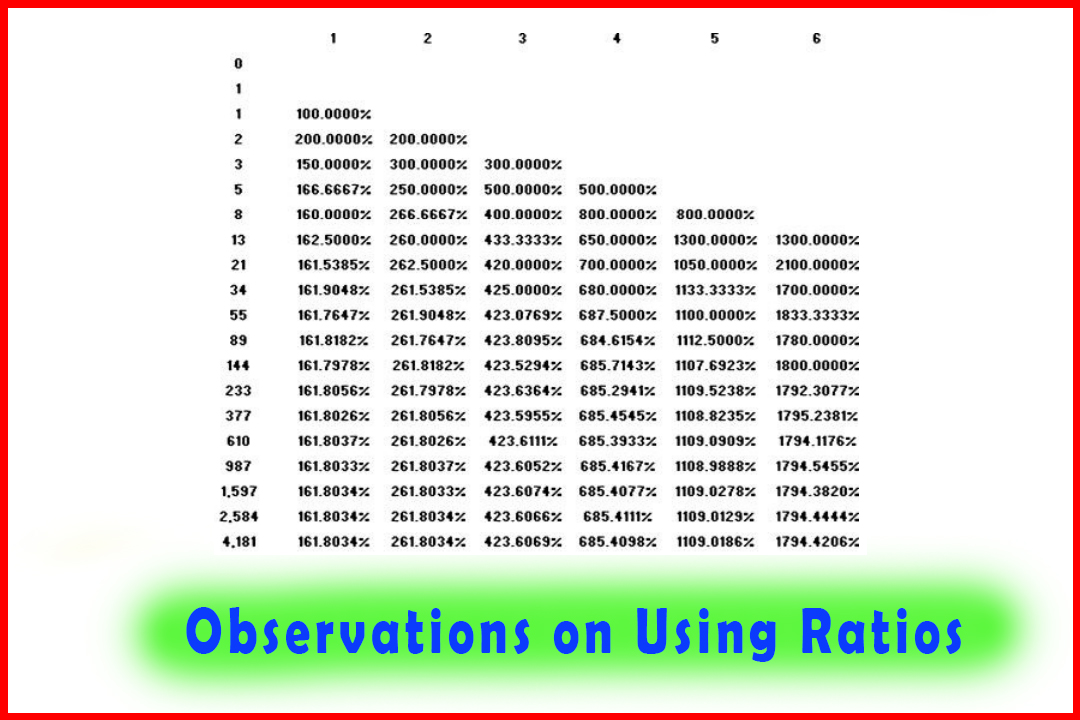

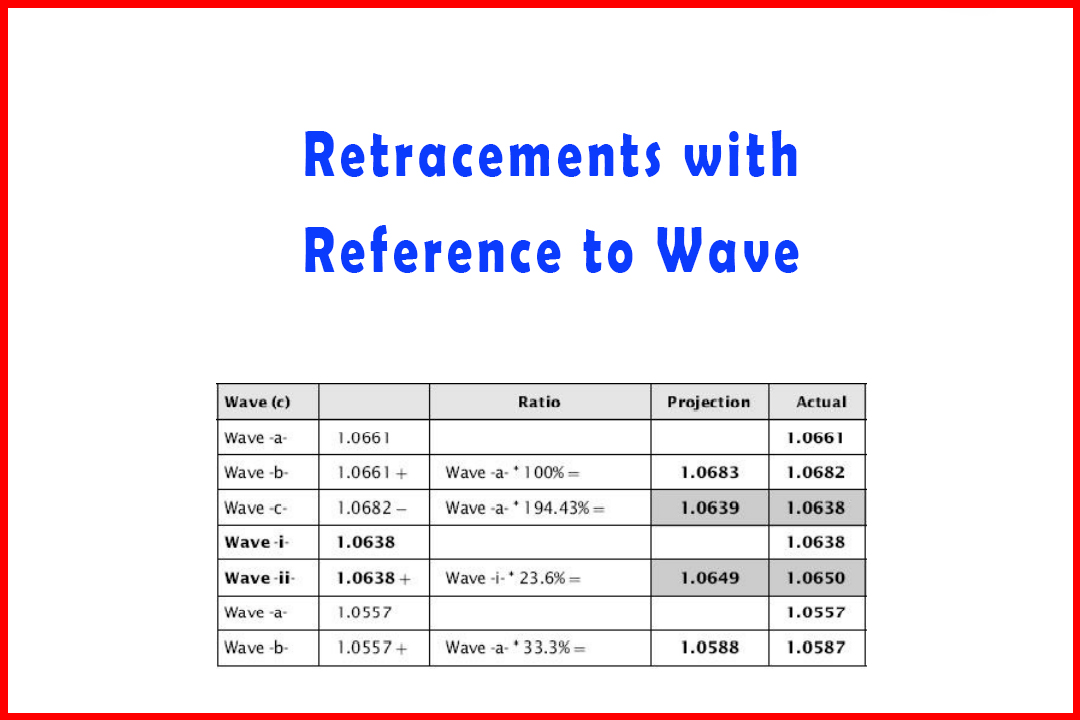

(see Tables 4.15. 4.16. and 4.17).

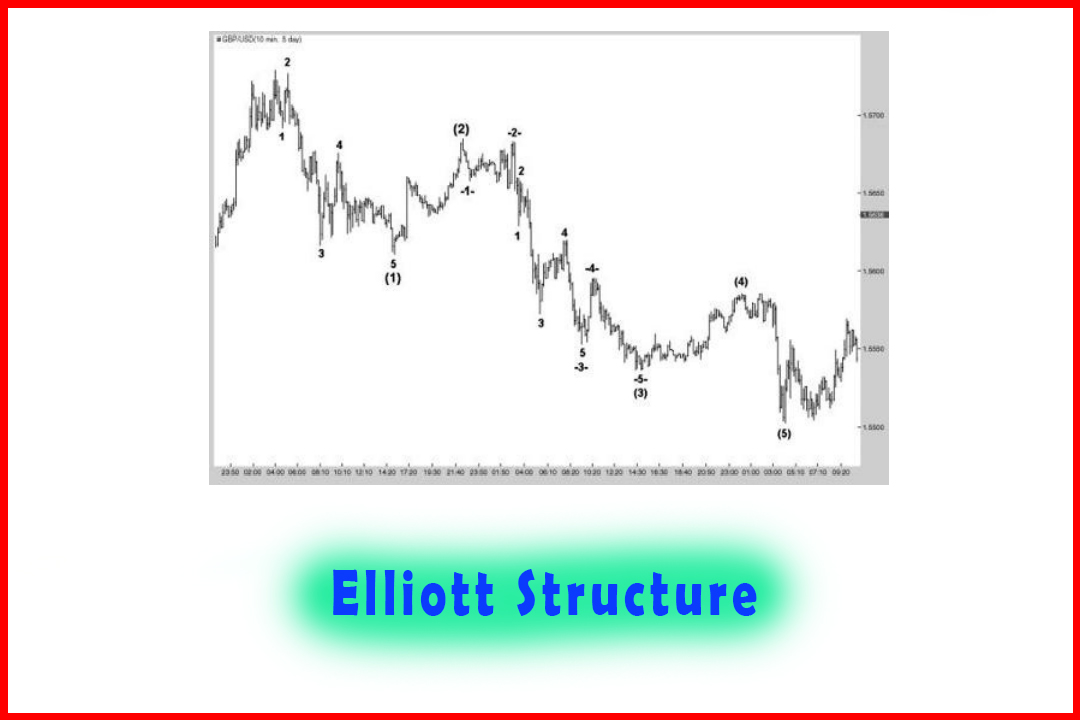

Figure 4.20 A Deep Wave -b-in Wave

-iii-Higher in Wave (c) of Wave (IV) in Hourly USDCAD

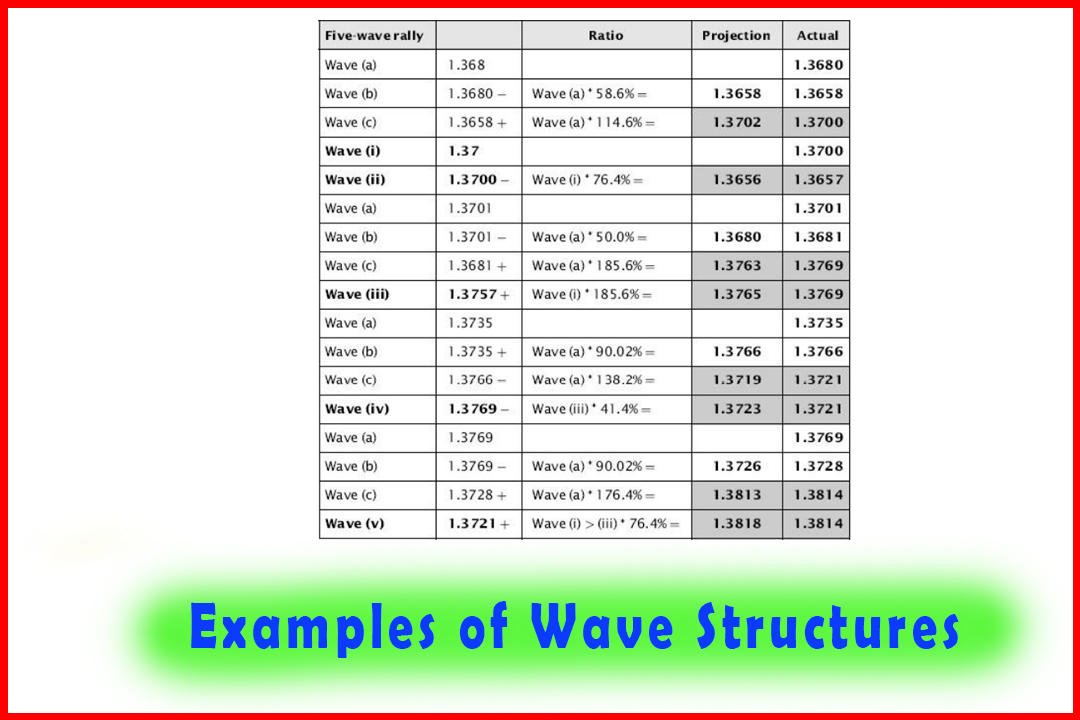

To

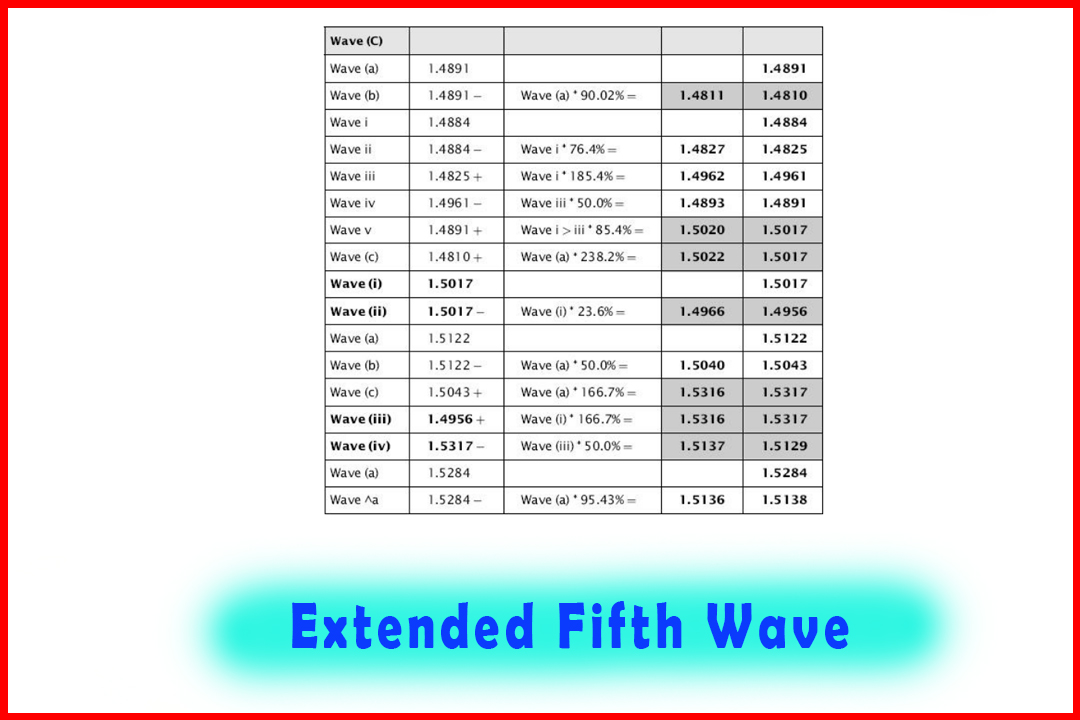

highlight the accuracy I shall provide the ratios for Wave (a), Wave (b), and

Wave (c).

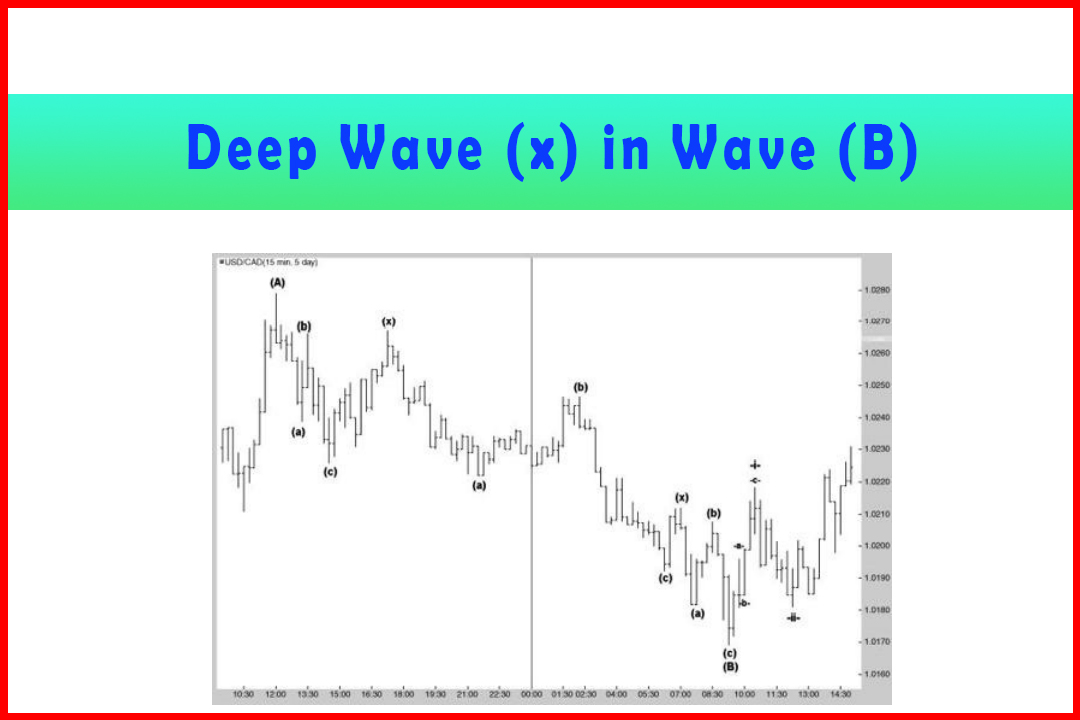

This

completed Wave (a) from where a pullback in Wave (b) was anticipated. It would

not be possible to know how deep this correction would be. The ratios were

shown in Table 4.14 as an example of a deep Wave (x) following a deep

correction in Wave (b).

Having

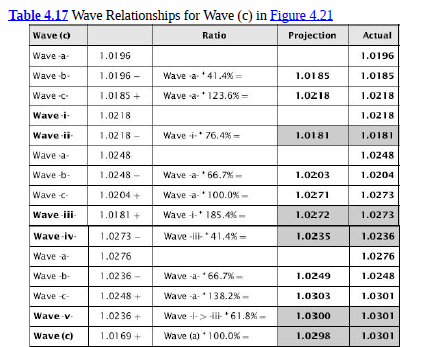

identified the Wave (b) low there would therefore be projections for Wave (c),

and being within a Wave (IV) there would also be ratios for this pullback.

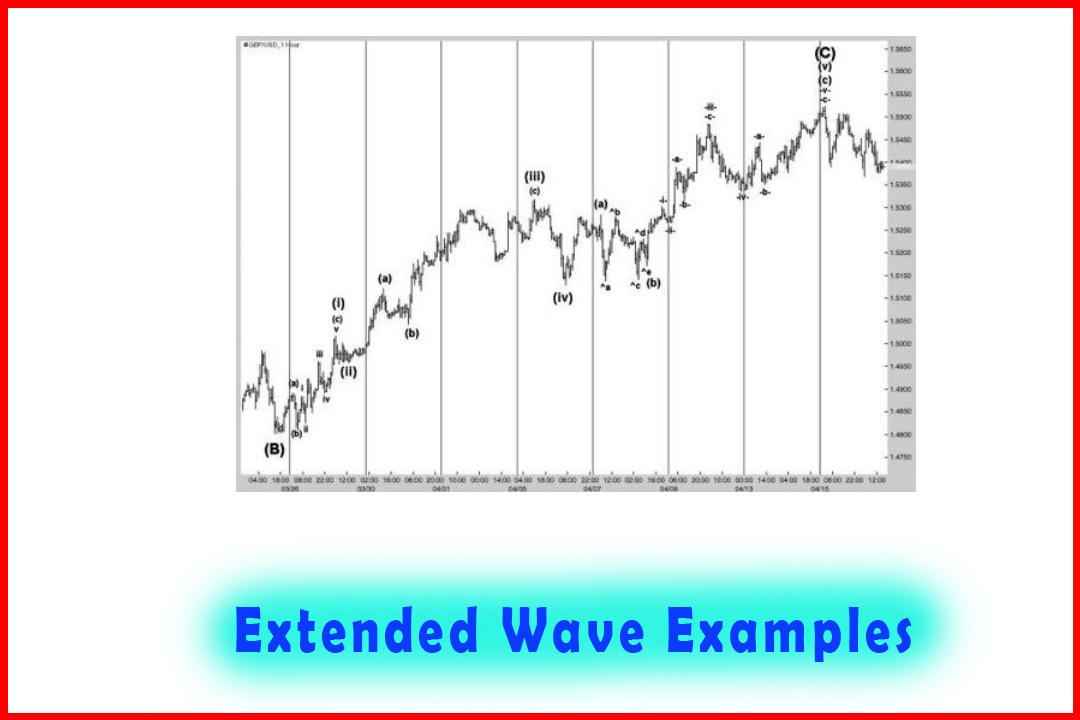

Figure 4.21 displays Wave (c) in more detail.

Figure 4.21 A Deep

Wave -b-in Wave -iii-Higher in Wave (c) in Hourly USDCAD

In

Elliott's structure this would not even be considered, as Wave 3 is

generally considered to be the strongest and most powerful wave of the entire

sequence. However, the ratios provide compelling evidence that this is not the

case.

The

key points to note here are:

- The 185.4% projection in Wave -iii-provided a projection target at 1.0272.

- The wave equality target in Wave -c-provided a projection target at 1.0271.

- Given Wave -ii-had a deep retracement of 76.4% the retracement in Wave - iv-of 41.4% was in line with normal ratios.

- The 61.8% projection in Wave -v-arrived at the same area as the wave equality target in Wave (c).

This

is the typical development of a directional move that includes a deep Wave (b),

and demonstrates very clearly the degree of synchronicity that develops within

the Harmonic Elliott Wave structure.

Harmonic Elliott Wave : Chapter 4: Projection and Retracement Ratios : Tag: Elliott Wave, Forex, Fibonacci : Trade retracement, Strength Harmonic Structure, Accuracy Harmonic Structure, Five wave pattern - Deep Wave -b-of Wave -iii-in Wave (c) Higher in USDCAD

Elliott Wave | Forex | Fibonacci |