Determining Trend Direction Using moving averages

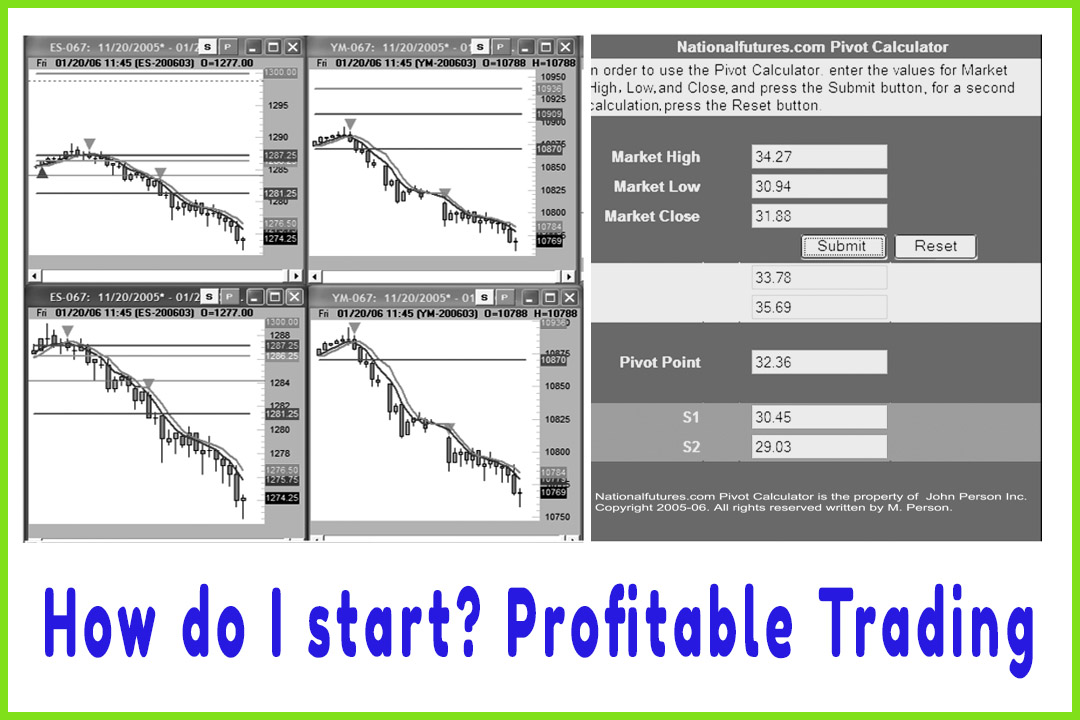

Best trading Strategies, moving average trading method, Pivot point trading strategy, Pivot points levels

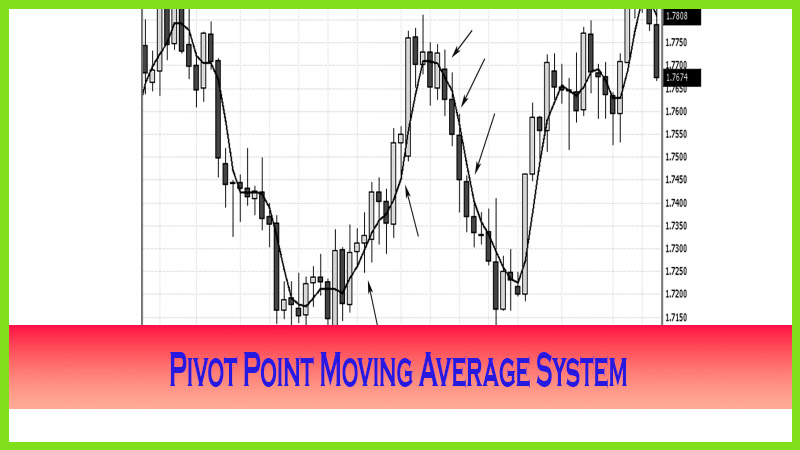

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System ]

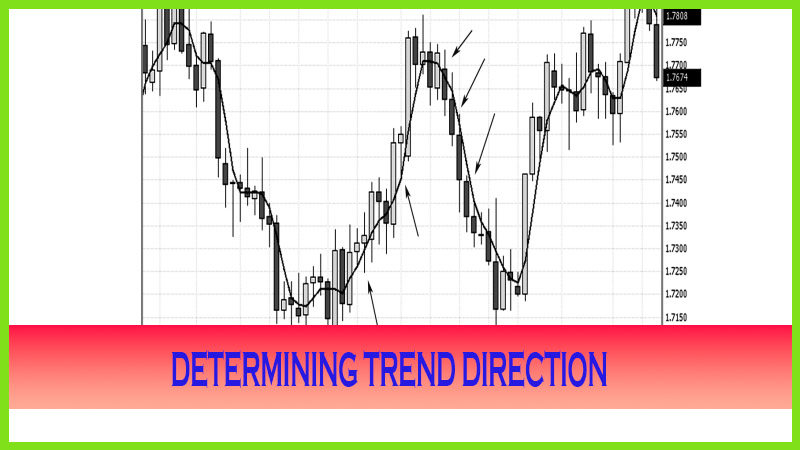

Simply put, one way to determine the trend is by drawing trend lines. In an uptrend, we should see a sequence of higher highs and higher lows, so we would draw a line against the lows and extend it outward to forecast a support level sometime in the future.

DETERMINING TREND DIRECTION

Simply

put, one way to determine the trend is by drawing trend lines. In an uptrend,

we should see a sequence of higher highs and higher lows, so we would draw a

line against the lows and extend it outward to forecast a support level

sometime in the future. In a downtrend, as the sequence of events shows lower

highs and lower lows, we would draw a line against the top of the highs and

extend it outward to help forecast a resistance point in the future.

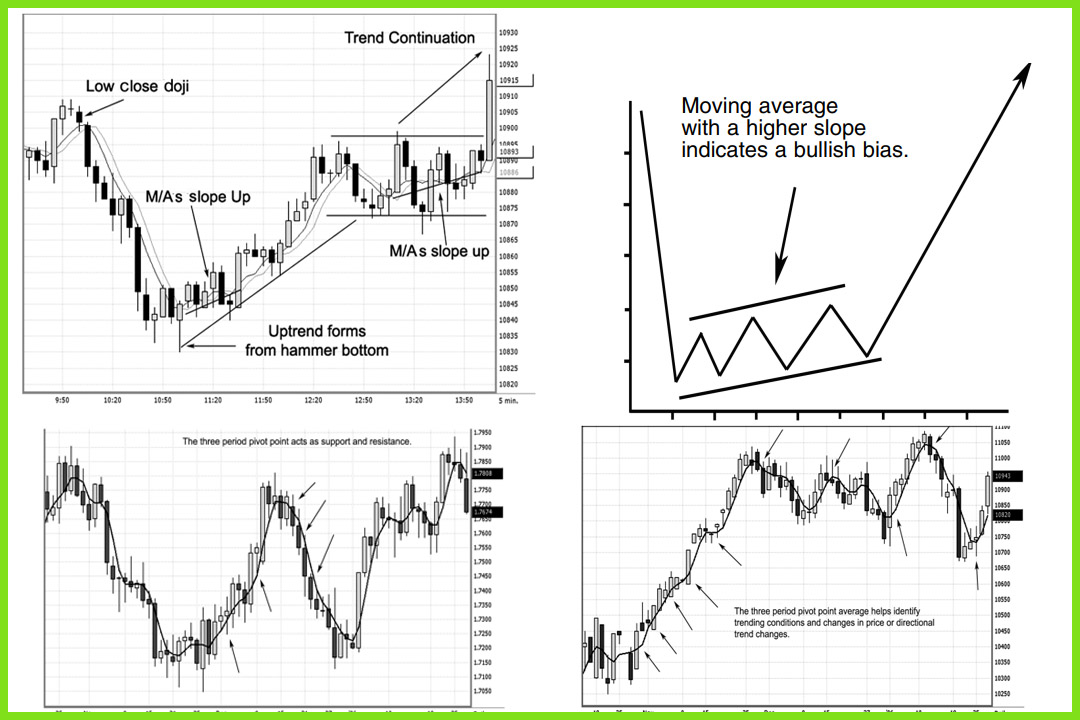

Another

method used in determining trend line support and resistance is through the use

of moving averages. The most popular method of using a moving average is to

average the closing prices (sometimes referred to as the settlement prices) of

a defined number of sessions. The moving average is a lagging indicator. The

purpose of the moving average is to indicate the beginning and the ending of a

trend. Since the moving average follows the market, the signals it generates

occur after the trend has already changed. It is argued that most traders (or

about 70 percent) lose their money in the markets. If the reason is that most

traders focus on moving average values that are predetermined by default

settings in their charting software packages or if they use the media’s

favorite 200-day moving average, it’s no wonder that people lose. The majority

are following the same indicator.

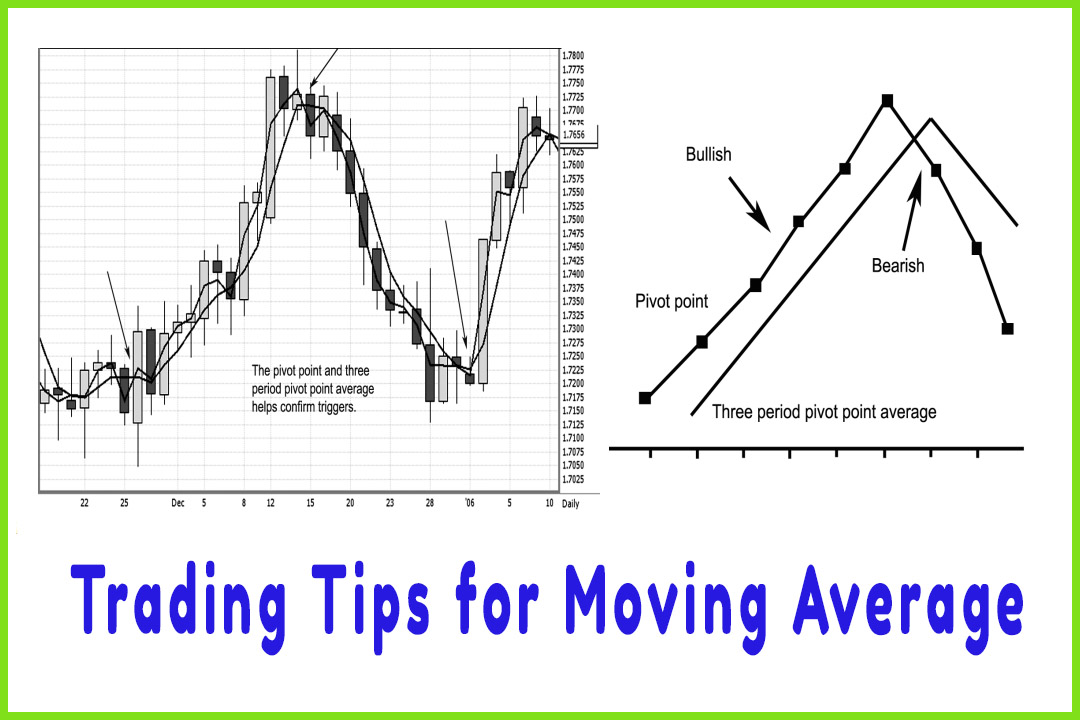

BEAT THE STREET

As Yogi

said, “If

you want to do better than the average bear, then you have to think better than

the average bear!” If you want to

beat the Street, then you need to think better than the Street—use a different

set of values or understand how signals are generated. You do not want to

follow and trade off what everyone else is looking at; so when it comes to

moving averages, you want to look at a different set of conditions and time

periods. Think for a minute: If lots of traders are watching for trade signals

on 10, 20, and 50 periods and if the statement holds true that the majority of

traders lose, then why do you want to trade based off signals on those moving

averages? It might serve you well to watch these indicators so you can see

where others get in or out of trades, but certainly not to follow those, which

would be the same as succumbing to crowd mentality. Some traders and technical

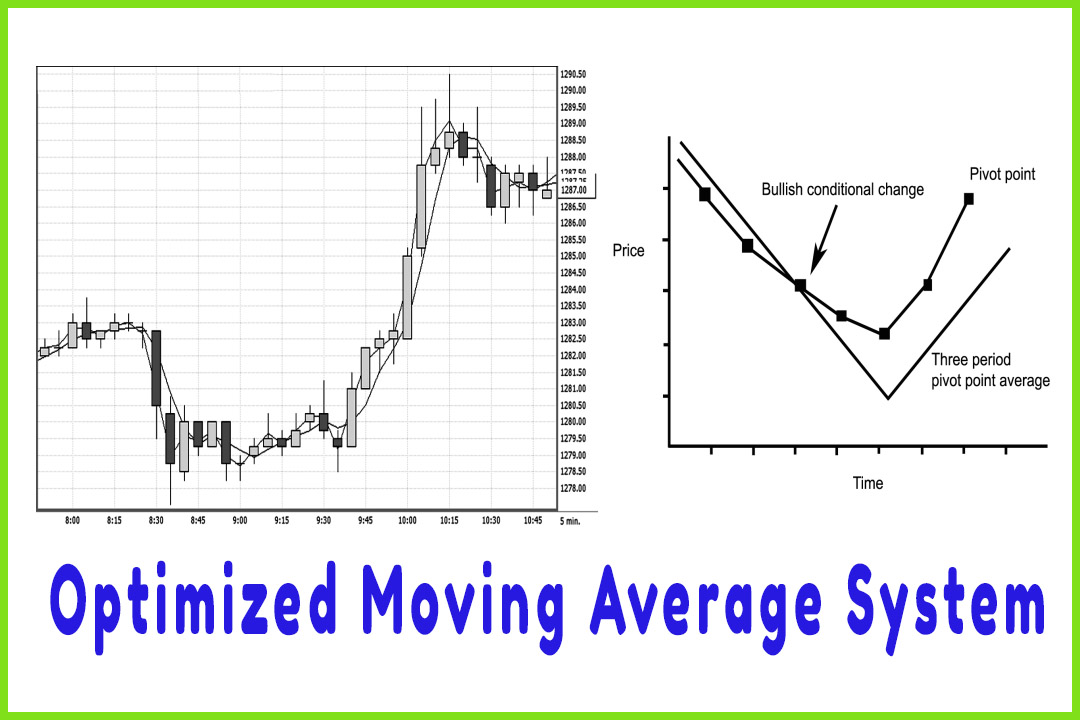

analysts use various ways to calculate moving averages, such as the simple, the

weighted, and the exponential. I prefer the simple moving average and a

different set of values for my moving average, namely the pivot point.

The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Best trading Strategies, moving average trading method, Pivot point trading strategy, Pivot points levels - Determining Trend Direction Using moving averages