Trading Trigger Stratergy

Downtrend, Uptrend, market direction, Best Trading Strategy

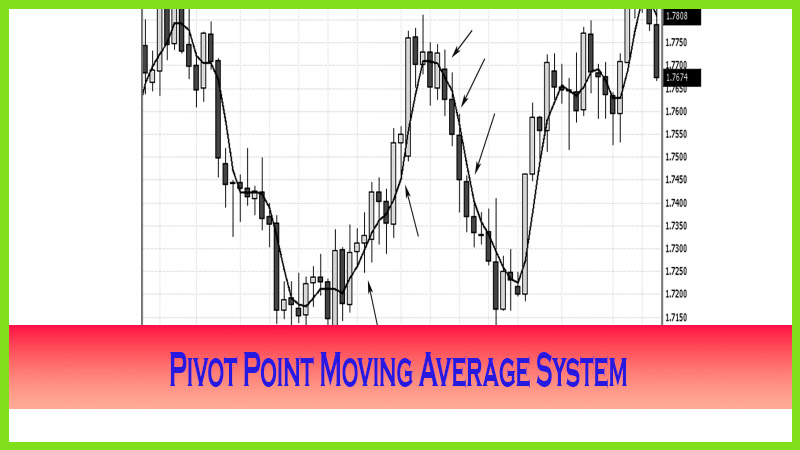

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System ]

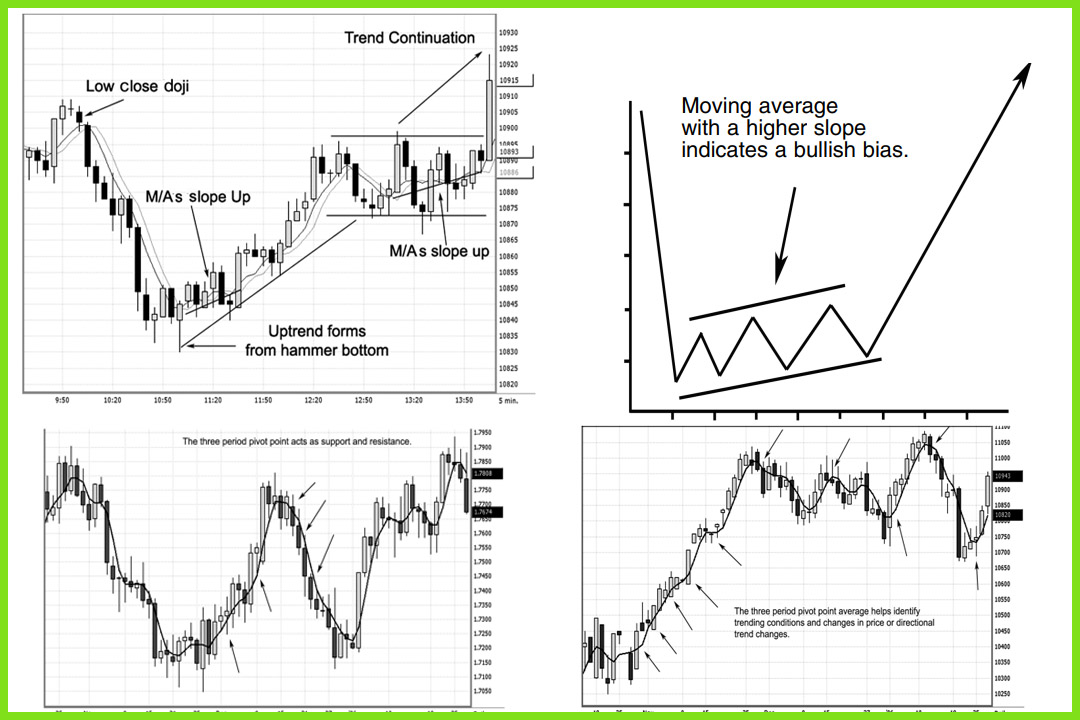

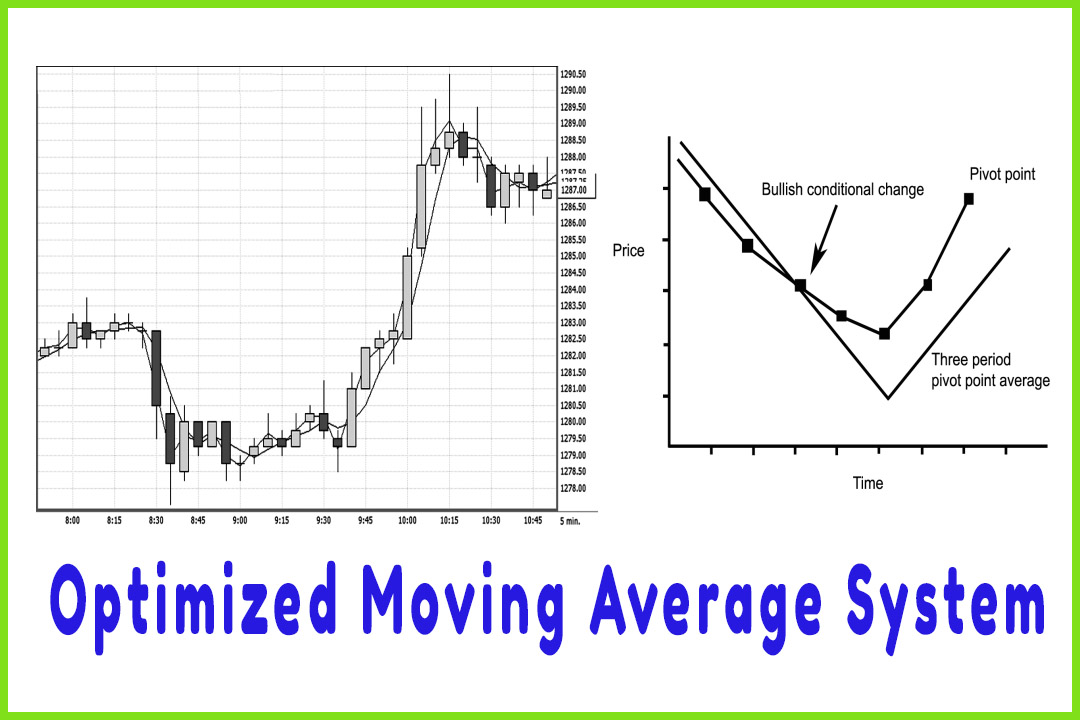

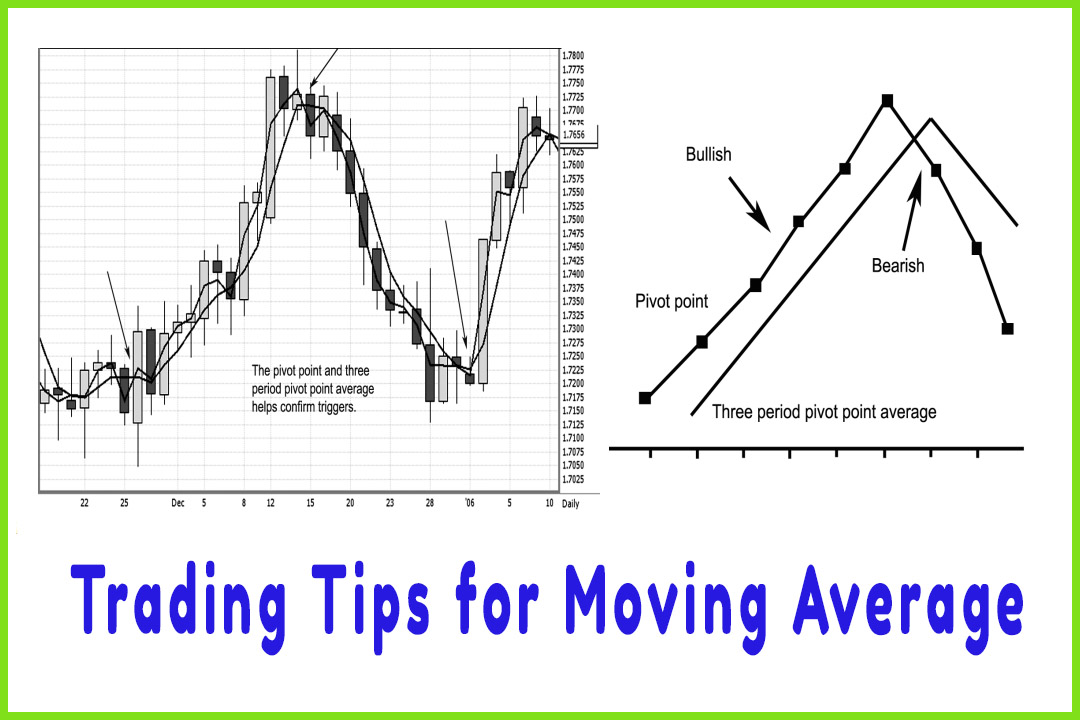

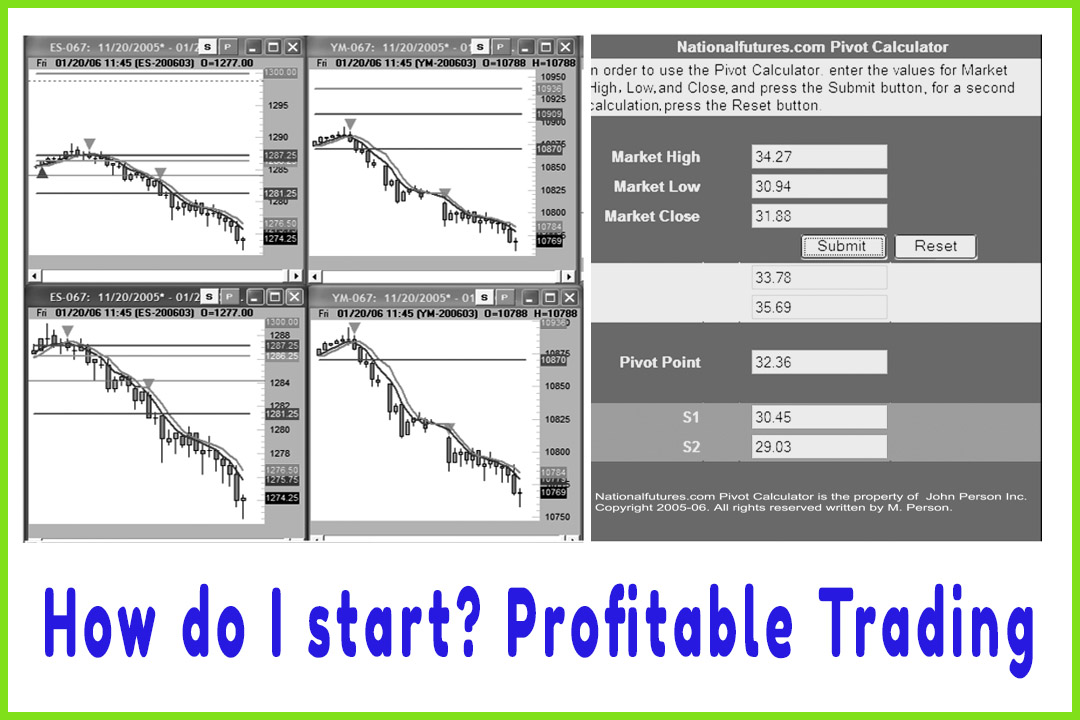

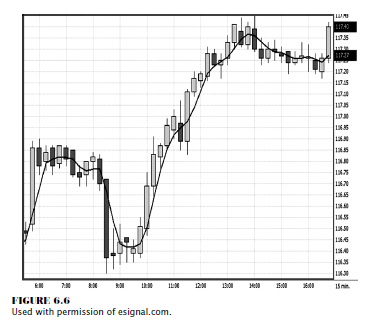

Trading based off the market direction number or three-period pivot point moving average, there is no need to wait for the value of the moving average to start rising or falling to determine the trigger to enter the market.

TRADING TRIGGER STRATEGY

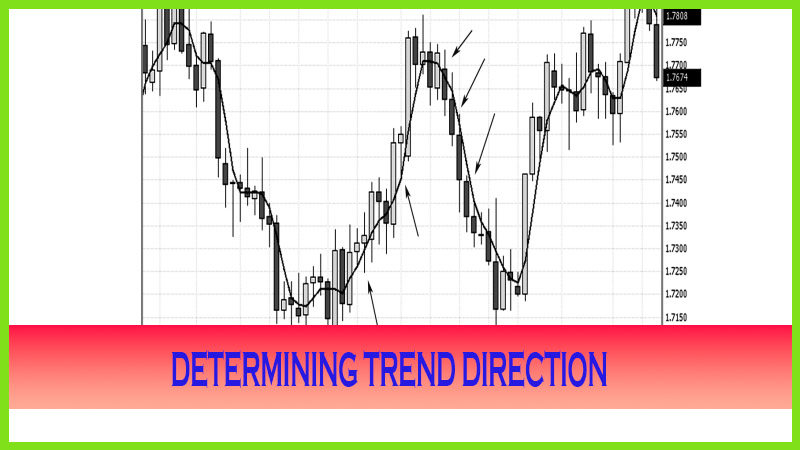

- After

a Downtrend. If the

price closes above the moving average (M/A) and above the prior time period’s

highs, with a sequence of higher highs and higher lows, enter a long position,

as the uptrend is now confirmed. You will want the moving average to have

formed a flat line or a higher- sloping angle. Place a stop below the lowest

low point.

Closing

Price > M/A = Go long or exit shorts

- After

an Uptrend. If the

price closes below the moving average and below the prior time period’s lows,

with a sequence of lower highs and lower lows, enter a short position, as the

downtrend is now confirmed. You will want the moving average to have formed a flat

line or a lower- sloping angle. Place a stop above the highest high point.

Closing

Price < M/A = Go short or exit longs

When

trading based off the market direction number or three-period pivot point

moving average, there is no need to wait for the value of the moving average to

start rising or falling to determine the trigger to enter the market.

A close above the moving average will trigger

a long position, and a close below the moving average will trigger a short

position. However, you want to see the moving average values follow the

direction of the price move in the desired trade.

The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Downtrend, Uptrend, market direction, Best Trading Strategy - Trading Trigger Stratergy